MSMEs contribute to about 30% of the nation’s total GDP.

Still, they struggle to secure enough financing, particularly when trying to turn trade receivables into liquid funds.

Looking into the matter, in 2018, the RBI introduced the Trade Receivables Discounting System or TReDS to support small and medium-sized businesses.

Challenges faced by MSMEs

Imagine that you are a small business owner, and you received a large order from a customer. To fulfill this order, you will source materials from your vendors and purchase raw materials. You’ll need to spend a significant amount of money to start production. However, you may not have the working capital at present.

For MSMEs or any other business, the working capital comes from the revenue from past sales. And for this, previous invoices need to be paid completely.

However, a key challenge for MSMEs and SMBs is that they often do not get paid on time by their customers. The customers pay in installments, so they may not have the working capital needed to fulfill the current orders.

In such cases, MSMEs have to take a loan from the bank. However, taking a loan means a lot of paperwork, and often, they do not qualify for a loan. They also waste precious time visiting banks to secure working capital. The sad part is, in all this chaos, the manufacturing gets delayed.

In other words, stuck cash flows and delayed payments lead to missed deadlines, reduced productivity, and unsatisfied customers.

The solution: TReDS

But before we get into TReDS and how it works, it’s important to understand the invoice discounting system.

Understanding Invoice Discounting

Often, businesses fall short of funds when they have outstanding invoices. Companies can utilize invoice discounting to gain a partial amount instantly.

The process is simple: when you send an invoice to a customer or client, the lender provides you with a portion of the payment, increasing your cash flow.

Another way to think of invoice discounting is as a succession of short-term business loans supported by invoices. In other words, the lender is ready to give you most of the money you owe them before your consumer pays you. By bill discounting your overdue invoices, MSMEs can access operating capital between 24 and 72 hours.

How does Invoice Discounting help?

With invoice discounting, MSMEs get access to credit from the bank, given the corporate buyer will pay back the financer.

The invoice discounting process requires a common platform where everyone will come together for the negotiations. This platform is usually a web portal.

All you need to do is upload the invoice to this online platform, where the corporate buyer will approve the invoice. Then the invoice will be forwarded to multiple financiers who will provide you with the working capital. You get the freedom to choose the bids that you think are suitable.

Once approved, you will receive the working capital directly in your bank account. Your customer will pay back your finances. Furthermore, the financiers can also provide extended credit periods that would have been unsustainable for you.

What is TReDS?

TReDS stands for Trade Receivables Discounting System. It aims to enable MSME sellers to negotiate discounts on invoices submitted to big businesses, assisting them in controlling their working capital requirements.

Since COVID-19, unpaid invoices have become a massive problem for MSMEs. Vendors and suppliers often wait months to get an invoice cleared. Now, MSME suppliers can discount their bills and invoices via the TReDS online platform. The platform also offers a lower yearly interest payout for SMEs.

TReDS was first introduced by the central bank in 2014, and three platforms—M1xchange from Mynd Solutions, Invoicemart from mjunction services, Axis Bank, and RXIL—were given licenses to use the TReDS mechanism in 2017. These online platforms are licensed to bring together the MSMEs or the suppliers, their buyers, and their financers in a single online platform.

Know how TReDS work with Mynd Online National Exchange (M1xchange) in the following video.

Key Features of TReDS

- A unified platform: TReDS connects corporate buyers, MSME sellers, and banks. Currently, three financial institutions backed by central banks are running this platform.

- Purely online: MSMEs and financiers should have digital payments enabled. They should be accepting and making payments digitally before they onboard TReDS. The discounting process is digital from when an invoice is submitted until it is paid. Documents are not physically moved. Both of these approaches aim to expedite vendor payments while preserving each stakeholder’s financial stability.

- Zero documents needed: TReDS allows suppliers to get funds from financiers without documentation. Unlike bank loans, TReDS do not need a lot of paperwork, and there is no underwriting process involved. The entire process takes place digitally, and the funds are available instantly. Businesses can have access to working finance within 24 to 72 hours.

- A standardized procedure: All financial institutions running the Trade Receivables Discounting System have a standardized procedure. Therefore, MSMEs have the freedom to choose their preferred platform or switch platforms if needed.

- Discounts at competitive prices: A Trade Receivables Discounting System offers you solutions from multiple financiers. This ensures that the discount and interest rates remain competitive.

- Without collateral: The financing is offered on the invoices. It does not require any collateral.

- Shorter cash cycle times: TReDS reduces cash cycle times. Suppliers get immediate access to operating capital and shorten the financial cycles of your company.

- Supports entrepreneurial development: With quick access to money, MSMEs can expand their operations and increase profits.

- No effect on the balance sheet: TReDS is designed to speed up the cash flow without disturbing the balance sheet.

How Does TReDS work?

To understand how TReDS works, you must first understand Factoring and Reverse Factoring.

Factoring and Reverse Factoring

In factoring, the buyer and the supplier jointly verify the invoice. This makes it possible for financiers to submit bids against verified and approved invoices.

TReDS gives the Suppliers the freedom to select the top factoring companies based on a variety of criteria, including transparency, customer confidentiality, factoring rates, and fees.

Funds flow from the buyer to the supplier in reverse factoring, just like in factoring. To start the bidding process, the buyer provides an invoice, which the supplier then verifies and approves. The payment is processed in 48 hours following the supplier’s acceptance of the bid.

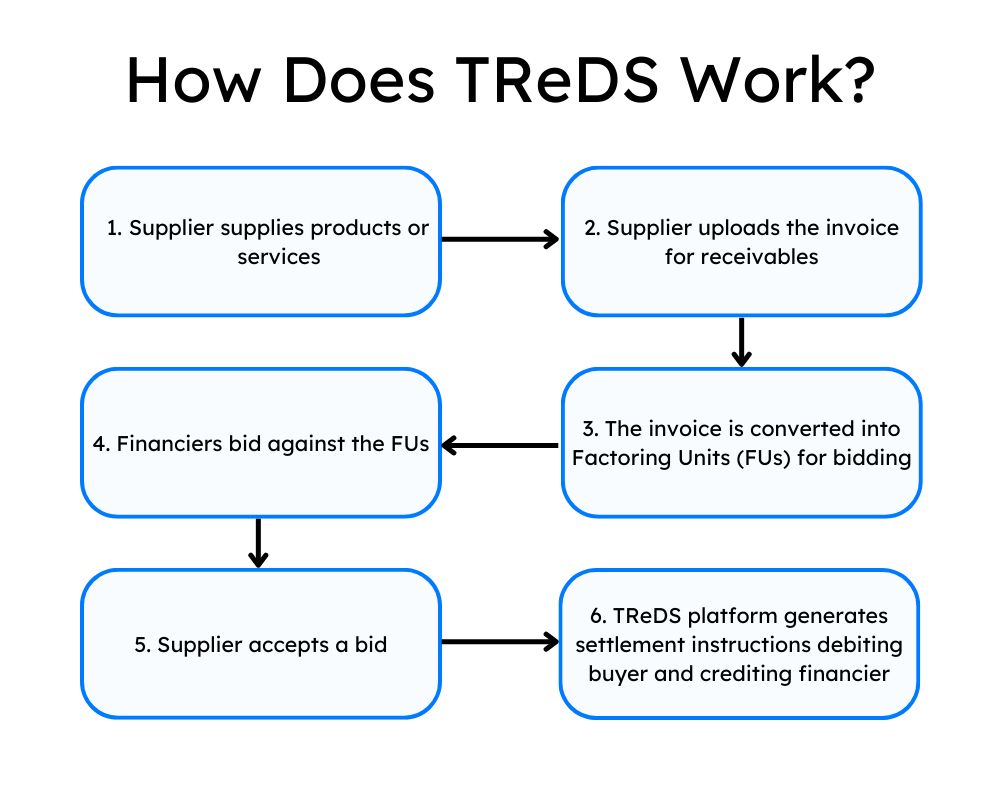

The following processes happen during financing or discounting through TReDS:

- Creation of a Factoring Unit (FU): A standard nomenclature used in TReDS for invoices or bills of exchange is called a “Factoring Unit” (FU). Each FU denotes a confirmed obligation of the corporates or other purchasers, such as government agencies and public utility companies. In TReDS, the MSME seller or the buyer may create the FU. Factoring is the process when an MSME seller initiates it; reverse factoring is when corporate or other buyers initiate it.

- Acceptance of the FU by the counterparty: This may be the buyer or the seller.

- Bidding: Bidding by financiers followed by the selection of the best bid by the seller or the buyer.

- Crediting the supplier: Payment made by the financier (of the selected bid) to the MSME seller at the agreed rate of financing or discounting.

- Crediting the financier: Finally, Payment is made by the buyer to the financier on the due date.

Pros and Cons of TReDS

Pros

For Buyers:

- By signing up for TReDS, the buyer can accurately monitor their cash flow.

- It guarantees smooth and error-free payment cycles.

- It only requires a small sum of money and paperwork.

For Suppliers or Vendors:

- The Vendor will be able to obtain a receipt of funds in a reasonable amount of time.

- It only requires a small sum of money and paperwork.

- Financing without recourse – the supplier receives the money from the financier, and the financier has no other way to get the money back from the supplier.

- Collateral-free financing – TReDS does not require the supplier to offer any security in the form of a mortgage or other asset-backed security interest.

For financiers:

- The financier might be able to access a larger market.

- TReDS makes sure that instruments are qualified.

- It lowers operating expenses.

Cons

Large corporations are worried about the MSME suppliers’ identities. The Reserve Bank of India and the government may need to rethink the Trade Receivables e-Discounting System because large businesses are reluctant to submit invoices online for fear that their competitors will learn about their MSME suppliers.

Businesses should be concerned about the requirement that they pay supplier invoices within 45 days of receiving goods or services because TReDS is a transparent system.

TReDS has multiple advantages for suppliers, buyers, and financiers. Despite the minor disadvantages, TReDS can help small enterprises improve their cash flow and expand their operations.

FAQs

The full form of TReDS is Trade Receivables Discounting System.

The purpose of the TReDS is to enable MSME sellers to negotiate discounts on invoices submitted to big businesses, assisting them in controlling their working capital requirements.

In India, currently there are 3 operational TReDS platforms. They are:

1. RXIL

2. M1Xchange

3. InvoiceMart

The list of TReDS platforms in India are:

1. RXIL, which is a joint venture of NSE and SIDBI

2. M1Xchange from Mynd Solution

3. Invoice Mart, which is owned by A TReDS Limited – a joint venture between Axis Bank and mjunction services