Once insurance was simple. It was just about insuring a building or maybe a vehicle and of course a person. However, in recent times it has become so much more. With this fast-growing pace of the industry, insurance sales has also evolved into so much more.

Insurance sales isn’t just focused on creating products to match the needs of a customer – it is much simpler to identify the exact needs of a customer and find a product that matches. If you’re dealing with just a few customers it is simple to do as you’ll know which customer needs what cover, and you can keep track of it simply.

Different Aspects of Insurance Sales

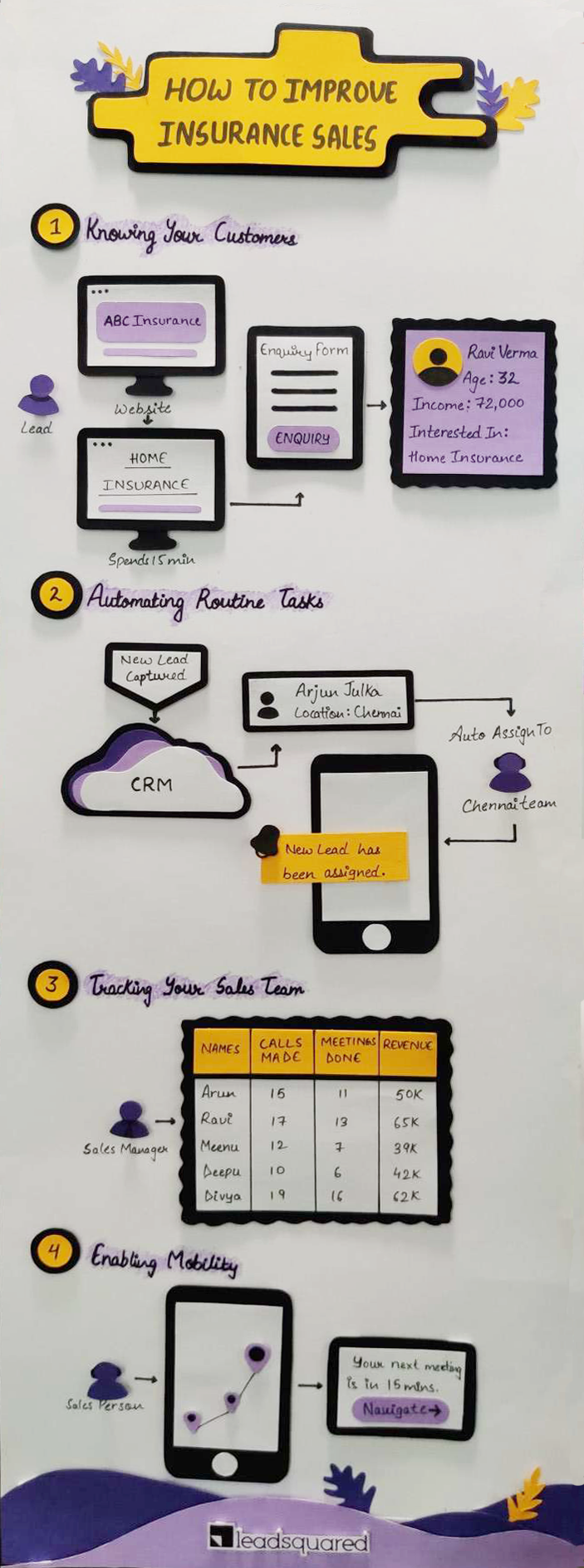

When you’re dealing with multiple customers looking for multiple products and have several members in your sales team, it can easily get out of hand without proper management. If you are looking for a tool to help you accelerate insurance sales, here are some benefits that you should be looking out for.

Improving customer experience

Using a piece of software with a CRM (Customer Relationship Manager) facilities will allow you to record the information that is relevant to the needs of your customer. This will be an invaluable reference tool should you need to research the best product for them.

With a web-based CRM, information can be seen by multiple members of your sales team instantly. This allows your business to provide better customer service as should the customer call back, every team member has the same information at their fingertips.

But just recording the information you are given might not be enough – every business can do that. What if you could understand the customer’s requirements before any member of your team had spoken to them?

