The insurance industry is incredibly competitive and faces a multitude of challenges, including shifting customer expectations and the rise of disruptive organizations from outside the industry. Digital technologies like CRMs (Customer Relationship Management) are a major driving force behind the changes taking place in the insurance sector.

Software solutions like Insurance CRMs have transformed the way insurers can interact with customers. It improves customer engagement and retention, streamlines sales and marketing processes, and analyzes customer data.

In 2020, the insurance industry experienced a slowdown in premium growth to 1.2% and a 15% decline in profits. The sharpest decline was in Asia-Pacific with a 36% decrease, owing to the decline in life insurance profits. However, data from 2021 onwards suggests a rebound in premium growth and profits, particularly in regions with strong vaccine rollouts that have allowed for a return to normal activities.

This proves to be a great opportunity for insurance business to improve their processes, tackle the challenges faced by the industry, and stay ahead of the curve with an Insurance CRM.

Challenges Faced by the Insurance Industry

The insurance industry is being affected by the growth of InsurTech, regulatory changes, macroeconomic uncertainties, decreasing customer loyalty, and difficulties in digitizing business processes. Here are the challenges that they slow down insurance businesses:

1. Poor Customer Experience

The insurance industry is facing challenges in providing acceptable customer experience, despite it being a requirement. There exists a considerable gap between customer expectations and the service provided by insurance carriers, with a lower percentage of customers reporting positive experiences.

The challenge of customer experience starts with communication as customers expect quick and comprehensive service via various channels and formats. Dissatisfied customers can easily voice their opinions through social media, adding pressure on the industry. This is a challenge for the insurance industry, as 84% of customers trust other consumers’ experiences.

2. Lack of Omnichannel Solutions

Consumer behavior and service demands have evolved across industries to meet the expectations of quality and speed. Research indicates that younger insurance consumers interact more frequently, seek insurance from non-insurance firms, and have different information requirements.

However, contextual factors such as the type of policy, family context, regional disparities, attitudes toward risk and insurance, employment status, and the local digital ecosystem can affect customer behavior. It is not entirely digital, even for Gen Y.

A lack of digital channels can also limit customer engagement, reducing the level of communication and interaction between the insurer and the policyholders.

3. Insurance is Now a Commodity

Insurance offerings in the Property and Casualty area are often viewed as commodities that consumers need to pay for but would rather avoid. The primary differentiating factor for consumers is cost, which is a dangerous trend for insurance companies.

Many insurance companies emphasize pricing in their marketing, using terms such as “cheap” and “cheapest rates.” This focus on cost is particularly evident online, where most insurance is purchased or compared.

4. Inefficient Workflows and Lack of Agent Productivity

Insurance carriers face challenges in efficiently handling customer requests that come from different communication channels, particularly with increasing customer expectations. While some channels like email have automated processes, other channels such as social media remain manual.

Manual processes, such as lead capture or tracking customers, can be prone to errors, leading to inefficiencies and additional costs. They also require more staff, leading to higher costs for the insurance company. There is an enormous pressure to increase efficiency, but finding customer data in legacy systems remains a bottleneck for end-to-end automation of the claims process.

5. Fraudulent Claims

Insurance carriers face a significant challenge with fraudulent claims, which cost the industry $30 billion annually in 2012. Since 2010, fraudulent claims have increased by 10%, prompting insurers to seek smarter, more effective security and fraud prevention technologies. However, many insurers use innovative technologies and network analysis tools to help prevent fraud.

Without a digital infrastructure in place, it can be challenging for insurance companies to implement new technologies and keep up with changing customer needs and preferences. An Insurance CRM is a dedicated software solution that helps businesses solve these challenges and brings along a string of benefits.

What is an Insurance CRM?

An Insurance CRM, or Customer Relationship Management, is a software tool that insurance companies use to manage interactions with both current and potential customers. This system helps companies keep track of customer data, manage leads, and automate communication with customers. The key features of an Insurance CRM include contact management, lead tracking, marketing automation, policy management, claims management, and reporting and analytics.

