Today, applying for a loan is as easy as saying, “Hey, Google.”

Don’t you believe me? Let me share something.

The other day, I dialled a leading bank for a loan. I was greeted by an IVR that collected all my basic information until a loan officer could pitch in. What a great use of the waiting time of the customer!

What surprised me was that the loan officer was aware of the details I shared. The entire experience was so smooth that there was no chance I would not have taken a loan from that bank.

This is just one example of how automation in financial services is enhancing customer experience (CX). You can use automation to improve both customer-facing and back-end operations.

This article covers 10 use cases of automation in financial services, its benefits, and quick tips on implementation.

Automation in Financial Services Equals More Efficiency

Simply put, automation refers to using technology to perform tasks that humans would otherwise do. It can include everything from software that handles routine tasks like data entry and account management to robots that perform physical tasks like sorting and counting money.

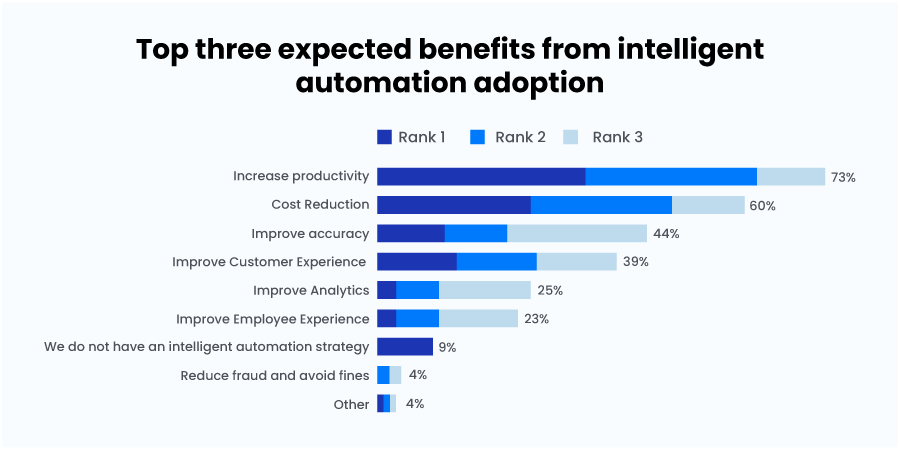

According to Deloitte, the robotic process automation (RPA) market has grown 20% yearly since 2018. In the same study titled ‘Automation with Intelligence,’ the authors discuss a survey of 302 enterprise organizations across sectors highlighting the benefits of workflow automation.

Let’s observe some areas where automation has significantly impacted and improved ROI for the financial services sector.

Overhauling Financial Services with Automation

1. Talent Onboarding and Management

While the adoption of Human Resource Management Systems (HRMS) was already underway during the last few years, the Covid-19 pandemic significantly increased the rates.

With the more advanced HRMS solutions today, you can hire and pay salaries across continents without worrying about local compliance. Additionally, by implementing automation, your HR team can streamline and automate various tasks, such as paperwork and document management, scheduling orientations and training sessions, and communication with new hires.

This is important because, according to the Bank of Baroda Economic Research, banking and finance were two of the three largest sectors contributing to new jobs in India Inc. in FY 22!

HRMS also are critical to other aspects of the human resource ecosystem, such as training, development, benefits management, payroll and leave management, regulatory and policy compliance, etc. With automation, your HRs can redirect their efforts toward hiring the right talent, building the right culture, and improving personalization.

2. Customer Acquisition, Onboarding, and Engagement

Sales is another front where automation has significantly resolved redundancies. For instance, new-age sales automation platforms like LeadSquared use APIs to integrate seamlessly with all your lead generation channels and instantly capture new inquiries across multiple channels.

These API integrations offer plug-and-play capability and reduce go-to-market time by up to 80% for many businesses.

Chatbots and website widgets are another innovative customer acquisition technology. You can deploy chatbots on your self-serve channels and reduce response time, engage prospective buyers and deliver a great experience.

Once you capture your customer data, connecting them with the right agent is the next step. Lead distribution automation can carefully assess various lead attributes (product type, income, region, language, etc.) and notify the appropriate officer in your team to help this customer.

If the assigned officer is unavailable, the automation redistributes the lead or informs the team manager to take corrective actions. It sounds simple, but it is effective.

For example, Poonawalla Fincorp, a leading NBFC in India, reduces its loan sales TAT by 75% by automating the above processes and aligning teams.

