In the modern climate, people demand easy ways to pay for products, services, and anything else they wish to purchase online.

This is why every business that trades on the web must consider how they can improve their payment systems to provide a strong user experience and retain their customers.

A P2P (peer-to-peer) payment app is one of the best options.

In this guide, we will talk you through how to build a P2P payment app. We’ll also discuss the challenges you may face and the overall benefits for you and your customer base.

What is a P2P payment app?

A P2P payment app allows users to send and receive money electronically using a mobile or compatible device without third-party interference. This is usually achieved by connecting a more traditional payment method to the app, such as a credit card or bank account. However, many P2P payment apps also handle crypto payments.

Once connected to your bank account or credit card, payments can be sent from one account to another. This can be a direct charge to your bank or credit card, or you can add money to your account to be used freely.

Please note, if you’re accepting crypto payments, make sure you have a secure wallet that will allow the safe storage and transfer of crypto funds.

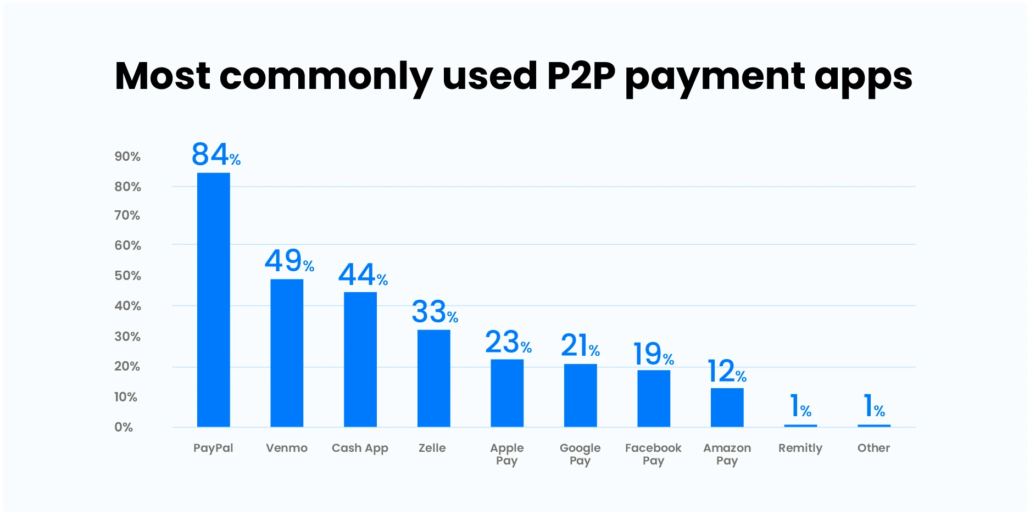

Examples of P2P payment apps include:

