Banking has evolved into an integral part of civilization, across geographies and cultures. Modern day banking, however, has realized that banking is not just about money transactions anymore. Today, with many money handling and payment technologies, the way people bank has undergone a revolutionary change. With customer centricity being the key, a banking CRM can be leveraged to create impactful customer journeys, identify upsell and cross-sell opportunities and plug lead leakage.

Why do Banks need Digital Transformation?

Previously, banking involved a lot of planning, long queues, and dealing with an irritated teller, to withdraw your own money. However, with the advent of technology, the customers have changed the way they interact with banks. With customers being more digitally aware, banks have slowly started to digitize their processes to hold a relevant market position. As many as 70% of new enterprise applications will use low-code solutions to support processes such as customer onboarding. Internet and mobile banking have successfully made it easier for customers to transact without having to visit an actual bank.

Banking as an industry is also changing shape with the advent of fintechs and other neo banks. For banks to stay relevant, they must leverage technology to monetize ecosystems and work with ecosystem partners better. In this context, a CRM can be pivotal.

Banks deal with a lot of data on a daily basis. This includes customer information, transactions, loan applications, Demat accounts, trading information, and even bancassurance related data. It is nearly impossible for banks to process and understand this data manually without a digital tool helping them out. In the quest for a customer-focused business, banks are slowly adapting CRMs that help them to identify selling points that would not be possible otherwise.

What is a CRM in the Banking Industry?

The modern banking customer is spoilt for choices when it comes to choosing the right bank. Loyalty and brand names play a very small role in this process. With every bank offering discounts on their services right from mortgages, credit cards, savings accounts and more, customers go with the option that makes the most sense to them.

A banking CRM will keep you notified of these selling points and help you position your bank’s offerings in such a way, that your customer base is on a continual rise. Here are some ways in which a banking CRM can boost your conversion rates.

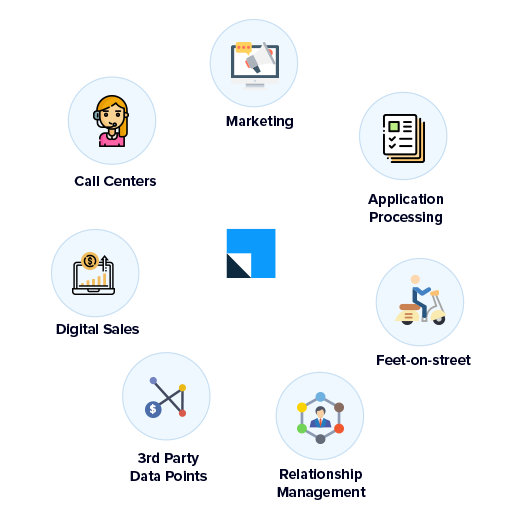

1. Enable flow of data from all sources

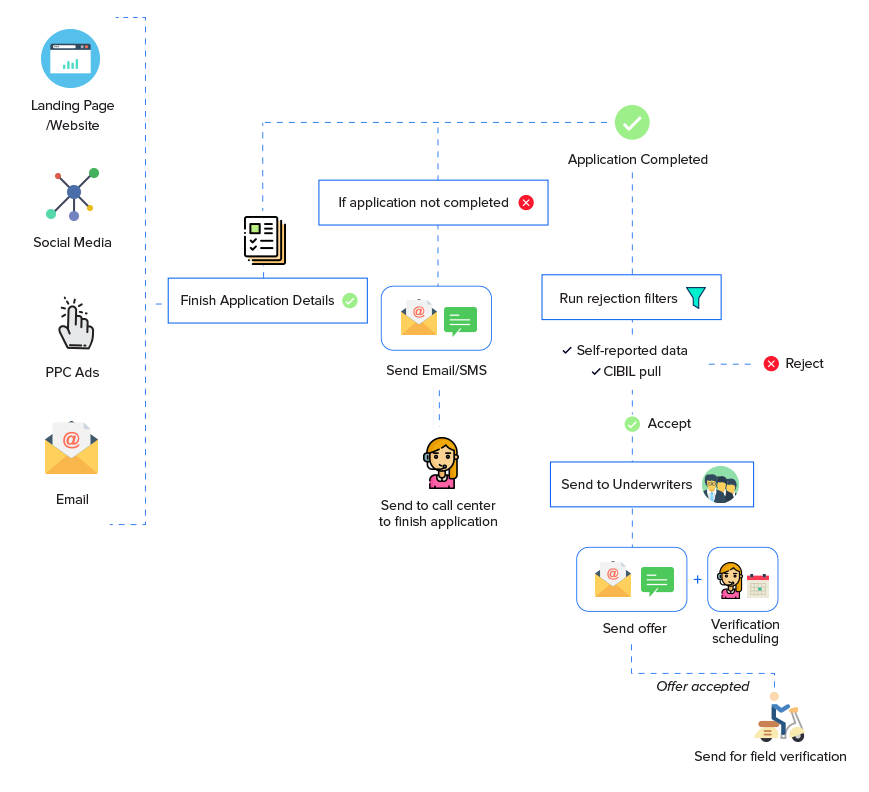

A bank might have various online and offline sources from which customers are acquired. This could be website’s visitors, cold outreach, paid ads, social media, referrals, email campaigns or through third-party vendors. A banking CRM should help capture all these leads that have intent that about your products and solutions on one platform. This way, you will ensure that none of your prospective customers are missed out on.

2. Handle multiple products/teams

A bank is not just about monetary transactions anymore. They now have a portfolio of different products, with different teams servicing each of these verticals. When there are multiple LOBs, it is essential that all of them work towards a common goal. To make this easier, all the teams need to have a transparent system in place. A banking CRM can help you do just that if configured properly and act as a centralized platform for better collaboration internally.

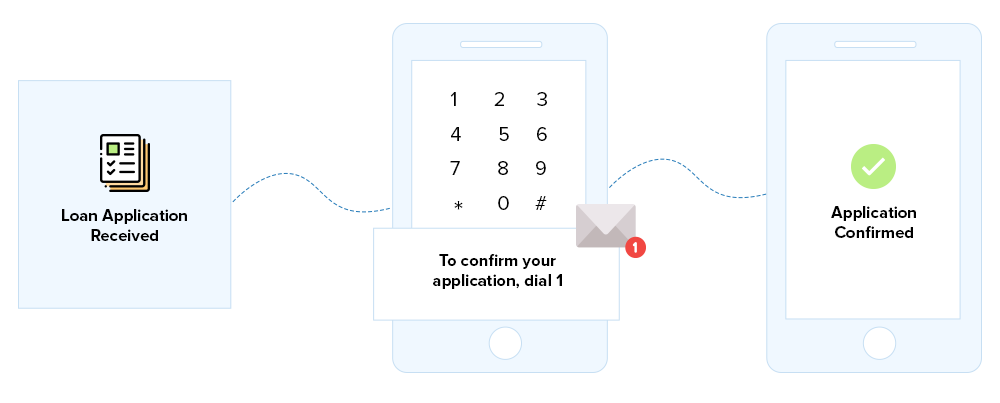

3. Automate qualification of prospects

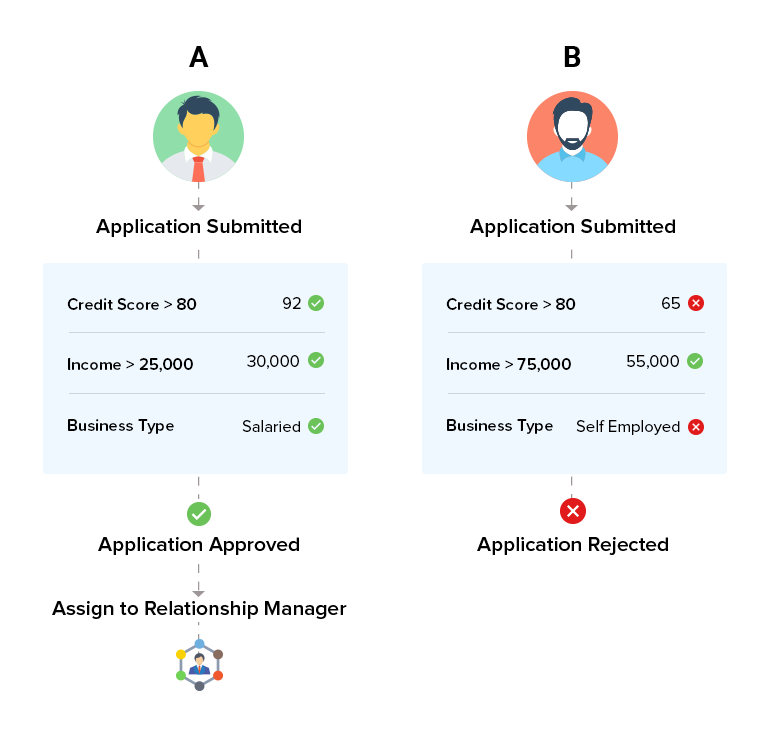

When it comes to loan disbursals, it is very important for banks to verify that their prospect is interested in applying for a loan. Banks usually employ tele-callers who call the applicant asking for confirmation. But this time-consuming manual process may lead to human error. A good banking CRM, on the other hand, can automate the entire process, making and simplifying customer engagement.

Additionally, banks also need to verify if a person is eligible to receive the loan he has applied for. Different banks have different criteria, such as their credit score, income, means of employment etc. A CRM can help banks qualify leads with a holistic approach to lead management and further automate routine processes such as allocating leads to relationship managers.

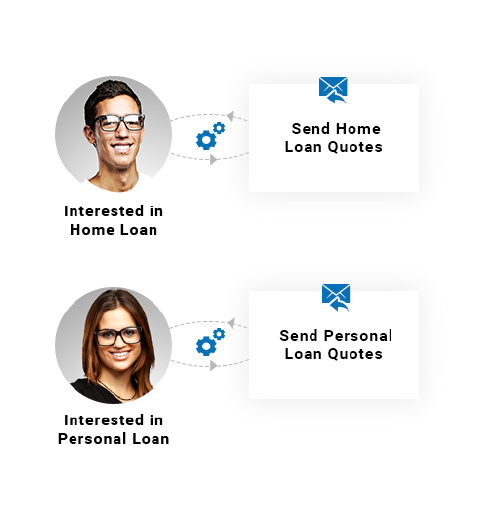

4. Build lasting relationships with timely communication

To keep your prospects interested, it is very important to be in constant touch with them. A banking CRM can help you design customer journeys, personalize and automate emails and other communication. With new age CRMs such as LeadSquared, channel-agnostic customer engagement is a must-have in a digitally-driven world.

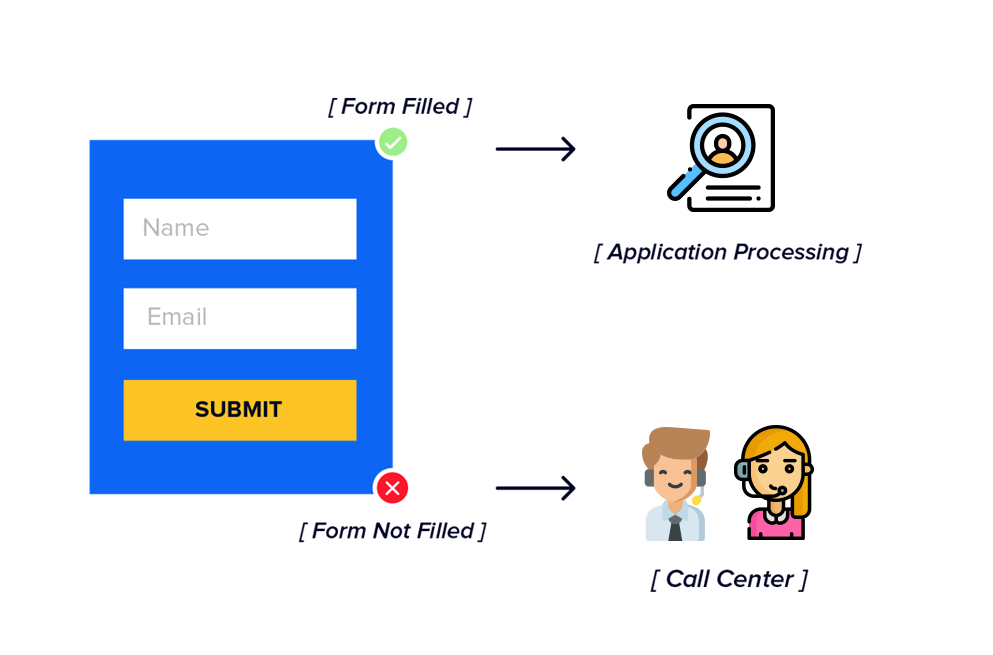

CRMs also have the option of setting instant alerts when a lead performs a sales-friendly activity. For example, if a prospect starts filling a loan application, but then abandons it halfway, you can either send them an automated email asking them to complete the application or alert the appropriate salesperson for a quick follow-up. This helps banks plug instances of application abandonment and ensure completed customer journeys.

5. Empower your call center teams

Call center teams are one of the most integral cogs in any banking process. They help both in bringing in new customers as well as helping solve the queries of existing customers. When this is the case, it is imperative that the call center team is given the right tools to carry out this task. Automatic lead distribution, instant call notifications, and complete lead history are some features that are pivotal for the call center team.

6. Unify business processes on a single platform

Every bank has its own process set in place. This means that a CRM that has a one-size-fits-all approach wouldn’t work. The CRM that you choose should be capable of adapting to your exact business processes and requirements. A banking CRM should be easily customizable so it can seamlessly co-exist and integrate with existing systems.

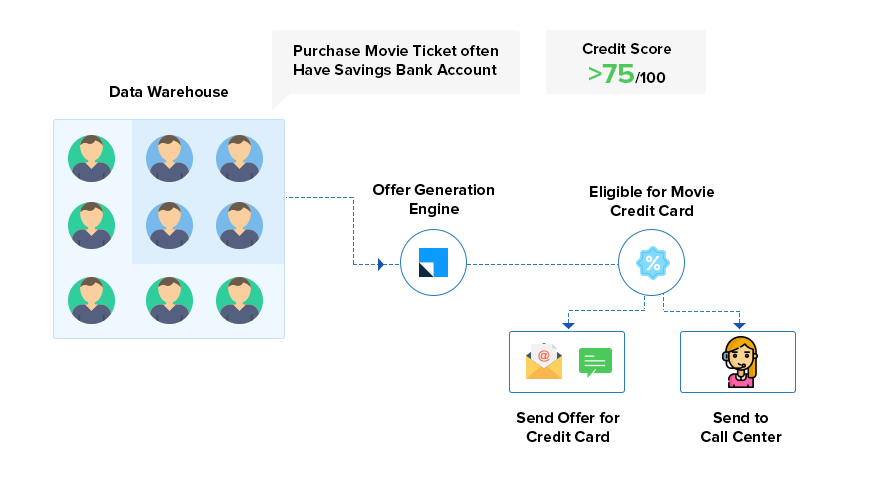

7. Identify cross-sell/upsell opportunities

The best thing about banks is that most products are interrelated, which means that you can sell a customer more than one product. With the right banking CRM, you can pick up on these sales cues to contextualize customer propositions. For example, if your savings account customer has a tendency to spend a lot on movies, then your team can offer him a credit card that offers discounts on movies.

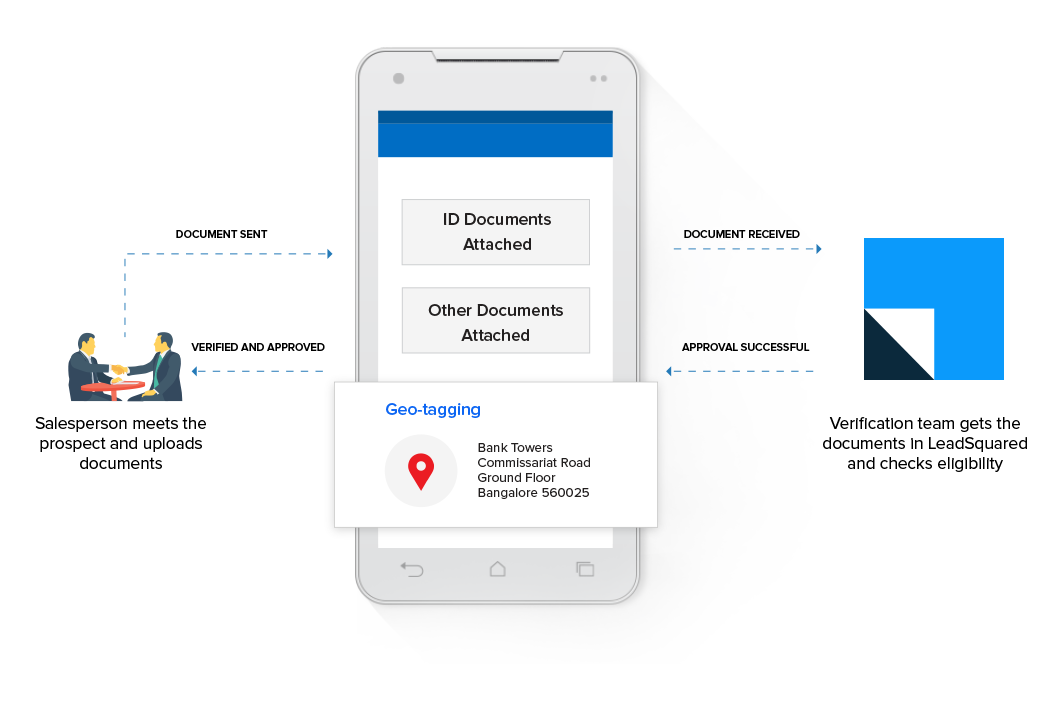

8. Build a productive field force with a Mobile CRM

Your banking CRM should be able to work on mobile devices as well as desktops to ensure simplified sales processes for the field force. This way, your field team can easily access a lead’s history to make a relevant pitch or identify upsell opportunities, and much more. With features such as instant document verification and collection, the chances of manual error are much lower. Moreover, digital documentation can enforce better process transparency.

9. Get complete and detailed reports

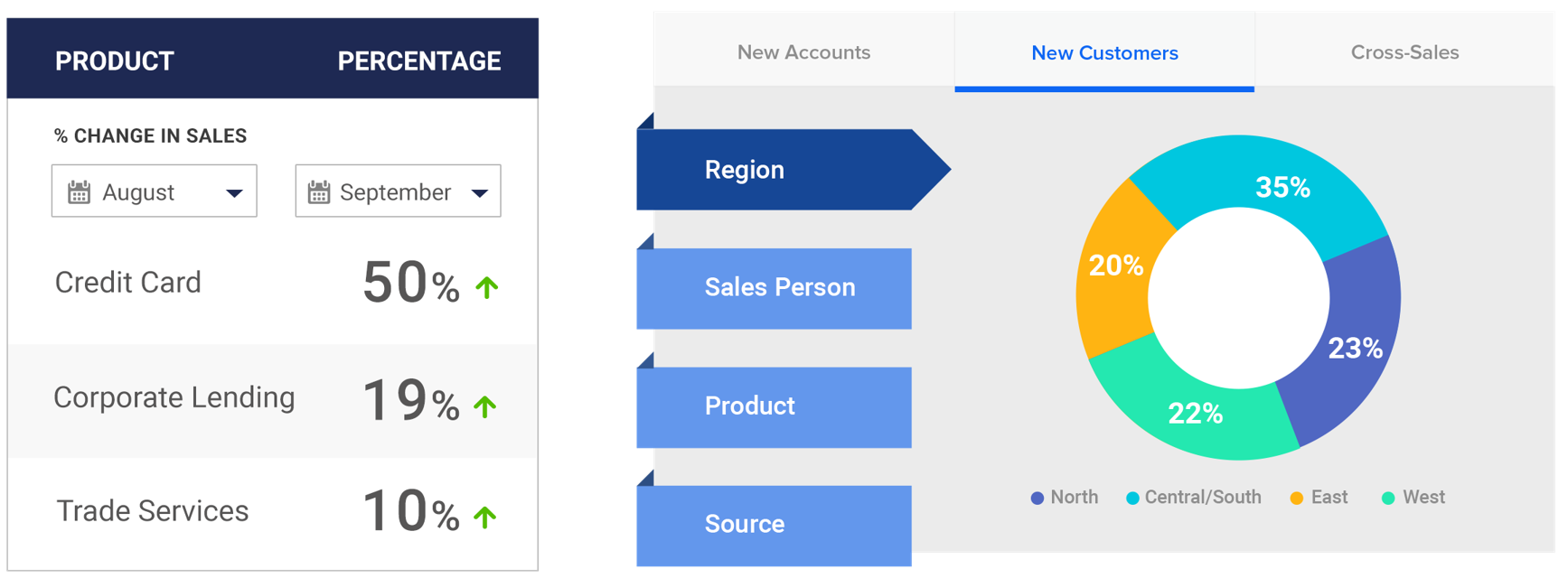

Timely and detailed reports help banks be in the loop of organizational progress from a macro and micro level. They can figure out which product is raking in more money, at which geography and through which relationship manager. This way they can keep track of what is working for them and what is not. A significant rise in loan disbursals in one geography can point to a positive impact, and they can easily find out why. Or if there is a drop in credit card purchases, they can try offering ones with more discounts. This way, teams can operate on data-driven insights, understand data patterns, and have better clarity about their next action plan!

Embracing digital transformation, with an intent to grow is the key for modern banks. With the emergence of fintechs and neobanks, banks that don’t embrace digitization can soon lose relevance alongside their market position. A banking CRM is a powerful tool to emerge as customer-centric institutions, maximize sales, boost customer engagement, and much more. . Most importantly, CRM in banking can help centralize data and set processes that mitigate manual errors.

Find out how LeadSquared’s Banking CRM can be your perfect match to enforce digital transformation!

FAQs

A CRM stands for Customer Relationship Management. A banking CRM helps ensure better customer engagement, offer products and solutions that customers are looking for, and grow long-term customer relationships.

While there are many benefits for CRM in banking, primarily, CRM in banking aids banks in growing new customer relationships as well as maintaining existing customer relationships. Banking CRMs give banks a 360-degree view of their customers to understand their needs better.

What is an example of a banking CRM?

CRMs help optimize the sales and marketing aspects for a bank. LeadSquared’s Banking CRM is designed to adapt to the exact requirements of banks and accelerate digital transformation.