You can probably identify with one of the following characterizations:

A) Your agency began adopting digital technologies before 2019 because you recognized the need to evolve.

B) The pandemic of 2020 forced an uptick in remote work and became the driver of your move to digital.

C) You’re a holdout. Old school insurance business suits you just fine.

If you’re a “C,” perhaps you’ve got a steady book of business and have no fear technology will threaten it. Or perhaps the article you’re about to read will shake things up for you.

This article is for all of the above. Because it’s time to become a digital agency.

But wait…

What’s a digital insurance agency?

Google likes this answer:

A digital insurance agency is a technology-based business that allows you to work more efficiently, build stronger relationships, improve on customer service, make well-informed decisions, and accelerate growth and profitability regardless of the type of policies you sell. (Source)

Note the definition doesn’t state you must dispatch with the charm of doing business “like a good neighbor.” Nor does it state you operate 100% online and remotely.

A digital agency need not be cold or impersonal. Digital simply means you’ve made moves to use technology to enable clients to communicate with your agency and receive services the way they like—via their phones and computers.

Many of your clients now favor self-service functions, such as calculating their own premiums or obtaining their own proof of insurance or ID Cards. So digital agencies put the power of automation to work. It could mean automating marketing or routine client communications and service requests, such as address changes, security verifications for claim filing, etc.

Digital means different things to different agencies. But to every agency it should mean responding to the needs of clients today. Essentially, you can become more digital or more irrelevant.

Digital agencies grow faster

A digital insurance agency can:

