When people plan their monthly or even daily budgets, a cup of coffee never seems to make the list of their top spends. But you’re probably wondering what it has to do with customer lifetime value.

Well, an average American spends $32,000, over their lifetime, on their daily cup of brew from Starbucks.

To put things into perspective, the daily purchase in the range of $2-$4 over time becomes equivalent to the cost of:

- A modest SUV

- A vacation abroad

- The seed money for your small business

Instead, the entire amount goes to Starbucks. To put it simply, $3200 is an average American’s customer lifetime value (CLV) at Starbucks! Now, after this tiny lesson, let’s understand what CLV is in-depth.

What is customer lifetime value?

Customer Lifetime Value is the total revenue each customer brings over the period of their association with your business. For example, in the case of Starbucks, the average CLV is $32,000, which is calculated by multiplying the average order value ($3.5) with the number of orders placed (approximately $9.1k) by a customer.

The exact approximation doesn’t apply across all businesses. The emphasis on increasing the customer lifetime value also depends on the type of industry.

The importance of customer lifetime value for product vs. service businesses

To increase profitability, all businesses can benefit from expanding their customer lifetime value. But, for some businesses, tracking CLV is more important than others.

Let’s discuss this for product and service-based businesses.

1. Customer lifetime value for product-based businesses

Product-based businesses can have one-time purchases, such as buying a house or an expensive car, or recurrent purchases, like buying multiple courses from an Edtech business.

These types of businesses benefit from customer lifetime value but only to a limited extent. For one-time purchases, like a car, there is a possibility that the client will appreciate the service extended and buy another vehicle or additional accessories, but it pretty much ends there.

While for an Edtech business, the opportunity to cross-sell courses or upsell programs extends across different subjects and academic years. For example, a student in 11th grade who has opted for Physics and Chemistry courses can also purchase the mathematics course or coaching for competitive exams. The only limit on the student’s lifetime value is when they graduate from high school and enroll in a university.

The lifetime value for such businesses depends more on customer referrals and satisfaction. Some of the sales metrics that product-based businesses can track are:

- Net Promoter Score (NPS) to gauge customer satisfaction

- Overall Customer Satisfaction (CSAT)

- Number of referrals

- Average order values

2. Customer lifetime value for service-based businesses

Using customer lifetime value, service-based businesses can structure their targets, marketing spends, and gross margins. Service-based businesses such as OTT platforms (Netflix and Amazon Prime) and SaaS businesses operate on a renewal model. Unlike product-based companies, the payment isn’t a one-time investment for their customers.

These service-based sector needs to ensure that the customer doesn’t switch over to their competitor. And if a customer does churn, the revenue they generate is higher than the sum of the acquisition cost and the service cost.

Since customer lifetime value is an important parameter for this industry, its calculation is a little complicated and depends on various factors. We’ll get to that a bit later in this article.

Essentially, all kinds of businesses benefit as the CLV increases. The most significant factor that affects CLV is customer satisfaction. Satisfied customers are an asset to your business because they have no reason to seek an alternative.

But, increasing CLV isn’t a Herculean task!

Because retaining a client is a relatively passive activity, you don’t need to convince them to choose your business or implement any services. Retaining a customer cost up to five times less than acquiring a new customer.

Why do you need to calculate customer lifetime value?

Along with improving customer retention, calculating and tracking customer value has many more benefits! A high CLV helps you achieve the following:

1. Improved Profitability

Acquiring new customers is expensive. From the marketing spends that go into lead generation to the product being adopted by your user, you’ve covered a long journey before a prospect becomes a customer.

But if this customer opts out after the first year of usage of your services or makes no recurring purchases, the customer acquisition cost can exceed CLV. In contrast, if the customer keeps renewing or making new purchases, your CLV and hence profitability shoots up. As a rule of thumb, your CLV should be at least three times your CAC.

Increasing the customer lifetime, or the number of years that they are associated with your business directly translates to higher revenue. Focusing on customer success and measuring average CLV across segments help companies extend customer lifetime.

2. Decrease Churn

Churn’s what all businesses are running away from; it makes your sales and marketing efforts go in vain. The opposite of churn is a good customer value that signifies a high customer success rate.

By focusing on increasing customer lifetime value, you are essentially targeting the touchpoints where most customers drop off. If the customer’s predicted CLV is low, it indicates that the account will churn soon, so your teams can try to troubleshoot the problem areas for the account and improve the customer retention rate.

3. Streamline your Business Goals

Every business wants customers who keep adding revenue to your business. Identifying similarities between high-CLV customers can help you segment your users based on purchasing patterns, regions, industries, or other parameters relevant to your business.

Calculating customer lifetime value can help you shift your focus towards new opportunities with a historically high lifetime value. A directed approach leads you towards valuable customers with improved product-market fitment and faster conversions.

4. Strategize Marketing Campaigns

Customer lifetime value impacts two teams, customer support, and marketing. For customers with a lower predicted CLV, customer experience management decreases the possibility of churn. And for customers with a longer customer lifetime, the marketing team can swoop in to increase upsell and cross-sell opportunities.

The marketing team can restructure their budgets towards high-return activities with the correct data on high-value customers and profitable segments. The lifetime value itself is a metric that can be used to evaluate long-term financial returns from marketing investments.

The first step toward achieving these benefits is knowing how to calculate CLV.

How to calculate customer lifetime value?

There are a couple of ways in which a business can calculate CLV. You can choose one of these based on the most reliable and trackable metrics. As the complexity of your business increases, you might have to factor in variable metrics for the CLV calculation.

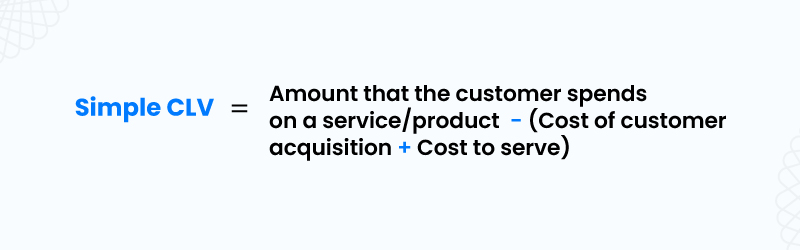

1. Simple Customer Lifetime Value Calculation

This formula considers customer lifetime value as a function of the monetary input and output related to the customer. The discount rate and gross margins are not considered for this calculation. If you’ve just started tracking your CLV, you can consider using this formula to calculate it individually for each customer.

Simple Customer Lifetime Value Calculation formula:

This calculator will help you find the Simple Customer Lifetime Value for your business:

Cost per Product/Service($):

Cost of Customer Acquisition($):

Cost to Serve($):

Your Simple Customer Lifetime Value is: $

Check out our article on Customer Acquisition Cost for average customer acquisition costs across different channels and industries.

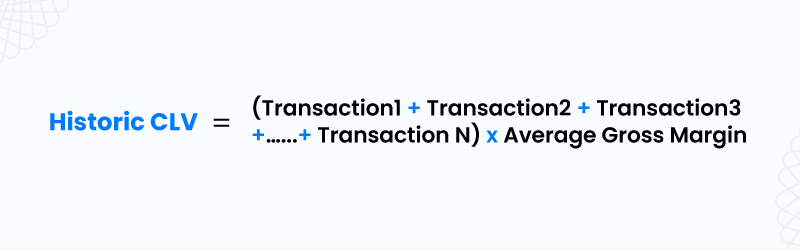

2. Historic Customer Lifetime Value Calculation

Calculating CLV historically is possible only if you have the data of all the transactions that each customer makes. The transactions can be individual purchases, monthly/yearly renewals of the service, and revenues from upsells and cross-sells.