- Paypal

- Venmo

- CashApp

- Google Wallet

- Zelle

- Snapcash

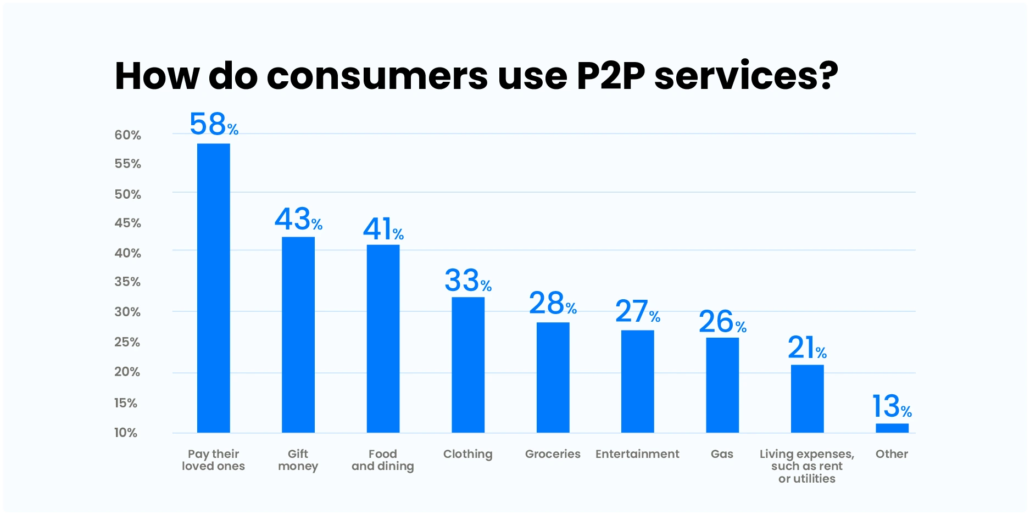

After setting up your account and connecting a payment method, you can make purchases on e-commerce stores and online marketplaces. Easy payments can be sent using a phone number (text messages), email address, or the other person’s account details.

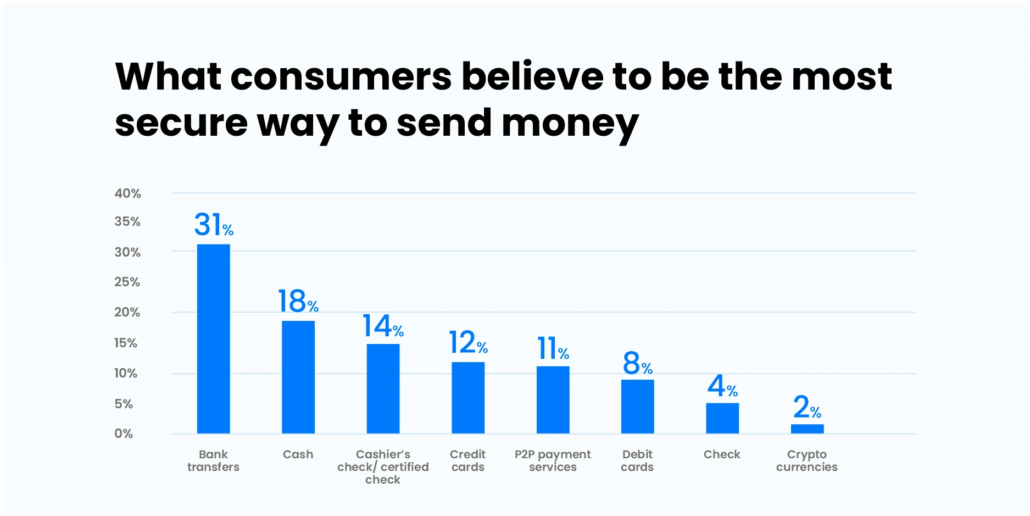

But is P2P payment method secure?

Yes, it is. Thanks to verification systems that require a strong password and additional information to access an account. Systems are also in place to identify unusual behavior, such as payments being made in a foreign country or being sent to an account flagged for suspicious activity.

Depending on the payment type, it can be processed in just several minutes or a few hours. You can also avoid transfer/commission charges usually linked to bank transactions. However, small charges may be incurred depending on the source of funds that are being added to the account.

What are the key benefits of a P2P payment app?

P2P payment apps have benefits for both businesses and individuals.

Benefits for individual users:

- Completely cashless

- Your money can be managed within the app, and all transactions tracked.

- P2P payment apps are global, meaning you can make purchases anywhere in the world at no extra cost.

- Most apps support various currencies with automatic conversion.

- The absence of third parties means lower or no transaction fees.

- More options to pay and receive money. Save your credit card to the app, send with an email address, or use a phone number for sending and receiving payments via SMS text messaging.

Benefits for businesses:

- Peer-to-peer payment apps can expand your customer base, and target audience as purchases can be facilitated from anywhere in the world.

- Apps can be monetized to earn additional income.

- No need to use third-party services, which come at a cost.

