The market for fintech apps is growing rapidly.

On an average, American consumers use 3 fintech apps to manage payments, paying bills, filing taxes, investing, budgeting, or lending. Similar is the case in the rest of the world.

Because fintechs are able to cover a wider range of use cases, the market opportunity is immense. But so is the competition. For instance, as of May 2023, there were 11,651 fintech startups in the Americas, 9,681 in the EMEA, and 5,061 in the Asia Pacific region.

While convenience drove the growth of banking and fintech apps, many new categories of fintech applications have evolved in recent times.

However, the question remains – how do you acquire more customers? How do you retain them?

We will walk you through the time-tested fintech marketing strategies to adopt in 2024 and beyond.

But as Thomas Edison said, genius is 1% inspiration and 99% perspiration; these strategies will inspire you and ignite ideas. The success of your fintech marketing campaigns will ultimately depend on how well you execute them.

Challenges in Fintech Marketing

Fintech companies spend millions of dollars in marketing to acquire customers.

For instance, in India, the fintech startups reported advertising and promotional expenses of $23.9 Mn in FY22.

Most digital payment start-ups offer huge discounts, cash backs, etc., to acquire new customers. But as soon as the offer expires or a competitor starts offering better deals, customers take no time to switch to another app or service provider.

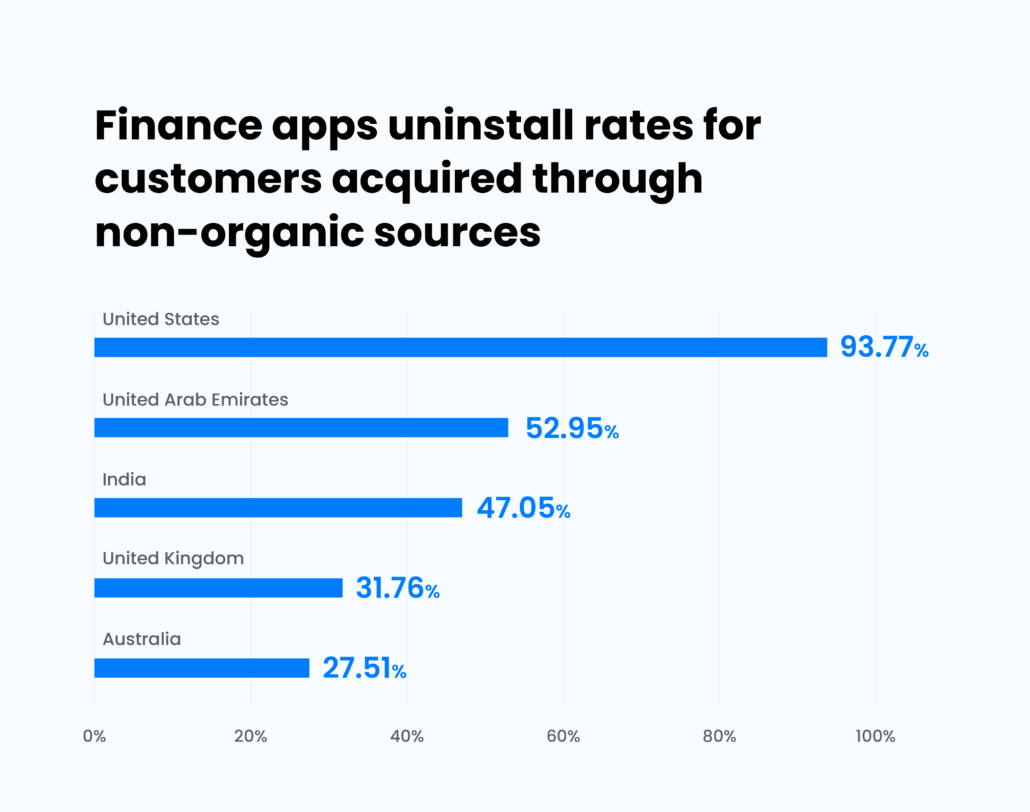

According to AppsFlyer report, finance app uninstall rates is very high for customers acquired through non-organic sources.

