Per-Agent Productivity

- Lead Distribution

- Sales Automation Designer

- Guided Actions

- Task Manager

- Upsell/Cross-sell Engine

360 degree member profiles, community engagement and more – meet and exceed your member expectations

Automate your marketing, stay top of mind with your members and provide targeted offers to increase revenue and engagement.

Reduce member acquisition & ownership costs, and connect all your teams and core systems securely

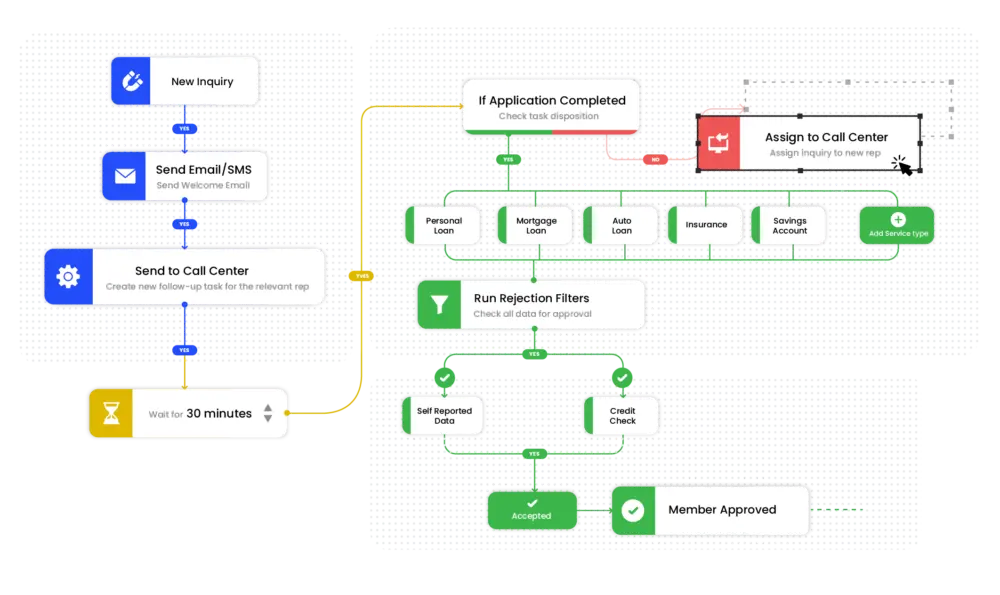

Customize all your new member acquisition, engagement, and sales operations workflows.

The security & privacy of your prospects & members are ensured with strict measures. Read more

While configuring other enterprise software can take months, LeadSquared gets you started in days.

We are here to enhance your existing processes, not replace them – connects with all your traditional systems seamlessly.

