Video KYC Solution. Onboard Customers & Partners Remotely

Accelerate your verification process and reduce onboarding costs – Seamless Integration of LeadSquared with 3rd party Video KYC solutions

Accelerate your verification process and reduce onboarding costs – Seamless Integration of LeadSquared with 3rd party Video KYC solutions

Manage your entire lead lifecycle from lead capture to onboarding in one single CRM

Fast verification without the need for physical document collection.

Live face detection using a robust face recognition algorithm.

Secure real-time customer data verification using OCR.

The location is authenticated with latitude, longitude + IP capture.

Done on the displayed ID proof using AI/ML-based algorithms.

Video forensics for pre-recorded risk and spoof detection is done.

Timestamp & audit trail captured for every application & video.

UIDAI compliant verification with LeadSquared Video KYC.

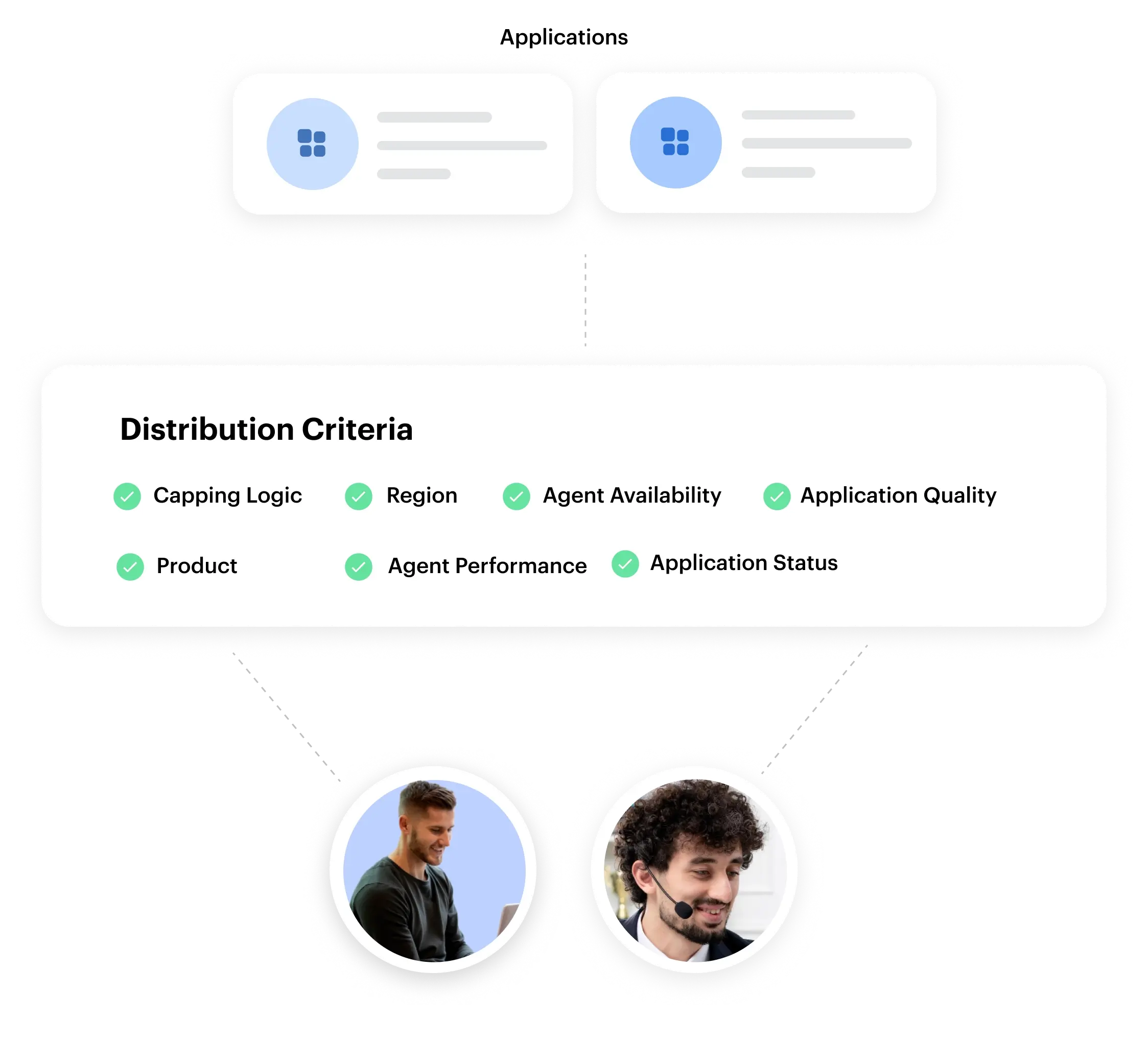

Applications are captured through the website, landing pages, APIs, field sales teams, and banking relations, and distributed to the verification team based on pre-defined logic – regions, rep performance, agent availability, or on a round-robin basis.

