Insurance sales funnel never works as an average purchase funnel. It involves multiple marketing touchpoints. If you have some experience with insurance marketing models, you will know that.

However, if you have just forayed into the complex and ever-evolving field of insurance sales and marketing, this guide is all that you need. Understanding the nuances of an insurance sales funnel will certainly give you an edge over competitors. If you already know about it, consider this as a refresher after the 2020 pandemic.

How is Insurance Sales Funnel Different from Other Sales Models?

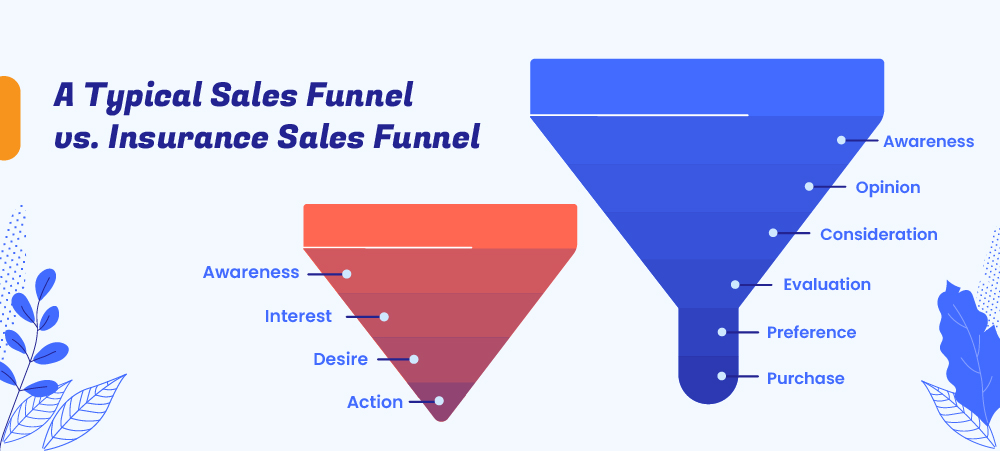

Sales funnel is a customer-focused marketing model that demonstrates a customer’s journey towards purchasing a product. A typical sales funnel includes brand/product awareness, developing interest in the company and product, creating a desire to buy the product by portraying the benefits, and then finally encouraging the consumer to purchase the product.

Insurance sales funnel includes the above components with a couple of variations. It involves product awareness, peer opinion, product and brand consideration, evaluation of benefits, preference for a brand based on prior experience and opinions of peers, and then the final purchase decision.

Also read: What is sales funnel management?

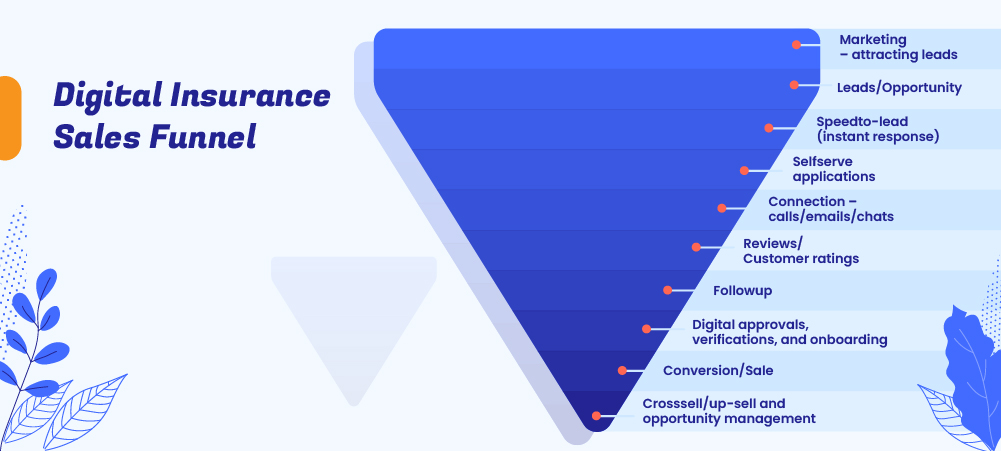

The rise of digital channels has added more stages to the sales funnel in the insurance sector. While insurance providers have adopted STP models of direct sales, the role of marketing in STP has also evolved. An STP (Straight Through Processing) model involves selling insurance policies from the company’s website through integrated application forms and self-serve portals.

