Over the last year, peer-to-peer lending has seen a large number of new entrants in the market. According to Business Today, P2P lending firms such as LenDen Club and Faircent have estimated the number of new joiners to be in lakhs.

Faircent, which is India’s first NBFC-P2P company, has disbursed Rs. 1145 crore loan in FY21 alone, which is a near 24% increase in its disbursals. Experts attribute this boom to the attractive returns of 14-16% p.a. compared to other asset classes.

So, you may wonder, why is P2P lending so attractive amidst this global economic crisis, and should you invest in it?

In this article, we will look at some of these questions. We will also discuss:

- The nature of P2P lending

- The risks involved

- The functions of P2P lending platforms

- And the best P2P lending platforms in India to start investing in

What is P2P Lending?

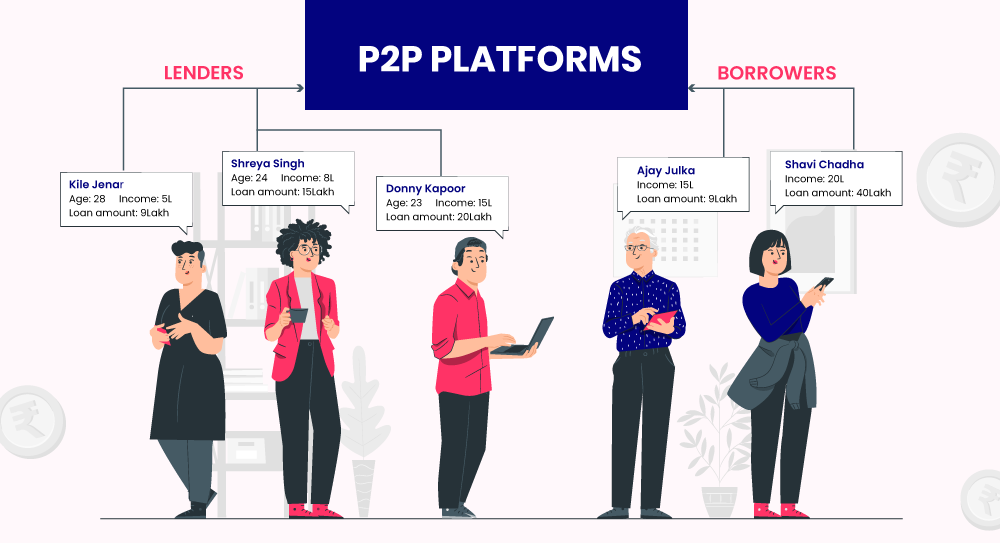

Peer-to-peer lending or crowd lending is a form of debt financing wherein borrowers can request a loan from another individual without the need for any financial institutions to act as the intermediary. P2P lending, as a source of financing, has the potential to extend financial inclusion globally. Groups with low credit scores or that lie in the low-income category find P2P lending highly accessible compared to other investment options.

Also, the underbanked/unbanked populace and small/micro businesses often face difficulty getting approved with organized credit. This makes P2P lending an attractive option for many.

Financial inclusion has been a critical issue for a country like India, where nearly 70% of the population resides in rural areas. But high smartphone penetration combined with the introduction of infrastructures such as Aadhar, UPI, Digilocker, eKYC, eSign, BHIM, and Indiastack has enabled many P2P lenders.

Although P2P loans mainly constitute personal loans, borrowers have other reasons for applying for P2P loans such as:

- Financing their education

- Buying real estate

- Debt refinancing

- To get a secured business loan

- Loan for machinery

Why become an investor/lender in P2P?

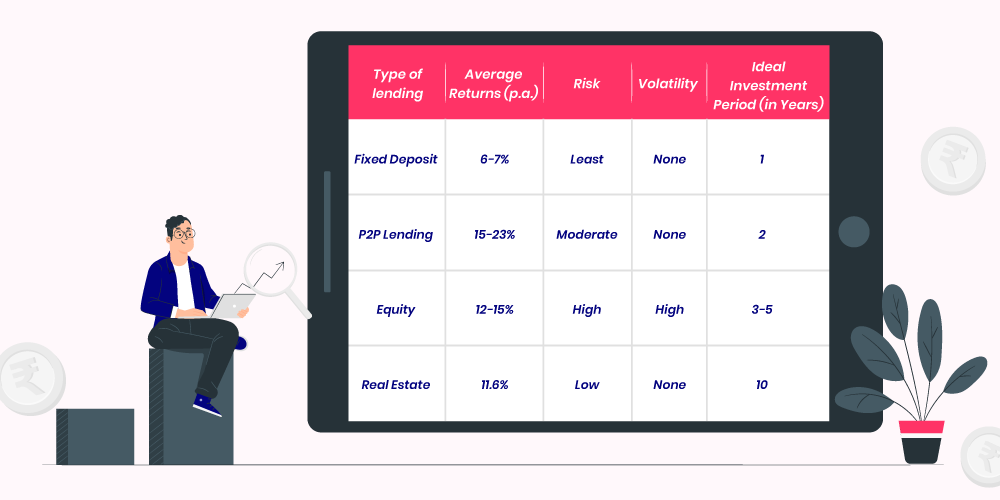

Over the last year, P2P loans have given a broad range of average returns on investments (ranging from 12 to 23% in some cases) compared to other instruments of investment.

