Mortgage CRM Your Loan Officers Can Trust

Turn prospects into borrowers faster. Automate your marketing and simplify partner engagement with a Mortgage CRM built for growth.

Cut down on customer acquisition costs. Equip your loan officers to close more home loans, loans

against property, and other mortgage deals—efficiently and at scale.

Boost sales efficiency across loan products with tools designed for speed and accuracy:

Support your marketing team with full-funnel visibility and automation:

Track and grow your referral channels with better tools:

From sourcing to sanction, LeadSquared’s mortgage CRM enables you to

manage the complete home loan lifecycle in one platform.

LeadSquared’s secure mortgage point-of-sale portal gives borrowers a simple web-based space to manage their application—from start to clear-to-close.

Applicants can fill out a housing loan or home loan application, upload documents, eSign disclosures, and track progress in real time—all in one location.

Managing documents for housing loans is often complex and time-consuming. LeadSquared streamlines the process with digital checklists customized by loan type and customer profile.

Sales teams can:

Eliminate back-and-forth over calls and emails. With LeadSquared:

This structured approach keeps underwriting and sales in sync, speeds up approvals, and minimizes bottlenecks.

Give branch managers complete visibility into partner performance, HLSE (Housing Loan Sales Executive) activity, and lead status—on a single screen.

The system provides timely nudges when key metrics drop, such as missed visits, delayed disbursals, or low partner engagement. Managers can immediately adjust beat plans, reassign leads, or follow up with teams to keep performance on track.

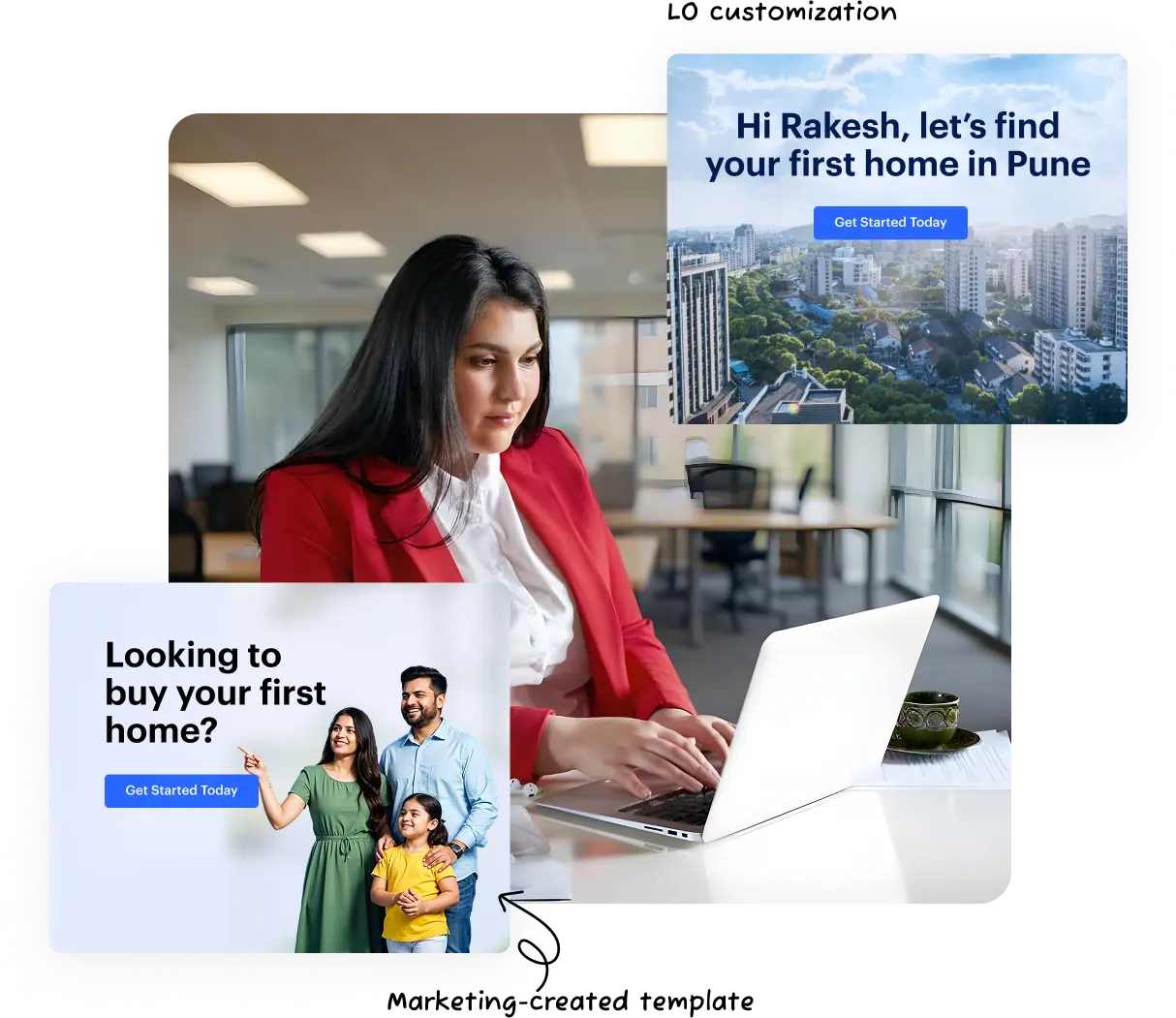

With LeadSquared’s Mortgage CRM, marketing teams can maintain brand consistency while giving loan officers the flexibility to personalize campaigns for their local markets across home loan and housing loan segments.

