NBFCs have been instrumental in filling the credit availability gaps and supporting SMEs and Professionals, who were underserved by the banking institutions.

However, today, NBFCs are facing stiff competition from micro-lending companies and FinTech start-ups venturing into the INR 118 trillion Indian formal credit market. FinTechs have already been successful in capturing a greater market share with their technology-driven low-cost operating models and superior customer experiences. For example, RazorPay and PayTM have partnered with banking institutions to offer loans to their customers. Khatabook – a digital platform for managing business and personal ledgers, has recently applied for the NBFC license. OkCredit, BharatPe, NiYo are also sharing similar expansion goals.

Given the rising number of digital lending platforms and customer preference for convenience, the time is ripe for NBFCs to adopt a smart digital lending strategy to stay relevant in the lending industry.

How NBFCs in India can improve online sales, operational efficiency, and customer experience

Unlike banks, NBFCs don’t usually have large distribution networks. A large part of their new business depends on third-party agencies and direct selling agents (DSAs). DSAs help lending companies reach out to the customers in tier II and III cities where branch office/financing companies are not present. However, most of the processes (including customer acquisition and loan recovery) are operation-heavy and involve multiple interactions between agents and customers.

A recent study by Accenture reveals that through strategic digital transformation, NBFCs can increase loan volumes and reduce operational costs by 20%. Direct sales through online channels, increasing operational efficiencies, and delivering seamless customer experience are at the core of digital lending.

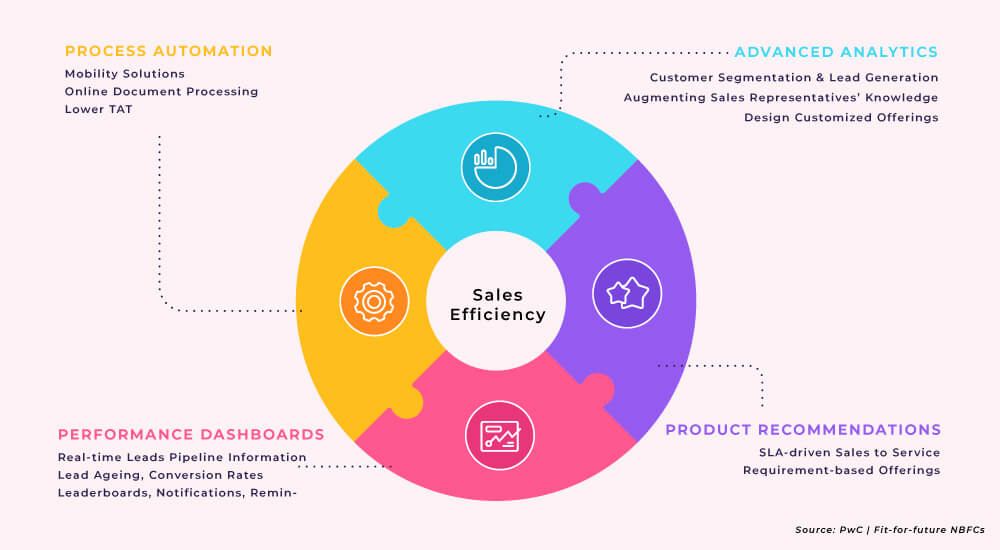

1. Optimizing sales cycles

As mentioned above, Sales in NBFCs are highly dependent on third-party agencies and DSAs, who might not possess a comprehensive knowledge of products and offerings. For instance, DHFL (Dewan Housing Finance Limited) relied completely on DSAs for leads. When they started deploying RPA-based technologies, they were able to generate 20-25% of leads internally.

“By slowly moving to their own resources, NBFCs can cut turnaround time on loan applications by 10-25%.”

Harshil Mehta, CEO, DHFL

Lending industry-specific CRMs are crucial for digital lending platforms. These are especially beneficial for disbursing loans faster, while managing operations like sales, call center, field sales, and collections.

While going digital, customer segmentation remains a pressing challenge for NBFCs in India. Leveraging Analytical tools for customer segmentation and defining segment-specific sales strategy can lead to better conversion rates. Also, with a real-time view of the sales pipeline, supervisors can quickly reform existing strategies.

