Maximize Policy Sales Through Direct Distribution Channel

0 Comments

/

As the notion goes, insurance is a push product. It has always…

How to Build a Data-driven CRM Strategy

In today’s consumer-focused milieu, customers expect brands…

A Look into the Digital Lending Market in India

The digital lending market has played an important role in creating…

How to Crack LinkedIn Ads: Lessons from a Pro

I am an avid user of LinkedIn Ads. After running more than 500…

[Webinar] Lessons from Angel Broking: Impact of Digital Transformation on Stock Broking

https://youtu.be/Gzx9aWC7O2Q

COVID-19 has been the dominating…

The Importance of CRM in Increasing Customer Satisfaction

Over the past few years, customer expectations in every business…

Grow Insurance Sales with Insurance Agency CRM

Insurance agencies have a lot on their plate. They must call…

Insurance Broking in India- Key Trends & Evolving Expectations

The insurance industry is one of the fastest-growing sectors…

25 Examples of Customer Retention Strategies Using a CRM

Staying competitive in the current business landscape is a challenging…

A Guide to Credit Risk Management for Indian Banks

Credit risk management is the process of assessing a borrower’s financial portfolio to estimate the risk involved when credit is extended. Know more about credit risk challenges, techniques, tools, in this guide!

[Webinar] Digital Transformation in Lending

The past year has been a challenge for the lending industry.…

[Webinar] How to Improve The Lead To Customer Journey in the Education Sector in 2023

https://youtu.be/OklAvfGBmdk

The education sector has been…

College Admission Management Software Features

I’m not too fond of all-you-can-eat-buffets. There is…

Revops: Turn Sales Operations Into Revenue-Generating Business Units

By definition, Revenue Operations or RevOps refers to the strategic…

[Webinar] Importance of Seamless Student Experience to Boost Enrollments

https://youtu.be/wXwfqTnwwvw

Key Discussion Points:

Impact…

Final Expense Insurance [Lead Generation & Sales Strategy]

Final expense insurance is an affordable form of life insurance.…

What Is An Admission Portal And Why Do You Need It?

The majority of people go to a school or college to prepare…

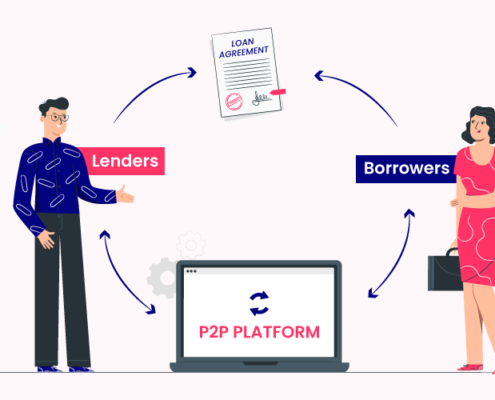

The Top P2P Lending Platforms in India

Over the last year, peer-to-peer lending has seen a large…

The Basics of First-Dollar Insurance Cover

In this article, we will discuss first dollar coverage.…

Bad Debt Recovery Strategies

What is bad debt recovery? Bad debt recovery is the money that…