The new components in the sales funnel for insurance involves the following:

- Marketing – attracting leads

- Leads/Opportunity

- Speed-to-lead (instant response)

- Self-serve applications

- Connection – calls/emails/chats

- Reviews/Customer ratings

- Follow-up

- Digital approvals, verifications, and onboarding

- Conversion/Sale

- Cross-sell/up-sell and opportunity management

How Does the Understanding of Insurance Sales Funnel Impacts Sales?

Every stage of the insurance sales funnel has an impact on your customer’s purchase behavior.

Knowing the process intimately and fine-tuning the rough edges of the process gives you an edge over your competitors.

Taking control over the insurance sales funnel is the next step. Let us discuss this in detail.

1. The Awareness Stage

You’ll be surprised to know that there are 5965 insurance companies and about 38000 independent insurance agents in the United States. You can imagine the fierce competition and the methods you need to deploy to stand out from the crowd.

Creating product awareness is the first stage of the sales funnel. It is also known as TOFU (Top of the Funnel).

You can make your customer aware of your services through various sources – webpages, social media, billboards, handouts, and digital marketing campaigns such as emails, PPC ads, etc.

Also read:

This stage may sound like a routine process in any line of business.

However, this is where the complications begin.

Creating awareness is expensive, and even if you do have the resources to establish great platforms – brick & mortar or digital, you still need to challenge competitors and their offerings. Unsurprisingly, insurance digital marketing expenditure in the US surpasses every other sector by nearly 8%.

The following are the factors that influence customers in the awareness stage of the insurance sales funnel. Answering these questions will help you devise an appropriate strategy.

- Timing – Is your customer ready to buy an insurance policy? Do they need it right now? Does your marketing strategy influence them to the next stage?

- Wrong Targets – Your PPC ads and SEO campaigns are not targeting your customer demographics. For example, life insurance ads on children apps/websites or auto insurance ads for people who do not own a vehicle.

2. The Opinion Stage

Please note that the next three stages – Opinion, Consideration, Evaluation, are very intricately connected.

During the purchase cycle, the customer thought process tends to oscillate between them.

The following are the impacts of the opinion stage on the customer’s purchase process.

Brand Authority: For an insurer, brand authority is a make or break factor. As an insurance agent, the insurance brands you promote or sell essentially influences a customer’s decision.

For example, State Farm leads in direct insurance premiums for property/casualty, homeowners, private passenger auto, followed by Berkshire Hathaway. Similarly, MetLife was the top insurance writer for life/annuity in 2019. Also, Progressive Group dominates the commercial auto/commercial lines insurance and workers comp insurance. (Source: iii.org)

These data points indicate the brand authority over a particular insurance product. For instance, if I had to buy auto insurance, State Farm insurance would top my list.

The learning here is – if you specialize in an insurance product, do not hesitate to reveal those stats in your marketing campaigns. It will help you pull your customer further down into the insurance sales funnel.

Your websites, landing pages, ad campaigns, etc. also play a vital role in building up your brand image. If these elements do not resonate with the customer’s mindset, they cannot seamlessly transition into the next stage of the buying journey.

(function(t,e,s,n){var o,a,c;t.SMCX=t.SMCX||[],e.getElementById(n)||(o=e.getElementsByTagName(s),a=o[o.length-1],c=e.createElement(s),c.type=”text/javascript”,c.async=!0,c.id=n,c.src=”https://widget.surveymonkey.com/collect/website/js/tRaiETqnLgj758hTBazgd9GRX_2Fdu0fb0_2BEFDtFHdgQyp6xHJ3U8M9xHQT4gzHMOE.js”,a.parentNode.insertBefore(c,a))})(window,document,”script”,”smcx-sdk”); Create your own user feedback survey3. The Consideration and Evaluation Stage

We live in a digital world. Here, all the information is available at our fingertips. Thus, as a salesperson, you should be very careful in communicating with your leads and customers. The following methods can negatively impact your sales.