An Insurance CRM system can help insurance companies improve their customer service, increase customer satisfaction, and more efficiently manage their sales and marketing activities.

7 Benefits of Insurance CRM

An Insurance CRM is a solution for the insurance sector that offers several advantages such as improving customer service, managing policies and claims, providing data-driven insights and reducing operational costs. These advantages are achieved by providing a complete view of the customer, automating routine tasks, and offering data-driven insights into customer behavior, policy performance, sales, and marketing activities.

Here are some of the key advantages of using an insurance CRM:

1. Increased Productivity

An Insurance CRM can automate many tasks, such as lead management, policy renewals, and claims processing. This automation can free up time for insurance agents to focus on other tasks, such as building relationships with clients or handling complex claims. By automating many of the repetitive tasks, an Insurance CRM makes agents more productive and efficient.

Before adopting LeadSquared as our Insurance CRM, managing leads and activities was time-consuming and resource intensive. We couldn’t dedicatedly focus on the service part, which is what we are good at. But now Leadsquared handles the operations bit for us, freeing up our bandwidth to constantly improve the quality of our advice.

Lokesh Gurram, Co-founder, Ditto Insurance

2. Improved Customer Experience

Dedicated CRM solutions for insurance can provide a 360-degree view of the customer, allowing insurance agents to provide personalized service and anticipate the needs of their clients. This system helps agents understand the needs of clients and provide customized solutions, which can lead to greater customer satisfaction and retention.

3. Better Data Management

Such software solutions can also track important client information, policy details, and claim history, all in one place. It can store data such as name, address, policy number, and contact information. With this data, agents can easily access the information they need to assist their clients, such as policy expiration dates and claims history.

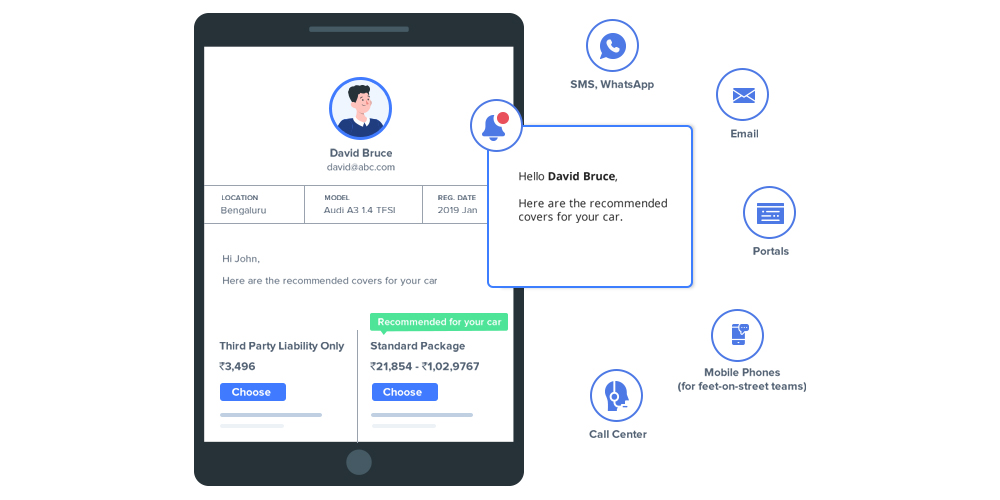

4. Enhanced Communication

Insurance CRM solutions can facilitate communication with clients through various channels, such as email, text, or phone. You can use the platform to ensure that clients receive personalized messages that are tailored to their needs, such as renewal reminders or claims updates. This system can also help agents build stronger relationships with their clients by providing a seamless experience across all communication channels.

5. Streamlined Sales Process

From lead generation to policy issuance, multiple tasks can be made simpler with CRM solutions. This automation helps become more efficient by reducing the time and resources required to manage the sales process. By automating many of the repetitive tasks, agents can spend more time building relationships with clients and focus on revenue generation.