Another aspect to look at it is, the investments into fintech companies is sinusoidal in nature. Between 2020 to 2019, fintech apps garnered interests from investors and reached USD 216.8 billion. However, in 2020, it decreased to USD 140 billion. IN 2021, again it increased to USD 247 billion.

The downward investment trend for fintechs started in 2022, which continued in 2023, when the global funding value stood at USD 52.4 billion.

Does it mean you should stop investing in promotional activities?

Absolutely not!

It means you need to rethink your fintech marketing strategy to spend prudently and stay relevant with the current market trends.

What are the Benefits of Having a Fintech Marketing Strategy?

According to Plaid, 88% of US consumers now use apps to manage their finances. This is a 52% YoY rise from 2020 to 2021.

Similar rate of adoption for refrigerator took twenty years, computer ten, and smartphone five.

Fintech is way ahead of the curve and nearly every consumer has experienced fintech. However, fintech still has a room for growth as individual use cases have not more than 70% penetration.

With fintech marketing, brands can:

- Reach new audiences. Almost every person in the world engages in financial transactions. When you plan your fintech marketing strategy, you get to explore the possibilities, untapped market potential, and, more importantly, satisfy people’s financial needs.

- Educate. You’ll be helping people better manage their finances. You’ll also be educating them about the convenience technology can bring to their lives.

- Build trust. You can help people trust technology.

- Explore data. Fintech marketing will let you explore data, understand buyers, their needs, and expectations. You can use this knowledge to customize your content, product, and services.

The marketing strategy for fintech products/services requires an in-depth understanding of the financial situation of the target audience.

Let’s look at the fintech marketing techniques in detail, along with examples and tips to incorporate.

12 Time-tested Fintech Marketing Strategies

1. Don’t market. Educate.

Financial literacy is essential. But, new research from Experian reveals that both millennials and Gex Z in the United States wish for ‘better understanding personal finance’ and 77% are striving to be more financially literate.

The situation is somewhat different in developing nations. For instance, only 27% of the Indian population is financially literate.

This clearly indicates that your fintech marketing strategy should focus on educating consumers about various financial aspects.

Here’s what you can do:

- Create bite-site videos to educate users. Share them on all possible channels – YouTube, Reels, Your App , TikTok, etc.

- Produce evergreen content to build brand authority. For example, your blog article can be a go-to resource for anyone seeking particular financial advice.

- Make your website mobile-friendly. (Americans spend 4.6 hours, and Indians spend up to 7.3 hours on mobile phones every day.)

For example, Venmo (owned by PayPal) educates its customers with bit-size videos to help them make better investment decisions.

2. If you support a cause, tell them.

Millennials and Gen Zs gave more than any other generation during the pandemic. It shows the economic power and generosity of this group of fintech consumers.

Also, these generations are more likely to engage with brands who share the same values.

Therefore, if you care for a cause, let your consumers know.

For example, Lemonade, the New York-based digital insurer, which targets the younger generation (approx. 70% of Lemonade’s customers are under the age of 35), defines its philanthropic process on its website.

Taking this strategy a step further, you can also let the users know about how their contribution helped/can help the environment or society.

“Organizations that are not aligned with millennial and Gen-Z values risk losing favor with this large and increasingly influential cohort,” says Michele Parmelee, Deloitte Global Deputy CEO and Chief People & Purpose Officer (via Forbes).

3. Explore opportunities with existing customers

Even though the use of fintech apps has grown considerably, there’s been only 70% adoption among U.S. users. Also, only 19% of Americans use mobile payments apps daily. That is, people are not using those apps for a lot of things that they can. But why?

The answer is simple – either they’re not aware of the feature, or they’d prefer a different app (your competitor) for that task.

Here are the ways to market and grow your fintech platform usage:

- Notify/email them from time to time about the things they can do with your app

- Cross-sell/up-sell relevant offerings

- Incentivize customers (more on that later)

You can also track the most used features of your fintech app and build a proposition around them.

If you already have a list of potential customers, you can run nurturing campaigns to explore opportunities with them (continue reading to find out how a debt consulting firm used this tactic to reactivate old leads).

4. Explore the untapped market

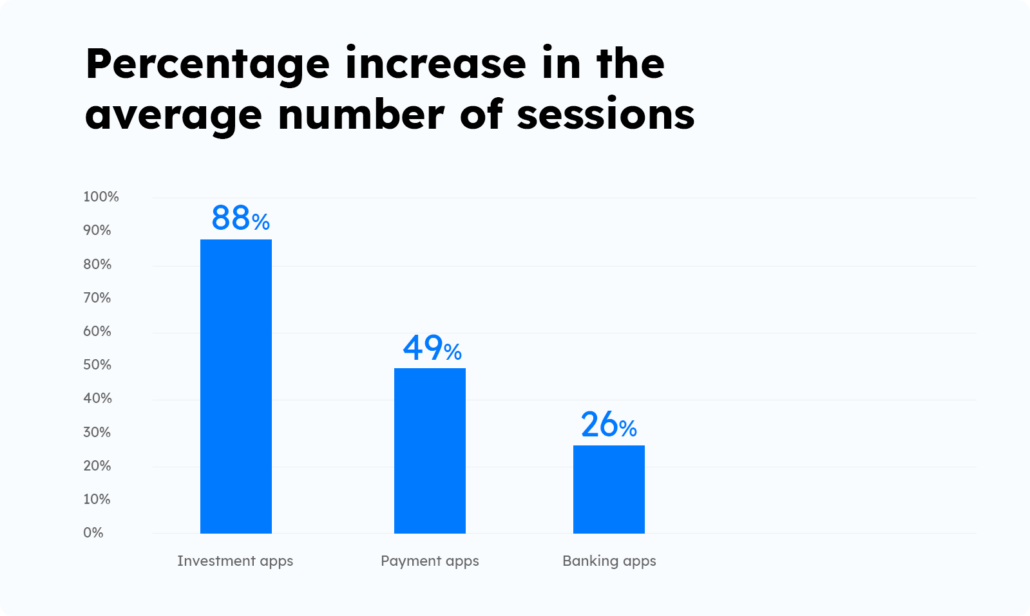

In 2020, the average number of sessions on fintech apps grew to a notably large extent.

Worldwide, 4.7 billion finance apps were installed between Q1 2019 and Q1 2021. However, the average number of app downloads in developing markets was 70% higher than the average in developed markets.

It indicates the emerging opportunities in the informal and unbanked sector. More importantly, some fintechs have started leveraging this opportunity as well.

For example, MOVii is a digital wallet service based in Colombia that enables contactless payments. At present, the app is working to disburse government funds to the people. People are using the same app to purchase items or pay their bills.

Similarly, Current is a banking app that targets freelancers and gig economy workers.

Thus, by targeting the underserved market, you can expand your reach.

5. Be empathetic

According to a report by U.S. PIRG Education Fund, digital wallet complaints have doubled in 2021. And surprisingly, three companies accounted for two-thirds of complaints (PayPal, Square, and CoinBase).

Similarly, in India, Phishing incidents have doubled in recent years. More than 90,000 cases of UPI fraud and over 60,000 complaints around digital payments were reported in 2022-23.

While the technology is still evolving, vulnerabilities are foreseen. But as a fintech marketer, one cannot turn a blind eye to consumer complaints. Usually, customers resort to social media only when their concerns are not addressed on the designated channel.

At such times, your fintech marketing strategy should involve an empathetic approach to address customers’ concerns. You must align your social media teams and customer support teams so that the issues are channeled and resolved immediately.

Another point to note here is, customers, in general, seem furious on social media when they’re raising a complaint. And that’s okay because they might not have received a response/resolution so far.

But such comments could be disheartening for your social media manager. So, prepare response templates in advance. It will help you ensure your brand voice and prevent any unhealthy communication.

6. Build trust

A notable change that almost all fintech platforms have adopted is a fully digital KYC system. With this, users can now send all necessary documents over the internet and digitally sign the required paperwork.

However, when it comes to finances, people seek security.

So, how do you convince users that your platform is secure, the one they can trust?

Here’s how.

- Tell users that you are ISO certified, GDPR and HIPAA compliant, or any other security protocol you follow.

- Be transparent about your pricing (fees) and benefits.

- Don’t use jargon. Explain terms and conditions in simple terms.

- Show trust signals, such as HTTPS on your website (get SSL certificate), use trust marks such as TRUSTe on your app and website, and make your privacy document easily accessible.

- Notify users about third-party security if you have partner vendors on your platform.

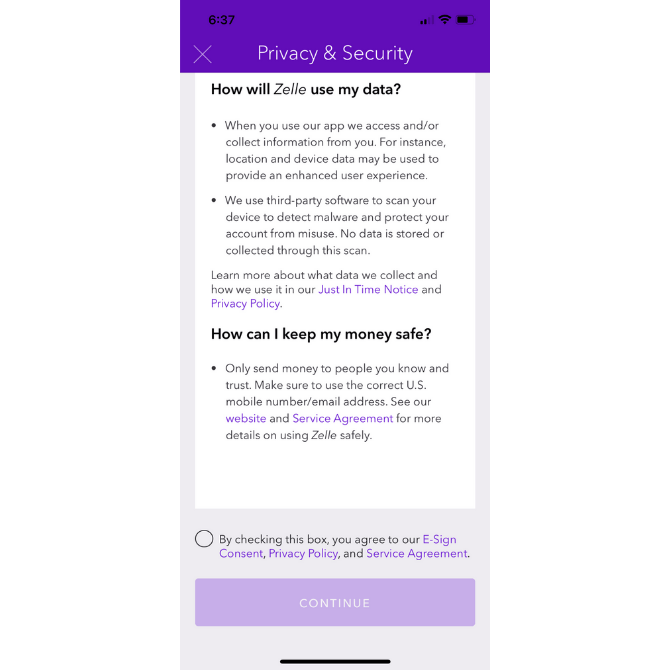

For example, Zelle, a Scottsdale (AZ) based digital payments network, provides data usage information when someone signs up. Users can also revisit their privacy information anytime from the privacy settings option.

7. Find your USP and market that aggressively

One of the drawbacks of traditional banks is their cumbersome processes. Even simple tasks like opening an account or getting a small loan take a lot of paperwork. Often it also requires you to visit the bank branch.

Fintech companies can provide the same services as a traditional bank but without all the friction. Marketing how your service is better than traditional financial services is a great way to acquire new users.

For example, Thimble, a New York-based insurer, found that people were lapsing on their insurance payments because of the coronavirus crisis. So, they offered users to pause payments for their insurance instead of canceling it straightaway. They also allowed users to resume the premium payment at the old rate.

8. Incentivize your customers

Incentives are one of the biggest motivators in sales (e.g., SPIFF).

Similarly, incentives can also ramp up your fintech customer acquisition strategy.

Here’s an example.

PayPal struggled to acquire customers in its early days. It’s not like they did not advertise or try partnership with banks. They did. But nothing worked as expected.

So, they decided to incentivize customers to drive organic, viral growth.

They gave $10 to new customers for signing up. They also gave $10 to existing customers for referrals. That is, they spent $20 per new customer. With this strategy, they saw 7-10% daily organic growth.

Here are the ways in which you can incentivize your customers:

- Offer cash backs

- Give joining bonus

- Give referral bonus

- Offer cash rewards on achieving a milestone

- Partner with popular brands and offer discounts to their customers.