While the adoption of digital has accelerated, it cannot eliminate field agents and DSAs from the value chain. But there is a need to augment agents’ knowledge with the company policies, products, and offerings in the simplest way possible. This is possible by making relevant information accessible whenever required. A cloud-based information repository can help field agents get the knowledge on the go.

It is possible to reduce sales turnaround time with mobility solutions. Executives can capture/process documents and customer information more efficiently and in most cases, loan applications can be filed and approved during the first interaction.

Explore Mobile CRM for the lending sector.

2. How NBFCs in India can improve operational efficiency?

From onboarding a customer to loan disbursal and recovery, lending is an operations-heavy process. It involves several stages like lead management, application, documentation, underwriting, fraud checks, legal checks, valuation, decision, and disbursal documentation. The legacy systems are time-consuming and error prone. Moreover, today’s customers seek speed and convenience. Thus, this is a high time for NBFCs in India to improve their operational efficiencies across different touchpoints to save time, cost, and resources.

Loan Applications

Many of the preliminary processes can be made online through self-service portals like checking eligibility for loans and custom loan requirements. Online portals for document collection, queries, and clarification can free the NBFC workforce for sophisticated tasks.

Customer onboarding

Digital verification for customer identity (for example, Video KYC, CIBIL score validation, etc.) can reduce customer onboarding time to a great extent and speed-up the entire lending process.

Underwriting

Leveraging AI and Machine Learning models, NBFCs can underwrite loans based on segment, geography, and product. FinTech players are already investing in automated underwriting models based on their customer data. For example, Lendingkart offers customized interest rates to borrowers (15-27%) based on past credentials.

Loan disbursements

Through digitized verification and validation, it is possible to disburse loans instantly into the customer’s account. Micro-lending FinTech companies shell out loans within 3 days of the loan application. Whereas NBFCs typically require 4-6 days for the same. Thus, digitization and efficient use of technology can ramp up NBFCs loan disbursal time.

“LeadSquared helps us manage our lending partnerships with banks & NBFCs, and our internal processes across the lending lifecycle (sales, credit, verification & operations) to disburse loans 30% faster than before. Our DSAs are 55% more efficient than before, and all their work is trackable,” says Anuj Sachdev, VP Product, Qbera. Case study.

Customer relationship

The lending journey entails several interactions, which can be automated through self-serve portals. For example, customers can help themselves with post disbursal documentation, new loan application, applying for an extension, early clearance of loans, to name some.

The relationship between lender and borrower is never terminated; even after the loan is recovered. Existing customers present an immense opportunity to cross-sell. Intelligent digital systems can keep track of customers and their ventures and accordingly nudge them for relevant products/offerings.

3. Improving customer experience

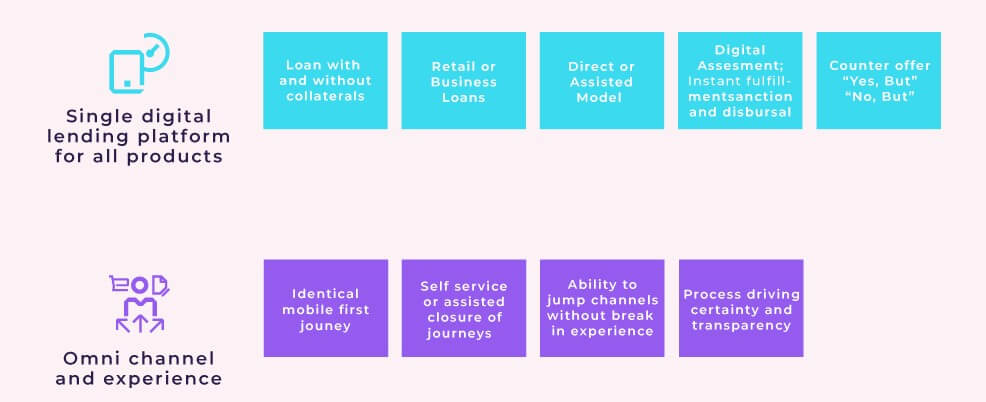

Customers still need to consult with their relationship manager and wait for their revert for any frivolous issues in the finance sector. Transforming customer experience in the lending industry requires reforming strategies from distribution, product, risk, legal, to pricing. It is an iterative process that involves measuring the impact of technology and acting accordingly to deliver superior experiences through digital.

