A Leading Insurance Firm Increases Their Daily Insurance Sales by 40% with LeadSquared

10x your sales productivity with LeadSquared.

Book your 1-1 consultation today!

Book your 1-1 consultation today!

INCREASE IN INSURANCE SALES

INCREASE IN CONVERSIONS

IMPLEMENTATION

IN RUNNING EXPERIMENTS

INCREASE IN INSURANCE SALES

INCREASE IN CONVERSIONS

IMPLEMENTATION

IN RUNNING EXPERIMENTS

Belonging primarily into the general insurance sector, the motto of this cutting-edge insurance firm revolves around harnessing data for intelligent underwriting. Having been in the industry for over a year, they initially focused on marketing third-party car insurance. Gradually, they expanded their portfolio to encompass comprehensive insurance products for both cars and motorcycles.

The Sales Growth Hacker at the company talks to us about how LeadSquared has been with them ever since their inception and helped them grow.

The firm aims to cover the entire internet economy with an intent to understand its users in great detail. This data is then used to underwrite customized insurance plans.

So, the larger problem with the industry is how to hand-pick people and how to cherry-pick users to underwrite them differently?

That can only be done when you have got a plethora of data with you to understand what the different user profiles are and create user personas accordingly. You can then use this data to differentiate among different sets of users and then create customized insurance plans. This ensures that the right benefits reach the right people and there is a difference in premium for different personas.

Let’s take an example of car insurance as a product, wherein the online insurance buying today is at 6-6.5%. A major part of insurance buying is happening offline through dealers and different agents. When you move a business from offline to online, you need to impart education to users to make them understand what benefits they get when they buy online. It’s not an e-commerce product where the users can come online and simply make the payment and then purchase. It is a higher ticket size product, so you need to build trust and you need to engage with the user.

For this, there is a middle layer involved, where the advisor talks to the user and explains the benefits of the product – what will be covered and what will not and all other nuances. Means, no last-minute surprises, where a desired feature is not covered by the policy.

You can have a 1000-seater call center who work on excels, call the users, and chase them at different points in time. It’s like a lead management system running in their own head and being maintained on excel. But, how do you chase people efficiently at the time they want, or when they are on your website and need information? It’s not about how you chase them, rather how smartly you chase them.

Let’s say you have 1 million prospects and have a capacity of 1000 seats. So tomorrow if you have 2 million prospects, will you increase your call center to 2000 seats or will you be smart enough to increase the capacity by 10%, but you can cater to 2x number of prospects? That’s why you need a smart CRM. And that’s why the firm zeroed in on a customizable, scalable and sustainable CRM like LeadSquared.

Four reasons: scalability, customization, deliverability, and cost. LeadSquared checked everything on the list.

As they went ahead, they felt their decision was correct. The kind of customizations they wanted was delivered on time. They had the flexibility of running multiple experiments. They could expect results within 15-20 days and could build upon the next problem statement. And that’s why objectively, by giving different weightings to different parameters, they decided that LeadSquared was the winner.

There were 2 important things that they were looking for in a CRM.

So, how can you chase the user appropriately and at the right time? So these were the two things that were important: reaching out to new prospects and to old prospects at the right time.