With LeadSquared, we could bring together all our processes and teams into a single enterprise-wide solution. Our agents are more efficient, and the journeys are more seamless, helping us deliver a premium experience to every borrower. Overall, our loan sales have taken a quantum leap with a significant reduction in our turn-around times.

Kandarp Kant, Chief Technology Officer, Poonawalla Fincorp

New automation initiatives such as 100% paperless journeys, e-KYC services, and e-sign have benefitted all parties significantly.

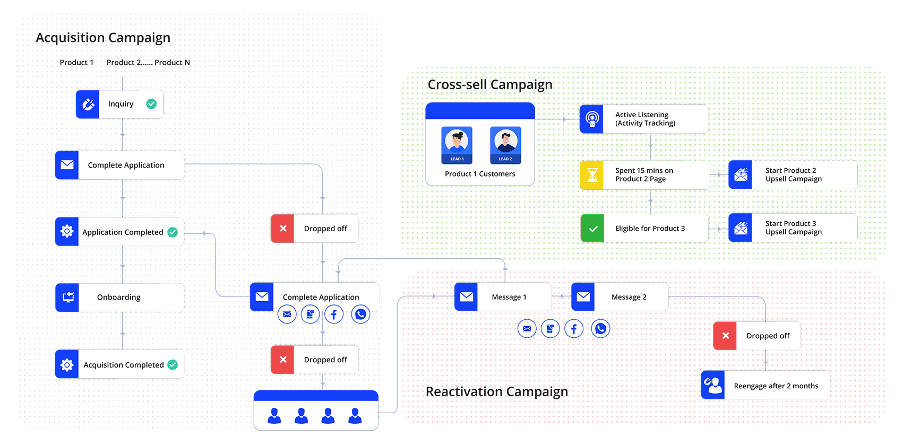

Lastly, automated lead nurturing is another excellent example of automation in financial services. By capturing sales signals from prospective customers, such as page visits, email opens, messages read, etc., it is possible to run targeted engagement and re-engagement campaigns to push them down the sales funnel.

For instance, sales and marketing automation tools like LeadSquared allow you to design step-by-step nurturing workflow automation to engage your prospective customers at the right time and nudge them towards conversion.

Example, if Mayank visits any credit card page, raises an inquiry, but does not complete the application process, your sales teams can engage him either through reminder campaigns or new offer campaigns via email, SMS, WhatsApp, or call from agents. These could be offers about the different range of cards, benefits of using the credit card, intimation of pre-approved cards, etc.

Bottomline it ensures that agents don’t spend too much time pursuing the lead but constant engagement keeps happening, so when the customers does choose to buy a credit card, they end up at your website/app.

3. Underwriting

Underwriting terms for a finance product have always been subjective to the customer and the underwriter. And this is where underwriting automation has changed the game.

With AI and propensity modelling techniques, finance companies calculate risks based on the data from their existing customer base. It enables them to underwrite terms based on customer attributes and creditworthiness instead of being subjective about it.

Today, many companies use automated underwriting platforms to calculate loan terms and insurance premiums for their new/existing customers.

And in the future, automated underwriting can help leaders distribute risks optimally and maximize their ROI.

4. Call Center Management

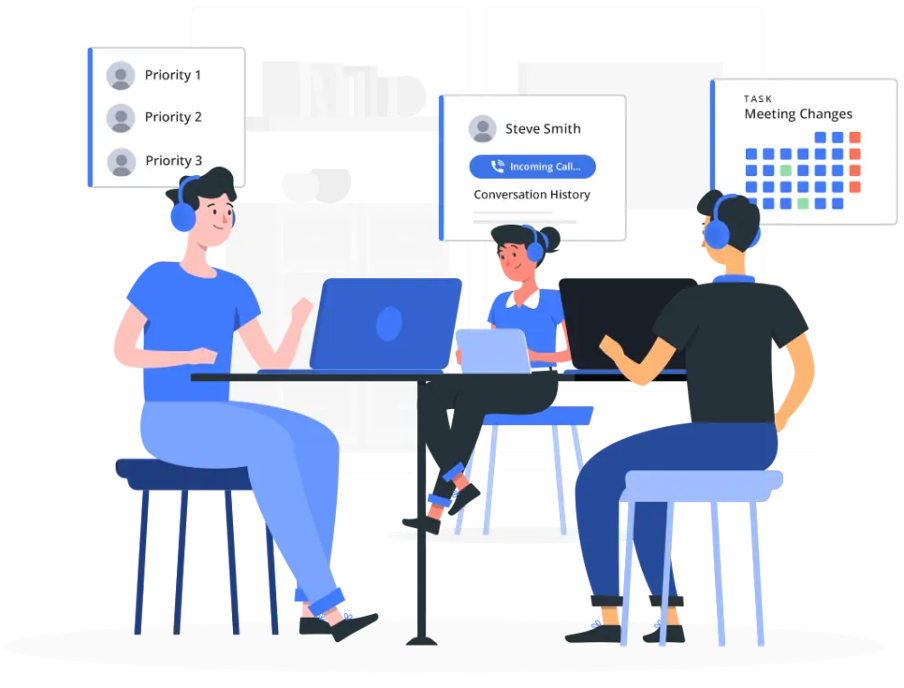

Call/Contact Center Management is another use case for automation in the financial services industry due to the daily high volume of calls companies receive.