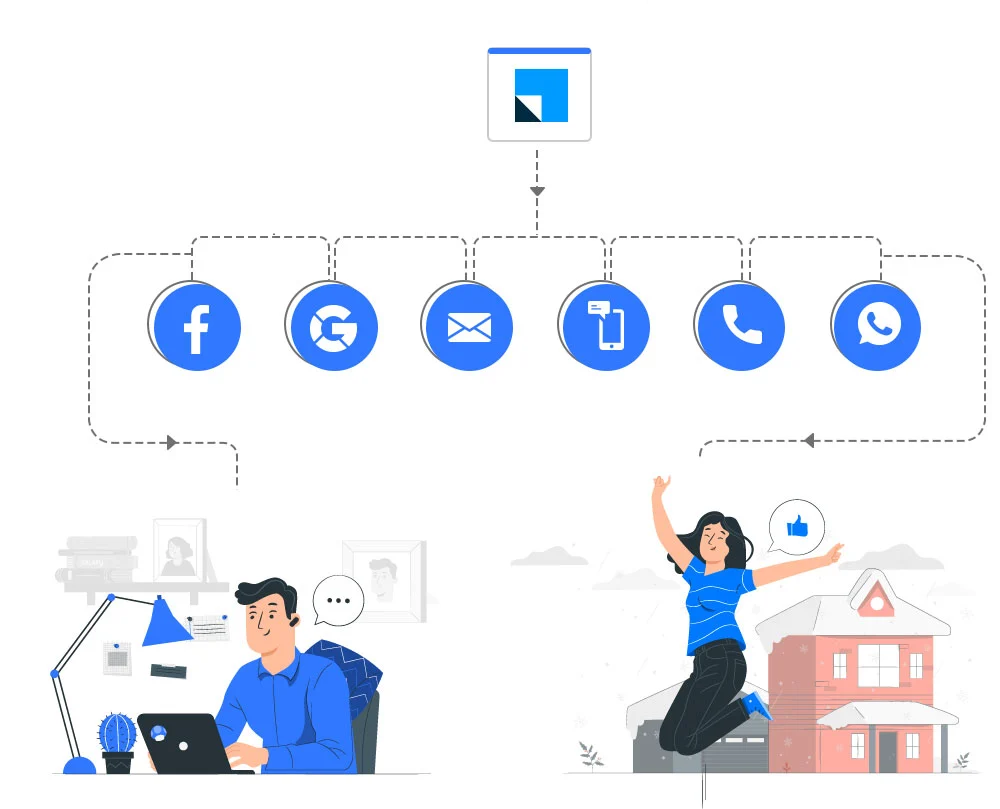

Drive more prospects to conversion with multi-channel engagement – email, text, WhatsApp, call center, and more.

Plan your agents’ day completely, allow them to identify prospects near them, and track everything they do.

LeadSquared’s secure point-of-sale portal provides a web-based access point for your members to interact with their loan right from application through clear-to-close.

Members can easily complete a loan application, upload supporting documentation, eSign disclosures, and monitor the status of their loan — in a single, easy-to-use location.

