The Indian economy is still a work in progress when it comes to recovering from the recent market conditions, such as unemployment, further increasing the risk in the credit profiles of borrowers – making credit risk management the need of the hour.

A recent RBI study suggests that banks have accumulated high non-performing assets (NPA) over the last few years. The increased risk prompts banks to up their interest rates, making it difficult for borrowers to procure loans.

Therefore, to resolve this challenge banks must develop flexible credit risk assessment and management processes.

In this article, we will discuss the nature of credit risk and different credit risk management tools and techniques to help banks curb risks.

What is Credit Risk?

Credit risk management is the process of deep diving into the borrower’s current and historical financial data for details about their financial behavior including past debts, repayment, loan periods, and much more. Credit risk management is an ongoing process in the borrower’s journey to examine credit risk according to their financial behavior.

If you’re wondering what credit risk is, it’s when there’s a chance of the bank incurring a loss due to the borrower’s inability to repay the principal loan amount and interest. This is where the ‘risk’ factor comes into play. On a case-by-case basis, every time lenders roll out a loan based on the borrower’s financial portfolio, a certain amount of risk comes along with it.

In simple terms, banks experience credit risk when assets in a bank’s portfolio (borrowed loans) are threatened by loan defaults. Infact, bad loans worth rupees ten crore have been written off by scheduled Indian commercial banks in the last five fiscals. The presence of credit risk deteriorates the expected returns and creates more than expected losses for banks.

Why do Banks Need to Manage Credit Risk?

Credit risk management helps banks understand the risk they can afford to take while extending credit to borrowers. It’s a core process for all lending institutions. The biggest advantages of credit risk management are mitigating negative returns to stabilize capital. It also limits the chances of financial fraud and helps engage with quality borrowers. In a way, credit risk management is essential to deal with a mixed bag of cases.

While the concept of credit risk signifies negative returns, it can also occur in different forms for banks. Here are five major types of credit risk that banks may witness:

5 Types of Credit Risk

- Credit default risk occurs when the borrower does not return the amount during the loan repayment period or 90-days past the due date.

- Secured loans are extended against assets that match the value of the loan being disbursed. However, selling off a secured asset that does not yield expected returns leads to a loss for the lending party.

- Concentration risk may occur when repayment is subject to a single factor. For instance, a corporate borrower may depend on one single high-paying client/sector that promises their repayment ability.

- Risks with payments to offshore organizations when they are under sovereign jurisdiction.

- Country risk is observed when a country blocks payments of a foreign currency, basis its political instability and economic conditions.

Banks use various credit risk management tools and techniques to offset such risks. But, there are other challenges that banks must combat first.

Let us take a look at some of those!

Challenges to Credit Risk Management

Volatile economic conditions and higher unemployment rate make credit risk management even more crucial for banks and other lending institutions. Without effective credit risk management, banks lose money to delinquent cases. When this happens on a large scale, it can significantly impact the bank’s cash flow.

There’s an array of challenges that banks encounter when they approach credit risk management, here are a few:

1. Data across disparate systems

With data present in silos, it makes it even harder to access it as and when needed. This can lead to a significant operational delay. Questionable data management is a potential obstacle in having an incomplete view of financial portfolios, therefore, leading to poor credit risk assessment and decision-making.

2. Absence of a credit risk analysis model

The decision of extending credit to a borrower depends on a credit risk analysis model. Analysis models are leveraged to estimate the credit risk that’s associated to a borrower and quantify loan prepayments and defaults. Lenders and banks depend on how the model positively or negatively validates the borrower’s case to make the right decision.

3. Unpredictable market conditions

While dealing with unsteady market conditions is inevitable, banks must leverage solutions or credit risk management tools with predictive capabilities. This can help them be resilient towards the shift in the market dynamics.

4. Legacy reporting technology and processes

Manual data entry and analysis via spreadsheets lead to inaccuracy and errors. It can also be time consuming and inefficient especially when there is technology to bridge this gap and optimize it.

5. Adapting to the latest tech

Efficiency, operating in real-time, being data-driven, etc. are capabilities that will define organizational relevance and the market position. Banks and financial institutions must strategically invest in adopting recent risk management technology.

If you’re wondering how these challenges can be combated, we’ve got you. The next section outlines the industry-standard best practices for credit risk management.

Best Practices for Credit Risk Management

A clear takeaway from credit risk management is driving profits by knowing the A-Z’s of borrower profiles. To make that happen, every organization has their own processes in place. However, here are a few best practices for credit management that’ll help your business stand apart.

1. Evaluate data sources

Credit risk models produce data that is backed by accuracy and logic. However, new sources of data that are always rapidly emerging. Always lookout for data that is relevant to improve decision-making.

2. Keep a tab on your risk analysis model

While models are dependent on current data sets, they’re accompanied by changing contexts. This is why traditional credit scorecard models will soon be outdated. ML-based models are used to operate based on predictions. However, to prevent model degradation, model monitoring tools are often used to identify issues in the Machine Learning (ML) model.

ML models must be retrained many times across the model’s lifecycle to operate with updated data sets, which still makes for a better decision as compared to traditional models.