Connect our mortgage CRM with the tools your team already uses.

Connect with your eSignature tools. Once a borrower signs a document, LeadSquared updates the file status automatically—no manual action required.

Seamlessly integrate with a wide range of loan origination systems, including LeadSquared’s, using robust APIs and middleware, ensuring smooth data flow across your home loan or mortgage processes.

Sync with your emails or messaging apps like WhatsApp to keep communication centralized. You can also integrate platforms like RingCentral to manage client interactions—voice, chat, SMS, or email—in one place.

Use our flexible API framework to connect with in-house tools such as credit scoring engines, verification systems, and more.

LeadSquared’s drag-and-drop workflow designer allows mortgage lenders to build complex

automation journeys—without depending on engineering teams.

Stay connected with your customers throughout the loan lifecycle—without adding manual work.

With the right automation, loan officers can continue building relationships after disbursing a home loan or mortgage, without overwhelming their schedule.

Instead of one-off follow-ups, automation helps you:

These consistent, low-effort touchpoints reinforce trust and encourage repeat or referral business.

Motivate your DSAs, connectors, and Housing Loan Sales Executives (HLSEs) with transparent, automated incentive tracking.

Set up home loan-specific payout plans, run monthly contests, and track performance in real time. Incentives can be auto calculated based on disbursed loans, with each partner or HLSE able to view their earnings and contest status directly on their dashboard.

This removes manual tracking, boosts engagement, and ensures timely, accurate payouts.

Referral networks are essential to mortgage and housing loan growth—but maintaining them takes structure.

With our mortgage CRM:

Automatically capture and distribute leads—online or offline—across your internal call center. Assign leads based on:

Improve speed-to-lead and conversion with smart routing.

Enable your field sales team to drive more conversions with smart automation. Let them plan daily

meetings by priority, optimize their travel routes, and surface nearby leads in real time.

Keep your housing loan disbursals moving with a mobile-first approach. With the LeadSquared app, HLSEs and field teams can:

This level of mobility ensures faster turnaround, better coordination, and higher field productivity.

Direct Selling Agents (DSAs) are a key channel for housing loan growth—but manual coordination slows them down. With LeadSquared’s Mortgage CRM, DSAs get a fully digital experience:

Access clear, actionable reports that show how your loan officers, sales agents, and referral partners are performing. Use it to make smarter decisions and reduce inefficiencies across your mortgage and home loan operations.

What kind of support and training is available for teams using LeadSquared’s mortgage CRM?

Whether you’re bringing new loan officers onboard or fine-tuning workflows for your home loan or housing finance teams, you’ll have access to a variety of resources designed to help your team succeed.

There are step-by-step video tutorials that make learning the platform easy—no technical background needed. For teams that prefer hands-on guidance, live training sessions and webinars cover everything from sales automation to borrower engagement strategies.

A self-paced learning library is also available, offering best practices and compliance tips tailored to the mortgage and housing finance space. If you need more specific help, implementation consultants can assist with set-up and workflow planning. And when questions come up, the support team is there—whether it’s a quick fix or a more complex issue.

User groups and industry events are also available for continued learning and networking, helping your team stay informed and confident in using the CRM effectively.

How do I keep borrowers engaged throughout the mortgage process and after closing?

LeadSquared’s mortgage CRM helps you stay connected with borrowers at every step of the home loan journey. From the moment they apply, you can automate timely updates—like application status, document reminders, or next steps—via email, text, or even short video messages.

After the loan is disbursed, the CRM makes post-close follow-up easy. You can schedule thank-you messages, loan anniversary check-ins, or seasonal tips—without having to do it all manually. It’s a simple way to stay top of mind, build trust over time, and encourage repeat business or referrals.

How does a mortgage CRM help loan officers manage their pipeline better?

A mortgage CRM keeps all borrower data and interactions in one place, helping loan officers stay organized throughout the home loan or housing finance process. Instead of juggling notes or spreadsheets, they get a clear, real-time view of where each application stands.

It also helps prioritize the next steps—whether it’s following up on a document, scheduling a call, or moving a deal forward. This creates a more predictable workflow and reduces delays or errors that often come with manual tracking.

What makes LeadSquared a good fit for mortgage businesses?