A few years ago, customer waiting times would be very long due to a shortage of reps to address their queries. Today, by deploying an intuitive IVR platform and voice-based solutions, calls can be received, engaged, and questions answered without needing agents.

Automation can also help leaders manage multiple reps. On average, companies manage hundreds of telesales reps. In enterprise organizations, this number is up to 100x higher. Handling multiple teams across different geographies can be tedious for even your best managers. You resolve this problem quickly with sales automation platforms that give you end-to-end call center management capabilities.

For instance, LeadSquared allows you to integrate with multiple IVR tools and contact centers. The automation will funnel leads to your sales reps for instant calling upon integration. By bucketing your inquiries based on their attributes, reps can place calls, set up follow-ups, prioritize leads, and complete tasks from a dashboard called SmartViews.

LeadSquared also allows you to derive call reports across teams, regions, and products. As a result, you can increase your call center efficiency by up to 85%.

5. Field Sales Management

Automation has significantly improved the lives of field sales managers. Until a few years ago, field sales were mainly offline and remote. As a consequence, operational efficiency was low. Managers had many challenges:

- Every day, they had to meet with their sales agents to get updates periodically.

- Covering large patches of area required more workforce.

- Document management was complex due to the offline nature of the paperwork.

- There was no way to track what reps were up to.

- The primary mode of payment was cash.

- Managers had to accompany the reps across locations.

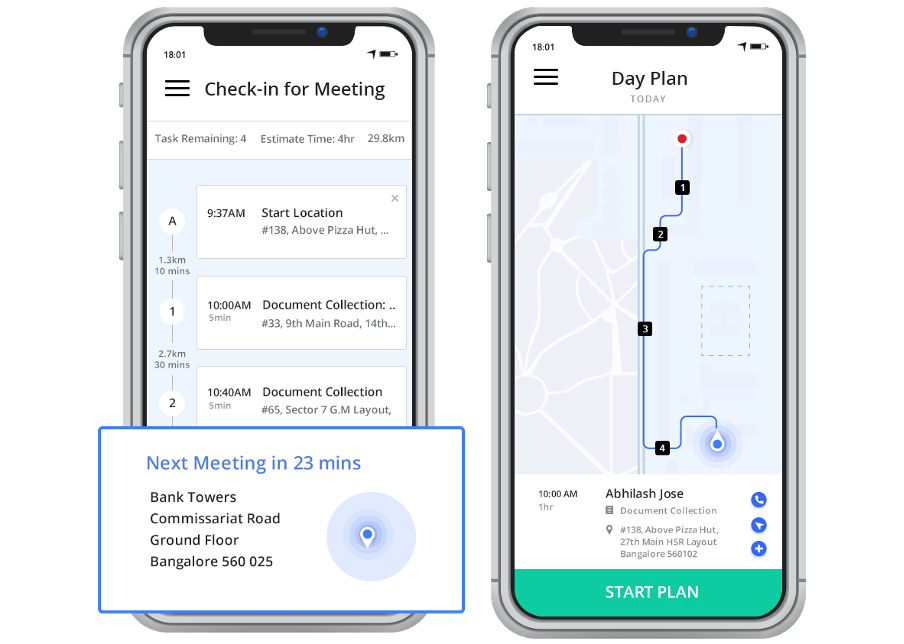

It was a very resource-intensive process. Now, field sales are online and genuinely remote due to sales automation platforms. With the mobility CRM app, managers can automatically set up daily plans and derive performance reports for their reps.

It also allows them to help reps prioritize leads, identify the shortest path to their next meeting, take virtual meetings directly from their phone in case they are in the field, and check in/out to manage attendance.

Another helpful feature is the geo-fencing of activities. Managers can now assign reps tasks specific to the geographies they want to cover, and geo-fencing helps them restrict task completion until they are present at the site.