From the table, it is evident that the average risk of investing in P2P is less. Also, the returns are at par or even higher compared to the equity market. The extension of financial inclusion has fuelled the growth of P2P lending and is responsible for these returns.

Before investing any amount, you must be wary of the risks.

What should you know before starting your P2P lending journey?

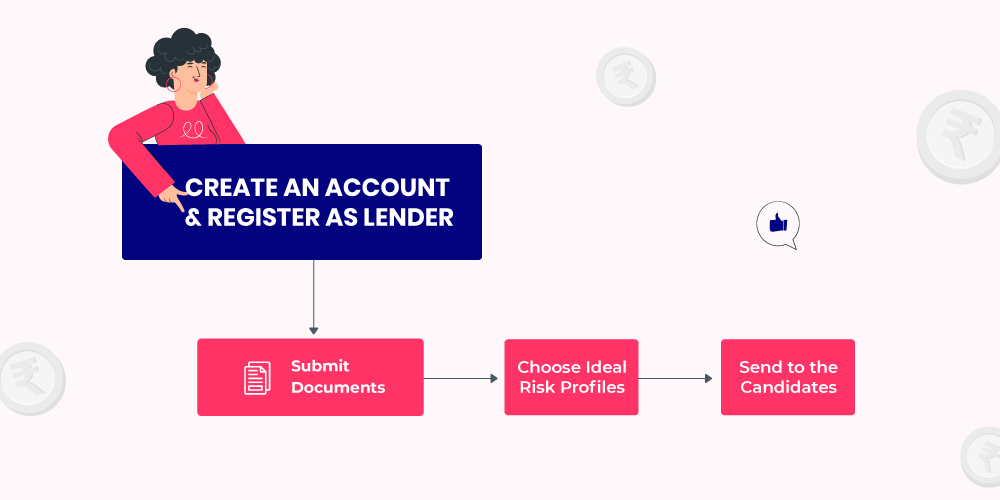

Since its start in 2005, digital platforms have majorly facilitated organized P2P lending. It is due to the increased convenience, paperless process, and reduced execution time. At the start of their journey, any P2P investor must:

- Create an account on a P2P lending platform and register as a lender

- Submit the required documentation and get verified

- Choose their risk appetite and review applicant proposals

Once an investor identifies their ideal candidate, they can accept proposals and initiate the process. Like any other asset class, there are risks involved with P2P lending as well. There are two main risks to know about before investing in P2P:

- The risk of payment defaults: Collections can become a challenge. Many P2P platforms help you recover your invested amount from the borrower based on the guidelines stipulated by RBI for NBFC-P2P. But in some cases, recovering the amount may need a lot more effort.

- The risk of lower returns: If your borrower repays the loans earlier than the set timeline, then you may end up with less than expected profit.

But there are many ways to remove these risks, and you must take all the required measures to do so.

Tip: To minimize risks and maximize returns, you can diversify your investments over different risk categories.

Advantages of P2P lending

- The risk-reward ratio in P2P lending is better compared to other asset classes.

- P2P platforms use discrete and AI-based algorithms for better analytics and target their audience accurately. They allot risk categories to different borrowers based on their (low to almost non-existent) credit history. In turn, investors can access a broader market tailored to their risk appetite.

- P2P Lending Platforms offer attractive interest rates to borrowers due to higher competition between investors.

Disadvantages of P2P lending

- Most P2P loans are unsecured, and hence recovery-related risks are present.

- Borrowers from high-risk categories are also eligible for loans which is not the case for organized lending.

- In case of payment defaults, no insurance/protection are available to the P2P investors.

What are my limits for investment?

The minimum investment amount for a lender to begin an investment is Rs. 500 and the maximum amount is Rs. 50 lakhs (across all platforms). Also, the max limit of borrowing to an individual borrower is capped at Rs. 50,000 by RBI (Source: ET).

How will my returns be taxed?

Borrowers usually pay the returns in monthly installments. Now, these returns are a sum of principal + interest portions. Only the interest part on the EMI is taxable as per the sec. 56(2) of Income Tax Act, 1961 (Source: OMLP2P). The government considers it under the category of “Income from other sources”.

So, you’ll have to pay the tax based on the tax slab rate applicable to you.

