A loan management system enables lenders to seamlessly manage the loan lifecycle. It centralizes data, enhances communication, and accelerates decision-making, significantly improving operational efficiency. This results in reduced manual efforts, minimized errors, and faster turnaround times.

Overall, loan management systems empower lenders to streamline processes and make for a seamless digital lending experience.

In this article, we aim to highlight the important features you should look at while evaluating a loan management system and the benefits you will reap by implementing these solutions.

What is a loan management system?

Loan management system is a digital platform that helps lenders simplify and automate their loan processes. It handles everything from application to repayment, including customer information, propositions, and collections.

It also offers features like customer verification, credit analysis, interest rate calculations, loan disbursement, and collection tracking.

Types of loans that you can easily manage through a loan management system

Automated lending solutions can manage a variety of loans ranging from simple unsecured loans to business fundings. Here are the different types of loans that you can streamline with loan management systems.

1. Personal Loans

These are loans that are for personal or non-commercial use. Organizations look up the individual’s credit history before giving out the loan. Loans can either be secured or unsecured.

For instance, a car loan is a secured loan, where the borrower will have to offer something as collateral, whereas a student loan is an unsecured loan where money can be borrowed outright.

Also, it is possible to co-sign such loans. In these cases, the borrower has another individual to sign the loan, who will pay the loan in case the borrower fails.

2. Commercial Loans

Commercial loans are intended for business purposes only and are offered by financial organizations to startups and established businesses.

These loans are designed to cover expenses that an organization cannot afford on its own. Typically, companies and startups utilize this funding to support their growth or expansion endeavors.

In order to qualify for a commercial loan, borrowers are required to submit certain documents that demonstrate their ability to repay the loan. To streamline this process, lending CRM solutions can automate the processing and storage of these documents.

3. Student Loans

Student loans are funds provided for educational expenses, such as tuition fees and accommodation, by government and private organizations.

4. Syndicated Loans

A syndicated loan is a loan where multiple lenders provide a loan to several borrowers under the same term. A group of lenders gives out this type of loan when the credit amount is too large for one lender to manage. Usually, larger organizations and banks give out such loans. This process is usually facilitated by a middleman who coordinates the entire transaction.

5. Mortgage Loans

Both individuals and businesses can obtain this type of loan from lenders to finance the purchase of real estate. These loans are secured by the property being purchased and generally have longer repayment periods. In the event of non-payment, the lender has the right to take ownership of the property.

Also read – what is mortgage software?

6. Payday loans

These are short-term loans with high-interest rates. Individuals often avail payday loans to cover for certain until the upcoming payday.