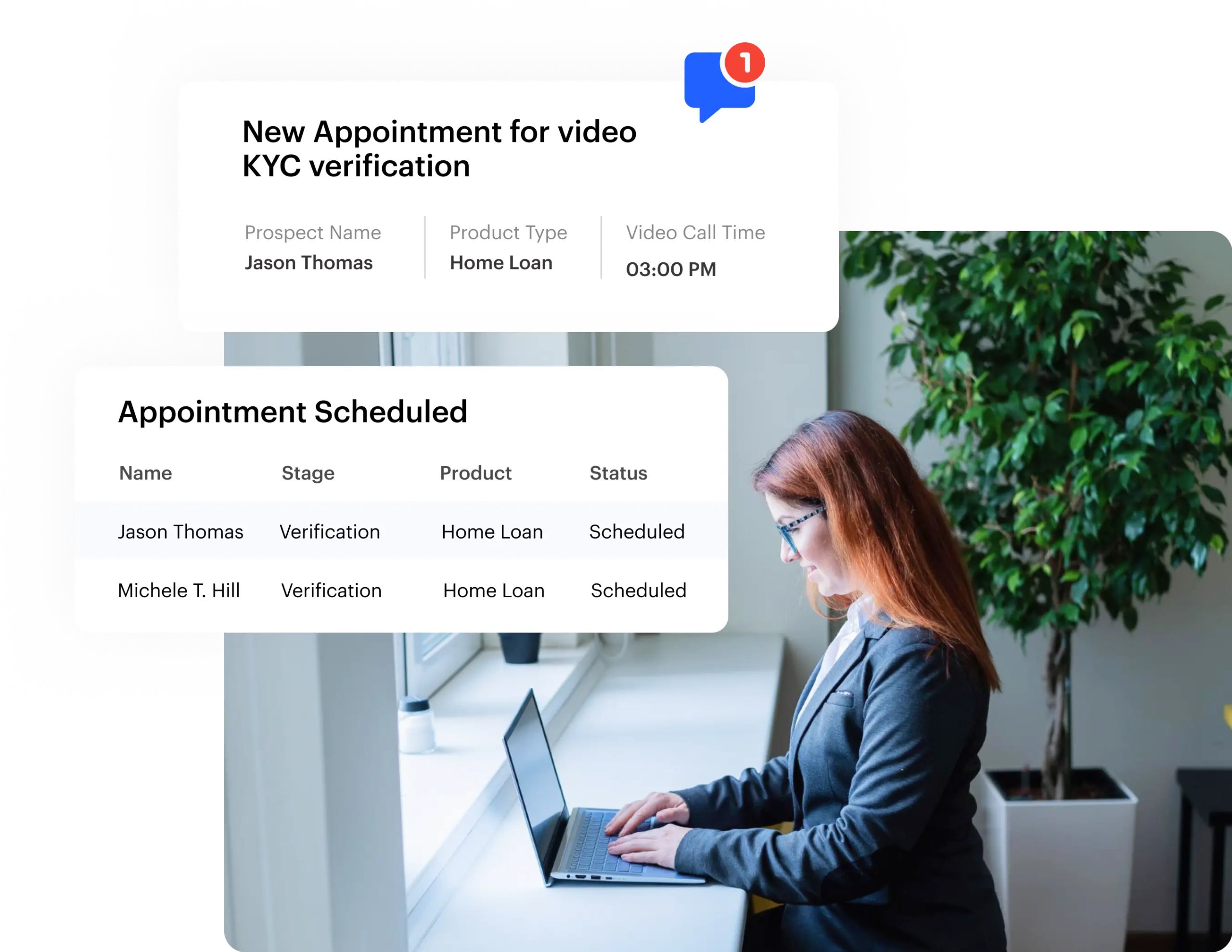

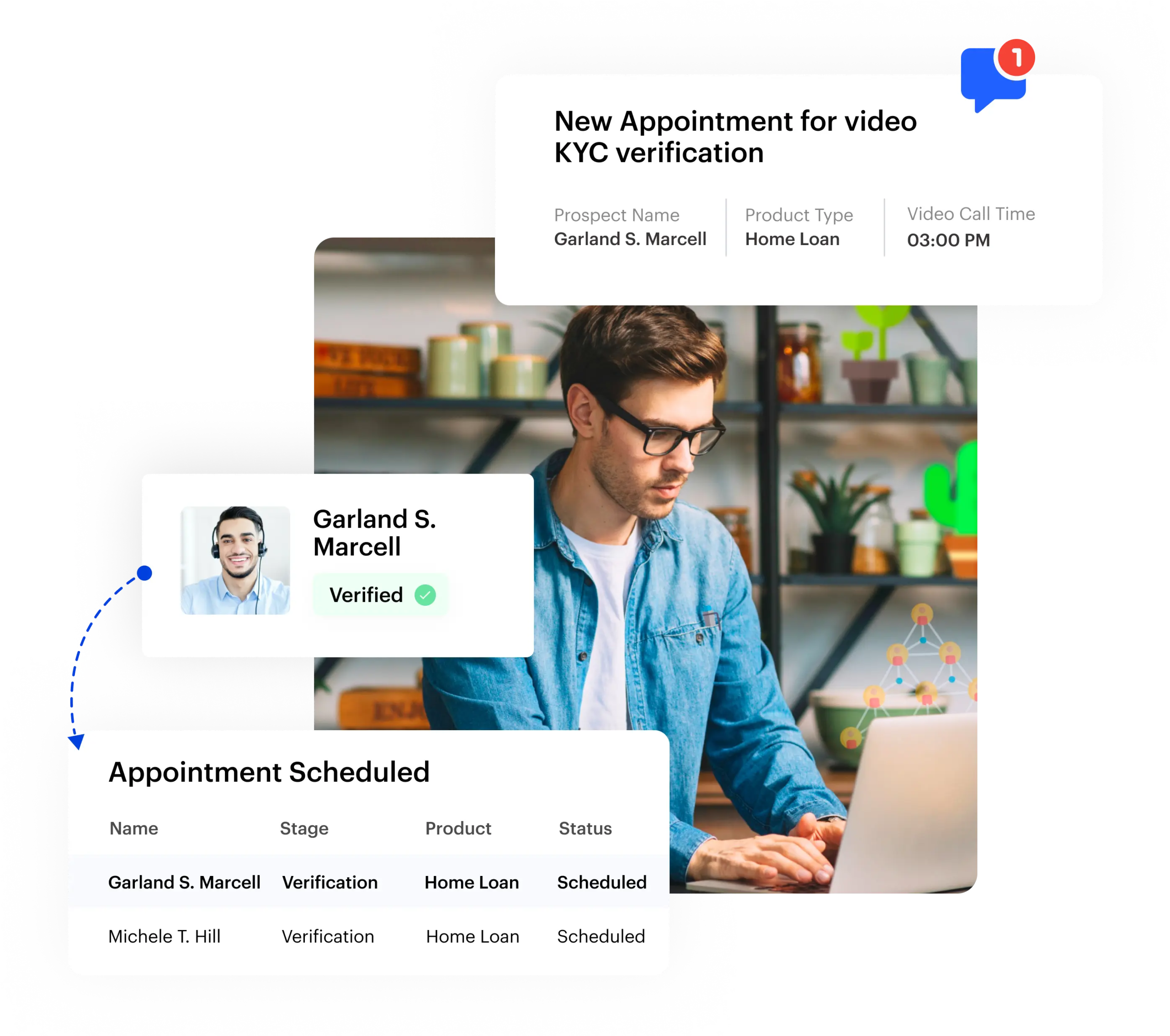

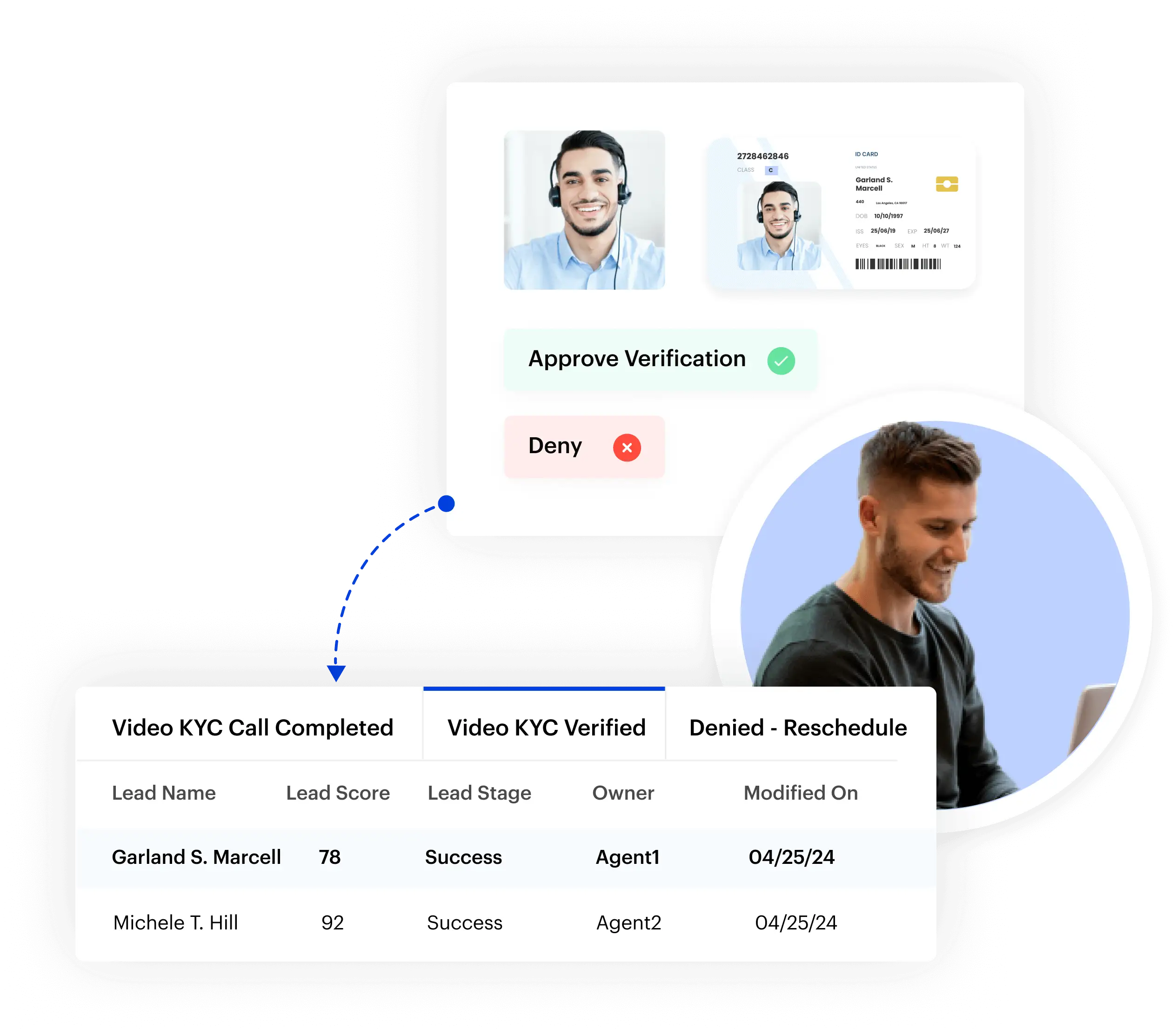

Once the application is assigned and time and date are set, the prospect will receive a call link – the time for this is completely customizable according to your requirements. The prospect initiates the video call by clicking on the link.