Amazon Pay, one of India’s leading payment brands, has built a world-class merchant onboarding process using LeadSquared to achieve short onboarding times and higher productivity with its teams.

Another example is UNI Cards, an Indian BNPL leader, that uses contact center and field sales automation that helped them 4x their sales onboardings and 2x their field collections visits.

6. Claims Processing

Automation is also being used to streamline the insurance claims process, including verifying information, calculating payouts, and processing payments.

In India, IRDAI is aiming for 100% insurance penetration by 2047. Automating claims processing will be a critical step to achieving that goal.

Account creation and Management

In the banking industry, automation handles tasks like account opening, account maintenance, and account closing, allowing banks to process these tasks more quickly and accurately.

The benefit is effortless account management and a rich customer experience.

7. Cross/Up-Sell Management

Cross/Up-Sell management is another case where finance leaders have found automation valuable. Top banks source nearly 80% of their retail assets through existing customers.

Therefore, leaders can generate new opportunities by capturing sales signals from existing customers and targeting them through email, WhatsApp, and social campaigns.

8. Customer Service

With self-serve portals and chatbots, finance companies are able to reduce the response time and handle grievances better.

Through automation, companies can handle a high volume of inquiries and segment and redirect service requests to appropriate departments.

Other benefits of automation in customer service include the following:

- Reduced response and resolution times

- Operational cost savings

- Improved efficiency

9. Reporting and Analytics

Traditionally, reporting was a manual activity. Reps/managers would perform excel operations to derive insights from the data they would have collated. As a result, teams would spend a few hours every day performing this exercise which would translate to a few days dedicated every month to collecting data and making reports.

Consequently, leaders would receive a deferred analysis of the organization’s performance. It would be a big problem if the study suggested urgent corrective actions. This would also put the organization out of touch with the ground reality of its market.

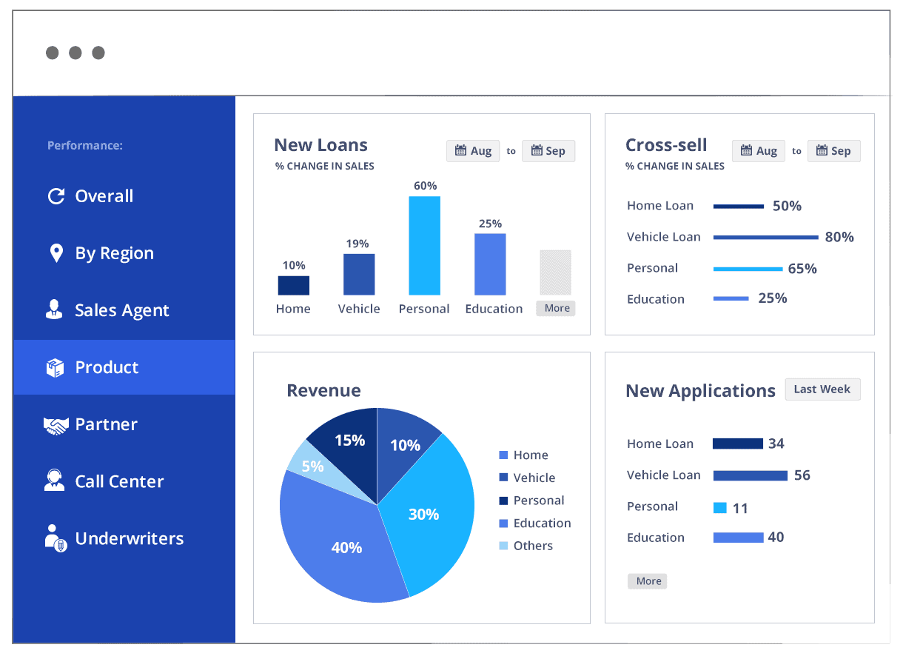

However, today, organizations can invest in advanced reporting and analytics platforms to avoid this problem. For instance, with LeadSquared, you can set up dashboards/smart views to analyze the performance of their teams/products/regions, and much more in real-time. This helps leaders set up appropriate incentives, promote growth, and align your business with the market reality.

10. Debt Collection

Debt collection is a highly resource-intensive operation. Of the many challenges lenders face, some of the common ones are:

- Manual case management

- Low intelligence about probable delinquencies

- Low rep productivity

- Communication problems with customers

- Team management

A Debt collection CRM can help reduce friction in the process. Through timely reminders to customers, repayment rates can be significantly improved.

Automated nudges/notifications to reps also help improve their productivity while reducing the overall cost of operation—another excellent example of automation in financial services.

