When it comes to insurance marketing, there’s a lot of room for automation to take over and make it easier for carriers to engage with their customers and prospects more effectively. Automation, generally speaking, refers to specialized software that “automate” tasks which used to be done manually.

Did you know that according to a study carried out by Accenture, the amount of customers who think that “most insurance carriers are the same in terms of their products and services” has jumped up by 50% in the last year? This is worrying for insurance providers, with only 16% of the respondents in the survey saying that they would happily do business with their insurer once again. If insurance carriers want to stand out from their competitors and win back some trust from their customers, they need to look into new and innovative ways of doing things.

Not only do insurers need to find ways of contacting consumers with products and offers which are relevant and helpful for them, but they also need to figure out how to nurture these leads further down the sales funnel without using up a disproportionate amount of human labor in order to do so. Furthermore, they face the challenge of acquiring relevant customer data in the first place, and it’s becoming more important than other to consolidate teams into one unified sales and marketing team who are all working toward the same goals.

So, where do we go from here?

Introducing Insurance Marketing Automation

By leveraging insurance marketing automation, insurers can begin to win back the trust and loyalty of modern digital buyers who expect a certain level of convenience and flexibility that insurers have yet to provide when compared to other industries such as retail and restaurants. Below, we highlight some of the ways that insurers can use marketing automation to their advantage.

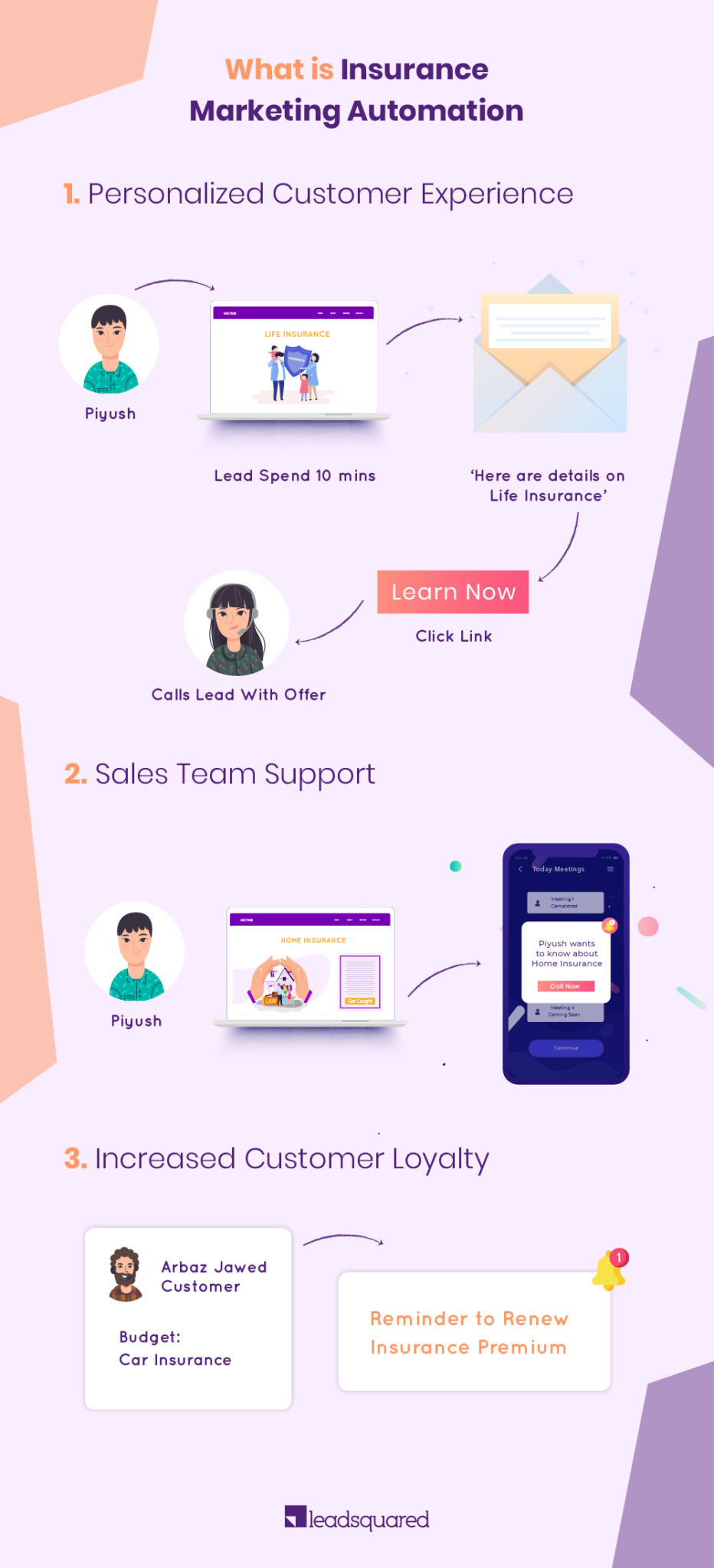

Personalized customer experiences

Did you know that 52% of customers are happy to switch brands if a company refuses to personalize its customer experiences? If you’re not customizing your customers’ experiences, then you’re only going to lose to a competitor who does. You see, with marketing automation, you can reach masses of customers with personalized messages which reflect user behavior and desires.

For instance, with insurance marketing automation, you can set up certain triggers which send personalized emails to customers. For instance, if a customer has been browsing your life insurance page repeatedly without making the purchase, perhaps you could send them a personalized offer for a small discount on the insurance.

On the other hand, you might have customers who have rarely visited your website in a long time, even though you may have insurance products which could benefit them. In this case, you could send them a sort-of “reminder email” to get your brand in front of them once again. Perhaps, you could offer them some customized deals and offers to try and tempt them back to your website.

You can also use customized lead capture forms for this purpose, as well as progressive profiling tools which allow you to select which form fields will appear when a lead is filling out a form, tailoring the form to things which are important to them. You can even create dynamic content, allowing you to engage customers with marketing materials which are fun, engaging, and encourage them to convert.

Sales Team Support

As mentioned earlier, it’s no longer viable for insurance marketing and sales teams to work separately – consolidation is crucial if you are to flourish in today’s market. With this in mind, insurance marketing automation goes far beyond the duties of the marketing team alone. For example, with insurance marketing automation platforms, your sales teams can access records which highlights a customer’s engagement with website pages, emails, and other similar marketing materials, allowing the salespeople to build up a detailed image of the customer’s interests on their end.

This synergy can go even further, with marketing automation services enabling sales staff to receive alerts in real-time when prospective customers are engaging with marketing materials. This way, they can swoop in and strike when the iron is hot, offering the interested lead products which are too good to resist. They could do this by directly calling them, sending them email templates approved by the marketing team, or by creating a new personalized nurture journey with them.

[Also read: 6 Insurance marketing hacks]

Increased customer loyalty

Did you know that only 29% of insurance customers are happy with the service they receive from their carrier? The remaining unhappy 71% make up a $470 billion slice of the insurance pie, meaning that there’s a lot of customers on the market who aren’t afraid of switching. So, once you’ve acquired these customers, how do you increase their loyalty and make them want to stay with you?

Using insurance marketing automation tools as part of the process, insurers could create new retention campaigns or onboarding programs which are designed to acquire and retain customers. For instance, if a lead signs up for a home insurance quote, you may want to nurture them with offers and information about protecting their home, providing them with valuable advice which can help them to stay safe and keep their premiums down by safeguarding their home effectively. Over time, they will come to appreciate the surplus information you are giving them which makes their life easier in the long run.