The borrower lifecycle journey has drastically changed in the last few decades. Instead of waiting for weeks to get any loan approval, today, many borrowers are already pre-approved. The turnaround time for new approvals has also come down to just a few days/hours.

There are two drivers of this fast-paced execution: borrowers and lenders.

In earlier times, people borrowed on special occasions—like marriage, tuition, a new house, and more. Today’s borrowers have more diverse needs—a new bike, groceries, internet, electricity bill, and travel. There is a constant outflow of cash, and to match their credit requirements, they rely on external credit lines.

The other side of this coin for fast-paced execution is the creditors. Lenders had to improve their operational efficiency exponentially to meet the growing demand and increase their bottom-line growth. To achieve this, they needed to rethink traditional operations and eliminate redundancies with the help of cutting-edge tools.

And so, financial and tech experts came up with strategies and tools to achieve this.

A loan automation system is one such tool adopted by lenders everywhere. It improves the lending and recovery process, from application to approvals and EMI payments. The loan automation system makes the loan process faster, more efficient, and it can decrease human error by 90% (as it did for IndiaLends—a fast-growing loan marketplace.)

In this article, we will explore what a loan automation system is, its benefits, challenges, implementation, and the future of loan automation systems.

What is a Loan Automation System?

A loan automation system is a technology or a collection of tools working together to automate the loan process. This means that aspects like origination, servicing, debt collection, and reporting are all automated to some degree to achieve higher efficiency.

Critical Components of A Loan Automation System

Usually, a loan automation system is an amalgamation of many vital components. Here are five critical elements that top lenders use to automate their loan lifecycle journeys:

Component #1: Loan Application Management System (Pre-LOS)

For many lenders, application management can be a standalone problem statement. As the demand for credit grows, more borrowers will apply for new loans at your firm. But there’s a catch.

These borrowers will also apply at 4-5 more firms for the same inquiry. Winning this competition depends on convenience and TAT, it’s straightforward in the borrowers’ minds today.

Simultaneously, due to the diverse nature of loan borrowing, lenders must also segregate their inquiries on various parameters and deal with them accordingly.

These factors could be:

- Loan type: Secured/ Unsecured

- Borrower income

- Borrower language

- Location

- Branch

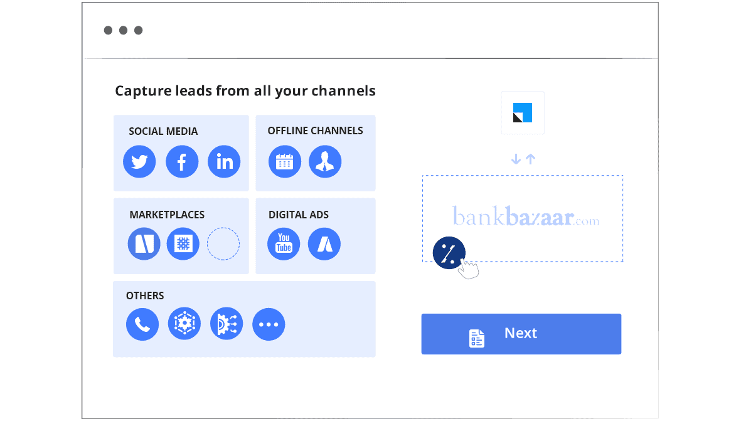

- Channel: Social media, app, website, pay-per-click ads, referral, and more

A loan application management system is an excellent tool that solves these use cases.

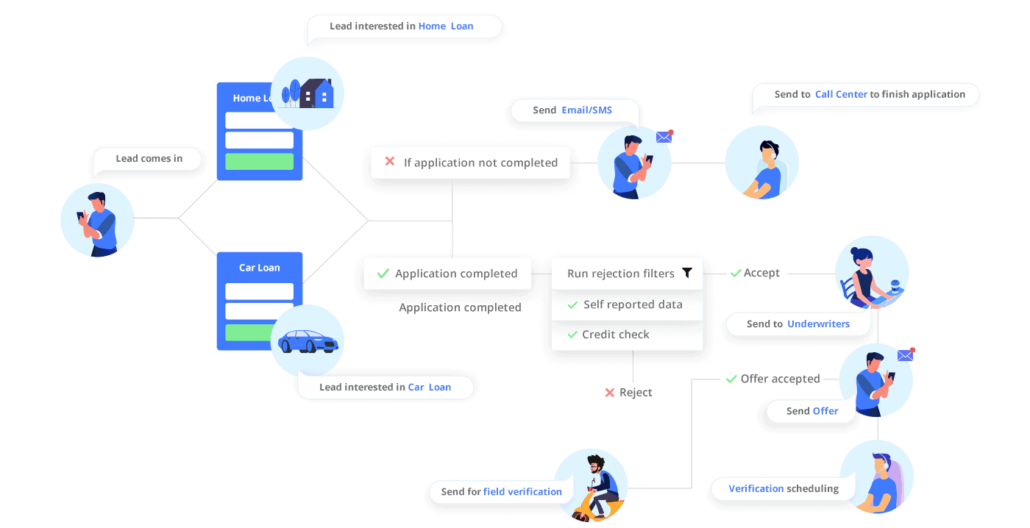

You can automate elements like inquiry capture, application, verification, processing, and sanctioning to achieve more efficiency.

The financial arm of the $8 Billion Poonawalla Group, Poonawalla Fincorp, is a leading Indian NBFC that uses LeadSquared–a pre-LOS platform–for their application process.

Let’s take a quick look at their story!

How Poonawalla Fincorp increased loan sales by 50%

With more than 7000+ employees and 5+ main loan businesses, Poonawalla Fincorp is a fast-growing financial services brand. To manage their pace of growth, the management team deployed LeadSquared as an enterprise-wide cloud platform.

| Goals Set By Poonawalla Fincorp | LeadSquared Solutions | Results Achieved |

| Capture new inquiries directly from the website | Self-service portal with dynamic forms and drop-off monitoring | More than 1,10,000 applications were captured in just three months, and 100% drop-off elimination |

| Cut down time to first contact | Lead distribution and prioritization capability for faster outreach | 75% faster outreaches |

| Maximize call centre productivity | Complete contact centre management capability and universal telephony integration | 85% more call centre productivity |

[Read: Poonawalla Fincorp Achieves 50% More Loan Sales Using LeadSquared to learn more about their success story.]

Here are a few ways in which a loan application management system can help you:

1. Streamline New Loan Application

Suppose you are generating new loan inquiries via multiple channels. But what if your applicants are not reaching your agents and are just sitting in the system waiting to be called?

To avoid this scenario, you can integrate all your lead gen channels to your Lending CRM using connectors and funnel new applicants directly to your preferred agents, eliminating lead leakage.

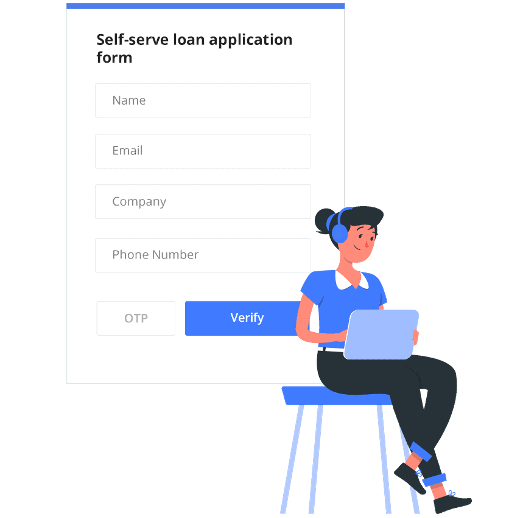

At the same time, if your borrowers prefer self-serve journeys (as is the rising trend), you can set up a loan application portal where they can apply for a loan at their own pace.

2. Manage Contact Centre Officers/Teams

The turnaround time at a contact centre begins to increase when reps encounter these problems:

1. The rep needs more visibility into applicant details since it’s the first interaction.

2. The rep doesn’t know how to prioritize applicants to call first.

3. During the first contact, the rep must constantly switch between the application management intervention systems and the tele-calling dashboard.

These actions take just a few minutes to complete, but over time, this delay can cost you a lot of hours and revenue every week. Also, since the effect compounds, it delays action on incoming leads.

Loan application management tools can solve this problem by routing new applicants to available agents. You can optimize rep productivity by highlighting the applicant’s creditworthy (based on pre-determined logic). These tools can also serve as a centralized dashboard for all calling activities.

Additionally, with the Universal Telephony Connector (UTC), lenders can adopt any cloud-calling platform effortlessly to save time and boost calls-per-agent. UTCs also allow you to capture call recordings for QA and training purposes.

3. Enable An Integrated Ecosystem For Applicant Verification

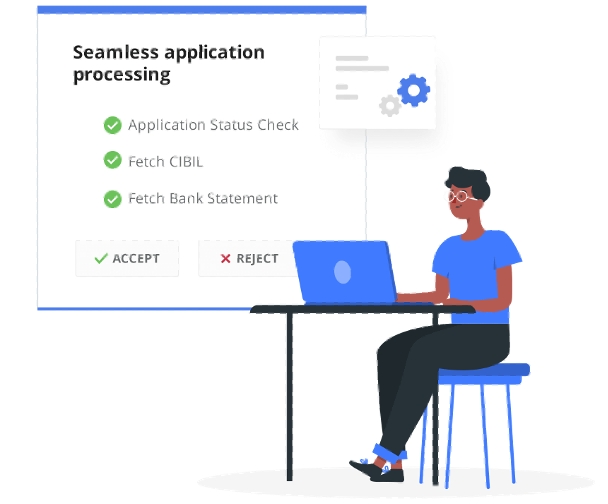

Some loan automation systems allow you to automate pre-screening through integration with leading credit bureaus like CIBIL, Illion, Experian, and CRIF and conduct KYC verification. This helps you to rule out junk applicants and eliminate any duplication that may happen.

A classic example of brand that benefitted from integrated verification is Profectus Capital. The SME lender was able to improve its funnel quality by 70% and streamline funnel movement!

Due to pre-screening automation, we are able to reject files right at the onset. It has improved our funnel quality by 60-70%. Only the quality data moves to the core underwriting process which prevents our underwriting bandwidth from getting choked.

Vaibhav Maheshwari, Former AVP, Profectus Capital

4. Manage Field Teams and Door-Step Document Collection

Managers often work with many loan officers whose daily actions involve the generation of new leads, onboarding partners/dealerships, collecting the necessary paperwork, or making door-to-door payment collection visits. Since each manager has hundreds of officers in their network, it can be tricky to track each officer’s actions to ensure consistency and high productivity.

Often, loan officers can also struggle to meet their numbers due to a lack of network connectivity. This is a significant problem for reps who visit remote areas.

Field management CRM tools propose an integrated solution to this problem. The mobility solution offers offline data capture and management to deliver a seamless user experience.

At the same time, the multi-lingual app enables digital document collection, hassle-free payment collection, end-to-end reporting, and analytics for loan officers.

As a result, loan officers can execute their daily actions swiftly, and the managers can monitor activities to improve productivity. For example, UNI Cards, a growing Buy Now Pay Later brand, increased the field visits by 2X by implementing LeadSquared’s mobility solution for its field collections process.

Component #2: Underwriting/ Decisioning System

Until a few years ago, the underwriting process was very subjective to the underwriter, and loan borrowing terms deviated often. The process was extremely time-consuming as it involved a lot of manual decisions and personalization.

For instance, the average underwriting time for a loan could vary anywhere between a few weeks to more than a month, and the time could be longer for secured products like home loans/ mortgage loans.

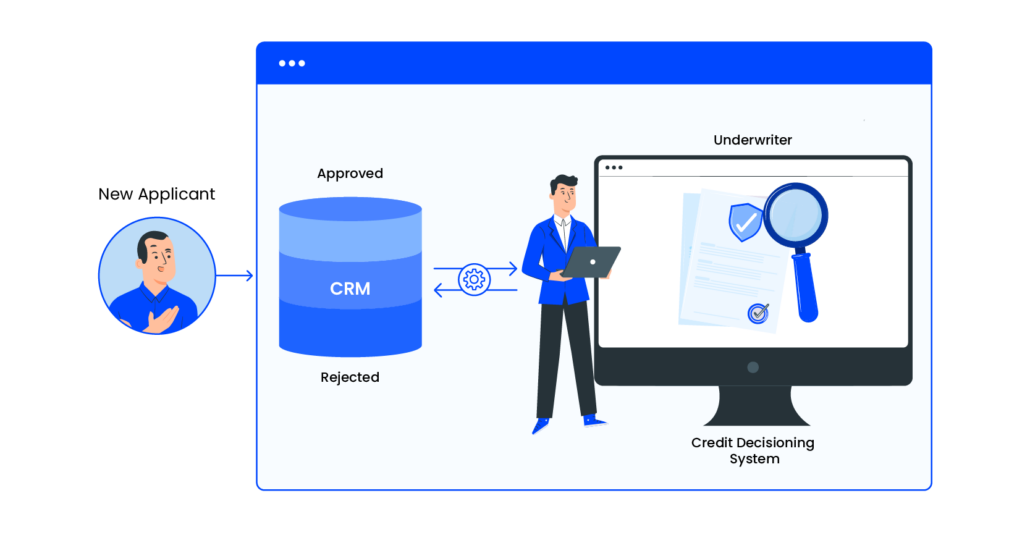

But today, new-age underwriting platforms can automatically verify KYC documents & other financial collaterals to identify incorrect information. Additionally, these platforms leverage pre-existing customer data to automatically suggest underwriting terms and can identify fraudulent applicants by comparing their information across multiple databases.

These systems offer homogeneity and personalization at scale in the application process, which is critical to the fast-paced growth of new-age lending companies.

You can even integrate your CRM with automated underwriting modules to enable high-velocity application processing with greater accuracy.

Component #3: Loan Origination System

A loan origination system can combine all pre-LOS, underwriting/decision-making, and disbursal capabilities into a single solution.

Such platforms have many benefits, including:

- Centralized operations

- End-to-end reporting

- Enhanced productivity

- Better customer experience

- Faster time-to-market

- Improved risk management

However, there are downsides to having all these features loaded into a single platform, as it can make the solution monolithic and inflexible. Hence, managing application processing on a pre-LoS platform is always better to increase efficiency and bring creditworthy applicants into LOS for the disbursal process.

Component #4: Loan Management System

A loan management system is another critical component used by lenders to manage the post-disbursal lifecycle of the customer. Once a lender onboards a customer, the lender can seamlessly manage all processes—loan servicing, cross/up-sell, debt collection, loan modification, and risk management.

An LMS platform can serve as a customer information database and generate actionable insights to create new sales opportunities. Some benefits of LMS solutions include the following:

- Self-service capability: If an existing customer is looking for a new loan, an LMS integration can help enhance the borrowing experience by fetching all relevant data from the previous application journey to personalize the engagement.

- Enhanced customer support: Businesses can integrate LMS systems with front-end tools like chat and call centre solutions to troubleshoot customer queries in a self-serve or assisted mode.

- Real-time risk management & compliance: Risk management and compliance are the two most important aspects while dealing with the financial services ecosystem. An LMS platform can support appropriate Credit Risk Management interventions and ensure compliance with government norms for smooth functioning.

- Prediction and reduction of delinquencies: Based on previous customer data, new-age LMS systems can identify at-risk customer loans and enable timely intervention to avoid future delinquency.

Component #5: Debt Collection System

The collections process is the backbone of the lending industry. While debt collection is usually an integral part of the loan management process, most lenders often treat it separately and have dedicated teams working on recovering loans.

But traditional collection processes have many challenges, such as:

- Manual case management

- Low intelligence about probable delinquencies

- Low rep productivity

- Communication problems with customers

- Cohesive team management

To solve this problem, top leaders deploy debt-collection CRM platforms.

LeadSquared collections CRM module helped us digitize our debt recovery process, building efficiencies and transparency. Also, tracking legal cases on the same module was a huge advantage

Harvinder Gandhi, Chief Group Chief Information Officer – ORIX Leasing and Financial Services

Using its intelligent automation workflows, debt collectors can:

- Get a 360-degree view of their cases/loan officer actions.

- Notify collection officers when cases are assigned.

- Track and manage soft and hard collection teams remotely.

- Enable seamless digital payment collection.

- Engage borrowers automatically via preferred channels to avoid missed payments.

You can read how ORIX Leasing and Financial Services transformed their debt collection process for maximum efficiency!

Future of Loan Automation System

Lending organizations globally are embracing digital transformation three years after the advent of the Covid-19 pandemic. It triggered an irreversible chain of events that gave loan borrowers a taste of convenient journeys.

Still going strong in 2023, the growth of the loan automation market will only take off from here since there is strong demand for credit.

With more advancements in artificial intelligence and machine learning, such as the introduction of Chat-GPT, lenders must expect tighter competition and a rise in demand for highly personalized experiences from borrowers. Soon, these tools will take on more complicated but repetitive tasks, leaving people-centric customer experiences to your loan officers.

You must start automating your loan journey today to keep up with the changing market, growing customer demands, and dynamic borrower profiles.

Many of India’s top creditors, like Poonawalla Fincorp, TVS Credit, HDFC Credila, Mannapuram Finance, Axio, and more, trust LeadSquared for their loan automation needs. So, check out our get in touch with our team today to boost your loan sales by up to 50%!