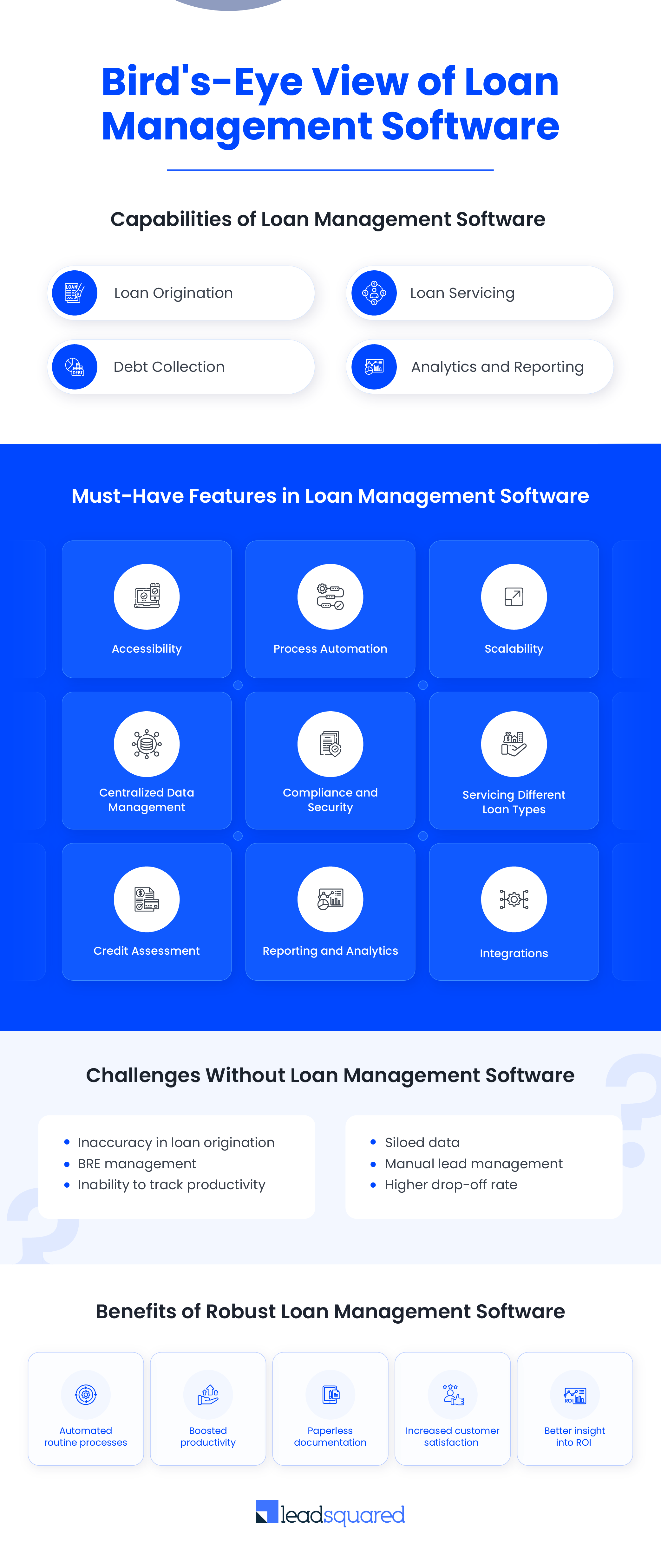

Essential features of loan management system

1. Accessibility

An organization planning to develop loan system may lack sufficient on-premises infrastructure for seamless operation, updates, and support. Scaling during peak workloads and accommodating more users and subscriptions can be difficult.

A loan management system that is deployed on-cloud can help employees, partners, and customers update information in real time from anywhere in the world.

2. Process automation

Configuring processes with automation helps streamline routine tasks, eliminate the possibilities of manual error, and increase productivity. For example, automated communication can be sent out to a customer about the receipt of his loan application during the loan origination process.

3. Scalability

Loan management systems should be evaluated based on two key factors: integration ease and scalability.

While it’s important for growing businesses to have software that can be easily integrated, they don’t necessarily need an end-to-end solution from the beginning.

Instead, they should prioritize systems that can be scaled to their evolving requirements as they grow.

4. Centralized data management

Loan origination, servicing, collections, etc., represent different stages of the loan lifecycle. When these processes are conducted independently, they lack integration. However, data centralization occurs by employing a unified platform, providing employees with a comprehensive overview of past actions and current tasks.

5. Compliance and Security

There are strict regulations in the banking and financial sector due to the sensitive customer information involved. To comply with these regulations and protect data, lending institutions can use these systems to prevent breaches and avoid penalties.

6. Servicing different loan types

As discussed in this article, every loan type comes with its own set of application processes and criteria to estimate eligibility. Systems and software that services different loans should be your ideal pick if you disburse loans of varied nature.

7. Credit assessment

This feature is crucial for determining payment terms, interest rates, and minimizing the risk of bad debt while maximizing revenue. When individuals without prior credit history apply for a loan, the use of software that accurately evaluates their creditworthiness based on bank statements, EMIs, tax information, and other transactions can assist lenders in making more informed choices with lesser risk.

8. Integrations

Intergrations help diversify software functionality. If there’s a new tool or extension that can help make the lending process more efficient, integrational capabilities of a software can come in very handy. LeadSquared’s marketplace offers some of the best industry standard connectors. Know more about our connectors.

Capabilities of a Loan Management System

Loan management system can enable a better borrower experience and streamline processes for a lender.

With digitized lending solution, borrowers can avail loans at their convenience with a seamless customer journey.

From the lender’s perspective, digital and cloud-based lending systems can automate a segment of the lending process or the entire loan lifecycle, depending on their requirements.

