The covid-hit last two years proved a game-changer for the education sector.

American EdTechs raised $2.5B in funding in 2020 and $5.82 billion in 2021 to $2 billion in 2022 till August 15. Similarly, Indian EdTechs raised $2.3B in 2020 and the funding in Q1 2022 amounting to $10.02 billion, 169.5 per cent higher than the $3.71 billion raised in the same period last year..

Even though classroom learning is expected to gain back momentum, the trend of EdTech is not going to fade in 2024 and beyond.

In this article, we will look at the EdTech market trends and what successful EdTechs are doing right to stay ahead of the competition.

Table of contents

The booming education technology sectors

In the United States, EdTech has leverage over three sectors:

- K-12 education

- Post-secondary education

- Corporate training

The market of K-12 education is the largest (about 56.6 million students attended elementary and secondary school in the United States in 2019). However, EdTech startups for skill development have received the highest funding. For instance, Roblox, an online gaming platform that also teaches kids how to program had raised $150 million in February 2020. Similarly, MasterClass, which partners with celebrities to teach people how to hone their skills, raised $100 million in funding.

The point is – the world is moving beyond the regular course curriculum. The rise of EdTechs has also created awareness towards skill development instead of aspiring for a graduation degree to land a decent job.

Another aspect to look at is the rise in demand for professional, short-term courses due to the Covid-19 pandemic. A large part of the workforce is suffering from furloughs and layoffs. People are also opting for corporate training modules to uplift their careers and prepare for jobs in the post-pandemic era. EdTech is simplifying the pursuit.

EdTech market trends 2024: what successful EdTechs are doing right?

The trend of online learning has brought a disruption for EdTechs. The leading EdTechs across the globe include India’s BYJU’s, China’s Yuanfudao and Zhangmen, and the United States’ 2U (America homes thirteen of the most-funded EdTechs in the world).

These companies are investing in technology across all business aspects and not only on methods to impart education.

For example, BYJU’s, India’s largest K-12 EdTech platform, follows a freemium business model where students can try their platform for 15 days and access complete learning modules after paying for the courses. Because of the freemium model, they generate millions of inquiries every month, and they have to rely on sales process automation to handle such volume.

“When you have 2000-3000 people in your team, you cannot just measure the output. You need to measure the input as well. If you have a six-step sales process, then you need to understand what is happening at every step. LeadSquared has helped us do this very well. Our sales conversion rates have improved drastically because we are able to give better feedback to the team. This, in turn, makes them accountable for their own numbers and has improved overall productivity,” says Mrinal Mohit, COO, BYJU’s.