- Payments can be received to your account almost instantaneously.

- Additional and secure payment methods help to build trust amongst your customers, building your reputation as a trustworthy business.

Can P2P payment apps make life easier for businesses?

Yes, P2P payment apps can indeed make life easier for businesses, helping to streamline the accounting process. Being able to download all your transactions for a specific month can save a significant amount of time compared to sorting through receipts or analyzing bank accounts.

More advanced apps can also provide analytics that give you an overview of your business, highlighting trends and insight into how your customers choose to pay. This analytical overview could also be combined with downloadable marketing reports, which can be shared across the business.

According to a recent study, 60% of surveyed business owners reported that they did not feel knowledgeable about finance or accounting. P2P payment apps with the functionality to export invoices and transaction history can go a long way in improving business owner’s confidence when it comes to basic accounting tasks such as these.

Features to include in your P2P payment app

Your custom P2P payment app should include the following features if you want to deliver a top-notch customer experience:

- Digital wallet – With a digital wallet, users can transfer and store money on the app, meaning they don’t have to make numerous transactions each time they wish to purchase something. Digital wallets usually use tokenization services provided by Visa, Mastercard, and other finance systems for seamless digital transactions.

- Request and send payments – Users should be able to send and request money whenever they need to.

- Invoicing options – Your users should be able to generate invoices that can be downloaded for their records or sent to a customer.

- Advanced security features – Your P2P payment app should be equipped with advanced security features, such as multi-factor authentication, unique one-time passwords, a fingerprint locking system, and data encryption to ensure only the user has access to their money and any fraud is prevented.

- Currency conversion – Automatic conversion functionality will allow for easy cross-border transactions.

- Notifications – Push notifications will inform users when they have received money or when money has left their wallet/account.

- Bank transfers – Users should be able to withdraw money from their digital wallets to their bank accounts.

- Accept cryptocurrency – Most successful, modernized apps enable cryptocurrency payments.

- Access to transaction history – As well as invoices, users should be able to browse their transaction history so it can be printed if needed. This transaction history could also be used to generate downloadable statements.

- Different support options – As well as email and phone support, your app should also feature a live chatbot that uses AI to provide help and support anytime.

How to build a P2P payment app

Now that we have covered what a P2P payment system is, how it works, its benefits, and what features it should have, we can move on to the app-building process. We will start from the research stage and go all the way through to testing.

Phase one – research and development

When developing a software project, conducting as much research as possible is important to ensure you are staying ahead of the competition and giving the user exactly what they need.

Deciding on the right type of app

When choosing which type of app to build, you have four main options. These are:

- A stand-alone service – This option is completely independent and is often supported by Visa or Mastercard. A stand-alone service is perfect if you aim to create a business by selling the app.

- A bank-based service – As you might guess, a bank-based service relies on banks to handle transactions. As a seller, you may need a point-of-sale terminal to accept payments.

- An app for a social media platform – Social media and messenger platforms are now adopting their own built-in payment systems, allowing users to send and receive money from their friends. This option is obviously only viable if you are also developing a social media or messenger network.

- An app for a mobile operating system (OS) – This is a service that is built into a mobile operating system (OS), such as Android or Apple iOS.

Choose your app’s features

Earlier in the article, we outlined ten features prevalent across P2P payment apps. However, for the app you intend to build, you may decide that not all of them are required, or you may wish to develop some features that are unique to your app.

In this stage, you need to determine the features your payment app must have if it is to function effectively and provide a great user experience.

Select the right technology

Features are important, but so too is the technology you plan to build your app on. Technology that you should consider for your app includes:

- Near-field communication (NFC)

- Biometrics ID systems

- Real-time payments (RTP)

- Blockchain (cryptocurrency)

- Artificial intelligence (AI)

- Unified platforms

You need to look into what technologies are trending at the moment and what value they offer. For example, integrating blockchain technology offers fantastic security and transparency that attracts certain types of users and future-proofs your app.