Automating the sales process

When looking for insurance, most people will initially turn to the internet. This is a trend that has been growing for around 20 years. Comparison sites and online quotes have made it easier for everyone to obtain insurance.

Through the early iterations of online insurance availability, websites popped up that were essentially business cards – “If you’re looking for insurance, email us or call this number” – and were viewed as just another method of advertising.

A well-designed site can now provide plenty of information on the different options for insurance for any visitor to see. Using an automated tracking system will allow you to discover many facts about your potential customer before a human is ever involved in the process.

Even better, every lead that fills a form or requests a quote will be captured as a lead. And instead of a sales manager manually assigning each lead to a sales agent, you can assign the leads automatically based on geography, demography or even product-wise.

Detailed Website Tracking

Every page on your website is important, and you’ll be able to discover what page any lead initially landed on. You’ll see how they progressed through the site, what other pages they viewed, and if they entered their details to find out more information about a product.

This will likely trigger an automated email giving further details and offering options on the basic product. When the lead clicks a link in the email, the web system will know who they are, and a better picture of their needs will be built up.

All of this information will be added to their profile in the CRM, meaning the most complete set of information can be compiled without a sales team member needing to intervene.

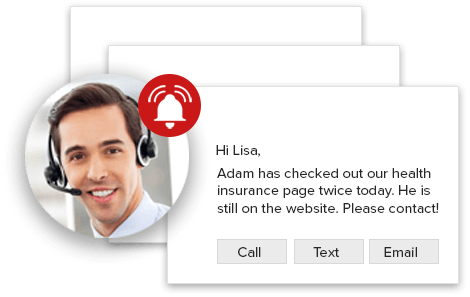

Automated notifications and sales signals

Custom triggers can be configured so that at any stage the sales team can be notified if they need to call, message, or email a lead to give clarity or close a sale. When it comes to insurance sales, the major factors that affect conversions are suitability and trust.

With the wealth of information that has already been collected, finding insurance that is suitable for their needs should become a straightforward process. There is no ambiguity and you are clear about what you need.

As for trust, communicating with a sales team member who understands what is wanted and how to solve the lead’s problems will rapidly build a relationship. If the lead needs to speak to several members of the team it will quickly become apparent that every team member knows as much about their needs as the others, giving an overall sense of care and commitment that further builds trust.

A lead that trusts you will be far more likely to convert than a lead who is constantly having to repeat what they want. Your CRM will be worth its weight in gold!

Tracking Your Sales Team

Getting sales is great, but it is only part of the story. Knowing how your sales team is performing is key to planning a strategy for the future.

Automatic reports can be generated every week or month as you choose, emailed directly to managers to assess the performance over the previous period. These reports can identify how each team member is performing, along with the sales associated with each product on offer. This can even be cross-referenced with geographic locations to provide an idea of which products sell best in which areas.

[Also read: why is insurance sales training crucial, and how to automate it?]

If you have a sales team that goes to the field for meetings, there is so much more that you could do.

Enabling Field Sales

Management is made easy with the use of a mobile device app that allows managers to track the exact location of their team. You’ll be automatically notified when they reach the location for a meeting, and they’ll be prompted to enter their meeting notes as they leave.

This will be synchronized with the CRM once again, keeping everyone and everything up to date.

The app will give instructions on how to get to their next meeting, alleviating the pain of trying to find members of your sales team who have got lost on the way.

You can allocate tasks to team members that pop up as notifications, and you can monitor and record conversations by voice or SMS from these devices directly to the CRM.

It makes management much simpler and makes it easy to keep the team on track while updating the customer profile at every given opportunity.

This efficiency will lead to more sales as every customer knows they are being looked after, no time is wasted searching around for missing sales team members, and everyone knows how to get to where they need to be on time.

In Conclusion

In order to accelerate your insurance sales, it is very important to have an insurance CRM that comes with all the benefits mentioned above. If you want a recommendation, may I suggest LeadSquared? It has been helping many insurance businesses such as Acko, Universal Sompo, Bharti Axa and Qbera to sell insurance better.

You can check it out for yourself and take a quick 15-day trial.