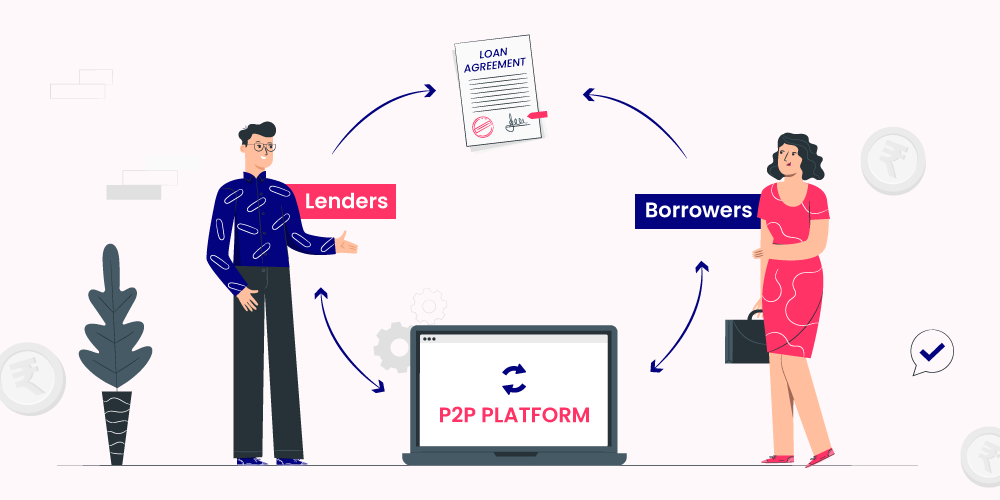

What are P2P lending platforms, and what are their functions?

In the simplest terms, P2P platforms are a marketplace for borrowers and lenders to connect. The platforms use advanced lending CRMs such as LeadSquared during the onboarding process to accelerate the customer acquisition rates and reduce the turnaround times exponentially. Once a potential opportunity is onboarded, P2P platforms use their tech-based processes powered by analytics and data-driven algorithms to segment these opportunities.

As discussed earlier, these platforms are capable of accurately categorizing all types of borrowers. It is a crucial component that helps P2P platforms improve access for people with higher risk profiles.

P2P platforms have many functions like:

- Completing multi-layered background checks on all market participants

- Assessing and timely updating risk categories of all borrowers (new and old)

- Listing the loans and facilitating financial transactions

- Enabling collections

- Assisting lenders in the recovery of loans in case of payment defaults.

P2P lending platforms have one-time registration charges and a processing charge for every transaction. The processing charges can vary between 1% to 10% (Source: Bankbazaar). It is usually dependent on the platform and loan amount.

As an investor, you need to understand the unique points of each platform. P2P lending platforms do not hold any deposits from either party and help lenders during the transaction period.

So, what are the best platforms to kickstart your P2P investments?

5 Best P2P Lending Platforms in India

LenDenClub

Founded in 2014 by Bhavin Patel, LenDenClub is one of India’s fastest-growing P2P lending platforms. It caters to over a million customers at over 19,000 pin codes. With its digital lending application InstaMoney, the platform aims to improve its outreach to pan-India and increase financial inclusion.

Faircent

With over 2 lakh lenders at the end of FY-21, Faircent was India’s first P2P lending platform to receive an NBFC-P2P license from RBI. Rajat Gandhi, Vinay Mathews, and Nitin Gupta started Faircent in 2013. With an innovative portfolio of loans, such as anti-lockdown loans, Faircent aims to ease liquidity-related stress on borrowers stricken by the pandemic.

Lendbox

Another popular P2P lending platform, Lendbox, is used by over 50k investors and 5.4 lakh registered borrowers. Ekmmeet Singh, Bhuvan Rustagi, and Jatin Malwal founded Lendbox in 2015. Investors at Lendbox have generated up to 16% annual returns by lending to various borrowers. It aims to cut down the middlemen in lending and extend financial inclusion to many borrowers through technology.

Lendingkart

In 2014, ex-banker Harshvardhan Lunia started Lendingkart to support India’s SME segment. Since its start, it has helped over 90,000 small businesses across 1300 cities. The company uses its cutting-edge credit assessment algorithms to categorize its borrowers and help you meet the ideal candidates.

Finzy

In 2016, Amit More, Vishwas Dixit, Abhinandan Sangam, and Apoorv Gawde wanted to create a platform that could enable risk-optimized investing. With this mission, they started Finzy. It offers various opportunities for investors to earn anywhere between 7.99 to 27.99% returns based on their risk appetite. Investors use advanced investment solutions like finzyPRO+, finzyBolt, and Reinvest-Pro offered on the platform to cut risk while maximizing returns.

Conclusion

“Risk comes from not knowing what you are doing.”

-Warren Buffett

Investors must educate themselves about the instrument before commencing any investments. Every platform has its strengths and weaknesses. Going through the platform guidelines will give you a complete understanding of what you can do if you need help. Additionally, a strong knowledge of the P2P ecosystem and your investing strategy will help you become a successful P2P investor.

If you want to know how LeadSquared, a new-age lending CRM, can accelerate your loan disbursals.