11. Sales Performance Management

Sales Performance Management must be an integral part of any fast-growing organization. It helps:

- Forecast future sales trends and employee compensation rates.

- Identify missing links in the sales teams’ training.

- Reduce rep churn/turnover.

- Build a strong sales pipeline.

- Improve the accuracy in delivering performance-based incentives

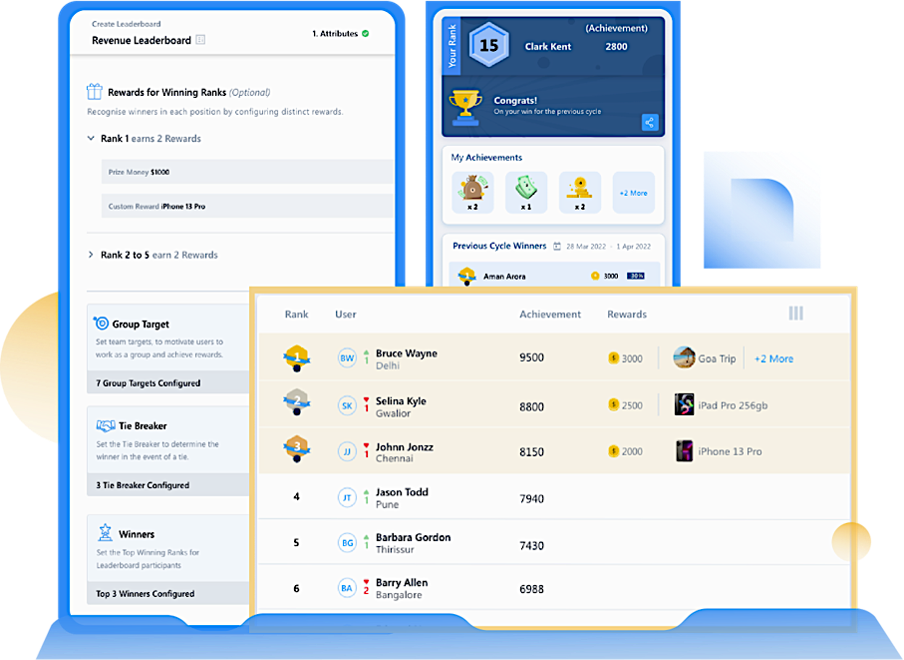

Many organizations use automation to turn their sales processes into a competition between their reps. Introducing goals, target Vs achievements, leaderboards, incentives, etc., encourages sales representatives and gives them more visibility into their performance.

Many tools today can help you improve team performance using SPM. In case you are on the lookout, check out LeadSquared ACE. Several sales leaders saw their productivity grow, as high as 55%, using the ACE module in 2022.

12. Fraud Detection & Prevention

By 2026, the fraud and risk prevention market will grow to USD 65.8 billion with a CAGR of 21.8%.

Many fintech companies are using ML algorithms to analyze customer data and identify suspicious activities that may lead to frauds.

For example, platforms like Sherlock (developed by CRIF Highmark) can improve anomaly detection, increase catch rates, lower review times, enhance credit decisioning, and more.

With the advent of big data, AI, and ML models, finance companies have a vital tool to verify false positives quickly and effortlessly.

13. Compliance

Compliance is a significant concern for financial institutions everywhere. And given the fluidity and diversity within the financial services industry, it is easy for organizations to make errors while adhering to their respective compliance norms.

In such cases, automation can help comply with regulations and reduce risk. For example, they can use automated systems to track and monitor transactions to ensure compliance with anti-money laundering (AML) rules.

14. Portfolio Management

Automated systems like robo-advisors can help manage portfolios, including rebalancing and analyzing risk. This enables wealth management firms to provide more personalized investment advice to their clients at a much lower cost.

Conclusion

Automation in the financial services industry has unlimited potential; this article only covers about a fraction of it.

Automation can help you free yourself of mundane actions that drown your reps in inefficiencies and replace them with complex business challenges that need the human touch. You can focus on improving process efficiency and delivering excellent customer experience—deliverables vital to stay in the game today.

It’s vital to make the distinction that automation in financial services does not necessarily mean replacing human resources with machines. Instead, it’s about finding ways to use technology to augment the work of humans and make their jobs easier.

Lastly, it is essential to remember that there are better answers than blindly automating. You must choose workflow automation tools to solve your organizational challenge and integrate well with your culture. For seamless adoption, you must prioritize features like no/low code capability, simple interface, and multilingual nature.

If you want to experience the best sales automation, improve staff efficiency, and increase new customer onboarding by 4x then, check out the LeadSquared sales execution solution.