Disbursing a mortgage loan is no mean task. It is hardly an over-the-counter product where you can hand it out to the next person who walks in. A mortgage in the US is a high risk, high cost, and volatile product that needs tons of background checks, credit checks, borrower credibility checks, and collateral in case of delinquency.

Mortgage lenders of the past might have tried to deal with this elaborate and quite tedious process manually. But it has led to many errors and an increased risk of identity fraud. That is why many mortgage lenders turn towards mortgage loan origination software to make the whole process simpler, automated, and error-free.

So, what is a mortgage loan origination software anyway?

What is Mortgage Loan Origination Software?

A loan origination software (LOS) is a tool that allows lenders to manage different stages of their loan servicing cycle – right from application to disbursal. It is a digital solution that provides centralized access to all data, resources, and teams. The primary purpose of LOS software is to help lenders process loans faster. The LOS that caters to the mortgage industry is called mortgage loan origination software.

LOS is quickly adopted by lenders over the world to expedite their loan disbursal processes. The LOS market is estimated to be worth 5210 million US$ by the end of 2025. The USA is the largest consumer of loan origination software, taking up 44.06% of the global market. The market is full of loan origination software, and lenders have a lot of options with them. Still, bringing operational efficiency remains a concern.

A better solution for end-to-end mortgage loan management is using LOS with mortgage CRM software.

How a Mortgage CRM Works with a LOS System

To streamline your mortgage lending process, having a LOS system is not enough. You will need a mortgage CRM that can work well with your loan origination software to ensure that there are no lead leakages or setbacks in your lending process.

Let’s look at how a CRM and LOS work hand-in-hand throughout the stages of the loan origination process.

1. Pre-screening

A lender might attract potential borrowers to their website in numerous ways. It could be through paid ads, real estate partnerships, social media campaigns, third party listings, and more. Once the lead visits the website, there is usually an eligibility check that they fill before they even apply for the mortgage.

This form captures details like employment status, annual income, bank statements, or tax returns that speak for the borrower’s credibility. When the lead doesn’t fit or fulfill the threshold criteria, then they are rejected right away without having to go through the whole process. A CRM will quickly mark disqualified leads so that your sales team does not waste time following upon them.

2. Mortgage Application

Once the borrower passes the screening, the second step would be to complete the mortgage application. Before the era of loan origination software, in most cases, the applicant would submit a lengthy paper form, which might include false information. A LOS, on the other hand, will automatically capture all this information, validate them, and make it easier for your credit team to process the application.

By integrating your CRM and LOS, all the application information, with both current and historical data, is captured in one place, where you can easily access it whenever needed.

3. Application Processing

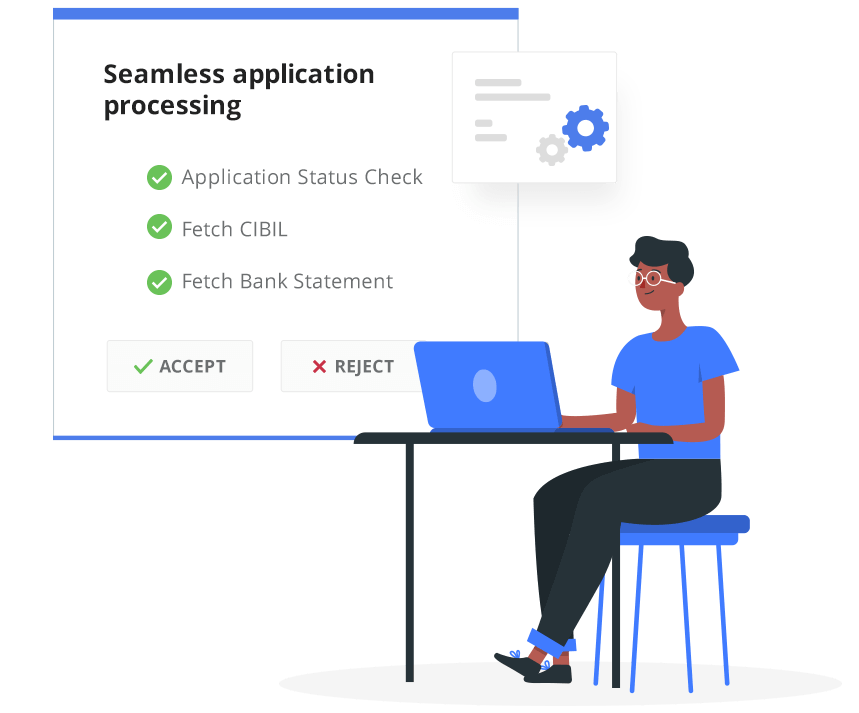

Once the LOS registers a new application, it quickly analyzes it for missing information, incorrect data, or other inaccuracies. Instead of having a whole team of people poring over long applications, a LOS automates and simplifies this process so that what took days, or even months, is now completed in a matter of minutes.

With a CRM integration, you can quickly route incomplete applications to your call center team, who can then follow up with the applicant to persuade them to complete the application. Additionally, they can also set up tasks and reminders to ensure that they follow-up with all leads.

