If you’ve always wondered what a loan origination system is, how it is different from a loan management system and the value it offers to lending institutions, this is going to be just the read you need!

In this article, discover the concept of a loan origination system, the stages of the loan cycle it takes care of, top loan origination systems to look for in the market, and more!

What is loan origination?

A loan origination system helps lenders simplify the lending experience by carrying out documentation from the loan application to the loan disbursal stages. It ensures compliance, and security while dealing with sensitive customer data. A loan origination system can also be helpful for lenders to process loan applications even at higher volumes by mitigating potential instances of manual errors.

Coming to loan origination, it is the process by which a borrower applies for a loan, and a lender disburses it or rejects the application. The origination process includes every step from application to funding disbursement, or rejection of the application. So, basically, the system of automating and managing the loan application and disbursal processes is what the loan origination system helps with.

Depending on the types of loans, the origination process differs. For example, the process for mortgage loans is different from that of personal loans. The loan origination process can vary between different financial organizations. It may happen through several channels, involving multiple conversation touchpoints, and several meetings with the borrower.

The loan origination process is usually cumbersome and requires a lot of documentation. However, with the increased use of automated systems, loan origination is becoming easier and faster.

What does a loan origination system do?

In the current market, financial organizations are persistently trying to improve their workflow. Efficient systems not only improve customer experience but also brings better ROI. Financial services institutions are focusing more on the automation aspect to improve loan management. Adopting technologies such as microservices, APIs, machine learning, and AI is now quite effortless. The integration of these technologies into legacy loan origination systems will cut down the processing time and reduce operational costs. To achieve greater efficiency, lenders need to focus on the following tasks:

- Automate data collection from the customer

- Verify the authenticity of documents digitally

- Automate the underwriting process

- Enable third-party integrations to the loan origination system

- Enable automated workflow models

What’s the typical software stack like in lending institutions?

While every lending institution may vary depending on their size, the loan products they offer and how digitally influenced their processes are, here’s a look into the general tech stack in most lending institutions.

Layer 1: Lead management system/ CRM

A CRM helps lending institutions to manage customer-facing processes. This could be customer acquisition, customer engagement to prevent drop-offs, automating lead distribution to internal teams, managing marketing campaigns, and other such functions. This system helps qualify the leads to push to the next stage.

Layer 2: Loan Origination System

A loan origination system takes care of borrower onboarding, underwriting and loan disbursal.

Some of the processes that fall under the purview of this system include ensuring DDE (Detailed Data Entry), KYC OCR verification, eligibility checks, offer and fee collection (subject to offer confirmation from the customer), credit appraisal, credit approval, and loan disbursal.

Layer 3: Loan Management System

A loan management system helps manage and streamline the loan lifecycle once the loan has been disbursed. This entails loan booking, servicing the loan, accounting of repayments, and loan closure. It helps lenders monitor repayments, gives access to borrower reports, etc.

Layer 4: Collections System

If there are cases of delinquency or loss of assets, the collections layer comes into play. When a borrower surpasses the due date to make the payment, a debt collection system helps lenders manage these instances. Lenders today also have provisioned a pre-delinquency module to identify borrowers who pose a potential risk in the future to avoid bad debt.

Layer 5: Integrations Ecosystem

The integrations layer supports any of the above layers in the processes they assist with. For example, an integrated BRE (Business Rules Engine) helps configure and automate application screening checks with knock out rules. This helps qualify applications that meet the set criteria and avoid dedupes. Few other integrations include KYC verification solutions, credit bureaus to soft/hard pull data, IVR integrations, etc.

How does loan origination work: Discover these 7 key stages

Loan origination takes place over multiple stages. The initial origination stages are crucial for delivering better customer experiences. Also, the origination process differs from lender to lender. However, some of the critical steps that are similar are as follows.

Pre-qualification

Also known as pre-screening, pre-qualification is the very first stage of loan origination. Here the lender checks the eligibility of the borrower for a particular loan and determines the authenticity of the borrower. The borrower needs to submit identity proof documents to the lender to get the loan. These documents include:

- ID proof such as a passport or a government-issued ID card

- Present employment status, and any certificate showing income status

- Credit score

- Bank statement and previous loan statements (if any)

Once the borrower submits these documents, the lender verifies them. The lender may verify these documents manually or have software systems that automate the process to an extent. Once the verification stage is complete, the lender allows the borrower to proceed with the application process.

Application

The application process is where the borrower provides relevant information to request a loan. The lender takes all the details from the borrower and proceeds with processing and underwriting the loan.

Traditionally, the application process involved a lot of paperwork. However, now, organizations are switching to digital applications and self-serve portals. Digital applications not only reduce human error but also makes the application process a lot faster. The borrower can apply for the loan via websites or using a mobile app. Digital application are also product specific. So, depending on what loan the customer wants, the application length and required fields will vary.

Application processing

The lender processes the application after it is submitted. In the case of larger organizations such as banks, it is a time-consuming procedure. Multiple departments review the application, one by one. It is essential to verify and validate the application and check whether it is complete and authentic. The verification department will contact the customer if the application requires any correction or if any information is missing. This way of application processing takes time – often weeks or months.

However, a lot of modern banks and financial organizations are now switching to automated platforms. Automated loan origination systems can process the application in an instant. Often, these systems use alternative data points to assess customer eligibility. It can flag files, return it to borrowers, and notify the relevant department.

Underwriting

Underwriting is a process by which lenders analyze your financial information. To decide how much funding the lender can allocate, they must consider multiple parameters. Lenders have different scoring mechanisms, such as credit scores, risk scores, outstanding loans, etc. to evaluate the eligibility of a borrower. Loan origination systems can take care of calculating these scores.