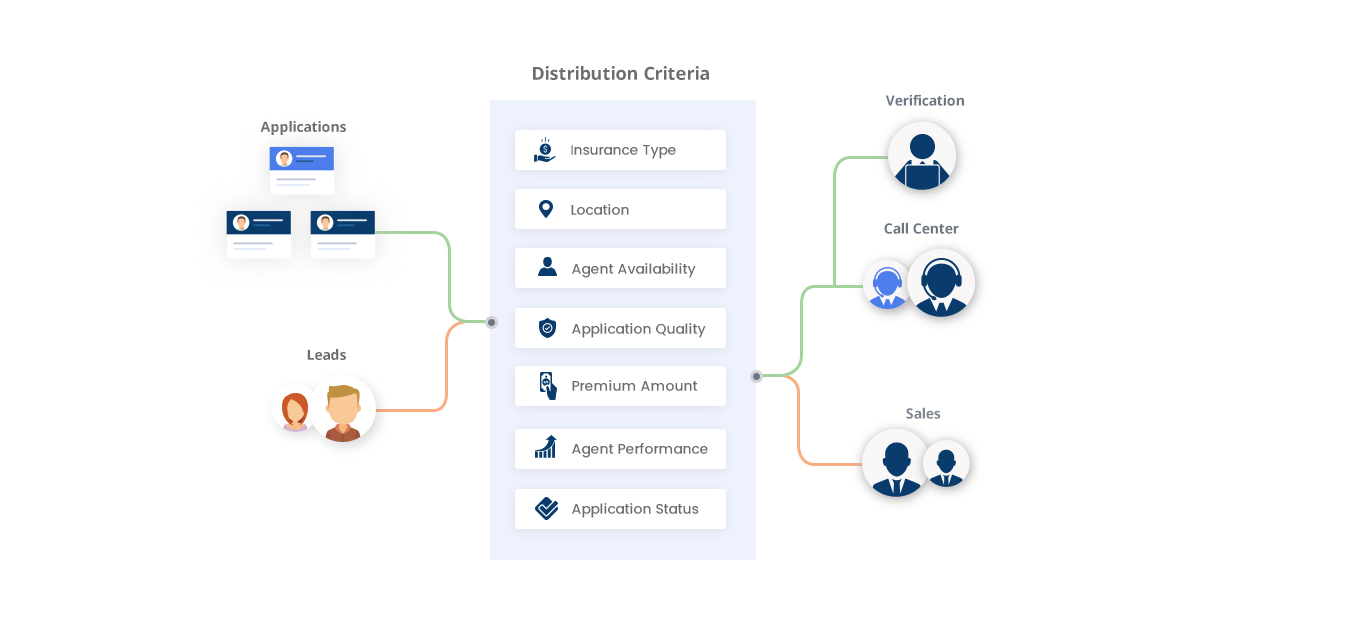

Their call center team uses LeadSquared the most. Every time a new lead enters the system, a priority score is assigned to them. This score is calculated based on parameters such as the source of the lead, time of the day, depth of product usage, etc. This is then distributed to their 200+ call center team, in a round-robin manner based on their availability. Thanks to this, the team knows who to call first, as the system decides for them who a high-priority lead is.

Their advisors, ie the sales team, use LeadSquared as well, and they use the data gathered by the lead tracking tool to pitch relevant products to the lead. The data collected at the call such as their demography and interests are then ingested back into the priority score.

The operations team makes use of the tool as well. When customers’ car insurance expires, the firm needs to inspect the vehicle before issuing a new policy. LeadSquared helps them schedule these inspections, assign them to the available user and even reassign them if needed. The product team also uses LeadSquared quite a lot, since the tool is now deeply integrated with their product and processes.

In their case, lead distribution is round-robin, and every lead has a priority score. There are hundreds of leads queued and they don’t have that many agents free at that point in time. Hence, based on the priority score, they push leads to the agents, and these leads have the highest propensity to convert into sales.

With the introduction of LeadSquared and continuous optimization of the product, in the last 3 months, the: avg sales per day per agent has moved up by 40% and lead to sale has moved up by 35%. They are working to improve the product further by bringing other parameters as well, in terms of prioritizing leads- like compartmentalizing lead scores to get a better understanding of user personas.

“I would love to recommend LeadSquared,” said the Growth Hacker. “In fact, I have already recommended it to a few internet economies that LeadSquared is a highly customizable product and can deliver as per your needs. The support system has been phenomenal, over weekends and holidays. This what you need when you are a new-age startup. Where you can grow fast and there is someone who can walk the mile with you. So yes, I will definitely recommend it and have already been doing so from the very beginning.”

“We have been using LeadSquared for more than a year. Implementation started in Aug 2017. As of now, we are not looking at exploring any other tool, we are well satisfied. We believe in committing to a technology and making it work, rather than exploring what is better in the market. With the right set of people we are working with, like the support team, the delivery team and different managers at the leadership level, we will make it work. LeadSquared is completely customizable, scalable and the support is phenomenal!”

(+1) 732-385-3546 (US)

080-46971075 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)

Avagmah Increases their Sales Conversion Rate by 20% Every Quarter

Avagmah Increases their Sales Conversion Rate by 20% Every Quarter