As the notion goes, insurance is a push product. It has always been a complicated sector, and selling insurance products has been an even bigger hassle.

The result- Insurance companies started selling their products through intermediaries. These middlemen, also known as agents or brokers, work on sales commission and introduce the common public to the world of insurance. They are responsible for making people aware of the need and importance of buying an insurance policy.

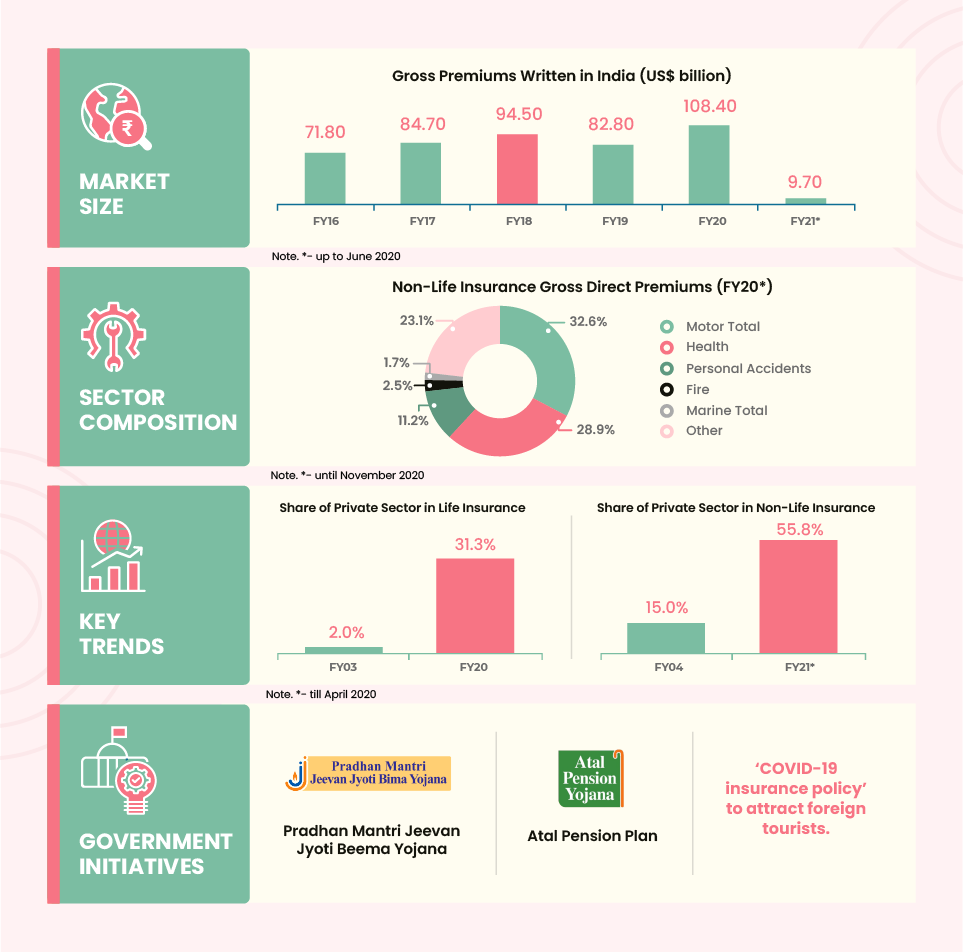

However, the pandemic changed the dynamics of this industry. Where COVID-19 came with uncertainty, life insurers believe that it bolstered the demand for insurance products. From life, health, and protection to guaranteed return segments, all gained severe traction during the pandemic.

Hence, from being a push product, insurance is now on its way to become a pull product. And the primary reason behind this shift is insurance companies making a pivot towards the digital channel. With no field movement and complete lockdown, insurers made a swift change in their distribution strategy. Without any involvement of agents or brokers, they started to sell insurance using direct distribution to consumers. This not only bolstered their sales but also helped them survive the pandemic.

This article talks about the direct distribution channel in insurance, maximizing policy sales through this channel, and its benefits.

What is Direct Distribution in Insurance?

Direct distribution channel or self-directed channel refers to an insurer selling an insurance product directly to a consumer without an intermediary. Hence, they need not shell out commissions to the middlemen. Website, social media, online channels, and kiosks are examples of direct distribution channels in insurance.

Changing customer behaviour:

Recently, consumer behavior has changed due to the rapid adoption of smartphones. It is expected to double from 468 million in 2017 to 859 million by 2022. 65% of India’s population is below 30 years. Also, internet data in India is the most affordable in the world (at USD 0.26 per gigabyte). These are the reasons behind the vast internet user base of around 357 million in 2017, which is going to increase to almost 840 million by 2022.

The 2017 Global Distribution and Marketing Consumer Study reveals that nearly 51% of digitally active consumers (39% of all Insurance consumers) have purchased insurance through an online channel. The direct insurance distribution channel encourages self-service and independent decision-making.

With the evolution of technology, consumers have changed the way they research, compare and buy products. With digital leading the way, insurers need to strategize their business model. Steps that will help boost their direct sales are:

- Informative websites

- Self-service models

- Chatbots to interact with the customers

- More straightforward and easy to understand insurance products

- Appropriate messaging across channels

- Customer-centric business model and value propositions

Ways to Maximize Insurance Policy Sales through Direct Distribution Channels

In today’s world, customer expectations have changed drastically. Customers seek convenience and speed. And to meet these expectations, insurers need to leverage technology that provides meaningful insights.

LeadSquared Insurance CRM empowers insurers to increase policy sales via the digital channel. The features useful for the insurance companies are:

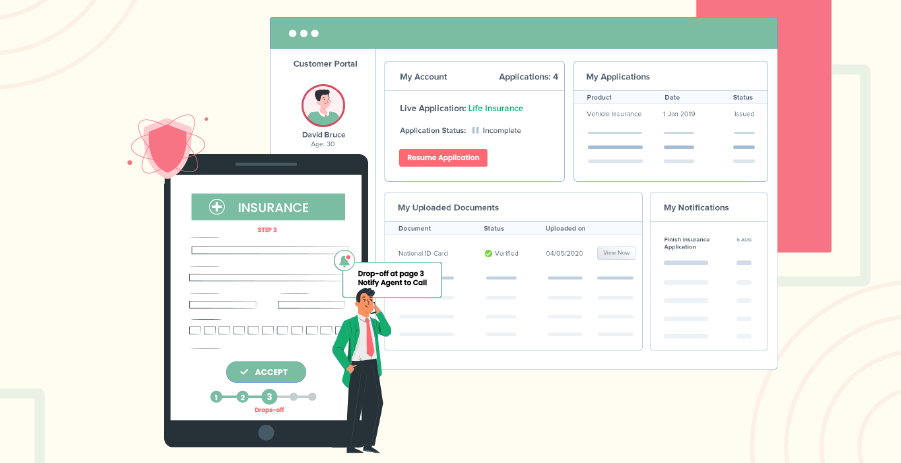

1. Ensure Smooth Application Experience with Self-serve Portals

What do you think is a significant differentiator between insurance companies?

It is customer experience (CX). According to Gartner research, 81% of companies expect CX to be the key battleground in the race for market dominance.

Insurers who have always been more product-centric than being customer-centric are rethinking their approach to business.. The first step towards this could be building a self-service portal.

The benefits of a self-serve portal are:

- Makes the application process paperless and allows you to increase applications from all sources

- Helps the insurer deliver services in a more accessible and convenient way

- Lets policy-holders sign-up for insurance policies safely, make payments, paying no heed to cybersecurity risks

- Allows applicants to see their progress, track application status, and pick up from where they left off

- Improves customer experience via personalization such as customized toolbars

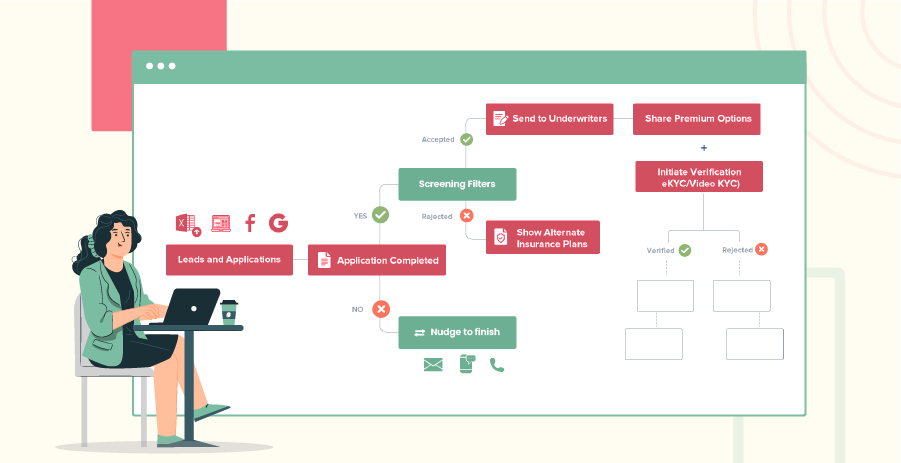

2. Reduce TAT with Automatic Lead Capturing and Distribution

As the industry moves towards digital, the primary concern for any insurance company is the turnaround time (TAT). This is largely due to inefficient and manual insurance processes.

