The insurance industry is fast evolving to meet ever-changing customer demands. But the change in customer expectations also brings immense pressure to speed-up processes and boost customer experiences.

Unfortunately, back-office operations still involve complicated workflows and tedious manual tasks. So, outdated methods and legacy systems are no longer enough to meet new demands.

Of course, different technological tools have a lot to offer individually. But a comprehensive insurance automation software is fast becoming a necessity. Already, the global robotic process automation (RPA) market is growing at lightning speed. Estimates suggest it will reach $12 billion in 2023.

If you look closely, automation is not a new strategy. BFSI sector has been using automation across their operations and reaping benefits.

Let us delve deeper into how automation transforms the daily activities of insurance firms.

In this article:

What is Insurance Automation Software?

At its core, Insurance automation software streamlines all kinds of day-to-day processes involved in insurance marketing, sales, renewals, to name some. For instance, it can handle basic tasks like:

- Calculate and present quotes

- Address customer queries

- Automate sales and marketing

- Automate call center operations

- Perform investment accounting

- Issue/renew policies

- Deliver bills and statements

- Issue payments

- Assign/triage claims etc.

Once you automate these basic tasks, your firm can instantly reap benefits. For instance, Deloitte observed that simple automation led to a 68% increase in productivity for a leading insurance firm.

Automation is a broad term and covers a range of technologies, such as software robotics, machine learning, artificial intelligence, cognitive solutions, and more – serving extensive use cases across insurance operations. But the most popular ones include sales process automation, RPA (robotic process automation) and IA (intelligent automation).

Sales Process Automation

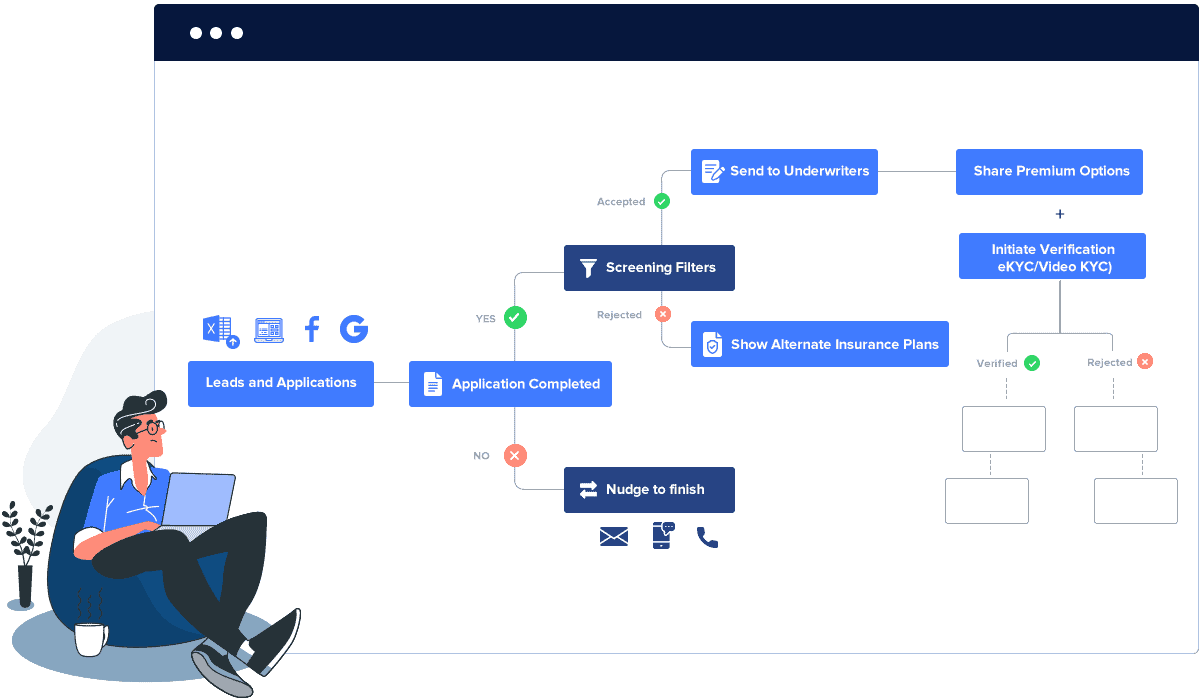

Insurance firms rely on several distribution channels for policy sales. For example, digital sales, bancassurance, agencies, brokers, agents, call-centers, and other intermediaries. Automation in insurance sales covers a range of applications and streamlines policy distribution across channels. Some of the use cases of insurance sales process automation are:

- Straight through processing (Insurance STP) or direct/online sales

- Lead management involving automated lead creation and scoring, lead distribution, lead deduplication and activity tracking, and task reminders to sales reps

- Opportunity management for identifying cross-sell and upsell signals

- Sales reps app for field representatives

- Video KYC for online customer verification

- Agent onboarding

- Call-center management or integrated call-center management solution for large enterprises.

Robotic Process Automation

Robotic automation uses rules to automate tasks with no variations. The applications of RPA in insurance include underwriting and pricing, claims processing, business and process analytics, customer onboarding, policy administration and client servicing, to name some. Some software solutions that serve this purpose include Better Agency, Agency Engine, Insurance Noodle, and Ebix.

RPA tools automate repetitive tasks making it easier to navigate complex business operations. It also reduces the chances of human error. Moreover, insurers need not worry about record-keeping as the automation system tracks every activity and update. RPA tools are the most common applications of automation in insurance.