Historic Customer Lifetime Value Calculation formula:

Where Average Gross Margin = (Total Revenue – Cost of Goods Sold)/Total Revenue x 100

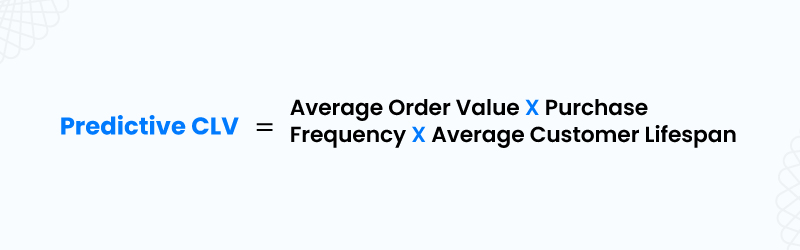

3. Predictive Customer Lifetime Value Calculation

Many businesses opt to calculate the predictive CLV instead of the historical model. Predictive models utilize the previous trends and data to estimate the lifetime value for new customers. This model helps you strategize your business plans and set targets for sales teams.

Businesses are also developing smarter ways to analyze data using machine learning and predictive models. Based on the kind of approach, you can predict CLV in the following ways:

1. Historical Approach:

- Aggregate Model: This model considers previous transactions to predict a value for CLV.

- Cohort Model: Customers need to be segregated into segments/cohorts based on similar characteristics—industry type, transaction date, etc. The customer lifetime value is calculated for each cohort individually.

2. Predictive Approach

- Machine Learning (ML) Model: A regression analysis is conducted on past transactions and customer data to forecast the CLV. It is a highly dynamic model, and with the right framework, the customer lifetime value can be updated in real-time.

- Probabilistic Model: A probability distribution is applied to the customer data to estimate value from the transactions in the future. The CLV is calculated on the predicted transaction values.

These models are highly accurate but developing complicated frameworks for transactional data is not feasible for many businesses.

But if you’ve recorded and tracked the right data using a Customer Relationship Management (CRM) or a lead management tool, you can use this simpler formula to forecast the overall CLV.

Predictive Customer Lifetime Value Calculation formula:

You need to use the recorded sales data for these metrics. Here’s how you calculate them:

- Average Order Value (AOV) = Total Revenue / Number of Orders

- Purchase Frequency = Total Number of Orders / Total number of Customers

- Average Customer Lifespan = Sum of Customer Lifespan (in years)/ Total Number of Customers

Note: The Predictive Customer Lifetime Value is calculated over a specific time period.

Don’t fret if you’re not a math genius, and you don’t have to be one to calculate your CLV in under 2 minutes. Just use our customer lifetime value calculator:

Enter total expense in sales and marketing ($):

Enter total number of customers acquired in a given period :

Your Customer Acquisition Cost is: $

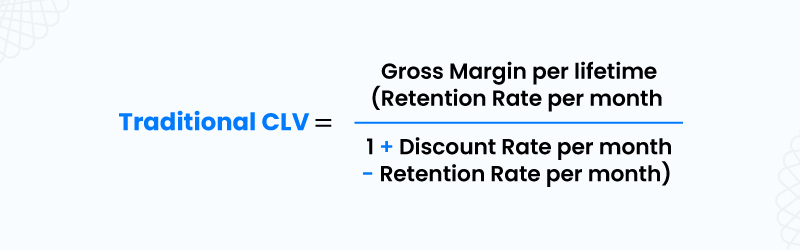

4. Traditional Customer Lifetime Value Calculation

The traditional calculation is best suited for businesses that don’t have a flat revenue model. Businesses where the pricing changes over time (for example, SaaS) or the cost of renewal rates varies over time (for example, Insurance) can utilize this formula to calculate CLV. It also accounts for inflation.

Traditional Customer Lifetime Value Calculation formula:

Where,

- Gross Margin = Total Sales Revenue – Cost of Goods Sold / Total Sales Revenue

- Customer Retention Rate = Number of users that stayed over the time period / Total number of users

- The discount rate accounts for inflation and for convenience, the value can be taken as 10%.

After choosing the Customer Lifetime Value Structure that works the best for you, the next couple of steps are to track it effectively and work towards improving it. These six tips can help you improve your CLV!

How to improve customer lifetime value?

1. Maintain customer relationships

The key to sales is working on customer relationship building. And the same extends to customer retention, especially for service-based businesses. Creating a meaningful customer relationship begins with listening to your customer.