The new-age customers want simplicity, personalization, flexibility, and guidance at every stage of their digital journey. Millennials and Gen-Z prefer self-service portalsover relationship managers for query resolutions. Most of today’s customers are mobile phone users and the NBFC platform accessibility over mobiles and tablets also contributes to the overall customer experiences.

Source: Accenture

Intelligent instant response is imperative to any customer-facing business. NBFC is no different. Tailored engagement based on past interactions can help in developing emotional connect with customers. Leveraging an omnichannel approach is also crucial because the customer might not appreciate repeating the query over and over again. Resources can be a challenge when it comes to scalability and capacity to handle voluminous customer queries. Call center automation and self-service helpdesk can be the solution.

Explore the call center automation solution.

Many borrowers resort to agents because of the complex platforms and their limited experiences with digital systems. NBFCs can leverage vernacular language within their platforms to improve accessibility, especially in rural and suburbs. By placing the customer at the core of all operations, NBFCs can redefine customer experiences.

Digital Lending: The Opportunity

Digital transformation is a prerequisite because sales, operations, and overall business success depend on the organization’s agility in this fast-changing world.

Over the years, FinTechs have leveraged analytics, blockchain, and Machine Learning to reduce operational costs and offer gold-standard customer experience. Their capabilities in underwriting models, seamless partner integration, and real-time loan decisions are milestones for NBFCs’ digital transformation journey. Partnership with FinTechs to design the digital lending platforms can also be a way forward for NBFCs.

Source: PwC

The current COVID-19 crisis: Prolonged lockdowns have severely impacted most of the industries across the globe. Businesses are thriving to continue operations without compromising customer services. To streamline operations through digital channels, businesses, especially in tier II and III cities are in dire need of loans, but lack of financial aid is creating a bottleneck for them.

There is an immense opportunity for NBFCs in India to serve the underserved market through digital lending platforms and contribute to their success.

NBFCs FAQs

u003cstrongu003eWhat is the meaning of NBFC?u003c/strongu003e

As per RBI (Reserve Bank of India), NBFC corresponds to a Non-Banking Financial Company. NBFCs engage in the business of loans, advances, and shares/stocks/bonds/debentures/securities issued by Government or local authority. Their portfolio also includes marketable securities like leasing, hire-purchase, and insurance.

u003cstrongu003eHow do NBFCs work in India?u003c/strongu003e

The main business of NBFCs involves lending. There are 6 main categories of NBFCs in India: Investment and Credit Company (ICC), Infrastructure Finance Company (IFC), Infrastructure Debt Fund NBFC, Gold Loan NBFC, Residuary Non-Banking Companies (RNBCs), and Account Aggregators (AA).

u003cstrongu003eWhen did NBFC start in India?u003c/strongu003e

NBFCs are in existence in India since the 1960s. They were started as an alternative to banks to meet the financial needs of underserved individuals.

u003cstrongu003eIs NBFC under RBI?u003c/strongu003e

RBI regulates the operation of NBFCs. However, not all NBFCs are registered under RBI. For example, Venture Capital Fund, Merchant Banking companies, and Stockbroking companies are registered with SEBI; Insurance Company registration is issued by IRDA; Nidhi companies are notified under Section 620A of the Companies Act, 1956; Housing Finance Companies are regulated by the National Housing Bank, Stock Exchange, or a Mutual Benefit company.

u003cstrongu003eWhat is the difference between banks and NBFCs?u003c/strongu003e

NBFCs can lend and invest like banks. However, there are differences between NBFCs and banks:u003cbr/u003e- NBFC cannot accept demand depositsu003cbr/u003e- NBFCs cannot issue cheques drawn on itself (they are not a part of the payment and settlement system)u003cbr/u003e- There’s no deposit insurance facility with NBFCs.

Related: