Providing financial support to members and helping them succeed is the ultimate goal of credit unions. However, members are not always aware of all the services offered by their credit union. At times, they might be looking for some services, such as auto loans, or mortgages, without knowing that they can avail them from their union and with much less hassle.

On the other hand, since credit unions are not-for-profit associations, they might not always promote their offerings directly to members like banks and FinTechs. Hence the information gap.

That is why identifying the needs and cross-selling relevant services becomes essential for the benefit of both parties.

Let me guide you through a step-by-step approach to cross-sell credit union services to qualified members.

A 5-step process to cross-sell relevant services to existing members.

Usually, Consumer Lending Sales Specialists within a credit union are responsible for establishing and strengthening member relationships by providing information about their services. They reach out to members via outbound calls and online channels to identify and act on cross-sales and referral opportunities.

By following a strategic approach, you can make this process more efficient and rewarding. You can also identify opportunities without outbound exploratory calls.

Here are the five crucial steps to cross-sell credit union services to qualified members.

#1 Automate Cross-sell Opportunity Identification

In general, the member service representatives or sales specialists call the members and explore whether they need any loans. This approach may have worked well in the past. But today’s generation wants more convenience.

For instance, you may have not called a member for months to explore if they need anything. Meanwhile, a bank that is tracking activities (on their website) reaches out to the member with a lucrative offer.

This way, you may lose an opportunity.

But how do you know if a member is looking for an auto loan or a home equity loan?

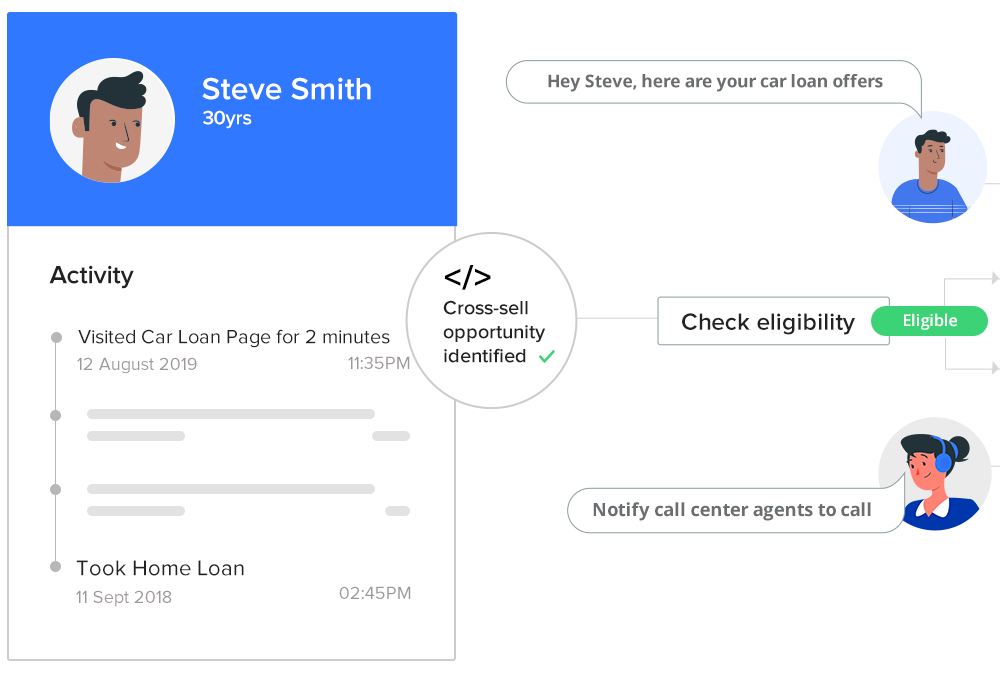

Well, the answer is simple. Organizations across industries use CRM (Customer Relationship Management) software to track lead activities and respond accordingly. You can also use a CRM designed specifically for credit unions to keep a tab on your members.

Let me explain this to you.

If you use CRM software, you can create a record for each member and track their interactions. So, when a member browses your auto loan or credit cards page, you will know that the member is looking for this service. So, instead of calling a member every week/month to explore their needs, identify their needs proactively using a tracking system and call them to explain your services exactly when they need it.

#2 Check eligibility

Even though a member is looking for a service, he/she may not fulfill the loan criteria. For example, for a member to qualify for a mortgage, they must have a good credit score, debt-to-income (DTI) ratio, employment history, and personal assets.

Before committing, check if the member qualifies for the loan.

Most credit unions use their proprietary software or LOS (Loan Origination System) to determine eligibility. However, if you want to control all your sales operations from one place, you can consider a credit union CRM on top of your loan management system.

There is another benefit to using CRM software built for credit unions. Suppose a member has already applied for an auto loan and is applying for a mortgage as well. The CRM system will let you know that the application is from the same member. This way, you can decide whether you want to disburse both loans at a time or want to check their credibility first. You can also use this software to track the member’s repayment history, outstanding loans, and more to make a better decision.

