The pandemic brought with it unending challenges to the credit union sector, its impact being as destructive as an unwritten circle of hell from Dante’s Inferno. We saw massive unemployment rates, making it difficult to identify members who were qualified for loans. Among other disruptions were a fall in auto loans and a rapid shift towards digitization.

In 2021, few new trends will shape the credit union landscape – with the most obvious being the move towards the adoption of greater front-end technology for more personalized member journeys.

Due to consumer values shifting towards saving, we have seen some of the lowest falls in auto-loans in 2020. A report by the CUNA Mutual Group has found that credit unions’ new auto-loan balances fell by 4.2% in November. This is significantly lower than the double-digit growth set during 2012-2018. Alongside the fall in loans, auto sales fell by 16%. It only dragged down the percentage further, making it difficult for credit unions to sell these loans.

As time passes, people are looking for places they trust to invest their finances. Similarly, credit unions also look forward to engaging with their members on a more personal and transparent platform. How can you quell the confusion among the minds of members within the credit union space? What are the ways of increasing credit union member engagement while ensuring that the members being engaged are profitable? For the answers to these questions, let’s dive deeper into a few key aspects of digitization.

5 Effective strategies to improve credit union member engagement

1. Go Digital

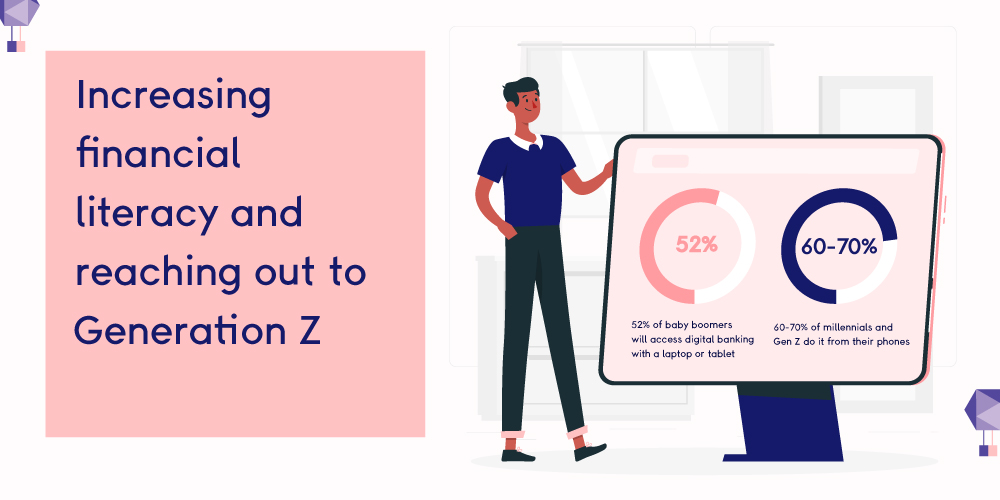

The need to make financial processes more convenient was propelled to the peak by the pandemic – with working from home, digital transactions, and digital lending becoming the new normal. Additionally, it is also important to use the digital modes used by different segments of the population. It was found that 52% of baby boomers access digital banking with a laptop or tablet, whereas 60-70% of millennials and Gen Z do so from their phones. This makes it all the more important to push for a cross-channel digitalization of your credit union products and services.

In a Forbes article that listed the best Credit Unions and Banks of 2020, credit unions scored far higher than banks. The credit union that came out on top was Frankenmuth Credit Union, with a score of 96.2. We attribute credit unions’ superior scores to their community model of growth and development. But the bank rated the highest was Capital One, with it being lauded as the best-performing bank across multiple states. Capital One is recognized as a digital disruptor in the banking industry, having built an online-first lending operation.

With lending being at an all-time low for credit unions, it’s almost confusing as to how a bank that is known for its loan services is at the top of this list. Or is it? Were credit union members not in need of loans or were credit unions unable to lend on platforms preferred by their members? If we’re all being honest, it’s definitely the latter. Members prefer the digital lending platforms as seen with Capital One when compared to credit unions. This further highlights the importance of restructuring the industry to suit the shifting consumer needs.

2. Personalize your marketing campaigns

Credit unions greatly outperform banks when it comes to customer service. You can notice this fact as seen in the article by Forbes. But credit unions are largely unaware of personalized marketing and its benefits. Two areas of banking were emphasized in an Accenture report which are relevant to the credit union sector as well – connected customer experience and the importance of building a targeted and personalized member journey. Around 79% of banking executives acknowledge in the report that re-engineering technology to meet human needs is essential in financial institutions.

