Sigmund Freud once said, “Everything that you and I do springs from a motive: The desire to be great.” This ideology holds true for people all around the world. It’s just the definition of greatness that varies. So when we talk about the insurance sector, greatness would mean – generating more leads in insurance and closing more deals than the competition – because the competition is immense.

What will set you apart are your strategies and execution. You need to channel your energy in a proper direction when it comes to generating and managing leads in insurance sector.

To do that, you can go through a hit and trial method, which can be highly time-consuming.

Or

You can make effective use of the technology to employ the already tried and tested techniques.

It will help you to transform your insurance sales process into a targeted and streamlined approach.

Technology Provides an Easy Way to Manage Leads in Insurance Sector

In the insurance sector, there are two business models. First, where you sell insurance online, and you generate leads from your website, social media, ad-campaign, and different other channel.

The second is through intermediaries like bancassurance, etc, where you sell insurance products through banking institutions.

When we enabled both of these insurance sales models with technology, the results were astonishing.

But before seeing the results, let me unveil the technology that was employed.

It’s LeadSquared’s Sales Execution Software for Insurance.

LeadSquared has helped many companies strategize their sales and achieve targeted growth in the insurance sector.

How has LeadSquared Enabled Companies to Manage Leads in Insurance?

History sparkles with amazing examples of businesses that thrive on robust customer relations. To that effect, LeadSquared’s Customer Relationship Management software provides an efficient way to generate, manage, and nurture insurance leads while providing quality customer experience.

Businesses function through people, and contrary to what we are taught to believe, people are not creatures of logic, but of impulse, of emotion. Now, while the insurance policy cannot appeal to the emotions of your prospects, but Your sales team can!

And this where LeadSquared comes into play. So let’s discuss how LeadSquared Insurance CRM can help you to manage leads in Insurance Sector.

Capture Insurance Leads from All Channels

When you are selling insurance online, you generate leads from your website, social media, PPC campaigns, events, etc. LeadSquared automatically captures these and notifies your sales agents to follow up with the same.

It ensures that there is ZERO lead leakage in your business. Because every lead could be an opportunity, and you would not want to waste it in any way.

Not just that, you can also capture leads from traditional channels like billboards, etc. through telephony integration.

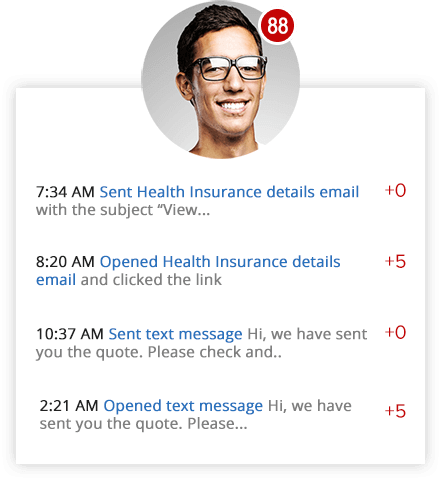

Distribute Leads To Call Center and Sales Agents

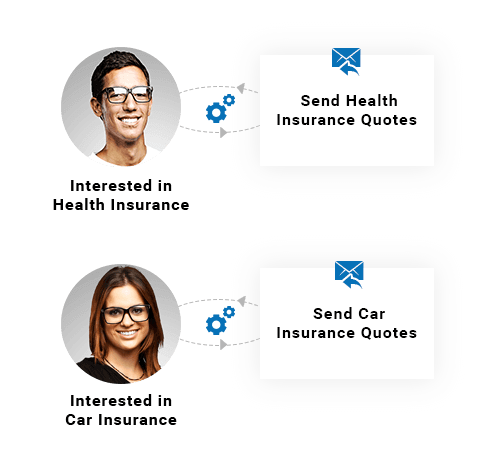

Once the lead is captured, the tool automatically distributes these to call centers and your sales agents. The distribution process occurs according to interests, location, agent availability, and other criteria.

For example, your prospect is interested in buying term-insurance or health insurance. The lead will go to the agent who specializes in that domain.

Distribution of leads ensures that only those agents handle enquires who are experts in that vertical. This improves customer experience and results in powerful word-of-mouth marketing.

[Also read: What makes it the best CRM for insurance agents?]