Intelligent Automation

RPA helps a lot in operations, but problems start when you have to deal with a high volume of unstructured data. Moreover, predefined keep changing due to changes in customer demands and regulatory compliances. Naturally, it is easy to reconfigure these rules on software as compared to paper-based processes. But how about software that can learn on its own and make those changes?

For this, intelligent automation is the answer. IA integrates all aspects of the RPA plus capabilities to learn and adapt to change in real-time. Intelligent automation in insurance uses technologies like computer vision, text analytics, NLP, and machine learning. Such technologies make it easier to handle unstructured data.

It can also use predictive analytics for crucial decision-making for optimal KPI results. On another level, you can leverage machine learning to let bot (usually chatbots) learn from the inputs (customer queries) it experiences. Still, intelligent automation software for insurance companies is in its early stages. There are still many challenges in applying IA to insurance.

Nevertheless, there is no doubt that IA would be the game-changer in the coming years. Already, IA software for insurance companies is emerging. Some examples include Indico, Cortex, and Mindtree.

Why Use Insurance Automation Software?

Insurance automation software can apply to all your business operations. You can currently find automation software for claims processing, sales and marketing, call centers, lead management, underwriting, and more. For these, insurers mostly use policy software, medical billing, commercial insurance, CRM tools, and insurance agency software. It is even possible to invest in marketing automation for insurance marketers. But the question is – how can insurance automation software benefit your firm? Let us look at some use cases that show that making such investments is critical to your growth.

1. Faster Document Processing

Insurance companies deal with volumes of complex workflows and paperwork. A single quote request from one customer might seem simple. But it involves a complicated mix of processes across data sources. Insurance automation software eliminates the need for handling these processes manually. It helps streamline data extraction and every step of document processing. You can quickly notify your customers about the status of their request. Or provide self-service portals so they can access such data in real-time. It helps customers to resolve issues independently or with the aid of your support team. You can also avoid errors and duplicate data associated with paperwork.

Even when your teams still have to carry out manual tasks, automation will speed up the process. Already, companies are making headway with RPA tools for automating document processing.

A great case study is PZU. The European insurance group added automation to nine areas of activities. Some of those activities include data entry, payments, car damage claims. The result was over 90% data entry accuracy and 1/2 reduction in customer service calls. It also improved the number of decisions issued per person by 15%.

2. Sales and Marketing Automation

Even with automations and self-service coming to the forefront, customers still expect personalized relationships with insurance agents. So, there is a need for holistic marketing and sales strategies to offer meaningful experiences to your customers.

Typically, marketing campaigns have an enormous number of moving parts. There is so much that needs personalization – from landing pages to sign-up forms, emails, and CTAs. Automation helps simplify these workflows. That way, your teams can better communicate with themselves and your customers.

It also helps them manage leads with complete visibility of their journey. Marketing automation can also help you assign scores to prospects automatically. So, your sales team knows when, how, and where to transform leads into buyers. Overall, automation handles the heavy lifting. In turn, your team can have more time and access to meaningful data to personalize their campaigns.

“With the introduction of LeadSquared, the average sales per day per agent has moved up by 40%. The lead-to-sale ratio has also increased by 35% in just three months.”

Mayank Gupta, Director of Business, Acko General Insurance Limited

3. Simplifies Compliance Processes

Insurance companies deal with ever-changing regulatory policies. Whether it is HIPAA, PCI DSS (Payment Card Industry Data Security Standard), or other regulations, you must maintain compliance. Your automation software can generate automatic logs of every process. It helps eliminate human error. It is also easier to reconfigure rules and procedures for new and updated regulations.

4. Boosts Customer Service

Automation helps agents to spend more time with clients than chasing paperwork. With faster overall processing, your team can close details quickly. Such efficiency leads to higher revenue and returns. Automation not only reduces customer acquisition time but also offers insights on personalized insurance pricing. Therefore, consumers can receive cheaper or better coverage. On your part, your firm can enjoy stable margins and assess your risks accurately. A study by Accenture reveals that customers are ready to share personal data to get cheaper coverage and personalized offers.

5. Underwriting

Underwriting is a unique aspect of insurance that also benefits from automation. Usually, it involves gathering information from many sources to determine and mitigate risks for chosen policies. For example, agencies can extract data to understand how creditworthy an applicant is. It can also help understand how much an applicant’s net worth today should affect life insurance packages. Or perhaps, risks and habits of an applicant should determine their premiums. Usually, connecting these dots and arriving at a conclusion takes weeks. But automation handles the data collection and extraction effectively. It also pre-populates data fields and assesses loss runs. Thus, reviewing customer histories becomes easier. Overall, you can reach a more accurate decision about the client in a short time.

[Also read: Decoding the insurance sales funnel]

Concluding Thoughts

Of course, there are many more use cases and benefits of automation in insurance. In the future, intelligent automation software will also ramp up these benefits. Workfusion states that in the coming years, companies can expect over 90% accuracy improvements. They can also expect a 30% free up of resources and 100% regulatory compliance. In turn, they can achieve over 50% higher profitability. Studies also show that insurance automated software can even fund itself with 100% ROI in the first year. Overall, automation can transform your operations and elevate employee satisfaction. It can boost customer retention leading to higher profit margins and success for your insurance firm.

If you want to automate your insurance workflows, check out LeadSquared no-code CRM trusted by leading insurers such as Acko, Kotak General Insurance, Max Bupa, Max Life, and more. Try it free.