Without loan management system, lenders often face manual errors as a consequence of legacy systems, further leading to poor customer experience. Keeping this in mind, we’ve outlined key capabilities you should look for in end-to-end loan management system/software. This includes:

1. Loan Origination

When a customer applies for a loan, the lender processes the application through different steps. Loan origination in a lending CRM aids in digital KYC, loan documentation, credit history checks, rolling out loan options suitable to the portfolio, and loan disbursal.

2. Loan Servicing

Whether it’s car loans, home loans, or gold loans, they all come with different loan management processes in terms of due diligence, interest payments, and estimating loan repayment periods. Working with a loan management system that can help service loans of different nature makes for a better choice.

Loan servicing helps lenders perform complex computations on taxations, interest rates, track monthly repayments, generate monthly statements, and more.

From a borrower’s perspective, this can help them understand how far off they are in paying off their loans through accurate statements.

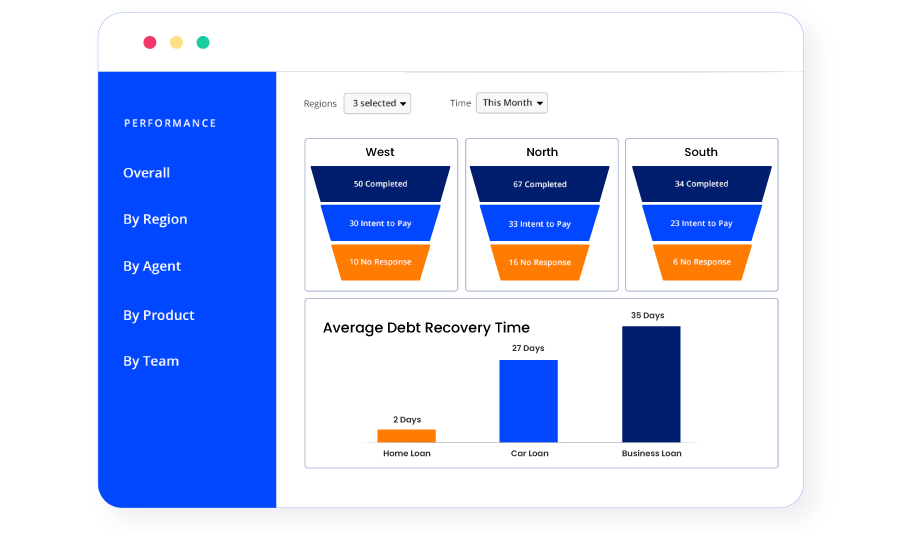

3. Debt Collections

The better the debt collection process, the lesser the bad debt. On a daily basis, lenders deal with multiple customers, varied borrower portfolios, different interest rates, and principal amounts.

In this context, systems that support debt collection helps lenders track repayments, overdue amounts, and late fees. It can also check borrower history and arrange for new payment terms.

Additionally, loan management systems often allow for third-party integrations to enhance its capabilities.

They also aid relationship managers and other staff in reviewing team-to-borrower communication throughout the customer journey.

4. Analytical Insights and Reporting

Analizing insights and reporting are pivotal in understanding profitability and performance of products. Most systems offer dynamic data dashboards to help operate with a better sense of clarity. Clearly, a non-negotiable capability.

Note: Often, terms such as LOS (Loan Origination System) and Loan Management System can be used interchangeably. LOS helps process loan applications from the start to loan disbursal. An LMS (Loan Management Software/ System) helps manage the entire loan lifecycle.

Benefits of a Robust Loan Management System

Here’s a low-down on the benefits of working with a robust loan management system.

1. Automated routine processes

Automation helps eliminate manual errors in background verification, loan processing, interest calculations, etc.

2. Boosted productivity

A digital loan management system can help reduce turnaround times drastically. With reduced TAT, sales executives can achieve higher productivity and efficiency.

3. Paperless documentation

Digital lending processes help reduce paperwork. Whether it’s KYC, document uploads, edits, and digital application processing. Lenders no longer have to maintain complicated filing systems with files being accessible just a click away.

4. Increased customer satisfaction

CX is everything. Customers today want to be understood as a ‘segment of one’. Lenders who understand customer aspirations through data can offer loan propositions aligned to their profile. A loan management system in this case will be a keystone.

5. Better insight into ROI

While analytical reports are easily accessible to monitor productivity, they can also help senior management get better clarity about their revenue streams and performance. With some systems also having prediction capabilities, they can highlight issues needing intervention.

How to choose the right loan management system for your business?

When choosing a loan management system for your business, it’s important to consider your specific needs and the size of your business.

1. Small businesses and startups

A lending CRM software can be beneficial for businesses that have just started giving out a small number of loans.

The system/software will have basic loan management functionality along with features for borrower management, interaction history, team management, and analytics.

They can also manage customer information, help track payments, and more. These are similar to most accounting systems. It will be a cost-effective solution and help the organization to get its feet off the ground.

2. Mid-sized companies

A medium and large-scale lending company will be providing more complex loans and will have a range of offerings. They will require more sophisticated software.

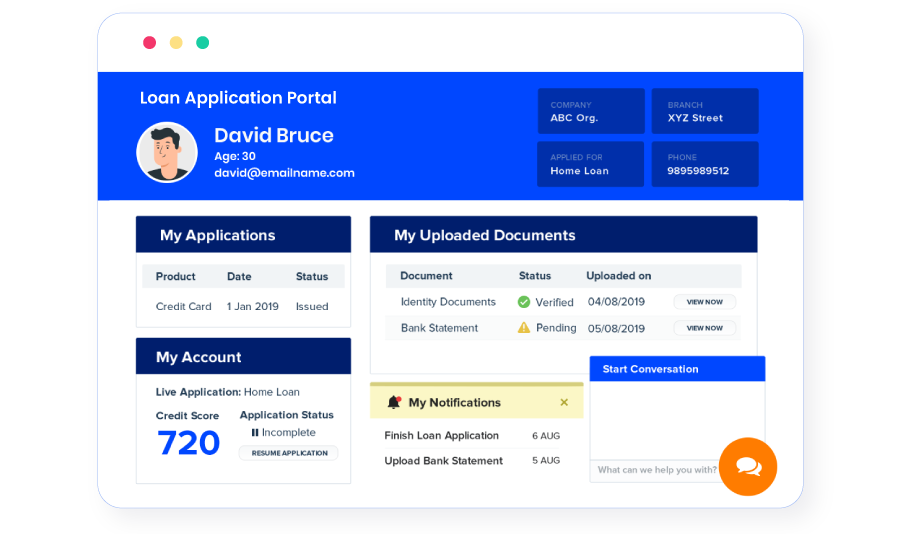

Moreover, organizations may want to look into software that provides a better customer experience. Some loan management platforms come with customer portals.

Customers can log into these portals and make repayments. They can also interact with the company, update details, and even ask them for help. Companies can also create payment schedules to encourage customers to pay on time.

3. Large enterprises

Large lending institutions such as banks cater to millions of customers. The primary need for such organizations is security.

Banks and other major financial institutions will seek to minimize credit risk for their clients. They will also want to deliver loans more efficiently.

Another requirement is the streamlined workflow. Larger financial institutions will also desire better reporting to track the profitability of their operations.

CRM integration with LOS (Loan Origination System), CIBIL, Experian Hunter, Perfios, NetBanking Connect, PDF Statement Analyzer, and others can provide a complete end-to-end loan management solution.