Wrong Information: Misleading information or offers are a big NO.

Google categorizes insurance-related search results in the YMYL category (Your Money Your Life). As per the Google 2020 May update, insurance-based websites, contents, ads, etc. will all be critically scrutinized by their team. The product pages with wrong/outdated information will be taken off by Google so that consumers do not get influenced by incorrect information.

The misinformation is mostly never intentional, but insurance marketers need to bridge the communication gap and send out the right message.

Competition: Your target demography is receiving competitive and better insurance policy quotes than yours.

No-Follow-ups campaigns: This is a common mistake that most insurance marketers commit.

The saddest part is that you put effort into making the customer aware of their needs, but they end up buying a policy from your competitor.

The lessons learned here are:

- Whether it is your sales or marketing team, always communicate the correct and updated information.

- Perform competitor analysis and check your product-market fit.

- Follow-up rigorously to never miss a lead.

Also read:

4. The Preference Stage

Now, this is the time to influence your leads to prefer you over your competitors. You can send exclusive offers and elaborate on the benefits of signing up with you. Also, claims settlement are the pressing concerns among insurance customers. You can also explain to your prospects that it is easy to file a claim and receive the settlement amount.

In short, with proper communication, you can win your customers.

5. The Closing or Purchase Stage in the Insurance Sales Funnel

The ball is in your court now. At this stage, your sales skills will shine. With regular follow-ups and a strong sales strategy, you can win life-long customers.

- Closing Strategies: It is essential that your salesperson is not only adept at sales but also has comprehensive subject knowledge. A closed deal is the first win, but Cross-sells and Upsells fuel your business.

- Follow up again: Studies indicate that only 2% of the sales happen during the first contact.

Pro tip: Address cost concerns, timing issues, and any other customer concerns with peace to make your customer an advocate of your product and service.

Also read: Features and Benefits of CRM for Insurance Agents

How Does Insurance CRM Help in Closing More Deals?

By now, you might have noticed the Elephant in the room. You might be thinking that with so many stages, processes, platforms, teams, data sources, etc. how is it even possible to connect everything? How to streamline and control the process with so many stakeholders involved?

Insurance Sales and Marketing CRM is the perfect solution to align all these stages and processes together.

From your initial Insurance Marketing effort – PPC ads, Chatbots, Email campaigns to the closing/purchase stage, the CRM integrates all the features and provide you with total control over the marketing and sales stages.

With the Insurance Sales and Marketing CRM, you can –

- Plan your marketing strategies

- Target your demography

- Capture and engage leads

- Classify leads into buckets and automate distribution to agents/in-house sales teams

- Prioritize leads and follow ups

- Allocate funds to the right campaign

- Compile crucial data from different sources to analyze and take further actions

- Bridge the gap between multiple teams – sales, support, retention, support, claims, etc.

- Track, manage and automate sales, marketing, and support

- Onboard vendors and stakeholders

- Manage sales and marketing lifecycle

- Fetch decision-ready analytical reports

Insurance Sales Funnel FAQs

To create your own sales funnel, first, analyze all the possible touchpoints in the sales journey. Then break it down into stages and assign a team/sales rep for individual stages. You can also use lead scoring to move leads from one step to another. Insurance CRM can help you automate lead scoring and the movement of Leads from one stage to the other.

Insurance lead funnel involves the marketing activities that create brand awareness, turn your website visitors to prospects, and assign the sales-ready leads to the sales team/agents/call-centers.

You can generate insurance leads through online and offline channels. Online channels include – website (product page), digital ads (Google Ads, Facebook Ads, LinkedIn Ads), and Email campaigns. Offline lead generation techniques in insurance include attend events, advertise on newspapers, radio, etc. There can be many ways to generate leads. But at the same time, you should also focus on managing leads.