LeadSquared helps mortgage teams manage leads, track loan progress, and engage with borrowers—all in one place. It’s built for the fast-moving needs of home loans and housing finance workflows.

From capturing leads to coordinating with DSAs and field teams, the CRM keeps everything organized and up to date. This reduces back-and-forth, helps avoid delays, and makes the loan process smoother for everyone.

It also integrates easily with loan origination systems and credit services, so data flows automatically between platforms. Managers can monitor team performance in real time, identify bottlenecks, and act quickly when things slow down.

How can automation improve communication with borrowers?

Automation helps borrowers stay informed throughout the home loan process by sending updates at the right time—like application status, document reminders, or disbursal alerts. This keeps communication steady without relying on manual follow-ups for every task.

It doesn’t replace personal interaction, but supports it—freeing up loan officers to have more meaningful conversations when needed. Borrowers get a smoother experience, and teams stay consistent even during high-volume periods.

You can also tailor communication by loan type or stage, so borrowers receive only what’s relevant to them, on channels they prefer—whether it’s email, text, or WhatsApp.

What kind of reports or data can a mortgage CRM provide?

A good mortgage CRM provides clear visibility into every stage of your home loan pipeline—so you can track how leads are progressing, where delays are happening, and which marketing or referral sources are driving the most conversions.

Beyond surface-level numbers, the reports help managers spot underperforming branches, disengaged partners, or stages where housing loan applications commonly stall. Over time, this data reveals trends that support smarter planning and resource allocation.

It’s especially helpful for teams managing multiple loan officers, DSAs, or connectors.

Can a mortgage CRM integrate with other tools my team already uses?

Yes. Integration is a core feature of any modern mortgage CRM. It should connect seamlessly with the systems your team relies on—like loan origination platforms (LOS), credit scoring engines, eSignature tools, and messaging or calendar apps.

This level of connectivity prevents duplicate data entry, reduces errors, and helps your teams stay in sync across departments—whether they’re managing home loan applications, tracking documents, or staying in touch with borrowers and partners.

Some platforms also support custom API integrations, so even proprietary housing finance tools can be connected for a more unified workflow.

How does a mortgage CRM support compliance

A mortgage CRM helps maintain compliance by logging every borrower interaction, tracking document handling, and ensuring sensitive data is stored securely and in line with regulations. This creates a clear audit trail and reduces the risk of missing critical information.

It also supports document version control and time-stamped communication logs, which are useful during internal reviews or third-party audits. In housing finance, where regulatory oversight is strict, this structure helps loan officers and managers avoid common compliance slip-ups.

Mortgage CRMs like LeadSquared’s even allow you to set role-based access, so only authorized users can view or edit specific borrower data—adding another layer of control.

How can a CRM help with referral partner management?

A mortgage CRM helps you stay organized and consistent in how you engage with referral partners—whether they’re real estate agents, builders, or housing finance consultants. It tracks where each referral comes from, how many leads convert, and which partners are driving the most value over time.

You can also automate routine touchpoints like thank-you messages, milestone updates, or co-branded marketing campaigns. By having visibility into partner performance and staying responsive, your team can build stronger, more strategic referral relationships that last.

Will implementing a mortgage CRM slow down our current processes?

There’s usually a brief adjustment period when adopting any new system, but a well-designed mortgage CRM should enhance your existing operations. It integrates with your current tools and workflows, so your team doesn’t need to start from scratch.

With structured onboarding and role-specific training, most teams quickly see improvements in efficiency. Tasks like lead distribution, follow-ups, and status tracking become easier to manage, especially in high-volume mortgage and housing loan environments.

In the long run, automating manual processes helps your loan officers and sales teams focus on what matters most—serving borrowers and closing deals faster.

How does LeadSquared handle borrower data security?

LeadSquared follows strict, industry-standard protocols to safeguard borrower data across all mortgage and housing loan workflows. This includes encryption for data in transit and at rest, role-based access controls to prevent unauthorized viewing, and regular audits to ensure system integrity.

The platform also supports compliance with relevant data protection regulations, helping lenders and financial institutions maintain trust with borrowers. Whether it’s personal identification, income documents, or loan details, every touchpoint is designed with security in mind—so your team can focus on lending with confidence.

How do sales tool integrations benefit my loan officers?

By linking key sales tools into your CRM, loan officers can access the latest market data and borrower updates without switching platforms. This helps them tailor loan recommendations based on real-time information. They also receive alerts when borrowers show new interest or behavior, allowing for timely follow-ups.

How do sales tool integrations benefit my loan officers?

Integrated sales tools save time and give your loan officers the context they need to act quickly. Instead of toggling between systems, they can view borrower activity, loan status, and key updates in one place. This makes it easier to personalize conversations, spot new opportunities, and respond when interest is high. It also reduces missed follow-ups and helps them stay focused on building stronger borrower relationships.