For instance, Universal Sompo partnered with LeadSquared to use the mobile CRM solution. The CRM implementation provided them with multiple benefits. These include:

- Better daily visibility through check-ins

- Intervention through low-engagement alerts

- Improved renewal rate and new lead addition

- Better sales execution through mobile activity logging

- Complete geo-tracking

This has resulted in a marked increase in the number of renewals and new leads, increased sales execution, and better visibility and communication within the sales hierarchy. Their renewal percentage grew by 10%, new lead acquisition climbed by 35%, and daily intermediary engagement increased by 2.5X.

6. Greater Efficiency

An Insurance CRM can reduce the time and resources required for manual data entry and document management. It allows agents to access the information they need more quickly and help them store and retrieve documents easily. By reducing manual tasks, a CRM can help insurance companies become more efficient and effective.

7. Better Analytics

A CRM tool can provide valuable insights into sales trends, customer behavior, and agent performance. This information can help insurance companies make data-driven decisions about their operations, such as which products to promote or which agents to provide additional training to. Companies can optimize their operations, streamline processes, and improve customer satisfaction by using an insurance CRM to gather and analyze data.

8. Identify Cross-sell and Upselling Opportunities

When it comes to cross selling and upselling, an Insurance CRM can help insurers by providing them with a comprehensive view of their customers’ policies and claims history. This information helps insurers to identify potential opportunities based on the customer’s needs and preferences.

With an effective CRM system, insurers can segment their customer base and create targeted campaigns for specific customer groups, promoting relevant products and services. Additionally, such a solution can also provide insurers with real-time data on customer interactions, allowing them to tailor their approach to the customer’s needs and preferences, thereby increasing the likelihood of success in cross-selling or upselling efforts.

9. Field Force Automation

Insurance CRM solutions can automate lead allocation based on proximity, provide route planning to maximize productivity, and monitor field agents with geo-tracking and geo-fencing to prevent fraudulent activities. Insurance CRM can also automate attendance management, payouts, and churn management to keep accurate records of active and inactive agents, deactivating inactive agents, and reassigning churned agent leads.

Furthermore, the system can generate comprehensive reports on field agent performance, including the number of meetings, distance travelled, check-in time, and meeting quality.

It is critical to pick the right CRM solution and implement it correctly in your organization to get the complete benefits of the solution.

Implementing an Insurance CRM Solution

Here are some of the key considerations for adopting a CRM solution for your insurance firm.

1. Optimizing workflows for automation

Several manual processes in the insurance sector can be digitized using a CRM solution, such as:

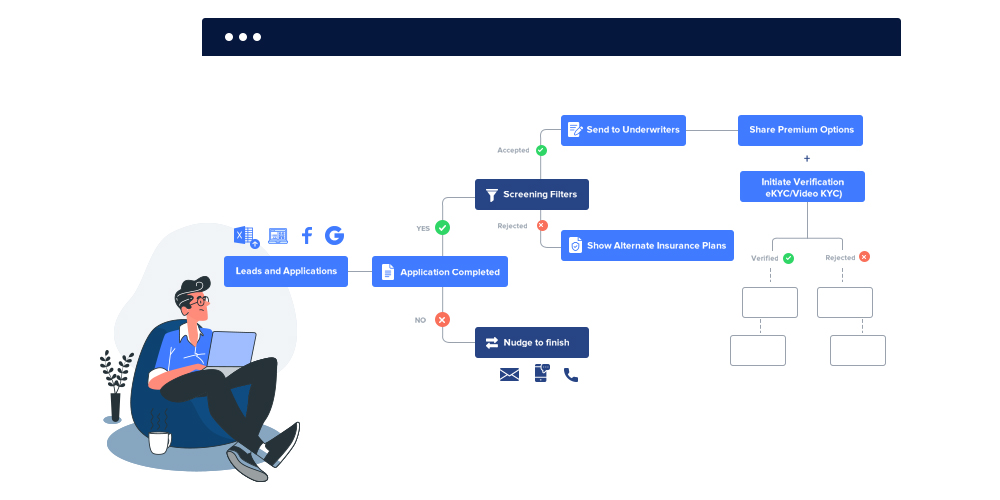

- Lead Management: CRM can help automate the process of capturing, tracking, and managing leads. It can help in prioritizing leads, assigning them to the right salesperson, and monitoring the progress of leads through the sales pipeline.