Phase two – compliance and security

A P2P payment app cannot be successful if it does not comply with regulations and offer the necessary security. Without reassurance that their money is safe, users will not feel comfortable using your service.

Set up strong security features

Any data contained within your system must be protected, including all transactions, bank transfers, and user history. Cybercriminals will target any system that gives them access to financial information, and payment apps are no exception.

A single data breach can tarnish the reputation of your business and potentially leave customers out of pocket. You can help to protect your app with security features, such as:

- Multi-factor authentication

- Biometric locking systems

- Location and device detection

- Crontosign support

- Secure storage systems

Comply with regulations

Regulatory compliance is equally as important as security, which can vary state by state in the US. Regulations are still being improved and amended to catch up to evolving technologies, so keeping a constant eye on things is recommended to ensure your systems do not become outdated.

Phase three – design and development

So you’ve decided on what type of app you need, what features it will have, and the technology it will integrate. You’re fully aware of regulations and know what security systems you plan to use to protect against cybercrime. Now it is time to design and build your P2P payment app.

Create a design that works

The design can be just as important as the functionality of your app if you want people to use it regularly. Many apps of this kind have a sleek and simple look, with a strong focus on creating an easy user experience that doesn’t require too many clicks to complete an action.

A great design is also important for branding and promoting your app, with a striking design sticking in people’s memories. The design goes beyond just colors and typography; the overall layout and navigation must also be cutting edge. To get this right, you may want to try A/B testing to see how users engage with different interfaces.

Choose your software engineers

All of the above considerations are completely redundant if you fail to choose a software development team that can deliver it. When choosing your development team, there are a lot of factors to consider, and it is important to establish their experience, level of expertise, and track record when it comes to delivering similar projects.

When choosing your perfect software development team, you should consider:

- Experience and specialization – If you plan to build an app that uses blockchain technology and specific security systems, you should look for a software development team specializing in that technology.

- Track record – Has your potential development team successfully completed similar projects in the past that are currently in use? If not, you should probably remove them from your shortlist and focus on software engineers with a proven track record in delivering bespoke payment apps.

- Reviews and portfolio – One of the best ways of determining whether a software team is good at what they do is by reading customer reviews. If a company has a lot of positive reviews on legitimate websites such as Trustpilot, then it is a good sign that they know what they are doing. If a customer has taken the time to write a review, it shows they are very happy with the service and final product. Finally, if you need one final push, you can also look at the company’s online portfolio or request access to it to check whether their style matches yours.

Phase four – testing

Once completed, your app will need to undergo rigorous testing to ensure it is bug-free and completely fit for purpose before your customers have access to it. If your P2P payment app isn’t fully firing by the time it is launched and users are met with a negative experience, you may risk them choosing not to use your app in the future. Even worse, you may lose their business altogether.

Monetizing your peer-to-peer payment app

In this section, we will briefly examine how some of the top P2P Payment apps have monetized themselves.

- Paypal – Paypal has monetized itself by charging transaction fees for some transfer types and offering a $30-a-month business account that provides additional features.

- Venmo – Venmo charges a 3% fee for credit card transactions and an additional charge for cash withdrawals. The company also recently launched its own debit card.

- CashApp – CashApp charges both businesses and individual users to use its services.

Conclusion

Peer-to-peer (P2P) payment apps can be designed by businesses to make the payment process easier for their customers. Users can simply connect a credit card or bank account to the app, add money to their digital wallet, and make instantaneous transactions to complete purchases.

Many new apps accept cryptocurrency and provide automatic currency conversion functionality, amongst other features. Strong security measures are also put in place thanks to multi-factor authentication, location detection, biometric locking systems, and more.

When building this type of app, you should work with an experienced software engineering team with a great track record in working on such projects. A good way of checking whether a software developer has the relevant expertise is by searching for online reviews and assessing their portfolios.