- Provide more immediate services

- Reduce time-consuming activities, and thus, overhead

- Serve more customers

- Grow far beyond their geographic footprint

- Drill deep into new niches

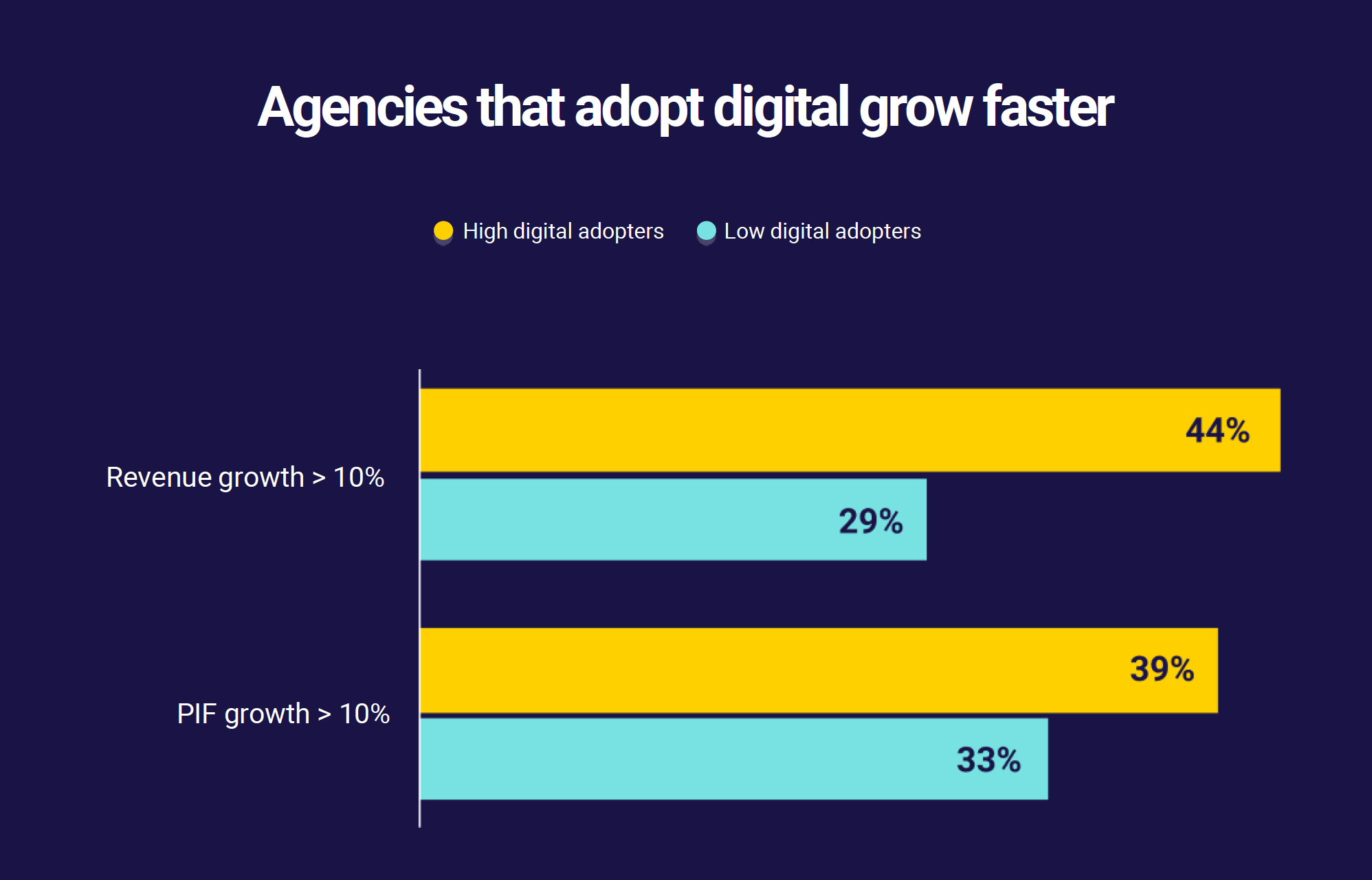

“Year-over-year, low digital adopters grew revenue 7.4% while high adopters grew 12%–equating to a more than 60% higher growth rate for highly digital agencies,” claimed the authors of Rise of the Digital Insurance Agency, a report from AgentForTheFuture.com.

“No longer will the local independent insurance agency be local. Agencies are now able to easily sell insurance wherever they can obtain a license and create, sustain, and maintain relationships wherever the client is located. This means that agencies can be increasingly deep in their product offerings. They can be increasingly deep in the niche business they try to write, but broad geographically. I believe, is the key to the insurance agency of the future.”

~ Tony Caldwell, The Future of Insurance is Data-Driven & People-Led

4 essential technologies digital insurance agencies rely on

Opportunity abounds for agencies automating sales and marketing activities.

