Everything you should know about Loan Origination Systems

0 Comments

/

If you’ve always wondered what a loan origination system is,…

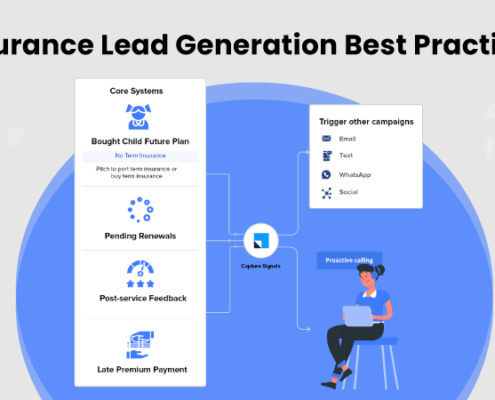

Insurance Lead Generation Best Practices: Do’s and Don’ts

In this article, we bring to you the digital marketing techniques…

How to Improve B2C Sales: Tips for Sales Managers

Today, e-commerce has shifted retail sales to online to a great…

What are the key capabilities of CRM Software?

Sales and marketing are the backbone of any business. They generate…

Residential Real Estate Outlook 2021

A definitive guide to real estate sales [Free Download]

The…

What is Mortgage Loan Origination Software?

Decoding the home buyer’s journey e-book [Free Download]

Disbursing…

Lending Business Technology Trends 2024

Technology has been changing the financial services since the…

EdTech Sales Process Automation Guide

There has never been a better time for EdTech sales than now.…

The Dos and Don’ts of Texting: SMS Marketing Best Practices

The top Admissions teams swear by the magic of SMS marketing.

But…

A Complete Guide to Loan Management Systems

Loan management software systems equip lenders with key capabilities to manage the entire loan lifecycle. Here's a guide to must-have navigating features & more!

Decoding the Insurance Sales Funnel

Insurance sales funnel never works as an average purchase funnel.…

Life Insurance Lead Generation Ideas: How to find exclusive leads?

There are over 5965 insurance companies in the United States,…

CRM in Healthcare Industry: 12 Practical Benefits

Hippocrates said, “wherever the art of medicine is loved,…

What are the Features and Benefits of Marketing Automation?

In this article, we will discuss the features and benefits of…

Mortgage Software for Effective Loan Management

When a home buyer decides to purchase a new property, he doesn’t…

Why is online onboarding system necessary for field sales agents?

Online marketplaces are growing tremendously. From the food…

How Can Chatbot and CRM Help Gain More Customers?

Arnav Patel, Marketing Lead at TARS, and Rajat Arora, VP –…

Understand Onboarding Automation

In this article, we will discuss the prevailing onboarding…

7 Benefits of using CRM to Accelerate Real Estate Sales

A definitive guide to real estate sales [Free Download]

Real…

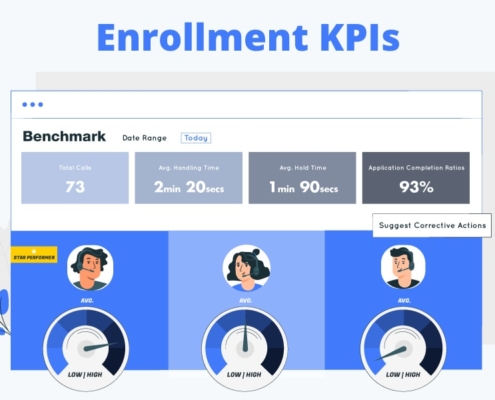

Digital Enrollment Management Strategies for Colleges

Student enrollment is taking a new dimension due to the…

5 Important KPIs to track in your enrollment management strategic plan

In a hurry? Download the experts’ insights on enrollment…

Edtech Sales & Marketing Hacks to Increase Enrollments

Playbook for EdTech Sales and Marketing [Free Download]

There…

How Lending Software Can Increase Operational Efficiency

[Free Download] e-book: Enabling data-driven lending at scale

Automated…

CRM for Insurance Agents: How Agents Can Grow Their Practice

As an Insurer, you must be familiar with CRM (Customer Relationship…