A Leading Insurance Firm increases Process Efficiency by 75%

10x your sales productivity with LeadSquared.

Book your 1-1 consultation today!

Book your 1-1 consultation today!

INCREASE IN PROCESS EFFICIENCY

CUSTOMER VIEW

TAT FOR QUOTATION GENERATION

AT SCALE

INCREASE IN PROCESS EFFICIENCY

CUSTOMER VIEW

TAT FOR QUOTATION GENERATION

AT SCALE

The insurance firm with a proven track record over the last 15 years, offers outstanding investment expertise. The company provides comprehensive protection & long- term savings, through its high-quality multi-channel distribution including agency & third distribution partners.

The company’s vision is ‘To become an esteemed life insurance provider by safeguarding the financial well-being of their clients’. The company has a good customer-centric approach focused on advice-based sales and quality service.

Insurance customers vary in their requirements of policies. Different plans aim at providing different benefits to customers. A huge amount of insurance business is still transacted using manual processes that are inefficient, costly, and prone to error. Policies are produced manually and any adjustments or endorsements to policies require manual intervention and simply add to the costs.

Quotation generation becomes accurate and simplified with automation in case of complex processes, especially group/commercial business quotation cycle, with high premium amounts. Further, automation strengthens sales while offering enhanced cross-sell capabilities.

The insurance firm required a system to issue and manage group insurance products for its B2B market. The system had to manage request capturing, criteria based distribution, quotation generation dependent upon policy type. In addition, the system needed to manage subsequent renewals including paperless document management.

Few challenges faced by the business were:

LeadSquared enabled the firm to leverage their existing systems and streamline the entire process – increasing quote generation capacity & process efficiency while delivering an optimal experience for all users.

“Having already migrated our B2B sales team and lead management to LeadSquared, platform capabilities were never in doubt. With the strong workflow and automation editors, we were able to simply transplant ideas and flowcharts from paper to browser in record time. The digitally-enabled Actuarial team now collaborates more effectively with Sales Managers, and is able to efficiently manage its own transaction volume, audits and internal reporting.”

Some of the key solution highlights provided by LeadSquared are:

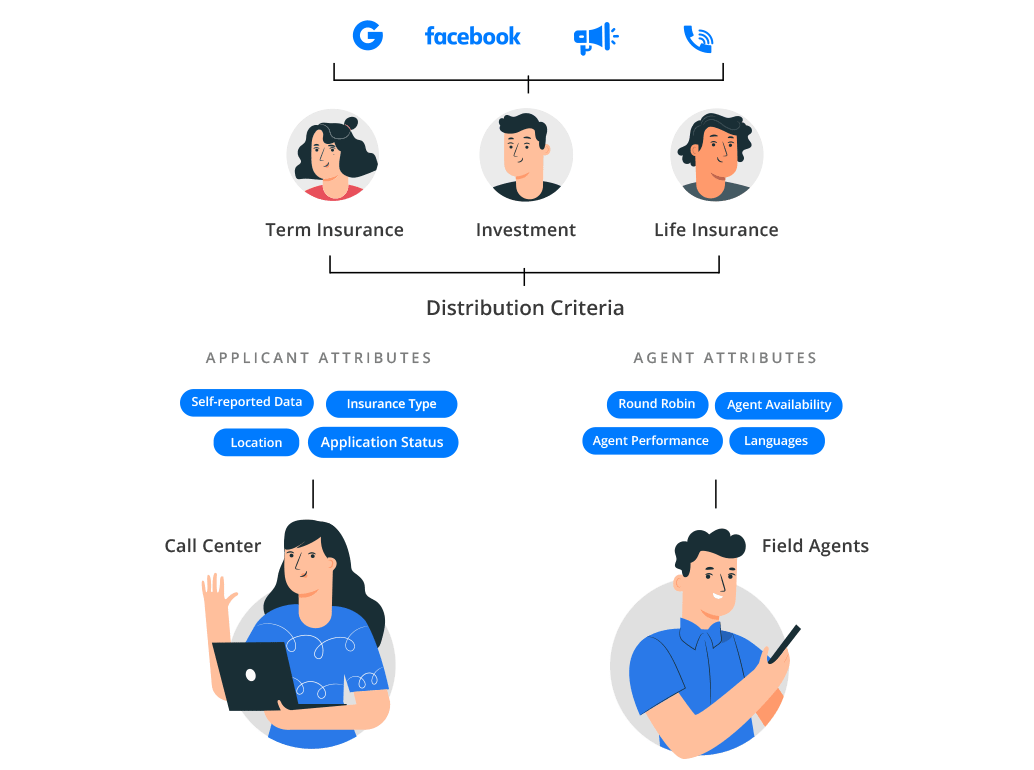

The solution supports capturing leads from online & offline channels. It also allows capturing policy inquiries from your website, social channels, PPC campaigns, phone calls, and even traditional on-the-ground campaigns, like cross-promotional events.

LeadSquared helps them in acquiring leads that directly land on the website or are added by the sales rep. The broker leads can also be captured through the system.

LeadSquared distributes the captured leads among the salespeople – based on different criteria of your choosing – including agent availability, past performance, insurance product specialty, location, simply in a round-robin fashion, or any other criteria important to you.

The direct or broker leads captured by LeadSquared are automatically distributed among the salespeople. The sales rep can then follow up with a single point of contact in each organization for lead conversion.

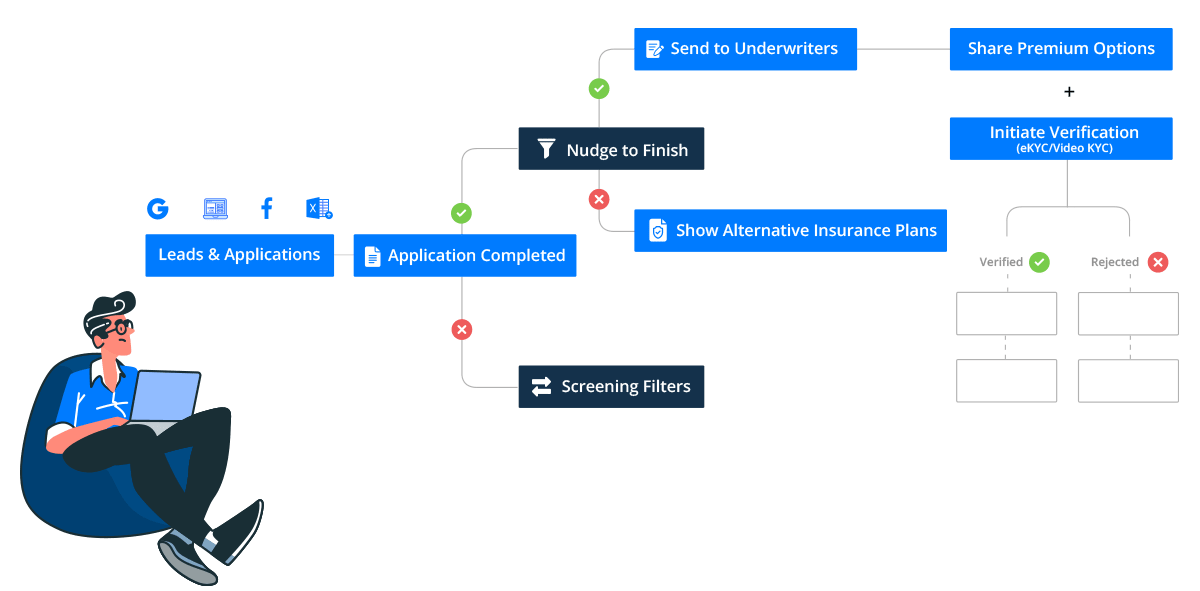

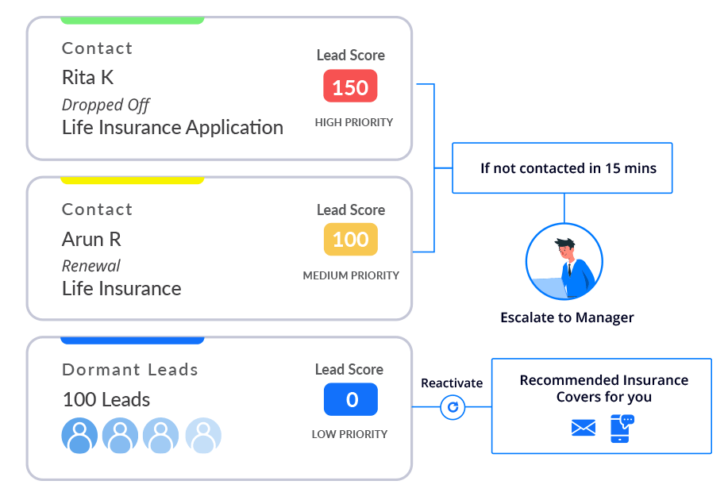

LeadSquared provides intelligent sales automations for unique processes. One can easily create fast and consistent sales processes by automating all back-end and low-value tasks.

The firm uses LeadSquared to let account owners post an activity requesting for a quotation where details can be filled along with IRF attachment. These details consist of drop-down menus to fill in fields like scheme type and business type. After posting an activity, the lead is further shared with the assigner team for further follow-ups. Each of these leads has a unique ID number generated through automation.

The workflow includes all the quotation data. This reduces the manual effort of data entry, accelerating the quotation generation process.

LeadSquared helps in creating simple and easy to use workflows to reduce chaos. The increased process efficiency results in the higher productivity of the sales staff and streamlined sales processes.

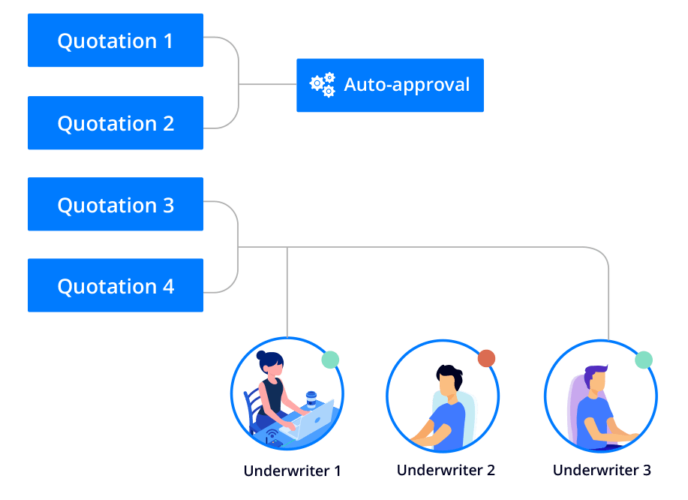

The solution identifies quotations that require the underwriter’s assistance for case evaluation and approvals. It automatically assigns such cases to the approver based on his approval limits and authorities.

A lead goes through various stages in a sales process before it gets qualified as sales-ready. The Lead Stage helps you quickly sort and identify your qualified leads and the ones that require a follow-up. LeadSquared supports customizable lead stages as per your business.

The stages change based on different dispositions such as:

LeadSquared helped the insurance firm solve a lot of the inefficiencies and time delays produced with historic manual systems and ensure that decisions are confined within certain rules. It leveraged their existing systems and streamlined the entire process – increasing quote generation capacity while delivering an optimal experience for all users.

“LeadSquared has time and again proven its expertise in solutions and enabling products with scalability and superior user experience. We had a requirement of a complex workflow for easing up the life of our sales and pricing team and LeadSquared came as a rescue. The entire automation was built so quickly and the LeadSquared team understood the requirements so well that they suggested many improvements in our design. With a forte in building solutions with extreme optimal resources, the team members are completely reliable. I would definitely like to work with the team again.”

The team now has a 360-degree customer view that provides instant access to all the requisite customer information. They have been able to reduce the quotation generation turn-around time by multi-folds.

With the introduction of LeadSquared and continuous optimization of the product, they have experienced a net increase of 75% in terms of process efficiency. They are working to improve the product further by bringing other parameters as well.

(+1) 732-385-3546 (US)

080-46971075 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)

Tricoci University Increases Student Enrollments with LeadSquared

Tricoci University Increases Student Enrollments with LeadSquared