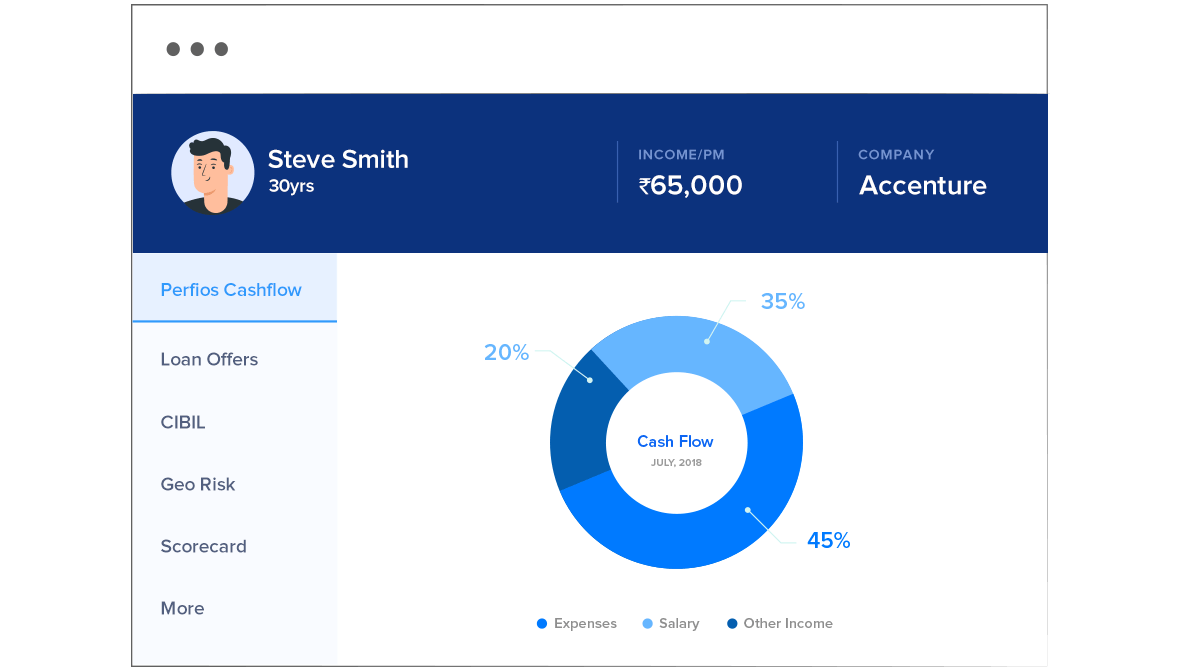

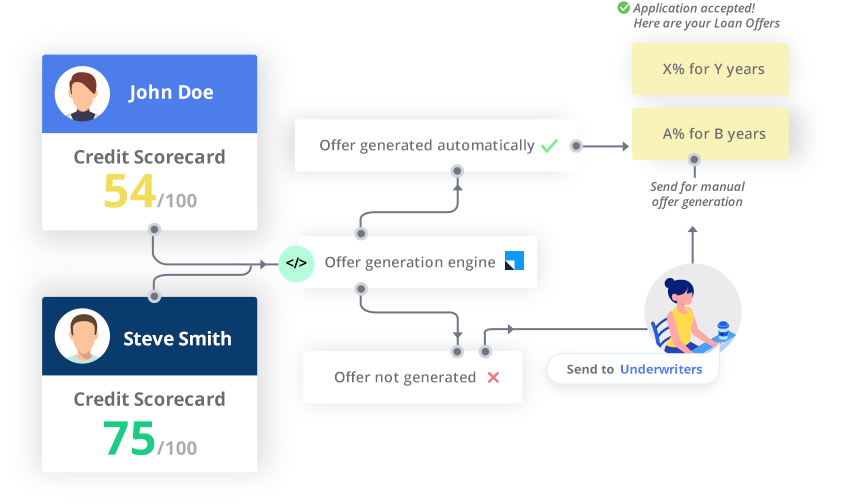

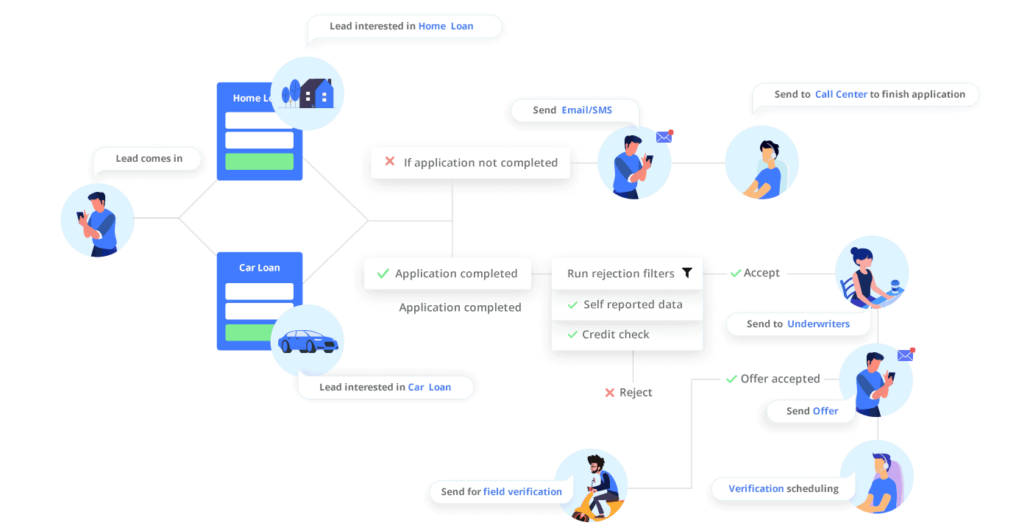

Here’s how a basic loan origination system workflow looks like.

The following image from LeadSquared Lending CRM automated workflow explains this.

Credit decision

The result of underwriting is the credit decision. The lender decides if the application will be approved or denied at this stage. Loan origination systems can make this decision for the lenders. It is easy to assess different risk factors and scores and conclude quickly using AI-powered software. Modern software systems also use machine learning to analyze these scores and make the credit decision.

Quality check

One of the final stages of loan origination is quality checking. The lending business is highly regulated. Therefore, to ensure compliance, the lending organization must check that the processes are error-free and compliant. The lender validates the internal and external regulations at this stage. The lending organization verifies the application one more time before the funding.

Funding

After all the documents are verified and signed, the lender makes the funds available. Some form of loans requires more steps. These include loans against property or business loans.

Capabilities of a loan origination system

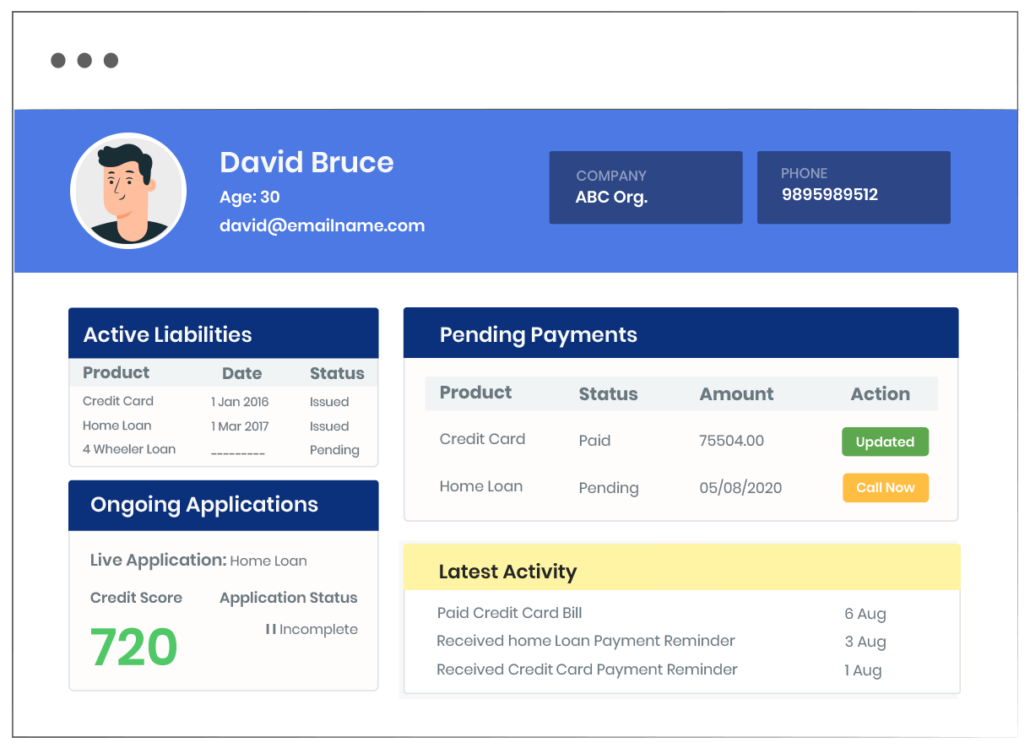

Customer (borrower) management

To ensure accurate decision making, getting correct customer data is the first essential step. For lenders, this can be quite an arduous task. The data collection involves a lot of paperwork with a high chance of inaccurate data getting into the system. Automated loan origination systems can help here with electronic forms.

Loan origination systems have web-based interfaces that the customer can fill in. Often, more advanced platforms will also pre-fill some of the data for the customer, making it easier for them. These platforms also come with APIs that can help integrate them with other apps and services.

Many financial organizations keep multiple copies of data across different departments. With an automated system, it becomes easier to access data centrally and reduces the duplication of documents. Employees with the right privileges can access them from anywhere. From the perspective of audit control, this can be quite helpful.

Credit analysis

Modern lending CRM software can help lenders understand the customers’ credit history in just a moment. With the appropriate permissions from the customer, the program can extract relevant data from the customers’ financial documents. The program can automatically inspect the documentation and create a spreadsheet. Technologies such as machine learning and optical character recognition help extract the information. These technologies can help the lenders pre-screen a borrower and even provide credit decisions in minutes.

Credit decision

In the loan approval process, automation helps with mining the data and simplifying the decision process. For many lenders, deciding to fund a loan by collating various documents is a difficult task. Not only does it allow human error to creep in, but it is also a slow process. For new customer relationships, this can create a negative impact.

Modern lending software can do this in minutes. These programs combine data from multiple stages and help lenders decide based on their predefined rules. To achieve this, lenders need to set a process based on the policies, the program screens the applicants. The final step is to approve or decline the loan. The automated software can flag potential risk factors and help loan officers prepare a proposal.

Portfolio risk management

A strong reason for using automation is improved data integrity and governance. All lenders have a set amount of risk they can tolerate. Organizations have rules based on which they set these risk levels. Without a portfolio reporting tool, coming up with these rules can be tedious and error prone. With manual underwriting, it may take multiple weeks to identify an issue. At that point, it may be too late or too costly to fix the problem. Automation in these instances ensures risk management.

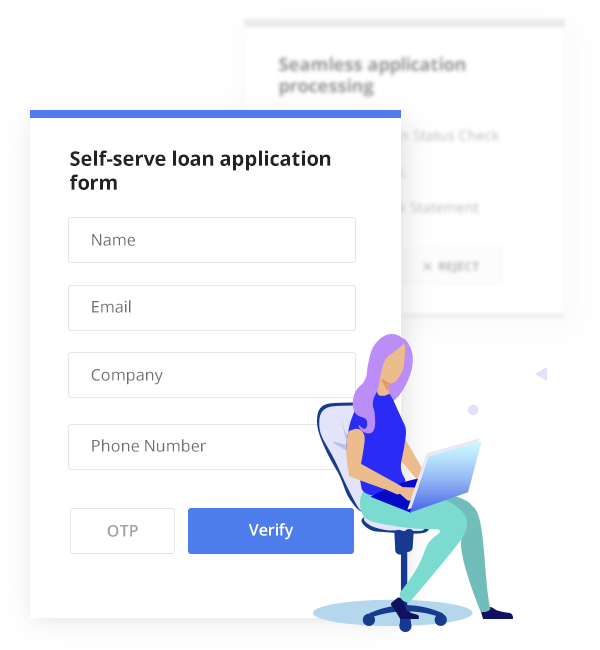

Self-serve application forms

Self-serve application forms provide customers with a simple and intuitive way to approach the lenders. For lenders, it is a neat way to reduce junk applications. OTP verification helps in getting authentic customers, improves the customer experience, and saves lender’s time.

Workflow automation

Loan origination systems can also help in automating workflows. Origination software can define and automate workflow for loan distribution to the in-house teams and call-center agents. The loan origination system software can take care of scheduling customer-agent interactions or meetings. From there, it can take over the application and analysis process. In the next stages, it can help in underwriting and decision processes. Finally, based on the decision, the organization can fund the loan. All these make it an end-to-end solution for managing the workflow of the loan origination process.

Benefits of a loan origination system

A manual approach to handling loan applications can be cumbersome, siloed, and prone to errors. In a time where financial institutions are progressively modernizing their processes, technological solutions are being designed to mitigate these challenges. A loan origination system can be a valuable addition to the tech stack of a lending institution because of the following benefits:

- Reduce risk of compliance with incomplete or unverified applications

- Helps with credit risk assessment with data being made more accessible through integrations with credit bureaus

- Enables a frictionless customer experience from the very start

- Helps internal staff to collaborate with better transparency and centralized data

- Streamlines loan documentation

Finding the right loan origination system

Borrowers today want loans approved in just a few clicks. Clearly, legacy loan origination systems can impact customer experience with manual data entry and longer turnaround times. So how should you go about finding a loan origination system that’s ‘right’ for you?

Here are a few points to help get you started!

Customer onboarding

Lenders today must be able to onboard customers across channels like a website, on call, or through SMS. Especially when we’re in a mobile-first economy. A LOS in this context must have the ability to ensure frictionless customer onboarding. This could be something as simple as enabling e-signatures, or OTP-based KYC processes, etc. This not only makes it easier for the borrower, but also simplifies the lending experience for front-end and back-end teams.

Process automation

Routine tasks have the scope to be automated. This allows lenders the opportunity to scale as the volume of loan applications increases. With paperless documentation, and automated screening, loan officers have the time to truly engage with borrowers and assist them along their borrower journey.

UI/UX

The loan origination platform you pick would be ideal if it’s low-code/no-code to help staff seamlessly adapt and reduce IT intervention for every minor roadblock. This will also enable quicker implementation.

Configurability

The loan origination system you pick should be easily configurable. This means, you should be able to configure it based on your unique business requirements instead of being a system that’s rigid with a one-size-fits-all approach.

Security and compliance

With the introduction of digitized processes comes the worry of data protection and security.

It’s paramount for lenders to choose a loan origination system that operates with robust security measures and guarantees the safety of sensitive financial data. SaaS providers like LeadSquared ensure enterprise-wide security and compliance.

Integration capabilities

Businesses are hardly monolithic anymore. There is increased collaboration with third-party service providers to enable quicker processes with better functionality. Loan origination software must have the ability to support a range of API integrations.

Top loan origination systems to choose from in 2023!

To help you make an informed decision, here’s a list of the top loan origination systems that outline their key highlights.

Name | Key Highlights | G2 Rating | Pricing for LOS |

LeadSquared |

| Personalized quote | |

LendingPad |

| Personalized quote | |

CloudBankIN |

| Personalized quote | |

Finflux |

| Personalized quote |

Conclusion

Automation is the driving force for all businesses in the modern era. Since the onset of the pandemic, the global lending market has exhibited a decline. However, it will start growing within a few years. Lenders should start focusing more on automating the process of origination and create frictionless borrower journeys right from the start.

Globally, more organizations are considering digital transformation as a key investment priority. A loan origination system is certainly a great start for lending institutions to yield a significant positive impact. By using such solutions, lenders can also reduce debt collection risk. Organizations that adopt these systems today have a higher chance of increasing their profit margins and positioning themselves as customer-centric institutions.

Listen to the evolving landscape of lending and the role of digital transformation.

If you’re looking at digital lending solutions such as loan origination to streamline the lending experience, get in touch with us for a personalized demo!

FAQs

A Loan Origination System (LOS) is a software or a set of multiple software built to support the loan application and disbursal processes. It saves time, improves operational efficiencies, and reduces default risks in lending.

Yes, you can integrate Lending CRM with LOS systems to automate pre-screening checks. It will save your time, improve funnel quality, and speed up loan disbursal.

Origination is the process of screening the applicants, authenticating them, underwriting the loan, and finally funding the loan.

A loan origination software simplifies loan management by automating data collection, verifying documents, automating underwriting and workflows, and enabling third-party integrations. LOS also integrates with CRM systems to maintain the borrower profile and track them until the final repayment.

A loan origination system is a solution to carry out customer onboarding, verification, loan documentation all the way to disbursal in an organized fashion. It helps banks and other lending institutions to ensure compliance with internal and external policies and requirements.

A loan origination system simplifies loan management by automating data collection, verifying documents, automating underwriting and workflows, and enabling third-party integrations. LOS also integrates with CRM systems to maintain the borrower profile and track them until the final repayment.

LOS (Loan Origination System) and Loan Management System (LMS) are often used interchangeably. LOS helps process loan applications from the onboarding to underwriting and loan disbursal. An LMS helps manage the entire loan lifecycle including servicing the loan and tracking repayments.

The loan origination process includes pre-qualification, application submission, application processing, underwriting, credit decision, quality check, and funding.