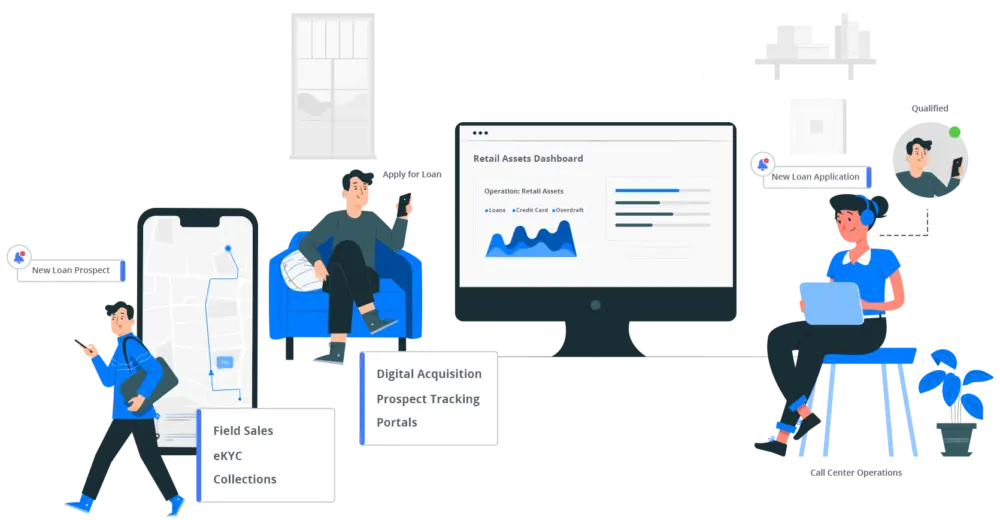

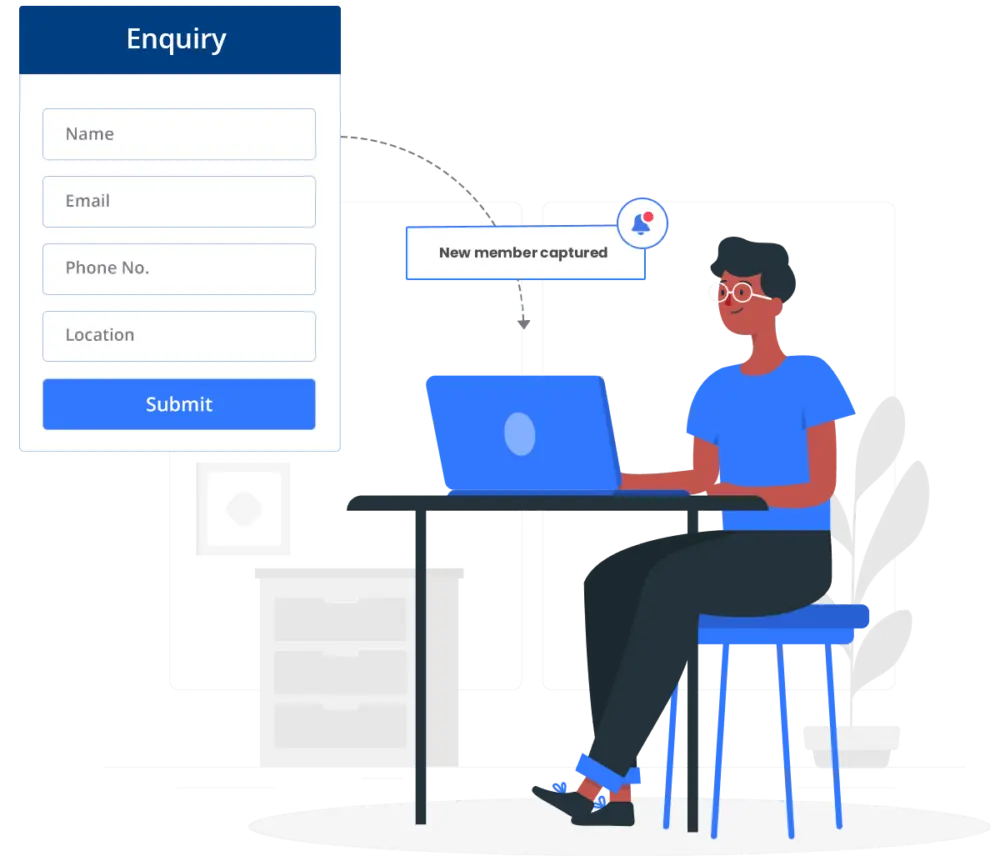

Ensure a smooth application experience for your prospects. Capture inquiries and applications with LeadSquared’s self-serve, mobile-friendly application interface (forms and portals) or integrate your own. Applications can be resumed anytime, thereby enhancing prospect experience, and saving your agents’ time.

Ensure faster and efficient member onboarding. LeadSquared add-ons like eKYC verification solution and Video KYC helps credit unions eliminate lengthy verification processes, reduce costs & fight fraud. Help your onboarding agents (both on and off the field), KYC reviewers, and verification teams stay on the same page.

LeadSquared’s proprietary workflow designer lets you build member acquisition and engagement automations with a drag-n-drop editor

Run highly relevant campaigns to engage your prospects until they become members and beyond. Keep the referrals coming by enabling compliant co-marketing while keeping referral partners in the loop at every stage. Give your agents better visibility into which sources are performing so they can make better decisions.