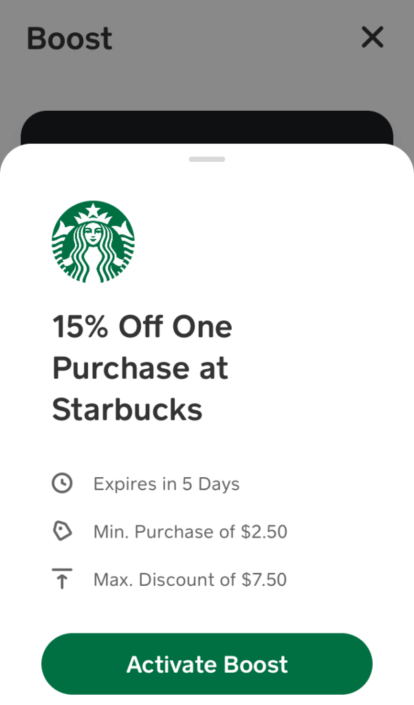

For example, Cash App, developed by California-based Square financial services, offers instant cashback on retail, dining, and other purchases. They have developed a program – Boost, to encourage users to pay through their interface – which includes discounts with companies like Starbucks.

9. Use in-app marketing

Customer retention is a major challenge in the fintech industry.

You can resolve a part of it through in-app marketing. In-app marketing is displaying marketing messages to customers while they’re actively using your app.

This fintech marketing tactic is great to engage with customers and at the same time upsell or cross-sell your offering. You can also use this strategy to announce a new product/feature launch.

For example, Chime, the California-based financial services company, sends in-app notifications about services the customer may be interested in.

10. Use social media

More than 4.5 billion people actively use social media. That means 9 in 10 internet users use social media.

You can use social media to reach out to a wider set of audience.

However, if you have tried social media marketing, you’ll know it’s not that easy.

Despite a good number of followers, your posts hardly get any engagement. Why?

It may be because the content is not compelling enough. Therefore, you must take a strategic approach to drive engagement on your social channels. For this,

First, identify what type of content your audience wants to consume on what platform. For example, people want to see and interact with pictures and videos on Instagram. Similarly, for conversations, people like using WhatsApp or Telegram.

After you have decided this, create (or repurpose), and share content on these platforms.

You can also:

- Try influencer programs to reach out to people who share the same ideology.

- Run paid ad campaigns to gain quick visibility.

- Do social listening to understand what consumers are looking for or talking about.

- Conduct polls and surveys to get a holistic view of buyers’ preferences.

- Use customer testimonials as social proof for your brand, product, and services.

Note, when you use different social media platforms, make sure you have a lead capture mechanism in place. It is because, one, you’d want to manage all sales opportunities in one place. And two, you’d like to analyze the interactions across platforms and determine the best ones in terms of revenue and business growth.

For example, LeadSquared CRM and Marketing Automation suite allows you to capture leads from several sources such as Google Ads, social media ads, marketplaces, your and third-party websites, phone calls, and more. Plus, you can track the sources, channels they’ve interacted with (with timestamps), and duration of interactions.

11. Understand your customer. Personalize communication.

Most traditional banks and their policies do not reflect the needs of millennials or Gen Z. While they may want to offer better products/services, rigid policies and regulatory requirements often do not allow them to do so.

But fintech has leverage here.

They can use technology and data to understand their customers better and personalize their offerings.

For example, PerkFinance is building a financial solution purely for the blue-collar workforce.

Today, fintech companies can use data from many sources like CRM, social media, and more to understand the financial situation of their users and use this information to devise their fintech marketing strategy.

So, you know the data source. But how do you personalize content?

Well, here’s how.

- Segment your leads/customers based on their location, industry, etc.

- Address them with their first name, use their info like company, product interested, page visited, etc., in your messages.