3. Credit risk monitoring in real-time

It’s key for banks to monitor borrower profiles periodically. For instance, if a borrower makes timely payments, his credit limit can be increased. Whereas payment terms may have to be restructured for borrowers who often indulge in late payments. The more recent your data, the better your credit-related decisions.

4. Outline a credit risk policy

Set policies help avoid cases of bad debt and financial risk. These policies also help define processes internally such as scope of responsibilities for every team, terms of sale, debt collection process, and payment terms externally.

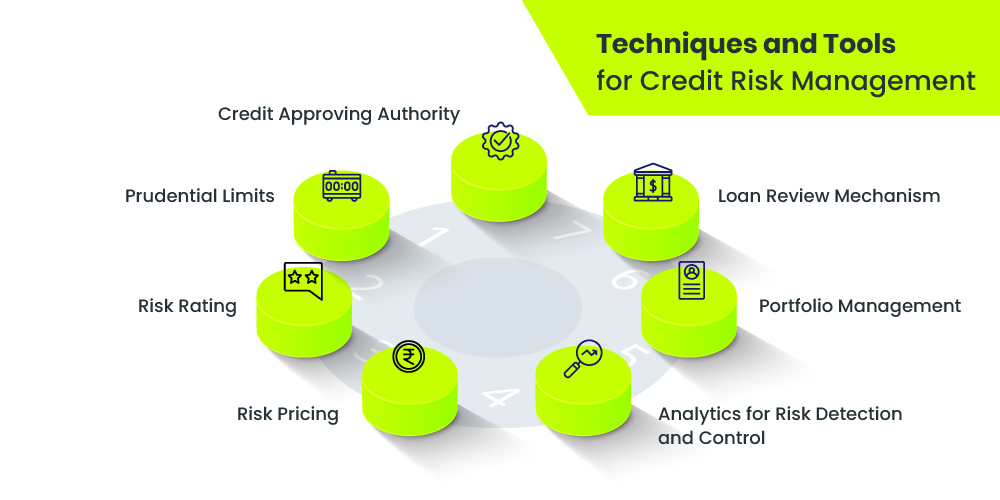

Techniques and Tools for Credit Risk Management

1. Credit approving authority

Banks can create a multi-tier credit approving system where officers review the loan before sanctioning it. It reduces the chances of any new credit risk. To maximize this benefit, banks can create a grid of officers who operate on multiple levels of the organization, i.e., regional offices, zonal offices, head offices, etc.

Additionally, the grid/committee could oversee the sanction of high-value loans by carefully assessing borrower creditworthiness. To ensure the best quality of credit decisions, banks must review them periodically.

Banks can also use new-age digital lending solutions like LeadSquared to conduct pre-screening checks and analyze credit profiles while onboarding prospective borrowers. Not only does this accelerate the screening process but it also maintains borrower credibility.

2. KYC

KYC (Know Your Customer) is a practice that is mandatorily executed by banks and financial institutions to rule out the possibilities of money laundering and terrorist financing. Under this process, banks collate and verify all the information there is about a borrower. Banks digitally onboard customers with e-KYC mechanisms that use the Unique Identity Number (UID) issued by the Indian Government. LeadSquared enables seamless e-KYC and video KYC experience backed with automation.

3. Prudential limits

Banks can set up prudential limits on various KPIs such as debt-equity and profitability ratio, debt service coverage ratio, and other important ratios. Further, they must ensure that the loan policy mentions the most permissible deviation that can be allowed from these KPIs. Based on the concentration risk, banks can also reduce their credit exposures to individuals who enjoy credit facilities excess of their capital threshold.

Even while lending to industries, banks can set limits for every sector. Based on the stress on each segment, banks can adjust the exposure and lend with reduced credit risk. They can do this by limiting new advances against assets that experience high price volatility and, hence, credit risk. While lending to distressed sectors, banks must adequately back their credit by collateral and strategic considerations. Prudential limits must be reviewed periodically. It will factor in other market-related issues and improve credit risk management.

4. Credit risk rating

Rating borrower creditworthiness is standard practice across all financial institutions. However, banks can also create a separate credit risk scoring/rating method for internal purposes. Credit risk rating will help banks and loan officers understand individual credit behavior better and the overall risk within their portfolio. The rating can be designed on various quantitative and qualitative factors such as:

- Financial analysis

- Projections

- Financial ratios; and

- Other operating parameters

Banks can improve their rating mechanism by weighing these ratios based on years. It will give a higher degree of importance to near-term developments and make ratings more accurate. In addition to this, separate scales for rating can be devised for different borrowers to personalize credit risk assessment and improve the system’s flexibility. To ensure that these rating models remain relevant and consistent, they should be frequently revised. It enables banks to identify variations that could cause any future credit losses, and address them quickly.

5. Risk pricing

Pricing your loan products based on risk categories of borrowers is important to curb credit risks. Generally, borrowers with less than average credit history or weak financials are categorized as high-risk individuals and subjected to high interest rates.

To ensure higher accuracy, banks should price credit risks based on the expected probability of default. Internationally, large banks have implemented the Risk-Adjusted Return on Capital (RAROC) framework, which adjusts the interest rates based on the expected loss on loans from the start itself. The banks then allocate some capital to cover the losses incurred on the prospective loan.

The RAROC framework helps banks in effective credit risk management and provides better loan pricing to borrowers.

6. Analytics for credit risk detection and control

Through AI and ML, banks can now analyze customer credit history to foresee changes in their credit behavior. Banks can detect any change in the risk profile of the customer and make effective credit decisions.

This real-time insight into customer behavior will allow banks to take proactive measures. It will help them design effective credit frameworks and install policies to reduce credit risks. Data analytics can also be applied to simulate stressful environments for lending processes and identify credit weaknesses.

7. Portfolio management

Appropriate credit risk rating/pricing can enable better portfolio management. Banks must identify patterns in the migration of borrowers based on the change in their credit quality. The data provides them with insights to identify the quality of their loan books and take corrective actions if necessary. Additionally, banks can also:

- Create credit ceilings based on borrower ratings to limit credit exposure.

- Understand the rating-wise distribution of borrowers in various industries.

- Limit exposure to segments based on the pros, cons, and current financial state. In case the industry is going through a period of stress, banks can increase the quality standards required to borrow from them.

- Design and undertake stress tests to identify weaknesses in their credit administration, policies, and tools to improve their credit risk management process.

8. Loan review mechanism

An LRM (Loan Review Mechanism) is a great tool to understand the quality of loan books and bring qualitative improvements in credit-related decision-making. LRM can help banks identify large value loans that can potentially develop credit weakness and create a proactive approach to credit risk management. Additionally, LRMs are also very helpful in:

- Identifying adequacy of and adherence to loan policies, procedures.

- Checking compliance with government laws.

- Supporting existing credit risk management infrastructure.

Credit Risk Management Software enables banks to action these techniques and have greater control over the credit they extend. In this context, the risk involved is clear to the lender from the initial stages of the loan lifecycle, making the process of mitigating losses much simple.

Features in Credit Risk Management Software

While various tools may package their solutions differently, here are the most important features/ capabilities that you should look for in credit risk management software.

1. Automated credit scoring

Automated credit scoring entails a detailed assessment of the borrower’s creditworthiness based on a specific criterion decided by the bank. It can help banks make the right decisions based on the risk involved. The same process, when done manually, can take hours! Automation in credit scoring also forecasts factors such as credit risk, borrower’s willingness to pay, and fraudulent activity.

2. Real-time risk monitoring

Banks need to assess changes in the borrower’s profile in real-time. This can help detect any unusual financial activity, last-minute payment patterns, etc. Real-time monitoring can come in handy to lower bad debt.

3. Credit data aggregation

Automatically extract credit data and reports from different credit reporting bureaus, public sources, insurers, etc. This can also help in the capacity of being a centralized repository of all credit data related to each borrower.

4. Integration with third-party systems

Seamless integrational capabilities enable collaboration with collectors and other agencies. This makes sharing data like credit scores and other risk analysis reports much easier.

While there are plenty of features you should look for in credit risk management software, these four must-have features are important for every organization.

Top 5 tools for credit risk management

To make your search easier, we’ve put together a list of top 5 credit risk management tools for you to choose from! We’ve compared them on the basis of their key features, user ratings, and pricing.

Software | Key Highlights | G2 Rating | Pricing |

| $15.00 1 user/month Per Year | ||

| Custom quote | ||

| 5/5 (based on one rating) | Custom quote | |

Abrigo |

| Custom quote |

Conclusion

Effective credit risk management starts with assessing the borrower’s profile and continues till recovery and beyond. Banks must create agile lending processes equipped with relevant rating systems to identify creditworthiness and charge appropriate interest rates. This will help them cover up any potential loan defaults that may happen in the future. Banks must also allocate enough capital to cover any major loan losses and remain afloat. Such practices are necessary to reduce higher default probabilities and improve the health of loan books.

LeadSquared’s new age digital lending solution is helping leading Indian banks identify creditworthy borrowers during the onboarding process and creating an additional layer of security for credit risk management.

The tool is a one-stop platform to enforce credit risk management, automate workflows with scalable technology, and verify borrower profiles. Its integrability with industry-standard connectors makes it a gamechanger for banks and other lending institutions.

To know more about how LeadSquared can help plug bad debt and enable better revenue management, get in touch with us!

FAQs

1. What is risk management in the banking industry?

Risk management is a proactive process to identify any potential loan losses that may occur due to some reason and reduce the overall risk in your loan portfolio.

Banks can experience operational risk in the event of a breakdown of internal controls and corporate governance. It can lead to loss of finance through error, fraud, or the inability to perform required functions promptly.

The banks can manage operational risks by setting up risk monitoring systems to gauge the performance of operations, set up operational limits, create contingent systems, and design policies to offset such conditions which can cause risk. Lending CRM is also a helpful tool to assess the borrower’s profile and disburse loans faster.

Credit risk management is a process through which financial institutions (FIs) can cut/mitigate any possible credit risks in their loan portfolio. FIs can do it through several tools and techniques such as setting up credit approving authorities, risk rating, risk pricing, portfolio management, and loan review mechanisms.