The digital lending market has played an important role in creating financial inclusion across the globe. However, in India, more than 70% of people live in rural areas, and only 10% have access to organized credit. Banks are hesitant to give loans to people without credit scores.

Additionally, the COVID-19 pandemic had become a roadblock to hassle-free lending. People had lost jobs and hence were cash strapped.

Then, there’s also a need to address India’s MSME sector. It contributes to almost 38% of the GDP and yet has been a very credit-starved segment. The overall credit gap for MSME businesses is estimated to be around $600 billion.

The answer?

India’s digital infrastructure.

Better smartphone penetration and high-speed internet services have improved accessibility. They have also reduced customer acquisition costs and improved credit access to the rest 70% of the populace.

Let us look at the digital lending market potential in detail and the novel methods through which India can unlock it.

The State of Digital Lending in India

Market Potential

To promote financial inclusion, the Government of India allocated USD 15 billion to financial services in Feb 2021.

Experts estimate that the total market growth potential for India’s digital lending sector between 2021-2023 is approximately USD 820 billion. Furthermore, the majority of this potential lies within the near-prime, sub-prime, and thin filer bands of the populace. Therefore, to capitalize on this potential, many investors have infused a lot of capital into digital lending businesses.

Between 2014-2020, the Indian digital lending start-ups have attracted nearly $2.4 billion in new funding. Furthermore, MSME loan start-ups grabbed 54% of the total share.

Additionally, between 2015-2019, credit inflow in business lending start-ups has grown at a CAGR of 72%. It shows that fintech start-ups are looking to capture the SME market aggressively.

Digital Lending Products

The digital lending market is majorly focused on two products:

Consumer loans and credit cards:

According to a 2019 report by ICICI and CRISIL, consumer loans in India may hit nearly $1.3 trillion in size by FY24. Furthermore, smaller Indian cities will be a driver for this expansion. Additionally, consumer durables and Pay Day loans are also experiencing higher demands due to liquidity crunch amidst the pandemic. According to Inc42 analysis, over 120 million working-class Indians are the potential consumers of credit card companies.

Business loans for SMBs:

Less than 10% SMBs have access to organized credit, creating a pending credit demand for $600 billion. The primary reason for this challenge is the unreliable credit data from this segment. But, with the increasing use of alternative scoring methods, digital lending is changing this scenario.

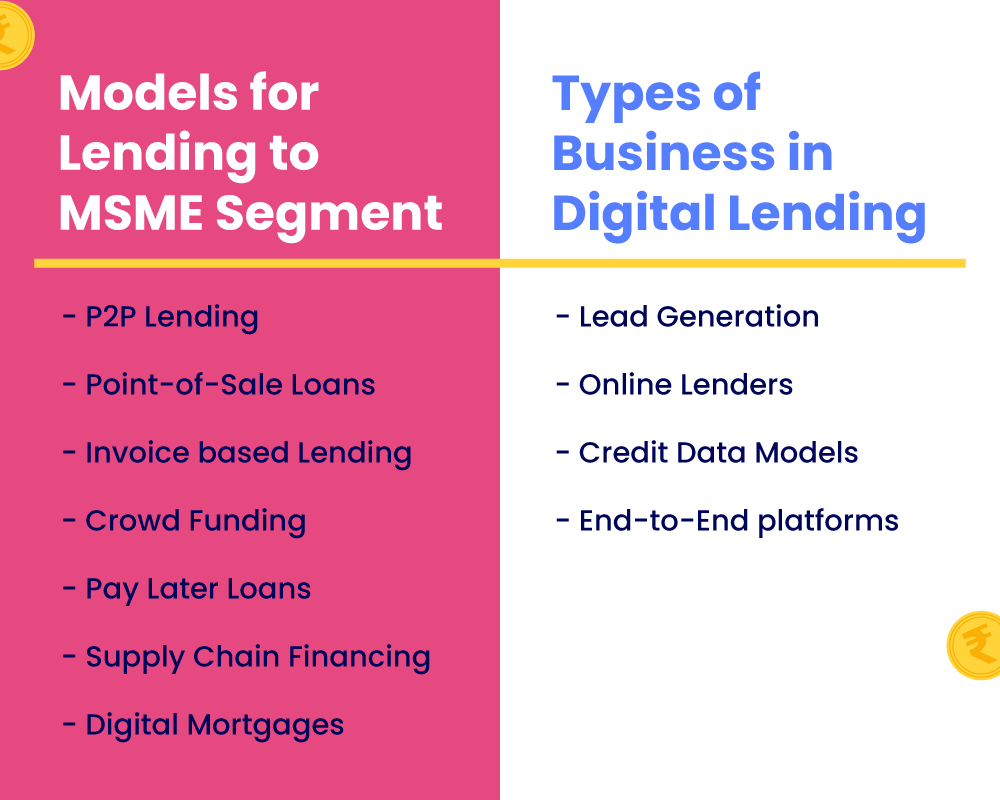

Digital Lending Models for MSME Businesses

The digital lending market for MSME has seen growth in the below segments:

- P2P Lending:

It is a form of debt financing wherein borrowers can request a loan from another individual without involving financial institutions (FIs). P2P lending in India has seen a drastic inflow of new market participants over the last two years, experiencing over tenfold growth.

- Point-of-Sale Lending (POS Financing)

It is a solution where any merchant can partner with FIs to offer solutions to their customers at the time of purchase. Not only does it increase merchants’ capabilities, but it also enables the customer to extend their margin of payment using credit facilities through the FIs.