Now you may be wondering how this relates to credit unions as banks are far less personal. And you’re right in your belief that credit unions are more personal than banks will ever be. However, this is because of the community-based membership rather than credit unions’ engagement campaigns. Accessing reports and analytics from a marketing and engagement platform may be the key to understanding what your members want. Integrating omnichannel systems of communication can help improve credit union member engagement greatly.

Therefore, credit unions must not only strengthen the marketing teams but empower them with tools to succeed. This will inform your members’ of the newly available products and services you offer at the right time, heightening the chance of purchase. This will encourage overall credit union member engagement and foster growth within the industry.

Unlike banks that have highly automated marketing processes, credit unions are yet to incorporate this in their products and services. It makes it difficult for them to compete with larger banks. Greater segmentation of members and integrating the right CRM will boost credit union member engagement like no other.

3. Increase financial literacy

Students between the age groups of 20-22 were found to be unaware of what a credit union was, and how it would help them, in a study conducted by Zogo. Most of us can relate to having no clue about financial institutions and their importance when we were younger. Several factors come into play here. For instance, the education system failing to keep its students aware and informed. Students themselves aren’t interested either (because let’s be real, nobody sends memes about better interest rates offered by credit unions.) This creates a gap in understanding how financial institutions work and how credit unions are helpful.

At the end of research conducted by Zogo, once the experimenters explained the purpose of credit unions most students were far more likely to look into getting a membership. Therefore, reaching out to the right audience at the right time is vital.

Why reaching out to Gen-Z and increasing financial literacy is essential?

- Students are the future members of credit unions. The ones who have the highest need are typically those graduating and in search of auto loans for their first car or student loans for university. Credit unions need to invest in marketing campaigns that spread awareness about their products to younger audiences within their communities. This can help you reach a new segment within the community you already cater to and ensure that they are brought into your fold.

4. Shared branching services

Due to credit unions being community concentrated, members find difficulty in accessing branches for their financial services when abroad. Especially when members of small towns move to some of the larger, more cosmopolitan regions. Being unable to access the nearest ATM or credit union can be frustrating. As the credit union industry has largely revolved around the idea of community membership, physical branches will not go unused anytime soon.

Co-op shared branching solves these issues, as seen below:

- Members of various credit unions can access their deposits, make loan repayments and withdraw cash in these shared branches. Keeping members informed of these locations and the method of locating a CO-OP space can help increase your member retention. These shared branches reach up to 5600 in number all across the United States. This gives greater opportunities to increase your credit union member engagement.

- In addition to shared branches, credit unions across the nation are reducing the size of branches and investing this revenue into digital banking instead. In an article by the American banker, Paul Seibert of Paul Seibert Consulting, stated, “There needs to be an acceleration to smaller branches,” Seibert said. “But we probably don’t need fewer branches. If you want to grow in our markets, you need to add smaller locations.” This also ties in with the studies conducted by Accenture that indicated that there is still a need for physical branches.

- This when paired with the data from 2017, found that- long lines at teller windows, inconvenient hours, and long waits for other services are the members’ most disliked aspects of branch visits. More than 60 percent of members say they wait at least five minutes for service when they visit a branch. That includes 13 percent of respondents who say they wait more than 10 minutes. To reduce the waiting time, 62 percent of members were happy to schedule an appointment.

- Credit Unions need to invest in tools that schedule and keep track of their appointments, tasks, and meetings. To ensure this happens smoothly sales reps and relationship managers should integrate CRM software into their operations. This will help decrease the time spent waiting and improve credit union members’ experience on the whole.

5. Reach out to the underbanked and incorporate sustainable financial goals

Ultimately, credit unions exist for one simple reason, for people to help people. 2020 brought with it a barrage of endless suffering that has impacted almost every individual in one way or another. Above all, several credit unions stepped up to serve their members in ways that helped more than they probably realized. CBC Federal Credit Union in California provided a short-term emergency loan at 5% interest. Along with the opportunity for their members to skip payments on any of their existing loans.

Apart from this a Tennessee-based credit union, ORNL Federal Credit Union created a Pandemic State of Emergency Assistance Loan Program. This brought forth tremendous relief to members who qualified. They could access unsecured fixed-rate loans at 0% interest for the first six months and 3% for the rest of the term.

All of this was possible because they were able to identify communities that needed their attention. Most smaller credit unions struggle to reach out to their members as they don’t have the required technology when compared to much larger credit unions and corporate banks. Several banks across America use CRM systems to streamline their banking process. Credit unions can use this technology to improve member engagement and create a larger sense of satisfaction among existing members.

At the end of the day, credit unions strive to build greater strength within their communities. Credit union member engagement can be difficult in this time of crisis. Thankfully, the market continues to evolve, with digitization at the forefront.

If you’re looking forward to optimizing member-facing operations, do check out the features of Leadsquared Credit Union CRM.