- Use forms or landing pages to collect the required information. Alternatively, you can also use third-party data-enriching tools like Clearbit or Sprinkle Data to get the desired information.

You can also A/B test different content formats. The following image illustrates how LeadSquared CRM can help you analyze your email campaigns.

If you see, personalization has been a go-to strategy for leading brands like Amazon. For instance, personalized product recommendations account for more than 35% of purchases on Amazon. 49% of consumers say, they purchased a product they did not initially intend to buy after receiving a personalized recommendation.

12. Be a smart marketer. Automate as much as you can.

All the above points converge to how well you execute your plan.

But how do you know if everything is going as per the plan? How can you say your strategy was successful?

Well, for this, first of all, define your goals. Your goals can be:

- Increase brand awareness or increase sign-ups/app downloads

- Reduce uninstalls

- Increase engagement on social media, or increase website traffic

- Drive more revenue from existing customers

- Encourage users to use a newly launched feature, and so on.

Next, determine the KPIs to measure the success of your fintech marketing campaigns targeting individual goals. For example, you can track email marketing KPIs, sales KPIs, incremental sales, etc.

But don’t involve people in tasks that you can automate.

For that matter, you can use marketing automation and sales execution CRM to track your campaigns, sales metrics, and more.

With this, you can get automated reports as and when required. And people can utilize their time on creative and productive tasks.

In the next section, we’ll tell you how some fintech marketers were able to achieve their marketing and sales goals through automation.

FinTech Marketing Success Stories.

Here are two stories that will help you understand what fintech marketers are doing and what is helping them do it so well.

Canadian Customer Debt Relief, the 4th largest debt counseling organization in Canada, helps thousands of Canadians resolve debts across credit cards, unsecured loans, payday loans, student loans, etc.

Initially, they faced challenges in marketing their services to potential customers. Some of them were:

- Email deliverability. They wanted to ensure their emails got to a prospect’s primary inbox and not spam.

- They wanted to capture leads and track activities. For e.g., website visits, email opens, link clicks in real-time, etc. They also wanted to initiate conversations with them based on those activities.

- The team wanted to nurture old leads and reactivate them.

The company uses LeadSquared CRM for its sales and marketing activities. It helps them with:

- Automated lead capture from ads (Google and Social Media), their website, and marketplaces.

- Email marketing including email templates, drip campaigns, campaign tracking, and more.

- Lead nurturing to keep the conversations going through email, SMS, portal, WhatsApp, push notification, and phone calls.

- Activity tracking across all the channels of communication. It helps understand the context and touchpoints.

This smart move helped them gain A+ score on Better Business Bureau, and their debt consulting is famous for providing a swift and customer-centric approach to all problems.

Also, using one platform for both sales and marketing eliminates the need to move data from one system to another. Thus, speeding up the process and ensuring data integrity.

Read the complete case study here.

Here’s the second story that tells why it is crucial to automate your fintech marketing.

India’s 3rd largest stockbroking firm, Angel One, wanted to automate and centralize their sales and marketing operations. Some of the challenges they faced were:

- Inability to engage with leads and customers leading to missed opportunities

- Inability to understand customer interactions – creating a gap between what customers want and what they serve.

- Time-consuming/delayed reporting

LeadSquared understood their sales and marketing challenges and offered a unified solution to align their overall operations.

Here’s how their marketing team has automated their tasks:

- Segmenting prospects and customers based on various factors (e.g., location, product inquired, etc.). It helps in engaging with customers with relevant content at the right time.

- Trigger-based marketing campaigns across several channels

- Managing drop-off journeys. If a prospect shows interest in a product, fills the KYC form, but drops off in the middle, automated email campaigns send a reminder to the prospect and allow them to start from where they left off.

- Automated reports for campaign performance, team performance, region-wise growth, and more.

“With the help of the right tools, our lead engagement has become measurable, and the lead volume has increased from 50k to 6 lakhs per month,” says Prabhakar Tiwari, CGO, Angel One.

In Conclusion: Emerging Trends in Fintech to Direct Your Marketing Efforts Towards

The average number of sessions on investment apps and payments apps continues to grow. It’s the same for banking apps, too.

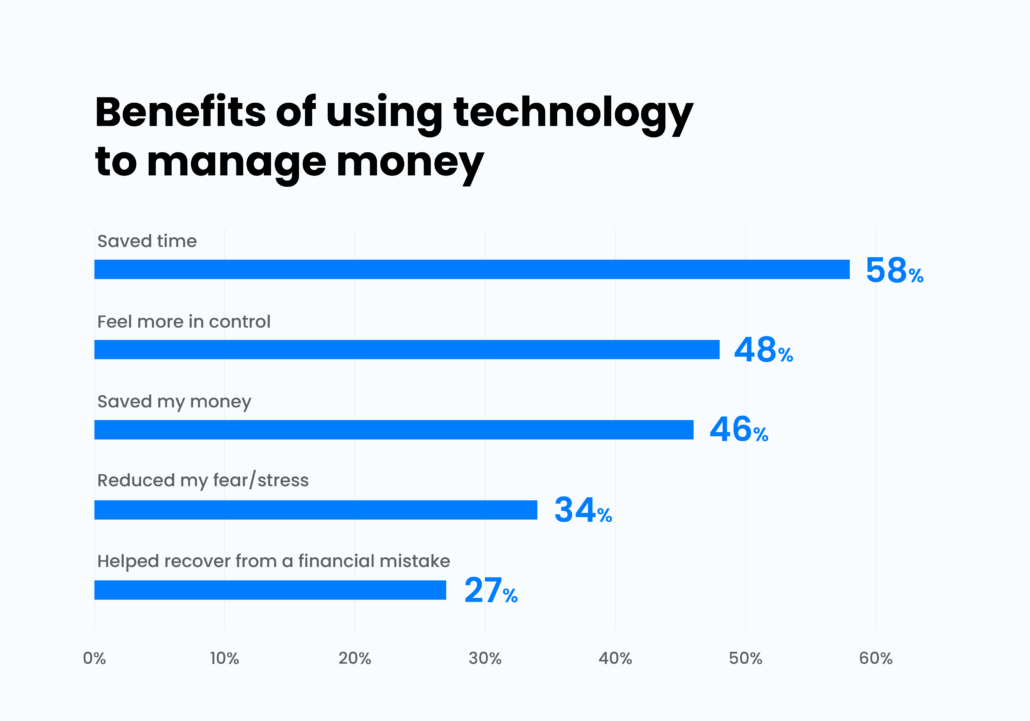

With fintech apps, people feel more in control of their money and appreciate them for the time and money they save.

Within Fintech,

- The largest market worldwide will be for Digital Investments (AUM USD 112.9 billion in 2023 with average per user AUM being USD 439.8)

- Projected revenue growth for the Digital Assets market in 2024: 33.6%.

- Projected number of digital payments users by 2027: 5.48 billion.

Fintech can play an important role in filling the gap left by the traditional banking system while also growing its customer base.

I hope this article gave you enough fodder for thought about your next fintech marketing strategy. For sales and marketing solutions curated for Fintechs, feel free to contact us.

FAQs

Fintech marketing is using strategies and skills to identify and serve the unique needs of financial consumers. It involves demand generation, customer acquisition, and retention to drive business growth.

To promote fintech, you must understand the financial situation and needs of the target user base. Then apply fintech marketing tactics to widen your reach.

In general, fintech products include:

✔️Financial services offered via the internet,

✔️Mobile devices (apps),

✔️And software (cloud services).

Some of the popular fintech business models are:

✔️Alternative credit scoring

✔️Alternative insurance underwriting

✔️Wealth tech & asset management

✔️Digital wallets

✔️Small-ticket loans

✔️P2P lending