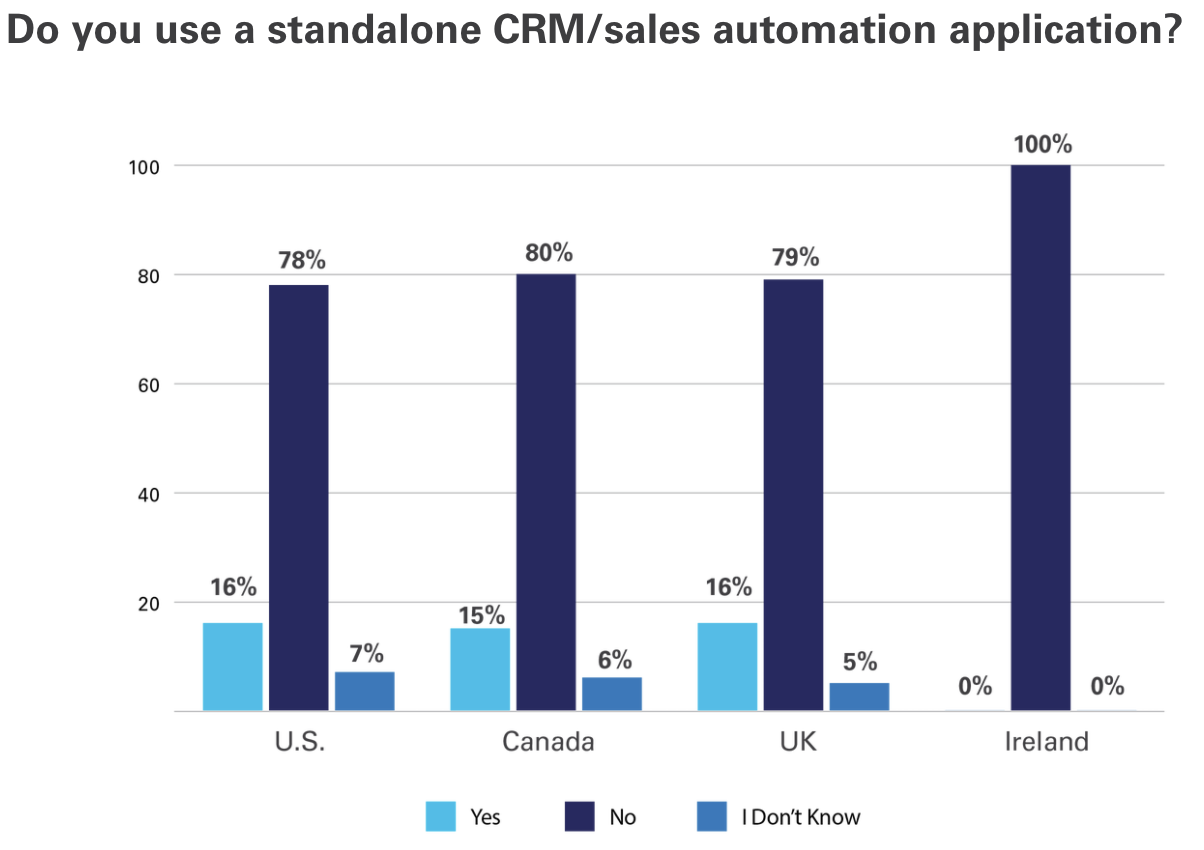

The majority of insurance agencies do not use a CRM system. Similarly, adoption of front-office automation technology remains low. The small percentage of agencies that are early adopters of these technologies tend to be larger in size ($25M+).

Takeaway: It’s time to take advantage of sales and marketing automation tools.

Communicating with customers only when it’s time to renew is bad business. You need to communicate proactively and regularly with helpful insights to keep your brand top of mind and elevate your role as a trusted advisor.

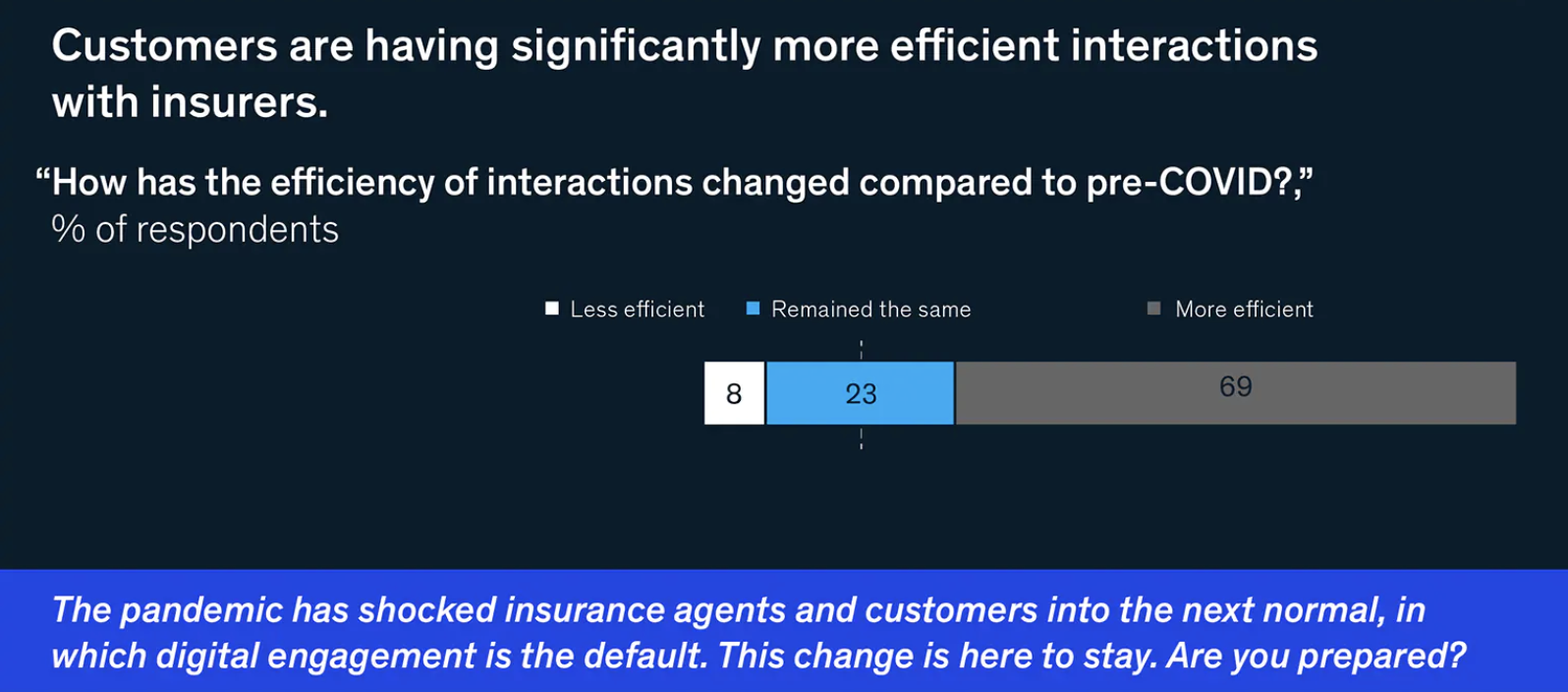

Agencies and insurers must come together for their clients

Independent agents and insurers must stay connected to ensure policyholders get the best advice and service at every stage of the insurance lifecycle. When agencies and insurers are connected via an insurance exchange, both are more efficient and profitable.