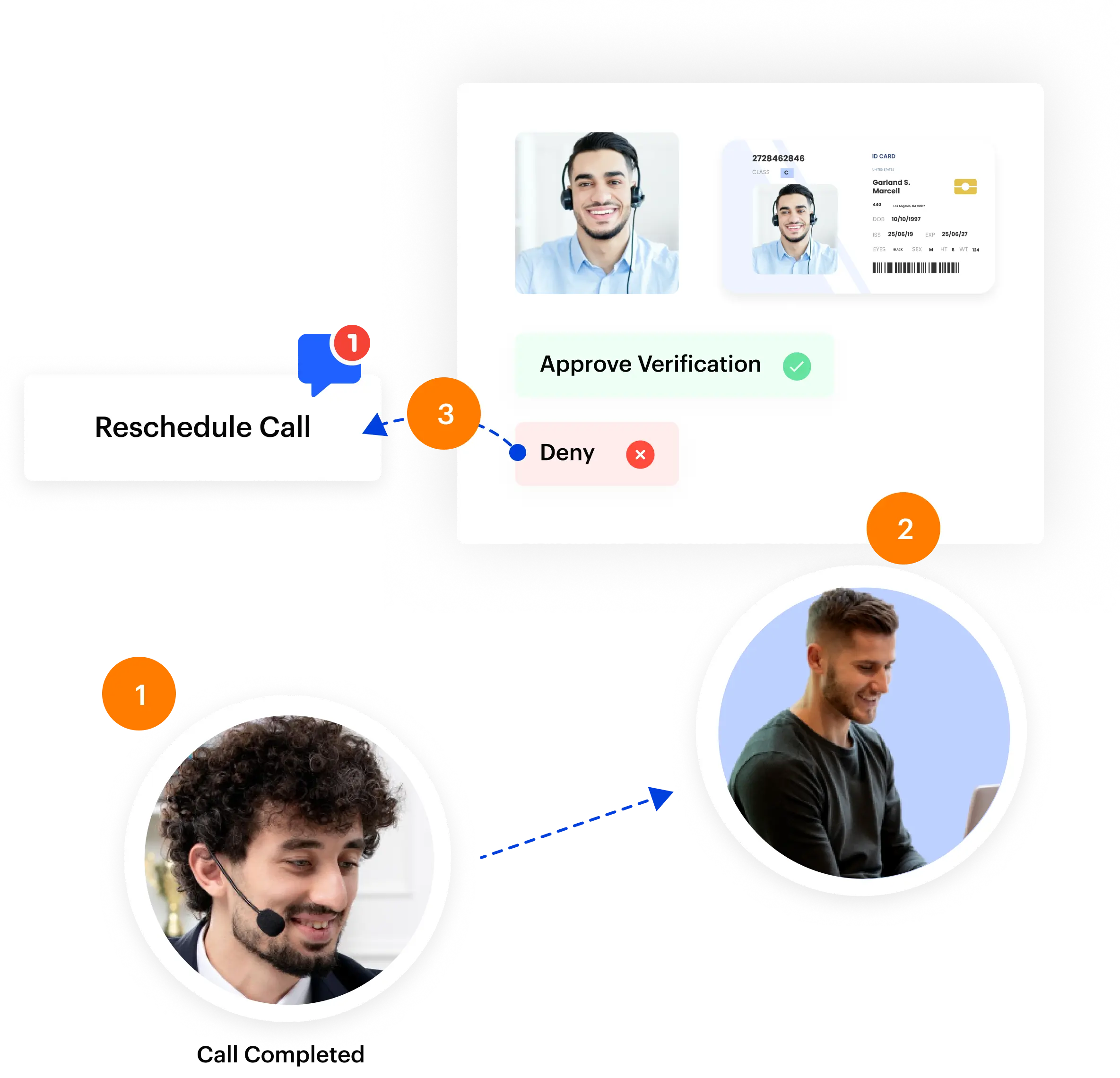

During the call, the prospect holds up any of the approved documents in front of the camera. The agent takes a screenshot of the prospect as well as the document, followed by face matching. The person’s name and DOB are also captured from the document using OCR and matched with details provided by them.

LeadSquared CRM connects powerfully with any video KYC solution provider to ensure that your customer acquisition process is completely connected – right from application to verification, onboarding, and closure.

The call is completed once the agent approves or disapproves, using a mix of face match results, the details captured by OCR, and his own judgment. A manager or reviewer reviews the call between the agent and prospect. Post-review, he can either accept the verification, ask the agent to repeat the video KYC process, or reject the prospect.

Once the reviewer has completed this the lead status is updated as verified or not verified. This is updated in the LeadSquared CRM and the lead can then be passed on to the next stage.

Get in-depth insights into your funnel, team performance and more

Regulatory Requirement | LeadSquared Video KYC Solution* | ||

1 | Video to be recorded; Live photograph of the customer | Recording of video interaction; Screenshot capability | |

2 | Offline Aadhaar verification; XML file not older than 3 days | Aadhaar XML through UIDAl site. Generation date to be checked | |

3 | Clear image of PAN card | Only clear and usable images will be accepted | |

4 | PAN verification from database | Verification is done instantly at real time | |

5 | Geo-tagging to ensure customer is in India | Geolocation captured using Latitude/Longitude | |

6 | Photograph of customer to be matched with the one on IDs | In-built FaceMatch providing compare scores and band guidance | |

AND MORE | |||

“We don’t need to check multiple tools to find out the progress we’ve made as a team. With dynamic dashboards on LeadSquared, we get to see all the quantifiable results at a glance. Since we have better visibility about the incoming flow of leads according to their source, we’re able to judge lead sources that make the most sense for the business and how we can pool in budgets and resources accordingly.”

Take a demo of LeadSquared video KYC add-on

(+1) 732-385-3546 (US)

080-46971075 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)