And that’s an insight that we learnt from this incredible session hosted by Navish Bijalwan, Enterprise Sales Manager, at MCUBE. You can watch the webinar where he shares other nuggets of wisdom on how businesses can improve customer connections with telephony:

Create touchpoints to collect your customer’s feedback and use it to improve your product or service. The customer should also have a few channels where they can reach out to your business. Your customers should have 24×7 accessibility, to at least one channel, either by call or chat.

You can implement LeadSquared, a Customer Relationship Management tool to manage leads and feedback. It ensures that each customer activity and feedback is tracked for a quick resolution with a shorter TAT.

2. Manage expectations

To gain your customer’s trust, you must deliver what you promise. If your product/service underdelivers or lets the customer down, it’ll lead to churn. And your product is probably not at fault here.

As a business, customer segmentation can help you find the right product fitment for customers from different industries or varying attributes. You can also understand their interests and buying intent based on their engagement with your marketing initiatives. Essentially, figure out what they need and provide the right solution to increase the customer lifetime.

3. Identify cross-sell and upsell opportunities

Upselling and cross-selling boost your business’ profitability. But not every customer fits the bill for this segment.

Maintain a close customer relationships to understand their current product usage and identify opportunities to cross-sell and upsell. Frequent audits of how the customer uses your service or the purchase frequency of your product can help you discover new opportunities.

Whether it’s a new update, feature, or accessory, the customer should believe that it’s an essential complementary addition to their current purchase. Based on previous activities, service-related businesses can use marketing automation to educate and nurture their customers. In contrast, product-related businesses can gather more insights into the user’s persona and use it to upsell. For example, suggesting a laptop with higher RAM to a software engineer.

4. Increase the average order value

“Would you like to make it a meal?” This is something that everyone’s heard at fast-food chains. It’s how they increase your order value from one burger for $1.99 to a meal worth $3.99. The same idea can apply to many businesses. For example,

- Offering pre-paid servicing to new car owners.

- E-commerce sites cross-selling products with their “customers also bought section.”

Understanding your client’s long-term goals help you recommend relevant services and products. SAAS businesses can also create service packs to become an end-to-end solution for businesses. Clubbing services or making products sound like add-ons ease the customer into deciding to buy.

5. Introduce new discounts and rewards

Loyal customers deserve all your appreciation, along with a few additional perks! Businesses need to keep their customers happy and excited about their service. And everyone loves a good deal.

You can introduce discounts on renewals; even seasonal discounts on products go a long way. But CLV highly depends on the cost of customer acquisition (CAC). Starting a referral program helps you decrease CAC while rewarding your customers.

Word of mouth influences around 20-50% of purchasing decisions, especially when a customer is trying out your product/service for the first time. The value that a referred customer generates is also 16% higher than a non-referred customer.

Membership programs work out pretty well for product-based businesses. Here, a membership card guarantees discounts on future purchases, which is a great incentive for customers to stick to your business.

In this article, we’ve covered everything related to customer lifetime value, but the ability to track your customer’s journey is the first and most crucial step towards improving it. Different stages in your post-sales process—product implementation and adoption, collecting customer feedback, and tracking usage—affect CLV. You need complete visibility into these and your customer’s activity for a higher CLV.

LeadSquared can help you track customer activity and record essential metrics to calculate customer lifetime value. And if you’re looking to improve it, you’re just a demo away. Get in touch with our team today!

FAQs

Customer Lifetime Value is a direct indicator of your business’ profitability. A high CLV is proof that you’ve achieved the correct product-market fitment and brand loyalty with your customers. It leads to higher customer retention and turnover for your business.

There are a few approaches that you can use to calculate customer lifetime value—Simple, Historical, Predictive, and Traditional. An easy formula to calculate the overall CLV for your business is:

Customer Lifetime Value = Average Order Value X Purchase Frequency X Average Customer Lifespan

A business should aim for its customer lifetime value to be at least three times the cost of customer acquisition. It ensures that your marketing budgets are in check and your customer retention continues to be high. For example, if your CAC is $50, a healthy CLV would be $150 or higher.