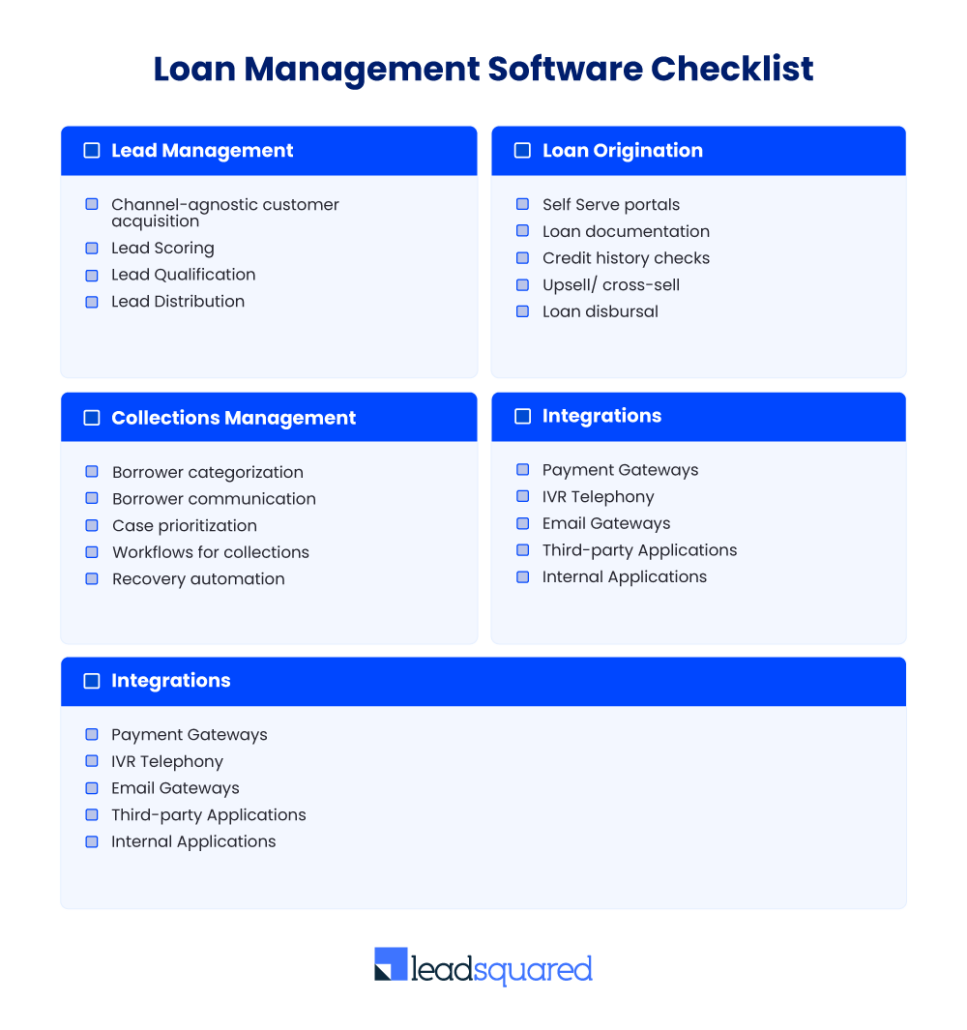

If you’re looking for loan management software solutions, here’s a handy checklist to guide you through the features and capabilities you should look for.

List of 5 best loan management software tools

Now that you have an idea of the challenges and benefits of loan management software, here’s a brief about the list of tools that you can evaluate:

Software | Key highlights | G2 Rating | Pricing | Type |

Salesforce Financial Services Cloud- Mortgage and Lending |

| Starting at $24 per user/ month | Loan Management Software | |

FinnOne Neo |

| Personalized quote | Loan Management Software | |

Sageworks Lending (Abrigo) |

| Personalized quote | Loan Origination Software | |

LendingPad |

|

| Loan Origination Software | |

TurnKey Lender |

| Personalized quote | Loan Management Software | |

LeadSquared |

| Loan Management System |

1. Salesforce Financial Services Cloud (Mortgage and Lending)

Salesforce for lenders offers a solution to manage all stages of the loan lifecycle. From pre-collection and contact management to debt recovery, it offers a complete end-to-end loan management system.

Additionally, for lenders who outsource debt recovery, this solution allows them to effectively monitor and track the performance of the agency involved.

2. LeadSquared

With a core competency of lead management, LeadSquared‘s loan management system is designed to help lenders seamlessly manage loan applications up until disbursal, offer a mobile app to support FOS teams, gives access to micro/macro level reports about products, teams, agents, and much more!

3. FinnOne Neo (By Nucleus Software)

Positioned as a loan management software, FinnOne Neo caters to retail and commercial lenders for loan origination, servicing and collections management.