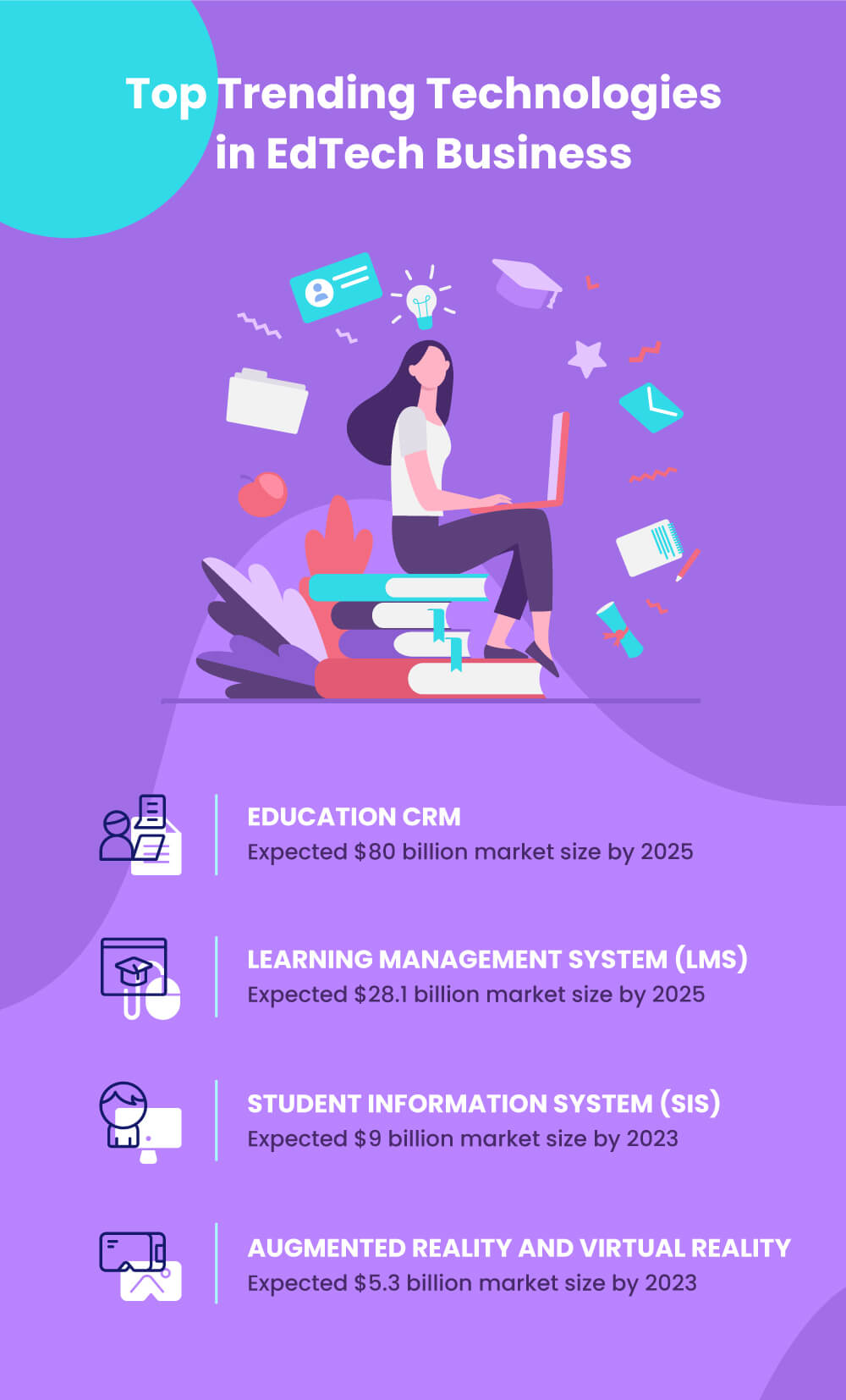

EdTech companies rely on technology and automation right from building and delivering the courses, to enrollment and student management. They use products like EdTech CRM for enrollment and student information management, and learning management systems for managing courses and tutors.

In terms of teaching strategies, gamification is helping Edtechs the most. However, recently, many companies have also started experimenting with AR and VR technologies to make their courses more interactive and engaging.

Types of technologies educational institutions are investing in

There are two main categories of technologies that are proving beneficial for educational institutions. One is – CRM for managing the enrollment processes, and the other is LMS (Learning Management System) and SIS (Student Information System).

Apart from these two, the adoption of AR (Augmented Reality) and VR (Virtual Reality) technologies are also on the rise as they enable gamification and interactivity in imparting education.

CRM market trends

CRM (Customer Relationship Management) is one of the fastest-growing software in the market, and its revenues are likely to reach over $80 billion by 2025. The education sector continues to contribute to this trend as well. Right from using CRM software for student inquiry management, customer service, enrollment automation, and call-center management, they rely on integrated marketing automation solutions to build personalized student journeys as well. Moreover, cloud-based CRM solutions are seeing a higher adoption rate (87%) as compared to their on-premise counterparts since the last decade.

Asher college’s management team states that with the help of LeadSquared Higher Education CRM, the admissions team was able to increase speed-to-lead by 12 times. It helped them personalize communications throughout the student life cycle and track all communications, leading to better student experiences. Moreover, their contact rate went up by 13%, and scheduled campus appointments improved by 5%.

Learning Management System market trends

Institutions are investing in learning management systems to access and manage educational resources. As per the Global Opportunity Analysis, the LMS market will reach a value of $28.1 billion by the end of 2025. In North America, the leading providers of LMS systems include Canvas, Moodle, Blackboard, and BrightSpace.

While learning and development professionals aim to incorporate gamification in their e-learning modules, integration with other digital platforms pose a barrier. Guide2Research indicates that 67% of LMS users prefer programs with complete functionalities, while 66% want programs with a better customer and technical support.

LeadSquared CRM seamlessly integrates with LMS systems via APIs.

Student Information System market trends

The SIS manages the student information for teachers, parents, students, and school/college administration. MarketsandMarkets expects that the global Student Information System (SIS) market share will reach USD 9.0 billion by 2023 – indicating a 12.4% CAGR since 2018. K-12 and Higher Educational institutions are the primary users of Student Information Systems. The top vendors in the segment include SAP, Oracle, Ellucian, Workday, Jenzabar, Skyward, Workday, and Illuminate Education.

Institutions prefer cloud-based SIS that integrates with other digital platforms like CRM for end-to-end student lifecycle management and LMS for curriculum management.

Augmented Reality in education

The AR market in the education sector is likely to surpass $5.3 billion by 2023. AR has leverage over VR because many smartphones are compatible to use this technology, whereas VR requires a separate headgear. The following are some remarkable AR use cases in EdTech:

- Developing interactive learning apps for kids

- Medical education (for example, Cleveland Clinic at Case Western Reserve University trains human anatomy and surgery through AR models)

- Engineering (to superimpose markings, messages, and diagrams directly onto the engineer’s field of view)

The takeaway

Once, there used to be quite a few differences between traditional educational institutions and EdTechs. Students preferred enrolling into leading institutions because of the perceived quality of education, placement, faculties, and campus.

However, today, EdTechs not only guarantee quality education but many EdTechs providing professional education also guarantee placements. Moreover, businesses are giving job opportunities based on talent and not on educational qualifications.

Apart from these behavioral shifts, EdTechs also have an advantage in terms of technology, scalability, and geographical outreach. All these factors indicate that traditional schools, colleges, and universities need to adopt technology instantly to remain competitive. To comply with EdTech trends, educational institutions need to:

- Automate their student recruitment processes

- Connect different platforms, teams, and software for end-to-end student lifecycle management

- Adopt new learning techniques like gamification, interactive classrooms to motivate students

If you are looking for a CRM solution to streamline your admission processes, then you must try LeadSquared EdTech CRM software.

EdTech Trends and Market FAQs

The modern educational trends include bite-size learning modules, live training, and the use of AR (augmented reality) and gamification to make learning interactive. In terms of operations, institutions are automating their enrollment/admission and student engagement processes.

The global EdTech and smart classroom market has the potential to reach US$181.3 billion by 2025.

The factors that are driving the EdTech market trends include the increasing use of mobile devices, availability of the internet, and flexible learning modules.

Further reading: