How a Leading Lending Firm Increased Their Loan Disbursal Rate by 30% with LeadSquared

10x your sales productivity with LeadSquared.

Book your 1-1 consultation today!

Book your 1-1 consultation today!

FASTER LOAN DISBURSAL

IMPROVED DSA EFFICIENCY

LEAD DISTRIBUTION

FASTER LOAN DISBURSAL

IMPROVED DSA EFFICIENCY

LEAD DISTRIBUTION

The company is a new age lending firm that believes that getting a loan should be as fast as ordering pizza or hailing a cab. They have been empowering the employees of over 700,000 companies to get personal loans digitally. They have built technology that is capable of making instant lending decisions and can disperse loans in as little as 8 hours.

The company co-founder talks to us about how LeadSquared has helped them manage their lending partnerships and increase loan disbursals.

When we started out, our research showed us that salaried people were not getting loans from banks and NBFCs because of three main reasons.

We decided to solve this problem by using a data-driven approach. And this has become our USP. We have a database of over 7 lakh employers, and we disperse loans based on credit behavior rather than scores. And we are slowly bridging this gap.

We have built lending partnerships with four vendors, and we have designed credit policies with them. And, together with them, we take care of customer acquisition, underwriting services, etc. The money to fund the loans come from the banks. But we, own the credit policies.

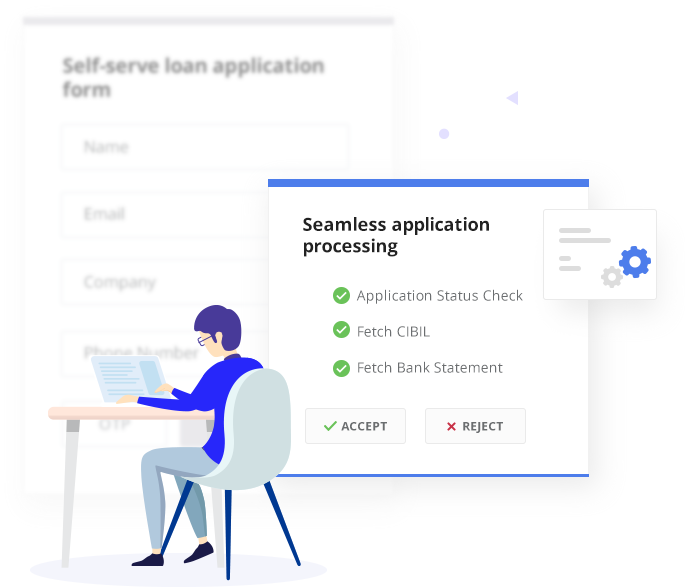

We use a lot of DSAs (Direct Sales Agents) for our business. They go around collecting applications from our prospects. Our applications are paperless and, hence, we have to verify that the applicant actually wants the loan. Once an application is processed, an SMS and IVR is sent to confirm that he indeed applied for the loan.

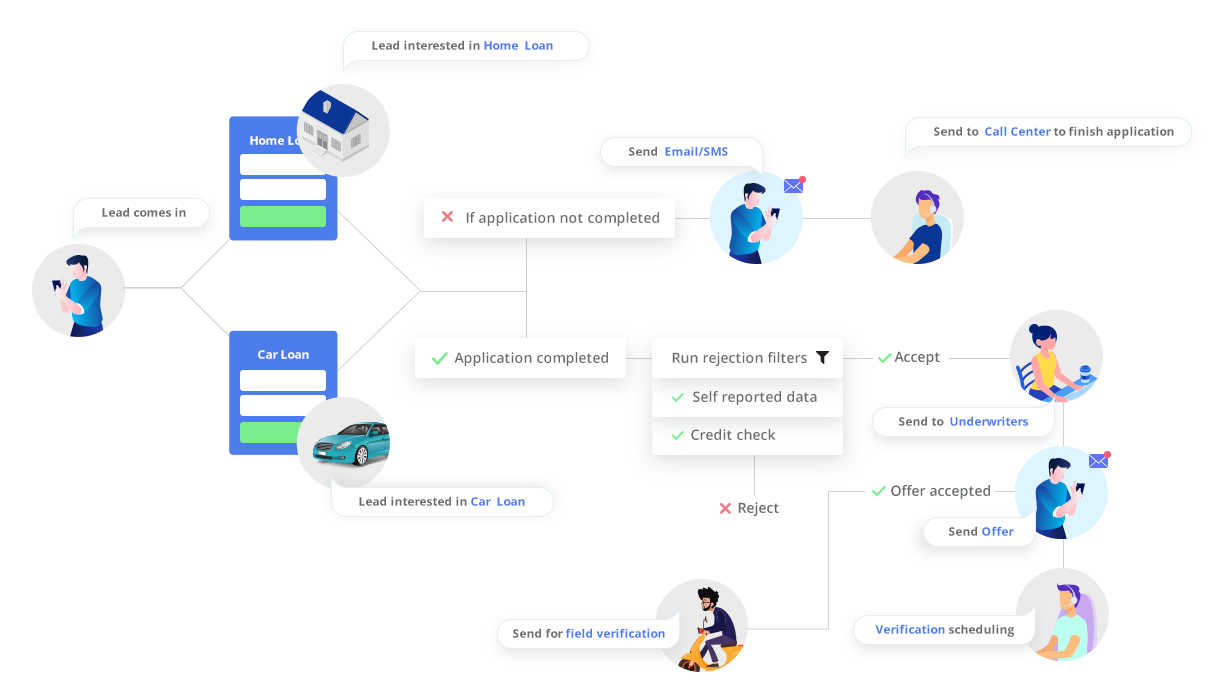

As soon as the application is completed, it is sent to the risk assessment team for verification. The leads are distributed automatically on a round-robin basis. We have automated a lot of our processes with LeadSquared. We have given access to the tool to all our DSAs. The larger agencies that outsource their DSAs have access to APIs to use the application.

Our DSAs use LeadSquared the most to process applications. We have removed the need for a call center team, by integrating IVR with our application process. This was possible through automations. We also use it in our marketing activities.

When leads come in through our website, via our ad campaigns, there may be a lot of drop-offs. Someone may have completed mobile verification, but not finished his application. Someone may have completed the application, but not linked his bank account. We have set up multiple drip campaigns that take care of this scenario. They send emails and notifications encouraging them to complete their application.

We also have a team of runners who use the LeadSquared mobile app. They collect ID proof and documentation and upload the same on the app. This data is immediately accessible to us and helps us process the loan much faster. Once the process is completed, it moves to the central database. And, based on the lender, the QA process is done with the lender and LeadSquared. The tool basically acts as an internal interface between us and our lenders.

LeadSquared has automated almost all of our processes. It is deeply integrated with our business. It has helped us manage our lending partnerships with banks and NBFCs. We are also able to manage our internal processes, including sales, credit, and operations, in a much better way. This has helped us speed up loan disbursals by 30%. Our DSAs are also 55% more efficient than before, and we are able to keep a better track of their work.

(+1) 732-385-3546 (US)

080-46971075 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)

How a Leading Real Estate Company Increased Property Sales by 54% with Lead...

How a Leading Real Estate Company Increased Property Sales by 54% with Lead...