They also offer digital mobile lending solutions for loan sourcing, servicing, collections, and much more.

4. Sageworks Lending (Abrigo)

The primary pain point this solution caters to is loan TAT. Sageworks Lending is designed to automate workflows and eliminate manual errors.

Top benefits include centralized data management, enhanced borrower experience with one-time data entry and digital documentation.

It also has auto-decision making capabilities for certain loans based on decision policies set by the lending institution.

5. LendingPad

LendingPad caters to lenders, brokers, bankers, and credit unions, offering technology that ensures automation and compliance. The lender edition of this new-age LOS offers capabilities such as automated underwriting and real-time pipeline monitoring.

6. TurnKey Lender

A pioneer in the development of AI software for lenders, TurnKey Lender’s digital lending solution offers propositions to automate the end-to-end lending. Known for its ease of use, customer support and quick implementation.

With LeadSquared’s solution for loan management, Poonawalla Fincorp achieves 50% more loan sales!

Headquartered in Pune, Poonawalla Fincorp (previously Magma Fincorp) is the financial arm of the $8 Billion Cyrus Poonawalla Group. As one of the fastest-growing businesses in the Indian financial space, Poonawalla Fincorp is empowering individuals and businesses through their five major lines of business – Personal loans, Home loans, Loan Against Property, Professional loans, and Business loans.

They wanted to onboard a cloud-based solution to provide a seamless borrower experience while also optimizing internal processes for their 7000+ employees, including feet-on-street agents, campaign managers, sales managers, underwriters, and call center agents.

Challenges the faced | LeadSquared Solution | Quantifiable Results |

To create new self-serve journey for website inquiries | Completely paperless self-serve journeys were enabled via LeadSquared Portal builder, empowering 1,10,000 applicants in just three months | 50% increase in loan sales |

A one-stop solution to cater to their loan sales and servicing needs for all their lines of business | As an enterprise-wide digital platform, LeadSquared enables, origination, application, customer service (raising service requests via call centre), and cross/up-sell operations | |

Data from multiple teams/processes collated and segmented, presented seamlessly to senior management | LeadSquared Reports and Analytics gave Poonawalla Fincorp the capability to automatically derive key data points for top management, bringing 100% transparency into the overall pipeline | 100% Drop-Off Elimination |

Seamless distribution of thousands of loan applications received per day | Robust and timely distribution of applications based on criteria such as product, vintage, region, ticket size, and more | 75% reduction in TAT |

Conclusion

The lending industry is evolving at a faster pace than ever with new age customer expectations to keep up with. To be at the forefront, technology will be a true differentiator and core competency for lenders.

With AI, automation and blockchain integration already underway, the loan management landscape is pivoting to becoming more efficient.

Features such as real-time reports and analytics are also helping lenders get a better perspective on where they can strategically place their investments for better ROI.

The future of the lending sector is only set to become a nexus for customer-centricity, personalization, data-driven, and technologically advanced.

As discussed in the article, loan management software and systems come with a diverse set of benefits for lenders and the borrowers.

To know more about our robust digital lending solution and its key capabilities, feel free to book a personalized demo with us!

FAQs

The best loan management system for you would be the one that serves your needs and blends well with your existing process. One of the best solutions is LeadSquared Lending CRM.

It helps disburse loans faster, track recovery, and more. With this, you can also manage all your processes and teams – Sales, Call Center, Field Sales, Collections, and more.

If you’re using a cloud-based or SaaS system for loan management, your vendor will guide you through setting up and integration processes.

Unless you’re using an on-premises loan management system, you need not worry about installation or setting it up.

SaaS Lending solutions are ready-to-use, and you can start using them within 2-3 days of buying a subscription.

The development duration of a loan management system can differ based on several factors, including the system’s size and complexity, the desired features and functionality, and the expertise and experience of the development team.

Typically, it takes several months to a year or even longer to create a functional loan management system on average.

A loan management system supports customers from the capacity of loan origination, disbursal, collections, customer service, analytics, etc.

LOS (Loan Origination System) and Loan Management System (LMS) is often used interchangeably. LOS helps process loan applications from the start to loan disbursal. An LMS helps manage the entire loan lifecycle.