#3 Identify the best time to call

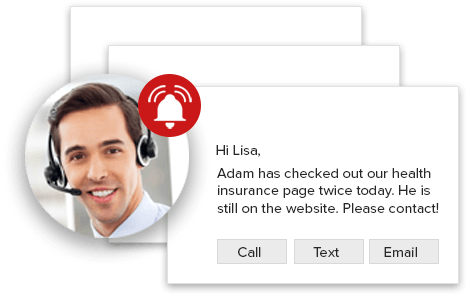

Calling members to explore their needs on a weekly/monthly schedule will just not cut it. It is because credit unions must compete with banks and FinTechs as well for the attention of their members. So, they must offer their services to the members right at the time when they need them.

Study shows that calling the person within 5 minutes of their activity on your website/email/web-form increases the chances of getting answered. Therefore, the best time to call a member is when he is actively looking for the service on your website or has opened a relevant email from you.

In case the member does not respond to the call, send an email or a text message describing the purpose of your phone call and ask for a suitable time to call back.

Now, you can make this step more efficient.

Typically, if the member does not respond to the call, the representative creates a reminder to call/SMS/email the member later. However, with a specialized CRM software, you can automate this task. You can create event-triggers and automated workflows to act on all such cross-selling opportunities.

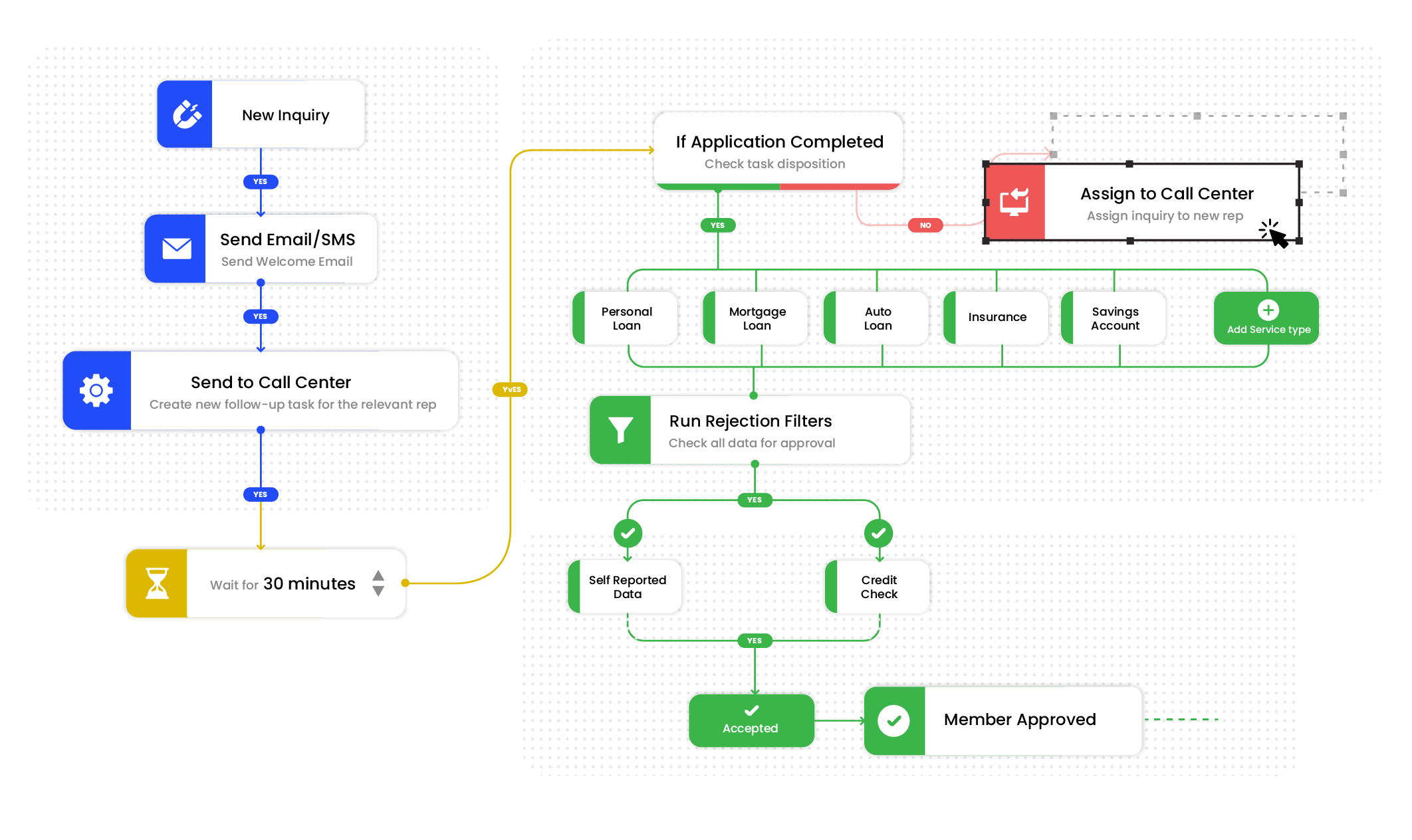

Workflow automation template

For example, if a member shows interest in a personal loan, the automated workflow in the CRM will look like this:

- Notify you when the member visits the personal loan page or uses your loan calculator tool.