The digital platform provides real-time data access to foster high-value experiences across the entire network—for finding markets, submitting business, quoting and servicing clients.

Good news on this front: download services are going strong in the U.S. insurance markets. Claims download is on the rise and U.S. agencies continue to discover the value of having benefits download alongside their P&C business.

But there’s room for improvement: eServicing adoption is only 34%, so U.S. agencies and insurers have a significant opportunity to improve how they manage customer service interactions electronically.

Self-service tools are on the rise

Customers now want to go online to:

- Get policy quotes online

- Initiate policy changes online

- Download policy documents

- Pay their bills

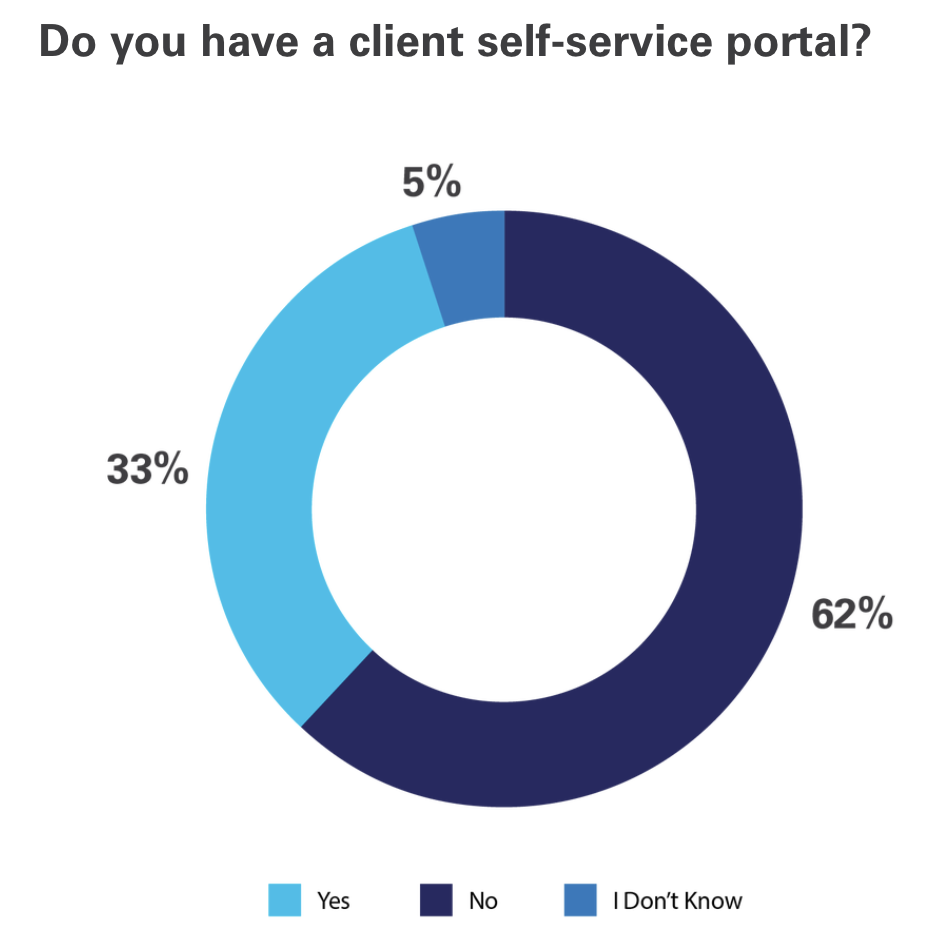

33% of agencies offer self-service portals, which represents a 50% increase year over year. Adoption of client mobile apps also increased 50% last year.

Self-service technology not only affords customers more choices and thereby strengthen relationships, but it also slashes the cost of servicing customers.