- Customer Onboarding: The onboarding process of new customers can be automated using a CRM. The CRM can collect customer data, schedule appointments, and provide the necessary forms and documents for the customer to fill out and submit electronically.

- Policy Management: A CRM can manage the entire policy lifecycle from issuing a new policy to renewals, endorsements, and claims. The policy documents and customer information can be stored in a centralized location, which can be accessed by authorized personnel.

- Claims Management: Claims processing can be streamlined using a CRM. The CRM can automate the claims filing process, track the status of claims, and ensure that claims are processed promptly.

- Underwriting: You can automate the underwriting processes by providing access to all necessary information and analytics. This can enable the underwriter to make informed decisions based on the data provided.

- Customer Support: A CRM can provide a centralized location for customer support, where agents can access customer data, history, and prior interactions. This can enable a faster resolution of customer queries and complaints.

By rethinking the workflow around these manual processes and adopting a CRM solution, insurance companies can reduce errors, improve efficiency, and enhance their customer experience. A CRM solution can provide a single view of the customer, streamline processes, and increase productivity, enabling insurance companies to stay ahead in a highly competitive market.

2. Choosing the right tool

Choosing the right Insurance CRM solution for your business can be a challenging task, given the multitude of options available in the market. However, we can help you simplify the process.

It is important to ensure that the app you choose covers all aspects of your workflows, offers reasonable pricing models, allows for integrations, is scalable, supports multiple agents, has a knowledgeable support team, and is customizable to meet your evolving needs.

It’s a lot to take but we have a guide to help you make this decision faster! Take a look at our CRM buyer’s guide for tips on choosing a platform and the features that you absolutely can’t miss on.

Different business goals and processes make it challenging to find the right CRM. Moreover, softwares differ in features and modules, so one application may not be suitable for all requirements.

Additionally, the selection of a CRM system depends on the resources available to the company. The number of app users and the cost could be critical factors in choosing the appropriate solution.

However, we have compiled a list of features that must be present in an insurance CRM solution.

Features checklist for an Insurance CRM

- Automated lead capture: Seamlessly attract prospects by capturing and nurturing leads with a good CRM that allows you to reach out to interested prospects and convert them into customers.

- Automated lead distribution: Utilize automated lead management and allocation to allot leads to sales agents and brokers for higher productivity and manage all leads on one page.

- Scalable and economic: Choose an affordable and scalable CRM for insurance agents that offers beneficial add-ons and can grow with your company.

- Customizable functions: Opt for a customizable CRM that can be tailored to your company’s policies and requirements to achieve optimal productivity.

- Omnichannel customer support: Provide a high-end customer experience with a shared team inbox for efficiently managing email conversations across multiple channels and resolving queries.

- Workflow management: Track, plan, and organize sales activities with the tracking feature to ensure work is getting done promptly.

- Remote work using mobile CRM: Expand your work beyond the office with a mobile CRM that allows you to manage and sell on the go, never missing out on any details or opportunities.

- Identify upsell and cross-sell opportunities: Seize upsell and cross-sell opportunities to provide a better experience and keep customers informed about upgrades to boost their growth.

- Policy management: Manage and update policies from anywhere and notify customers about changes to ensure they can work accordingly.

- Customer retention through constant engagement: Develop customer trust by using a smart, automated CRM that not only gains more clients but also positively impacts customer retention.

Closing thoughts

Insurance agents encounter several problems while working with clients, managing them, and completing more business in a competitive sector. CRM solutions may help the insurance sector by automating activities, following up on leads, and strengthening client connections.

LeadSquared is a one-stop solution for Insurance businesses to optimize insurance sales and agent productivity! If you’re looking for a look that enables lead and activity tracking, management and updating of policies, and the opportunity for upselling and cross-selling, you should give LeadSquared a shot today.