- Invoice-Based Lending

Invoice financing is a way for businesses to get short-term working credit against the invoices of pending customer payments. Moreover, IT companies use this option to pay their employees, smoothen operations, and improve short-term liquidity.

- Crowd Funding

Crowd Funding platforms match businesses that need to raise capital through investors. They do this by showcasing their business plans, funding requirements, and market potential.

- Pay Later Loans

An upcoming mode of financing (popular with e-commerce platforms) is Pay Later loans. They are instant loans of small ticket size that enable the customer to purchase an item and pay for it later in a scheduled manner. Sometimes, these payments are interest-free.

- Supply chain Financing

FIs are also lending short-term working capital to MSME businesses through supply chain financing. Essentially, enterprise institutions with good credit scores can partner with multiple suppliers (that lack access to organized credit). MSMEs can then collect their payments directly from the FIs based on the pending payment invoices.

- Digital mortgage

Digital lending platforms enable mortgage loans through completely digital channels. It helps in shortening the traditional timelines and increasing onboarding efficiency.

Business Models in the Digital Lending Market

- Lead Generation Model

Third-party marketing agencies like Bankbazaar, Paisabazaar, Credit Mantri are a few examples. These businesses connect with prospects through marketing channels and capture data. Also, they direct those leads to lending websites.

- Online Lenders

Lending businesses with completely digital customer journeys fall in this category. They use AI and ML-based algorithms for credit underwriting and reduce the cost of customer acquisition. For example, Capital Float, Aye Finance, Rupeek, and Earlysalary are a few such lenders.

- Credit Data Models

Credit Bureaus like Experian, CIBIL, Equifax, and more are some mainstream data aggregators. In addition, platforms such as Perfios and CreditVidya help FIs like banks and NBFCs through their alternate scoring models. They use AI and ML to generate credit profiles and assist in measuring creditworthiness.

- End-to-end Lending Platforms

End-to-end or full-stack platforms contain all the above – lead generation, online lending and authentication, risk assessment, and more. For example, PayU has merged LazyPay and PaySense, two of its digital lending platforms, and created a unified full-stack platform. Another example is the Noida-based fintech start-up PayMe India.

Digital lending in NBFCs and Banks

In new customer acquisitions, fintech has a lead in the digital lending market. A BCG analysis shows that Indian fintech accounts for almost 30% of all new acquisitions. In comparison, NBFCs have only 10% of the share, and banks (public and private) have 19%.

Traditional FIs are partnering with fintech companies to use their digital capabilities. FIs are:

- Utilizing a marketplace (MPL) fintech that can assess borrower creditworthiness and generate risk profiles and connect with leads. In this instance, the MPL platform acts as a matchmaker.

- White labeling fintech capabilities like underwriting, application processing, collections, etc., and increasing conversions. Fintech lends these capabilities to FIs on a subscription-based model. The model is advantageous for FIs because they remain customer-facing even while using the tech infrastructure of fintech.

Some traditional FIs are building their own digital lending channels to compete with Fintech. It is to see which model serves its purpose best for the FIs. Higher new acquisitions, reduced TATs, and reduced risks will be some KPIs to determine the best approach.

Ideas in Focus

The lending industry is evolving rapidly to reduce the cost of operations and serve more customers. Additionally, the aim is to extend financial inclusion to many credit-invisible individuals. Let us look at two main priorities for the digital lending market:

Designing a Contactless Infrastructure

Interpersonal interactions were a major part of the Indian lending market. The pandemic came as a realization of the need for a digital, end-to-end onboarding journey. As a result, businesses integrated various tools into their processes.

For example, LeadSquared, a new-age loan origination tool, enables many FIs like Capital Float, InCred, Godrej Housing Finance, and more to capture loan inquiries from organic, social, third-party channels using out-of-the-box connectors.

Also, introducing a tool like LeadSquared helps lending businesses:

- Design self-serve customer portals

- Conduct pre-screening checks by integrating with third-party bureaus

- Collect documents

- Automate credit underwriting

- Reduce TATs

- Identify cross/up-sell opportunities

- Generate detailed reports

With LeadSquared, Finance Buddha was able to increase their loan conversions by 30%. Using such tools also enhances customer experience and improves customer acquisition rates.

Credit Risk Mitigation and Collections Using Data Analytics

Undoubtedly, AI and ML have a major role to play in the next few years of digital lending evolution. Financial institutions are using cutting-edge algorithms to assess credit scores. The alternative credit decision-making engines or ACD engines use unconventional data sources to understand credit behavior and generate risk profiles. Consequently, it helps FIs create healthier loan books.

Additionally, these algorithms can help build propensity models that enable better collections. Analysts can use such models to identify at-risk loans through repayment behavior or other parameters. Risk officials can then notify collection officers to take corrective measures. Furthermore, businesses can extend this process to entire industries for better portfolio management. It will also help them risk rate any borrowing entities and avoid concentration risks.

Conclusion

The digital lending market may host up to 48% of all lending transactions by 2023. It is the highest penetration of digital channels in any segment across India. Experts have a bright outlook of the industry due to:

- A fintech ecosystem that is in its growth stage

- Increasing participation of non-traditional players

- A stringent yet nurturing regulatory environment

- Evolving partnerships between institutions

Finally, by becoming more customer-centric, the digital lending market can improve customer acquisitions. Digitizing lending processes will also be a major step towards financial inclusion for the other 90% in India.

Find out how the LeadSquared Lending CRM can help you digitize and increase your customer acquisition numbers.