This issue can be resolved to a great extent using automation in initial processes like lead capturing and distribution. It will help insurers:

- Get rid of cumbersome and time-consuming manual processes

- Reduce lead leakage and capture leads automatically from all online and offline sources

- Automatically distribute leads to call center reps based on factors such as product type, location, agent availability, language preferred, and more

- Reduce turnaround time by assigning the lead to the right call center agent within seconds

3. Provide Personalized Experience with Chatbots

As mentioned before, customer experience is the prime differentiator between multiple insurance companies. Moreover, with COVID-19 forcing people to be at home, insurers have to find a way to interact with their customers remotely.

One way to drive this communication is by using Chatbots. A chatbot is a software application used to conduct an online chat conversation via text or text-to-speech instead of direct contact with a live human agent.

Chatbots have proven to be beneficial in the insurance industry as they:

- Assist the customer every step of the way while he completes his insurance application

- Provide personalized suggestions to lower the quote and guide the customer from start to finish

- Improve user experience while reducing operational costs

- Manage insurance claims for customers quickly and efficiently while serving as a listening channel that provides actionable insights

According to a Juniper Study, the use of conversational AI chatbots for insurance will lead to cost savings of almost $1.3 billion by 2023 across motor, life, property, and health insurance, up from $300 million in 2019.

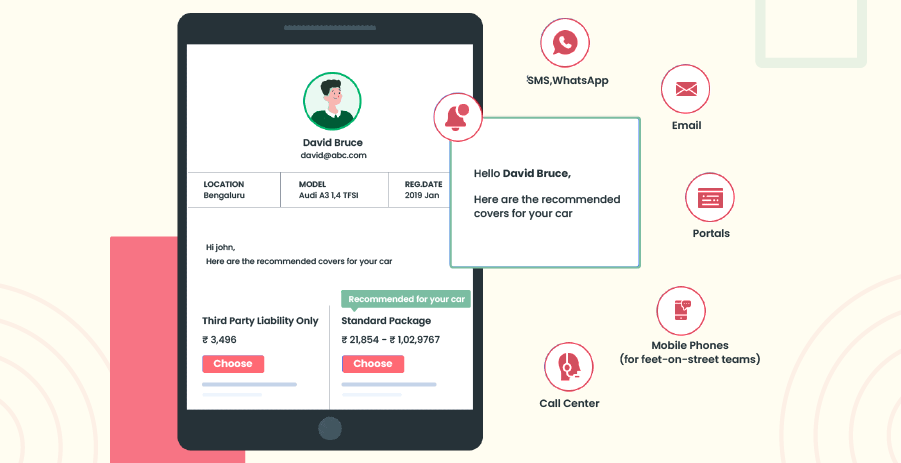

4. Improve Customer Engagement with Marketing Automation

Marketers spend a considerable amount of money running ads on various channels to sell insurance products. But without knowing the audience and the right time to engage; every effort goes in vain.

Automating the marketing processes reduces the time teams spend on redundant and low-value tasks and eventually improves customer engagement.

The various benefits of using marketing automation are:

- Reduce response time and enhance prospect experience by nurturing relationships throughout the journey

- Engage the leads promptly with relevant content at the right time

- Design prospect journey workflows, automate communication across channels and notify sales teams accordingly

- Provide complete reports about campaigns, sources, and automation

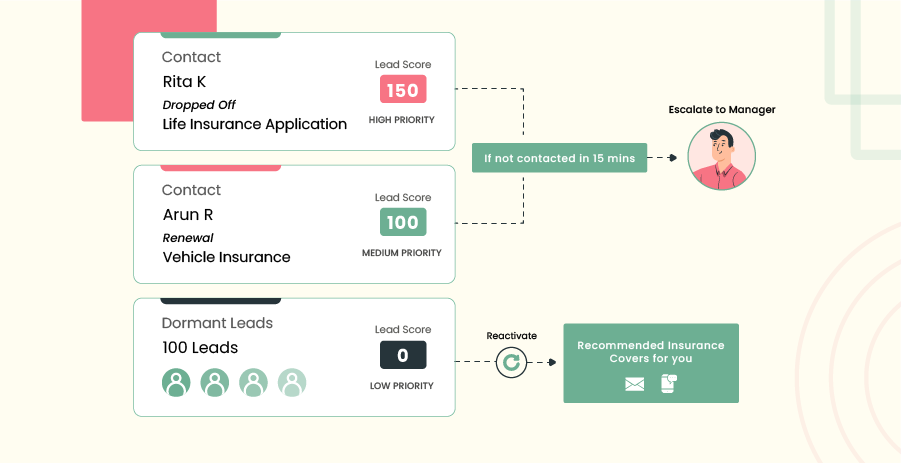

5. Reduce Response Time with Lead Prioritization

An insurer receives hundreds of applications to work on every day. With several activities to perform, an insurance rep might not give sufficient time to each lead. Hence, he might lose a potential client.

Prioritizing leads separates the quality leads from the junk ones so that the rep can reach out to those most likely to buy first.

Lead prioritization can be beneficial in ways such as:

- Lead scoring makes the follow-up better and ensures fewer lost opportunities

- Prioritizing leads that are most likely to win improves the conversion rate

- Enhances productivity by focusing the efforts of sales reps on the right prospect

- Spending less time on processes and making more money automatically increases the ROI

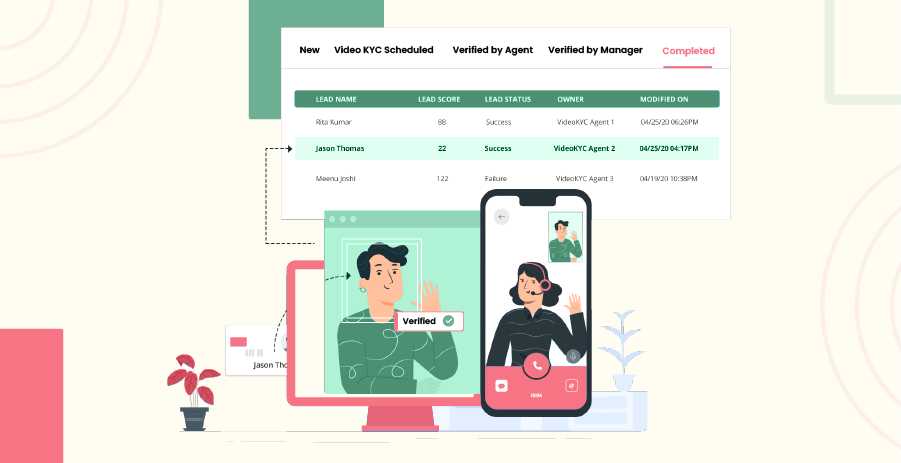

6. Onboard Customers Faster with Video KYC

Documentation is an essential step in Insurance. While on-field agents did most document collection, insurance companies struggled to digitize this process during COVID-19.

To address the problem, the Reserve Bank of India (RBI) allowed a video-based know-your-customer (KYC) identification process that provides an additional customer onboarding method. This can be done by capturing a live photo of the customer and submitting documents like Aadhaar, PAN card, etc.

Video KYC can help insurers make their direct distribution seamless in the following ways.

- Faster verification without the need for physical document collection

- Live face detection using a robust face recognition algorithm

- Automatic distribution to verification and onboarding teams

- Completely connected customer acquisition process right from application to verification, onboarding, and closure

- Faster verification process and reduced onboarding costs

7. Ensure Productivity with Real-time Reports and Analytics

Once the automation processes have been set, the insurer must track the productivity and efficiency of the team while also keeping a check on the revenue generated by the marketing campaigns.

Real-time reports and analytics help in performance management and forecast sales for improved revenue visibility.

- Detailed sales report depicting revenue generated based on product, regions, and more

- Insurance rep performance reports with new business and renewal generated by each individual

- Marketing reports to identify best and worst conversion campaigns

- Lead source and attribution report to check the number and quality of leads from every source

- Sales funnel information to check sales closed, pipelines forecasted, and revenue committed for a time frame

8. Increase Customer Lifetime Value & Retention with Upsell/Cross-sell Identification

Upsell and cross-sell are the two fundamental processes for any insurance company. It helps sell more to the existing client by either upgrading his policy or adding a policy with the one previously bought. It benefits both the insurer and the customer.

But an insurance rep must be reminded of the right time to upsell or cross-sell. Automation helps here by:

- Identifying the upsell and cross-sell opportunity and notifying the sales rep to take necessary action

- Improving customer retention rate by engaging with the customer at the right time

- Sending automated messages to the customer if any opportunity is identified

Direct Insurance: The Opportunity

Short-term health insurance, long-term health insurance, whole & term life insurance all saw a surge of anywhere between 20-40% CAGR during the previous pandemics of SARS & MERS.

This is not the first time the world has seen a virus overturning lives and businesses across the globe.

The question is, how ready is your business to bolster operational load implications concerning increased levels of customer inquiries and subsequent support and counsel they may require?

COVID-19 disrupted various livelihoods, but it also posed an opportunity for insurers to pivot their businesses to digital and still shine through the crisis.

Find out how the LeadSquared Insurance CRM can help you drive more policy sales through direct distribution channels while decreasing your operational costs.

FAQs

Direct distribution channel or self-directed channel refers to an insurer selling an insurance product directly to a consumer without an intermediary. Hence, no commissions need to be shelled out for the middlemen. Insurers generally use CRM software to streamline their direct sales process.

Distribution channel in insurance refers to the process of delivering insurance products to their target audience. The distribution channels may vary from direct to intermediary.

Insurance is distributed to the customers through various channels such as direct channel like website and social media, or intermediary channel like agents, brokers, bancassurance and more.