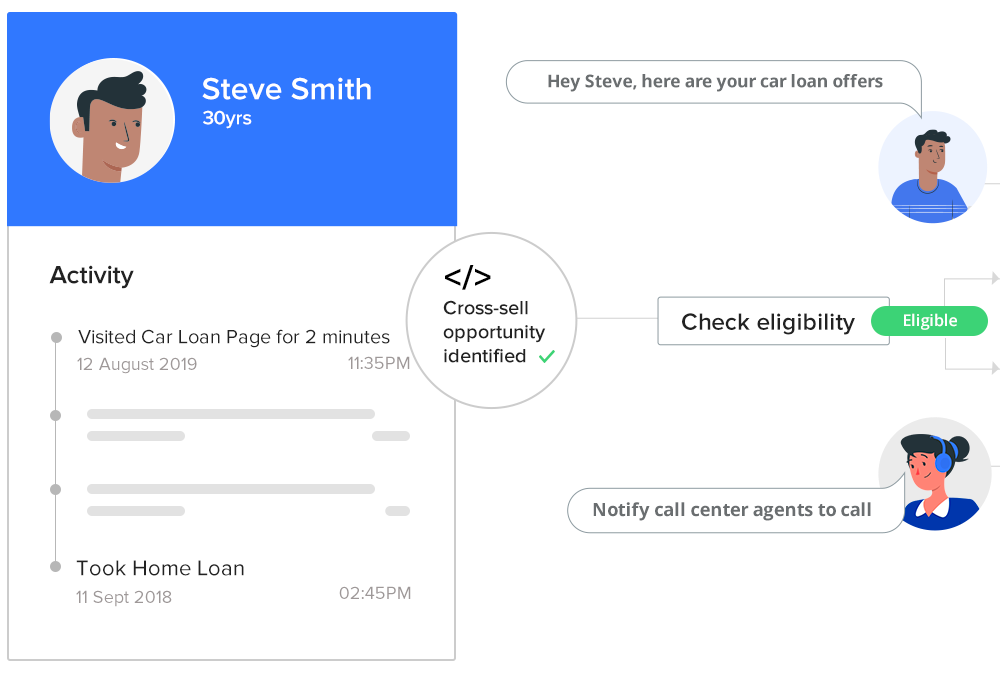

Provide all your sales teams – digital, call center, or field sales teams (relationship managers, verifications, collections, etc.) comprehensive details about their prospects. They’ll always know the existing products, credit history, and cross-sell opportunities, to build better relationships and sell more.

Help your member retention rates by identifying and acting upon cross-sell opportunities. For example, a home loan customer with an excellent credit repayment history who visits the car loan page on your website can be offered a pre-approved vehicle loan.

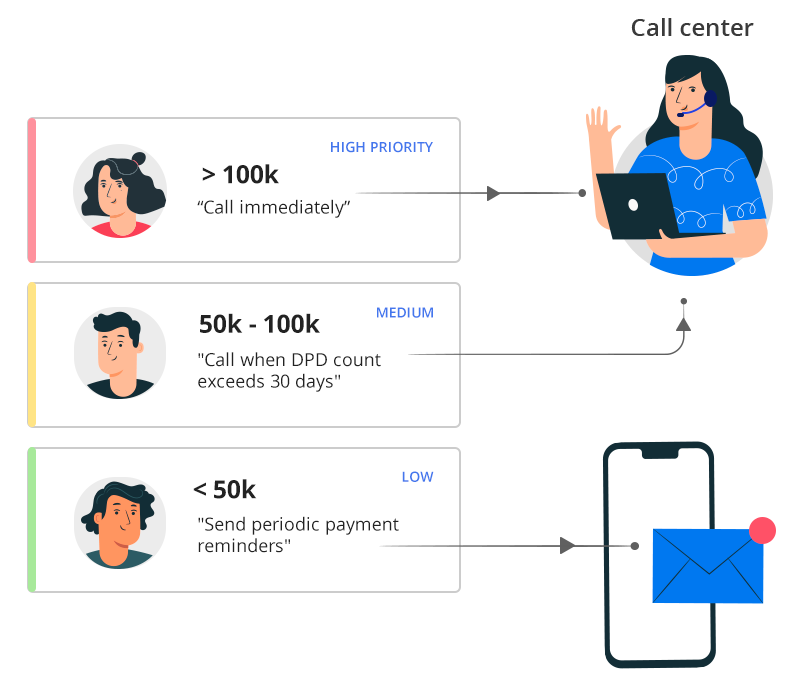

Empower your call center teams to track and follow-up with members efficiently and enable faster resolution of requests. Complete member management, categorization, case prioritization, and detailed borrower, team & collections analysis.

Reduce member acquisition costs and increase operational efficiency

LeadSquared helps us manage our lending partnerships with banks & NBFCs, and our internal processes across the lending lifecycle (sales, credit, verification & operations) to disburse loans 30% faster than before. Our DSAs are 55% more efficient than before, and all their work is trackable.

VP – Product

The only Credit Union CRM you need for member acquisition and engagement

(+1) 732-385-3546 (US)

080-46971075 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)