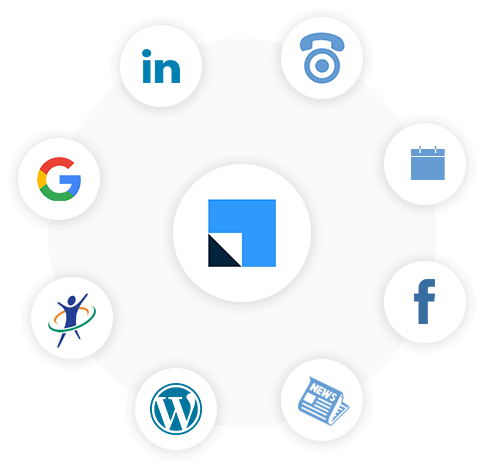

Identify the Best Opportunities

LeadSquared helps identify the best opportunities from the loads of enquires captured every day. The software checks the eligibility criteria, age, medical history of the family, etc, based on the factors important to you.

Quality score, allocated from 1 to 10 based on variables defined by you, enables your team to reach out to prospects who have a higher probability of converting into sales. It increases the efficiency of your sales team, and in turn, builds up their confidence level.

Track All Communications At One Place

Let’s say you delivered the perfect pitch. You appealed to the right emotions of your prospect and made them your customers. The entire sales conversation sings in your memories for days like the music of morning stars. But, you should understand one thing, what worked with one closure might not work with other prospects.

You must understand that every prospect is unique. You must keep track of every conversation, sales or otherwise, to weave your sales pitch according to the response you get.

The software enables you to track all conversations that have happened with the client. It includes monitoring of phone calls (through connectors like telephony), emails, text, or other channels of communication. Your sales agent can add personal notes about the client’s response to these.

The complete overview of the conversational history assists your agent to plan the communication to engage your prospects better.

Provides Smart Views to Better Plan Agent’s Day

LeadSquared provides a unified 360 – degree view of all activities and sales process. It accumulates all data related to meeting schedules, conversational history, daily tasks, to provide a holistic view.

This enables your sales agents to attend meetings with a higher lead score and get more conversions.

Alert Your Agents with Important task

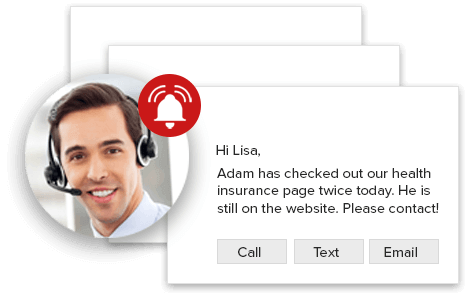

Website tracking alerts your sales agent to reach out to the lead when they view a specific page.

For example, as soon as your prospect submits documents for verification, the agents will be notified of the same. Simultaneously, the software will assign the next task to initiate the verification process.

Empower You Field Agents with Mobile CRM

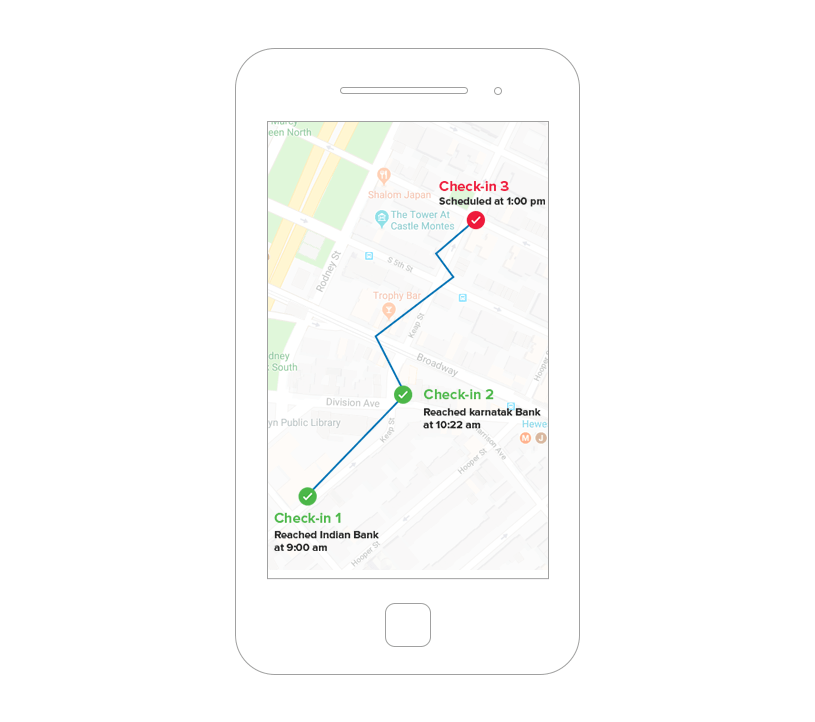

Insurance providers that operate through banks (bancassurance) have relationship managers who visit banks regularly. Relationship managers ensure that banks are meeting their targets, and help them with proper training about different/new products.

Here, The mobile CRM auto plans your agents’ day, schedules their meetings to optimize their day, without any unjustified wastage of time.