Data analytics is catching on (slowly)

Agencies can propel growth by extracting data across the business. Data analytics applications present insights on key performance indicators for an agency’s book of business, employee operations and insurer relationships to drive informed decision-making.

Data-powered agencies are empowered to drive superior employee productivity, identify greater sales opportunities, and focus on the most profitable insurer relationships.

For example, a data analytics platform can present intuitive dashboards that identify clients with a strong probability to respond to cross and upselling.

Global adoption of data analytics software remains low at only 29% of agencies, but is on the rise. Unsurprisingly, larger revenue agencies have the highest adoption rates.

Except where noted, data presented above is sourced from the 2020 Digital Technology Adoption Survey, by Applied Systems.

7 revenue drivers

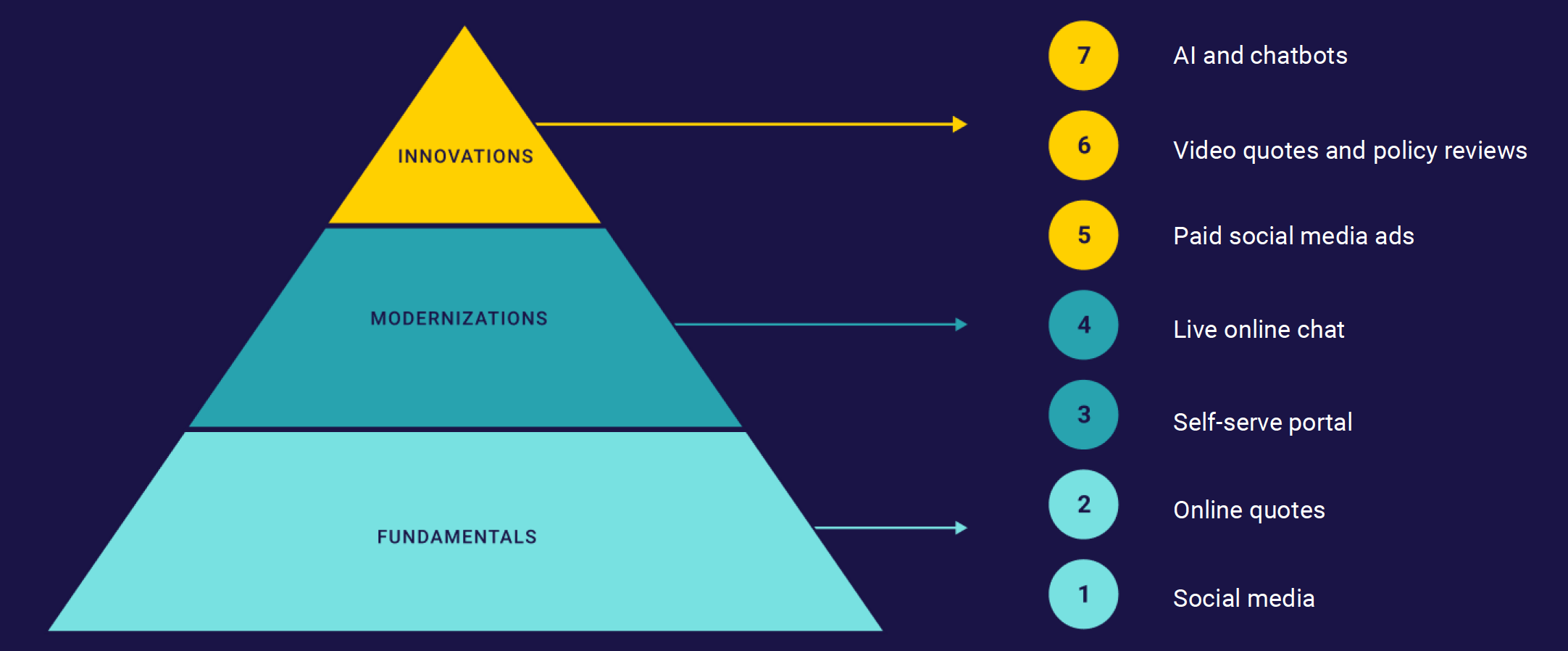

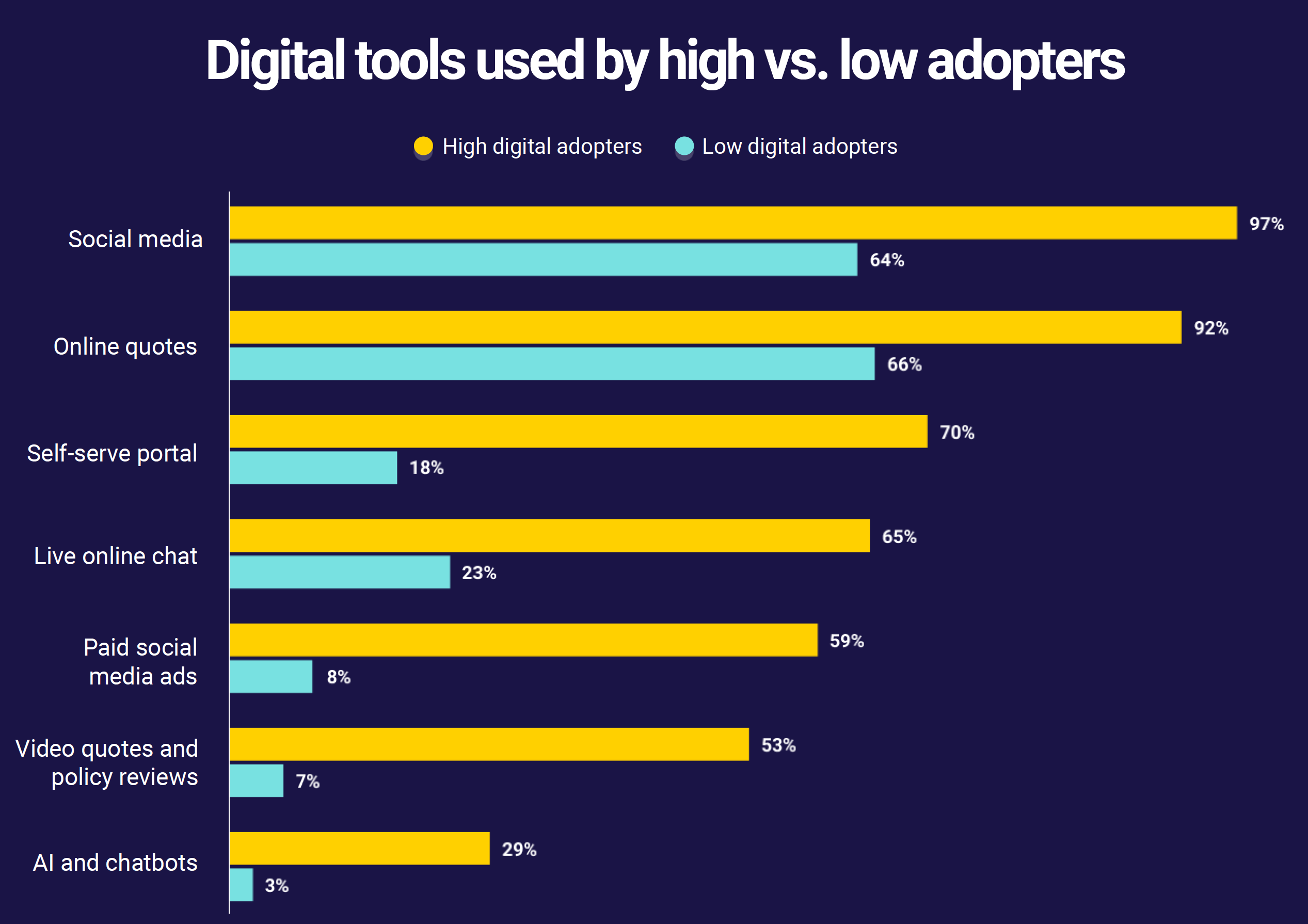

The Rise of the Digital Insurance Agency (cited earlier) claims seven capabilities fueled by digital correlate highly with revenue growth.

These seven capabilities provide a path forward for agencies. As you examine which to invest in, think about where you are in your digital adoption journey. Understand, the tools build on each other, forming a hierarchy of digital capabilities.

Here’s where adoption of the above capabilities now stands amongst both high and low-level digital adopters:

Digital agencies make more

Overall, agencies that completely transform into a digital business experience 158% higher revenue per employees than those that do not.

Source: 2020 Applied Digital Agency Report, Applied Systems

In the throes of intense competition and rising consumer demands, running a traditional brick-and-mortar agency is far less profitable and client-centric than a digital insurance agency. Your chance to survive and thrive depends on strengthening your online presence and enhancing your services in the digital spectrum.

As you transform into a digital agency (even if you maintain a traditional agency as well), you win back time to develop stronger relationships, which will result in generating more revenues year over year.