Finnable uses LeadSquared to Improve its Sales Conversions by 25%

10x your sales productivity with LeadSquared.

Book your 1-1 consultation today!

Book your 1-1 consultation today!

FASTER TURN AROUND TIME

INCREASE IN SALES CONVERSIONS

INCREASE IN EFFICIENCY

SECURITY

FASTER TURN AROUND TIME

INCREASE IN SALES CONVERSIONS

INCREASE IN EFFICIENCY

SECURITY

Finnable Credit Pvt. Ltd. is one of the fastest-growing fintech start-ups in India. Headquartered in Bengaluru, Karnataka, their goal is to make personal loans available to salaried professionals in less than 1 minute.

They believe that the financial services industry in its current form is regressive. Higher-earners have access to better-value financial products than lower earners, which drives inequality in society. Through technology, innovation, and support of willing employers, they strive to make the lives of millions of salaried earners stress-free, productive and happier.

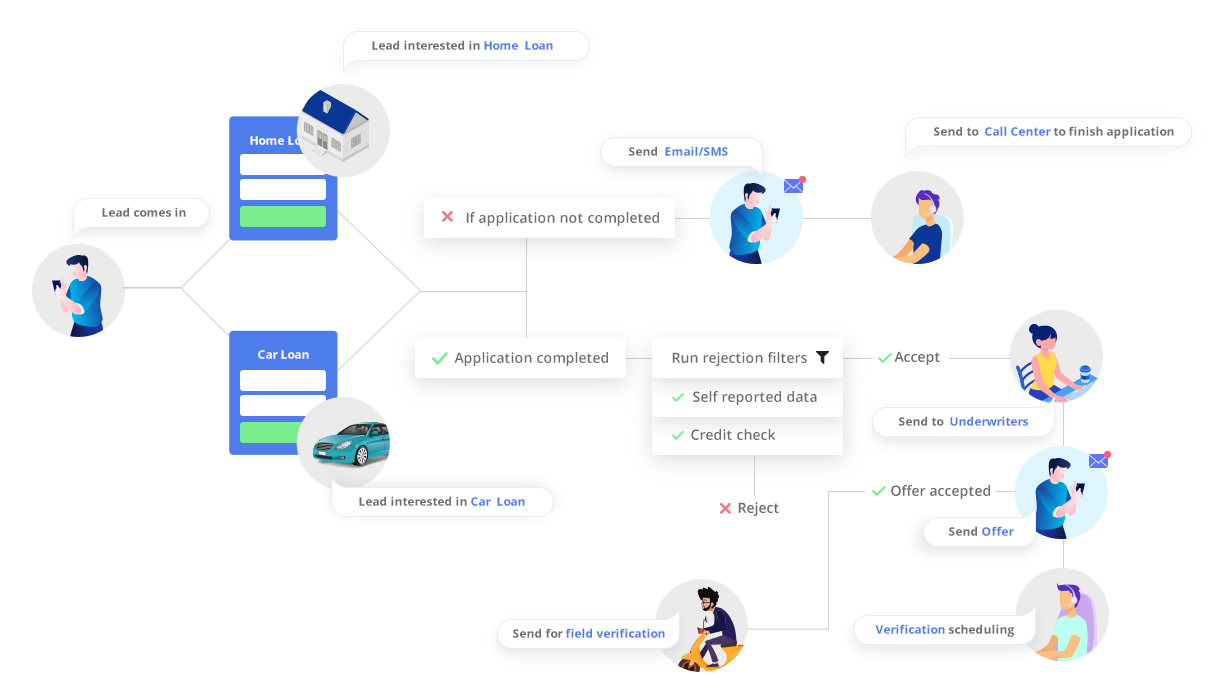

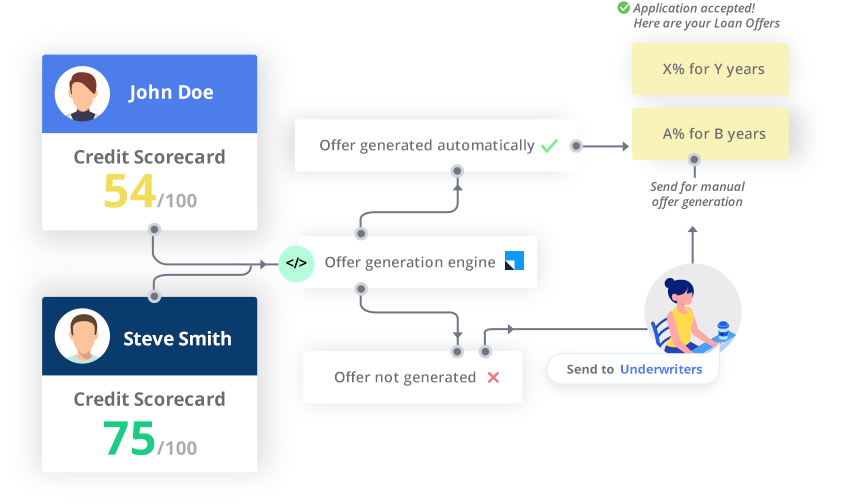

When the promise is to grant loans in under 1 minute, one can expect several challenges. Processing a loan includes stages like document collection, background verification, underwriting and finally loan disbursal. This, if done manually, can take ages.

In order to implement these repetitive series of tasks, workflow automation is effective to streamline the process and remove the risk of human error.