You can even make the process essentially paperless by allowing your relationships manager to upload documents for verification, digitally.

Once the documents are submitted, the software will automatically set up the task for the verification team, who can follow up on the same

Identify Cross-sell Opportunities

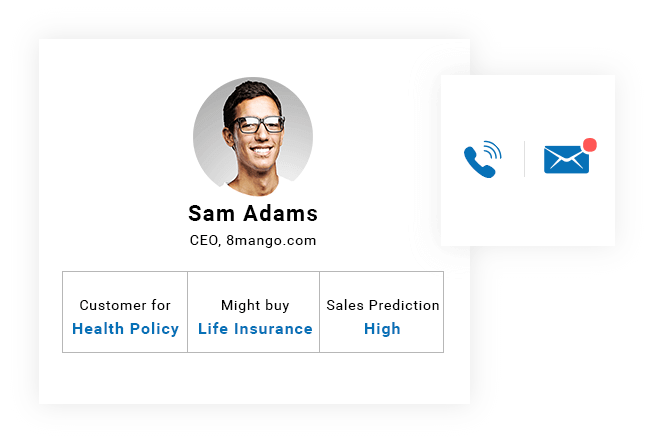

CRM keeps track of all data related to the customer. Based on the type of policy purchased by the customer, the software identifies possible cross-sell opportunities at the spot.

For example, if a person has recently purchased a policy of health insurance, the software will notify the team specializing in life insurance to approach the customer and check whether they are interested.

Automate Policy Renewal Process

How often do you follow-up with prospects to renew their policies?

When several new insurance leads are flowing in, you may consider it a low priority task and procrastinate. Or more likely, with the number of customers you have, you simply forget.

But, customer retention and lifetime value is even more important. You may wreck all your dream ships on the sharp rocks of reality when you lose an opportunity to retain your customers.

LeadSquared empathizes with you and provides you a way to automate emails and texts to policyholders as their renewal date draws closer. Simultaneously, the software notifies agents and set tasks for them to make follow-ups if the customers don’t renew on their own.

Monitor all Your Sales Channels

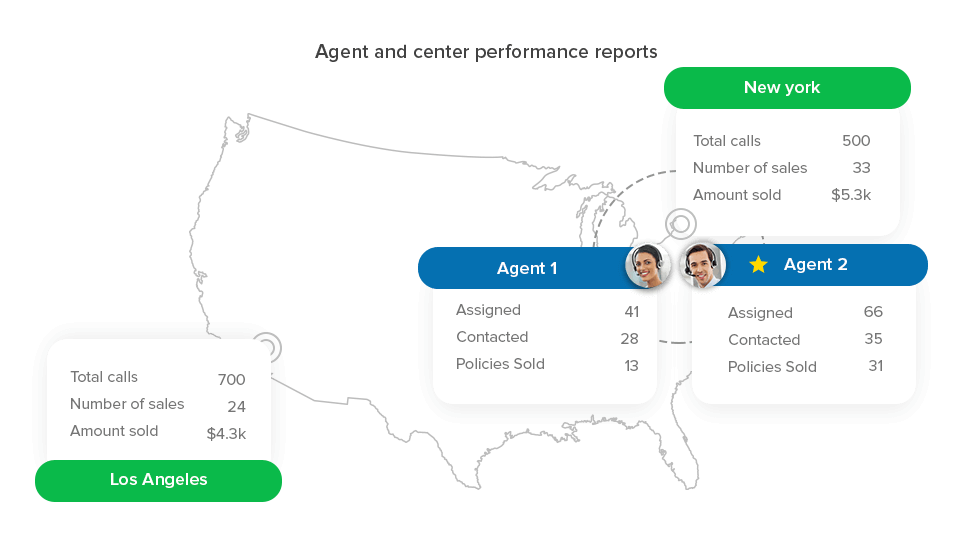

When you have offices across cities, it sometimes gets challenging to keep track of all activities. It includes monitoring the performance of your sales team, number of policies sold, and the total revenue generated.

These attributes collectively help in modifying your sales approach and plan strategy. LeadSquared offers a way to monitor and analyze all your sales activities in different regions and collect all of them in one place.

Become the Best in Managing Insurance Leads Now

LeadSquared helps you to manage your insurance leads effectively. It creates a channeled process for your team, and enables you to construct real relationships with your customers.

So let’s be ahead of your competitors and gain the most out of every lead that flows in with LeadSquared Insurance CRM.

![[Roundtable] From Traditional to Digital: Building a Customer-Centric Insurance Strategy](https://www.leadsquared.com/wp-content/uploads/2024/07/insurance-RT-popup-1.gif)