LeadSquared Automations Help a Leading Lending Firm Reduce Human Errors by 90%

10x your sales productivity with LeadSquared.

Book your 1-1 consultation today!

“It takes us at least a day to make any changes in our own CRM, including code formation, bug removal, and testing. Whereas in LeadSquared, it’s only a matter of 15 minutes. LeadSquared Automations are very easy to build, so, with minimal manual effort, any chance of human error has reduced by 90%.”

Book your 1-1 consultation today!

REDUCTION IN HUMAN ERRORS

LOAN DISBURSAL

TO MODIFY WORKFLOWS

APPLICATION PROCESSING

REDUCTION IN HUMAN ERRORS

LOAN DISBURSAL

TO MODIFY WORKFLOWS

APPLICATION PROCESSING

The firm is a digital lending marketplace that connects consumers and small businesses looking for low rate loans, with institutional lenders looking for good returns.

It has been at the forefront of lending since 2014 and continues to set the pace with fast and convenient loan products.

Headquartered in Gurugram, Haryana, it is available on both web and mobile. The company also provides value-added services such as big-data analytics, credit risk assessment, verification, and automated work-flows for loan origination and management to lenders. Similarly, borrowers can apply for unsecured personal loans online, get access to free credit reports and manage their daily spends via the company Mobile App.

The firm uses its internal CRM to capture loan applications from the website. The tele-calling team collects the documents and passes them to lending partners, where the possibility of soft loan approval is highest.

The major challenges faced by the team were in processing the applications after soft approval.

The team had the following goals in their mind from their automation system:

“There were a lot of manual processes between compiling the data on our own CRM and passing it on to the Quality Assurance team. All the issues in the manual processes needed to be managed. That’s why we turned to LeadSquared.”

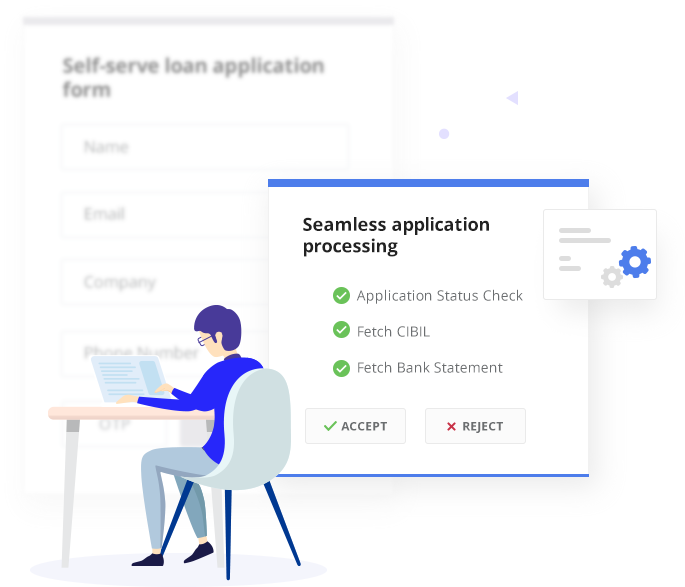

The company chose LeadSquared to support the application processing of its online lending platform.

The team also uses LeadSquared for distribution, pre-screening checks, call centre intervention and report monitoring.

Once the applications are received post soft approval, they are distributed using LeadSquared automations to the tele-calling team, underwriters, quality assurance, verification & other teams.

The LeadSquared distribution is based on specific criteria – loan type, location, agent availability, performance, application status and more.

![]()

The tele-calling team schedules house visit to collect and scan the original documents from the customers. Third-party executives are responsible for this.

After that, they pass the documents with the CIBIL information on to LeadSquared.

The user can generate Experian reports on the platform through API integration. The reports consist of detailed information on your credit/loan history, including identity information, credit accounts, loans, credit cards, payments, and recent inquiries.

The Quality Team does the quality check of the document and credit bureau reports. Subsequently, they mark the leads as QC approved or rejected.

If QC Approved lead is marked as “Send for disbursal”, a webhook is called. Lastly, the data is sent to their own CRM from where the information is shared with the lending institution for the final approval.

Using LeadSquared, the performance of every single product, salesperson, region and more can be analysed. The team monitors multiple reports including cases disbursed, cases pending and time spent on each case.

With LeadSquared, the firm has seen considerable growth in its business.

LeadSquared Automations involve no manual process. As a result, any chances of human error have reduced tremendously.

“It takes us at least a day to make any changes in our own CRM. It includes code formation, bug removal and testing which takes a long time. Whereas in LeadSquared, it’s only a matter of 15 minutes. The LeadSquared Automations are easy to build and are not very time-consuming. In conclusion, with minimal manual effort, any chances of human error have reduced by 90%.”

(+1) 732-385-3546 (US)

080-46971075 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)

How An Award – Winning Higher Ed Institute Reduced Their Lead to Enrolment...

How An Award – Winning Higher Ed Institute Reduced Their Lead to Enrolment...