How Profectus Capital Improved Funnel Quality by 70% using LeadSquared

10x your sales productivity with LeadSquared.

Book your 1-1 consultation today!

“Due to pre-screening automation, we are able to reject files right at the onset. By doing that we are able to improve our funnel quality by 60 to 70%. Only the quality data moves to the core underwriting process, and our underwriting bandwidth is not getting choked.”

Book your 1-1 consultation today!

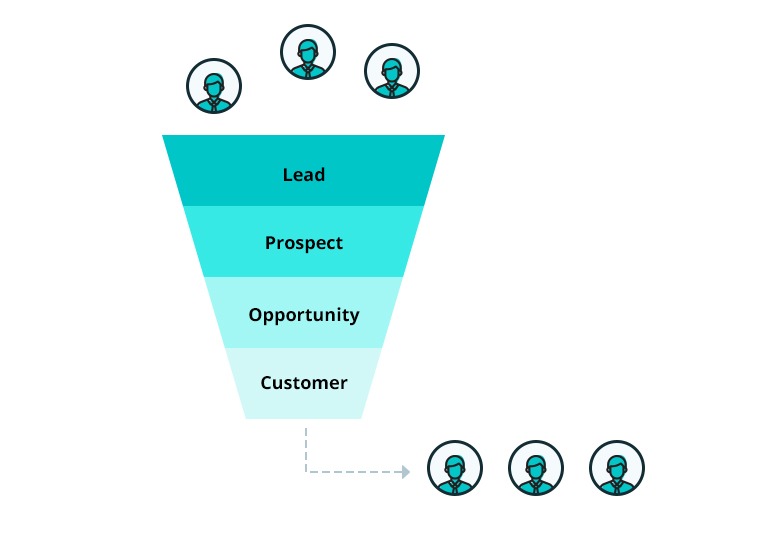

Improved funnel quality

Lead leakage

Trigger-based funnel movement

Customizable dashboard

Improved funnel quality

Lead leakage

Trigger-based funnel movement

Customizable dashboard

Profectus Capital is a non-banking financial services company that offers lending solutions primarily for the manufacturing and service sectors. They also provide supply chain financing solutions to high turnover industries such as automobiles, pharmaceuticals, and consumer durables. The company was founded in 2017, by K V Srinivasan along with top industry leaders in the finance industry.

Vaibhav Maheshwari, the AVP of Profectus Capital, gets candid about how implementing LeadSquared has changed the way they do business.

When they started operations, they realized that old school methods like Excel or notebooks were just not going to cut it. We needed to have a good digital solution that would help their salesforce to streamline their operations. Having a good tool not only improves the productivity of the sales force, but it also helps them give a good experience to their customers.

LeadSquared fit the bill perfectly and they have been using the tool for more than 9 months now.

The tool is used by various teams within the organization. The team that uses the tool the most is the sales team. They use it for field operations such as offline verification and document collection. Some of the company’s DSAs also have access to the tool for prescreening leads.

Besides the presales and sales teams, the company’s product team also uses the tool. They use it to perform basic marketing activities such as emails and lead capture through ads. The MIS team also uses the tool to create reports. They collect sales and marketing data from LeadSquared and use the same to build custom dashboards and reports which are then sent to the management.

Previously, any tool they needed to implement took them at least 2 to 3 months to get onboard. However, with LeadSquared, they were able to configure the tool in just 3-4 days. The integrations took another week, and they were live in 14 – 15 days. That’s the kind of agility that the solution has provided for them.

Besides that, the support team is very prompt. Any issues that are raised are resolved within an hour. The tool itself is highly intuitive. Which means that there was no need for constant support from the LeadSquared team. The Profectus team explored the tool themselves and set most of the integration without much assistance.

“That’s what I like about the LeadSquared team. They let you do it themselves, and do not insist that you buy their services,” says Vaibhav.

Profectus uses LeadSquared for their sales activities, lead capture, lead engagement, prescreening and sales monitoring. They have been using the tool since their inception and have incorporated it into all their processes.

They use it mainly for prescreening their leads. The tool integrates with their Loan Origination System (LOS) through which applications are verified. They do email and mobile OTP verification, after which they pull the CIBIL score. Only those leads that qualify are sent for underwriting.

They use LeadSquared for sales activity monitoring using the geotagging feature. They know how their agents have performed in terms of tasks completed, meetings done, leads called, etc.

They also extensively use the automation feature. They use different triggers to help leads down the funnel. The automations are very easy to configure and save a lot of time. They also use forms and processes to build their own custom forms.

They use the email sync feature, to ensure that all communications with the leads are made transparent. In the event of a salesperson leaving the company, another one can easily continue communicating with the lead.

Dashboards are another indispensable feature for Profectus. Since they are easily configurable, they have created various dashlets that cater to various departments. Any data that is required is readily available and can be presented in the form of a dashlet.

As LeadSquared helps us in prescreening the applications, we are able to identify underqualified applications faster. Which means, that only high-quality applications come in. Their funnel quality has increased by 60-70% thanks to this prescreening that happens. It has also helped them deliver a better customer experience, as they are instantly able to update them on the status of their application.

They have reduced leakage completely, as every lead that comes in is accounted for and there is no way to miss out on leads. The productivity and accountability of the sales agents have also gone up, as the expense reports are linked to the tool as well. Every time they submit a report, it is cross-checked with their geotag report, and only then they are reimbursed.

“We chose LeadSquared after evaluating a lot of bigger tools in the market. The tool is designed in a very user-friendly manner, which makes the adoption of the tool easy as well. LeadSquared is built in such a way, that it will grow along with your tool and your business. This is what sets it apart from other software in the market,” says Vaibhav.

(+1) 732-385-3546 (US)

080-46971075 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)

How Zolostays Reduced Lead Leakage to 0.1% with LeadSquared

How Zolostays Reduced Lead Leakage to 0.1% with LeadSquared