- Send an email or SMS to the member about the loan details and application link.

- If the member opens the email, the system will add an activity and inform you about it.

- (Email opened?) If the member does not open the email within a day or two, the CRM system will prompt you to call.

- If the member does not attend the call, the system will send an automated message/email asking for a suitable time for the call.

- And so on.

This is just an example. Based on your policies, you can create your automation workflows in your CRM system. If you choose LeadSquared Credit Union CRM, you can do it without any technical knowledge. Its drag-and-drop workflow builder can help you do so in minutes! Plus, you can integrate your telephony system (for example, RingCentral) and call the member from the portal itself. It will save the hassle of manually dialing the number.

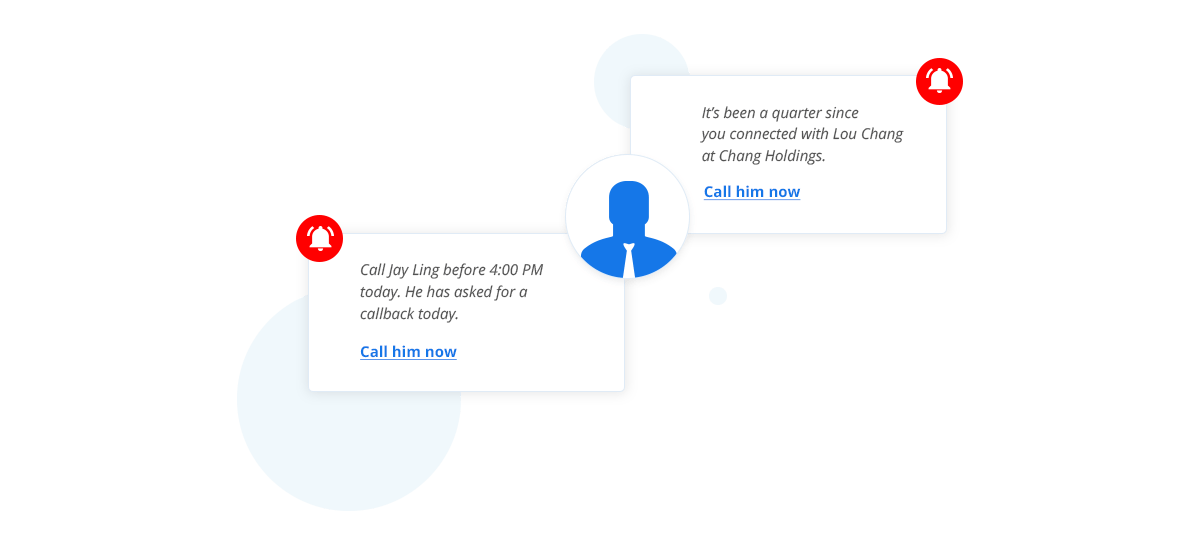

#4 Schedule follow-ups

The above step assumes that the member is actively looking for a service. But there could be cases when the member is only thinking about investment and not yet ready to apply for the loan.

In such cases, do not pressurize the member or bother him with the details. Pushy techniques will never translate to a good member experience. Instead, note the disposition and follow-up with him later.

You can also send the member relevant content (blog articles, eBooks) to help him and remain engaged with him. By being an advisor, you can foster a long-term relationship with members.

#5 Recognize and reward

Members trust that their credit union will always think of the members’ benefits first. Strengthen this bond by recognizing and rewarding the members whenever you can.

For example, you can reward cashbacks on credit cards. Something like Navy Federal rewards its members at least 1 point per dollar or 1.5% cashback on the spend. Other forms of rewards could be a discount on home loan, student loan, or on whatever service the member is looking from you. Rewards are great because they ensure loyalty and engagement with the members.

Bonus – Manage all the member-transactions from one place

Being in a consumer lending or member service department, managing the member transactions is the most crucial step.

For example, a member who has a savings account with your union can be eligible for cross-selling student loan, mortgage, auto loan, home equity loan, and so on.

If the member is interested in an auto loan, you would not want to create and manage separate records for the same member. Instead, you would like to see all the transaction history and opportunities in one place.

You can do this via a specialized CRM software designed with Credit Unions in mind.

It will give you better visibility of the member and potential service opportunities. You can record all the services – completed, on-going, and opportunities along with relevant details such as meeting notes, eligibility, and status in a unified platform.

The bottom line

For credit unions to thrive in this competitive landscape, a strategic approach to member engagement is essential. Remember, an engaged member will bring you more cross-sell and referral opportunities. Therefore, you must streamline your member service process.

If you want to optimize your member-facing operations, consider using the LeadSquared Credit Union CRM. It has helped several financial institutes achieve better process efficiency and overall business growth.