Hence, they needed a Lead Management Platform that could not only automate the customer journey but also improve the sales conversions.

“We evaluated multiple platforms, Zoho being one of them. It did not make sense for us to undergo a massively expensive integration when we weren’t even sure if our approach would work. So, in terms of cost and from our requirements perspective, LeadSquared stood out for us.”

Finnable implemented LeadSquared even before the platform went live. LeadSquared maps the entire journey of the borrower, right from inquiry to loan disbursal.

“We started using LeadSquared even before we started booking the loan. Every team in the organization – from sales to underwriting and disbursal teams – uses LeadSquared. The team sees LeadSquared as a front-end LOS system, to not only map the customer journey but also to provide customer support.”

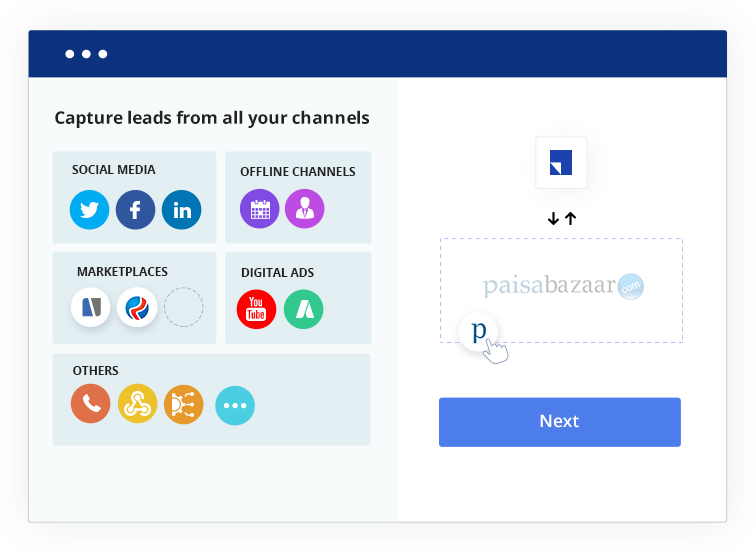

Finnable acquires its leads from two major channels:

In the first case, once the lead fills the form, an API is triggered and the lead is automatically added to LeadSquared. Whereas, in the latter, DSAs push their leads to Finnable’s inbuilt portal, which LeadSquared pulls automatically.

“One of our major concerns was missing out on cases or loan inquiries. It happened on a large scale before we started using LeadSquared’s auto-distribution function. Workflow automation is a great relief since we can automatically distribute leads in a round-robin fashion based on our specifications. There has been zero lead-leakage since we introduced this.”

As the borrower progresses in the journey, the documentation process begins. It starts with uploading KYC details, where the customer needs to show address proof, identity proof, bank statement, and their salary slip.

Post documentation, the leads are auto distributed to the credit/underwriting team. They have embedded an iframe on the LeadSquared app so that the team does not have to go back and forth between applications. This makes their work easier, and faster.

“Throughout the customer journey, the lead stages change automatically, based on pre-specified parameters. As soon as a stage change occurs, the lead gets added to a list dynamically. This allows sales team members to manage their warm leads in their own lists, making their follow-ups more organized. Since we started using workflow automation, we have experienced a 40% increase in turn-around-time in our underwriting process.“

Disbursal of a loan is the final phase of the loan application process where the applicant will receive the loan amount as hard cash or in their bank account.

The loan disburses automatically once the disposition changes to approved.

“One other added benefit from using LeadSquared for automated loan processing is improved customer experience. Our inside sales conversions have improved by 25% reducing the time taken for loan processing. The customers are gaining from not having to wait long for approvals, which in some cases is almost instantaneous.”

In every organization, improving sales conversions is related to greater prospect/customer experience. But that should not be limited only to new sales. It must go beyond, to include average transaction value or the average customer lifetime value. An effective way of doing that is through cross-selling, a method of offering a complementary or related product to a customer’s original purchase.

Finnable offers a loan top-up policy for customers. This applies to every individual who has successfully paid 6 EMIs, hence is eligible for an extra loan of a certain amount. Disbursal of the top-up loan is a quick process since the customers’ documents and background have already been verified.

LeadSquared helps them identify and manage cross-sell opportunities as well.

Customer service is as critical to your business as sales and marketing — maybe even more so. Finnable uses LeadSquared for customer support as well.

“Knowlarity, our telephony service, is integrated with LeadSquared. Since the sales rep can view the complete customer history, data sharing over mails within internal teams has reduced by 60%, increasing efficiency and security.“

The customer has an option to raise a query through their inbuilt application. This query appears as a ticket in LeadSquared. Activity history consists of all the customer details. The support team just needs to call the customer, fix the issue and close the ticket.

LeadSquared provides a centralized system to store all captured leads, without letting any of them slip away. All the interactions between the lender and the borrower are logged and easily accessible by the system admin. The data that is automatically collected includes things like payment history and customer service queries.

“It gives us an invaluable insight into the entire customer journey and provides us with a powerful means of communicating with them.”

Going forward, the company, aside from using LeadSquared more actively, will look at integrating other features to improve sales conversions further and enhance business efficiency.

(+1) 732-385-3546 (US)

080-46971075 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)

DSR Leasing Improves Customer Acquisition Cycle Using LeadSquared

DSR Leasing Improves Customer Acquisition Cycle Using LeadSquared