4. Mortgage Underwriting

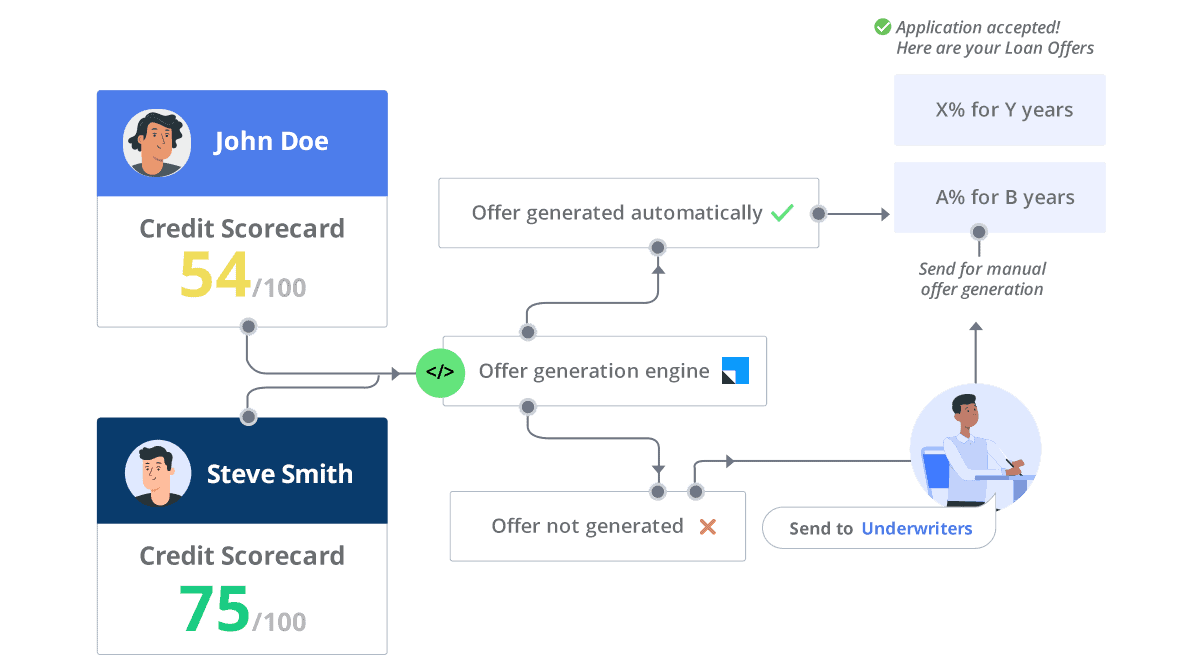

Underwriting for mortgages is the single most crucial step in your entire loan origination process. Underwriters receive the completed and verified application from the mortgage CRM software, who then assesses the risks to create a loan proposal.

An underwriter will typically check an applicant’s credit history, identification, income statements, cash reserves, equity investments, financial assets, and other risk factors. A CRM can also help you keep track of the underwriting status so that you can quickly view the prospect’s stage in the funnel.

A CRM can fetch data from LOS, CIBIL, Experian Hunter, Perfios, NetBanking Connect, and PDF Statement Analyzer to automate borrower qualification & offer generation.

In the US, underwriters usually follow the guidelines set down by Fannie Mae and Freddie Mac, that oversee the mortgage market. Most LOS and CRM software integrates with these two entities to help automate the underwriting process.

5. Credit decision and Quality Checks

After the underwriting process is complete, the mortgage lender will have all the information he needs to process the mortgage. They will look at the applicant’s risks and then decide whether the application can be processed, rejected, or modified. If an application is approved, then the creditor can determine the principal amount and the annual rate of interest, depending on the applicant profile. A CRM will then import all this information from the LOS so that the applicant profile remains up to date.

After this comes the quality check process, where the quality control team audits the application to ensure that it meets both internal and external guidelines. It is a vital step in the loan process, as it helps mortgage lenders avoid any lawsuits in disputes.

6. Loan Disbursal

The final step in this process is sanctioning the mortgage once the parties sign the documents. After funding the mortgage, the borrower is considered closed in the LOS.

But with a CRM integration, you can continue to keep track of the borrower even after mortgage disbursal. You can keep track of monthly payments, changes in interest rate, amortization of the principal, and more by setting up simple workflows within the CRM. In the case of delinquency, you can also send reminders to the relevant loan officers to ensure they quickly take remedial action.

Conclusion

With COVID 19 suddenly uprooting the way the world works, many businesses are adapting to the new era by going digital. The mortgage industry is not far behind, by quickly adopting productivity tools like loan origination software and mortgage CRMs.

When choosing a suitable mortgage CRM, you must look for one that can integrate well with your LOS so that you can manage mortgages from one centrally connected system. Here are some benefits of integrating your CRM and LOS:

- Quicker loan disbursals

- Reduced acquisition costs

- 360-degree view into borrower information

- Optimized operational costs

- Faster underwriting

- Increased borrower engagement

- Reduced collection costs

Pairing your mortgage loan origination software with your CRM is the best decision that you can make, and reviews say that LeadSquared’s mortgage software is one of the best in the game. Why don’t you check it out?

Loan Origination System FAQs

A LOS helps lenders centrally manage and automate various loan servicing lifecycle stages, right from application to loan disbursal.

There are six types of mortgages for homebuyers:

1. Fixed-rate mortgage

2. Adjustable-rate mortgage

3. Conventional mortgage

4. Jumbo mortgage

5. Balloon mortgage

6. Interest-only mortgage

A mortgage originator is an institution or individual that works with a borrower to complete a home loan transaction. It can be either the original mortgage lender or a broker or banker.

Further reading: