The insurance industry has struggled with legacy systems and siloed infrastructure for a long time. The increasing adoption of digital, and customers’ rising affinity towards InsurTechs have made Insurers realize that only a transformative approach can let them survive and thrive in a fast-moving digital world.

The root cause of inefficiency in insurance operations is manual processes and the lack of agility in trying new technologies.

To remain competitive in a fairly saturated market, Insurers need to let go of manual, time-consuming processes. Optimizing both front-end (for superior customer experience) and back-office operations is the need of the hour. Intelligent process automation in insurance can resolve most of the operational challenges. Let’s see how.

What is intelligent process automation?

Automation solutions integrated with artificial intelligence (AI) is transforming the insurance business ecosystem. It is opening new possibilities and addressing challenges that were impossible to implement before. Intelligent Process automation (IPA) can automate the entire insurance workflows. At the same time, it allows the system to learn, improve, and adapt to the changes as it moves forward.

One of the widely used use cases of intelligent process automation in insurance is that of using Machine Learning in automating underwriting, identity verification, and fraud control.

Some of the largest global insurance institutions are already leveraging automation principles to drive value and save exorbitant expenditures while increasing their profits.

In another instance, Acko registered a 40% increase in insurance sales per agent after implementing Insurance CRM software for sales process automation.

The need for insurance process automation

Automated software applications carry out more tasks than humans can accomplish, supplement their manual efforts, and even perform tasks that go beyond human capabilities.

The key to operational excellence, digital transformation, and improving customer experience is to automate workflows, wherever possible.

There is also an urgent need to explore the automation potential for manual processes managed outside of core system applications, such as invoice processing, insurance certificate generation, proposal, and claims, data entry, payroll audit, etc.

The Insurer workflows that still use legacy systems are overflowed with routine back-office operations and are heavily reliant on manual and outdated methods.

Insurers also struggle with impediments such as duplicate and manual processes, contrasting and stranded legacy systems, multiple data sources that do not communicate with each other, scattered conversations, complex business models, and miscommunication in organizational structures.

The complicated workflows, time taking deployment of initiatives, and relying too much on manual intervention not only increases the company’s expenditure exorbitantly but also leads to a bad customer experience and lesser sales opportunities.

Advantages of intelligent process automation in insurance

Simple solutions like Insurance CRM can help Insurers streamline their basic workflow that relates to critical operations such as sales, marketing, support, underwriting, customer lifecycle management, and opportunity management.

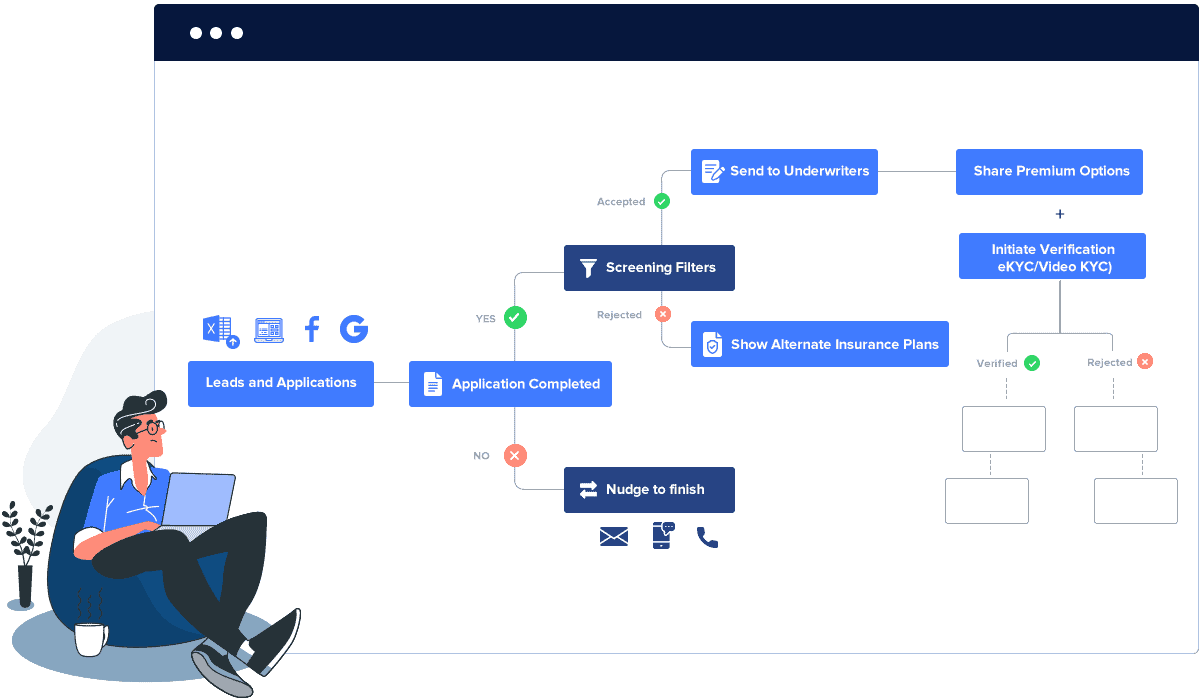

The following workflow illustrates the automation in STP (Straight-through Processing) for insurance policy distribution.

1. Streamline data processing

Insurance companies need to manage large amounts of data. Data processing requires a lot of resources, such as labor, time, and money, when performed manually by humans.

Human-based tasks also multiply the possibilities of errors, which brings down the overall quality of operations and increases rework and risk.

Intelligent Process Automation makes data processing run without complications and errors. The result is faster and efficient data processing.

It also complements the human task force and enhances productivity by eliminating mundane and repetitive tasks.

IPA can prove fruitful for document-intensive tasks such as ID verification, processing data for quotation generation and approval, processing invoices of insurance claims, to name some.

2. Bridge the gap between legacy and contemporary systems

McKinsey estimates that up to 40% of P&C and life insurers’ expenses are locked up in their top 20 to 30 core end-to-end processes. One of the top reasons that most insurance companies and agencies are still reliant on legacy systems is due to the cost of overhauling the whole process.

On the other hand, delaying the adoption of new technology/tools can compromise the business. Therefore, the insurance industry needs a system that integrates the existing system and the new one.

Intelligent Process Automation can smoothly handle challenges such as frequent system updates, data migration, and integrating new software with older legacy systems. They also create an ecosystem where internal systems can easily interact with external companies, vendors, customers, etc.

3. Increases compliance, regulation, and protection

In the U.S., the insurance segment faces the same kind of scrutiny as the health sector does; the ever-changing laws that advocate individual privacy protection, regulatory compliances, audits (internal and external), claims process, and more.

These elements are obligatory requirements for insurance firms, which makes automation even more essential for them.

Software with IPA in place generates detailed logs of all transactions and from every source. It becomes easier to track the end-to-end processes and assure that every stakeholder is compliant with the government regulations. It also ensures that external audits are no longer an issue for insurance companies.

4. Achieve scalability

While scalability is every Insurer’s goal, only a few achieve it. For instance, due to the Covid-19 pandemic, the demand for health insurance products suddenly accelerated. In India, health insurance premiums saw a 13% YoY growth. However, Insurers took months to introduce relevant products and cater to the rising demand of customers.

Scalability corresponds to the capacity to be flexible enough to change in size to balance the demand-supply equation. When the demand is high, the system should be able to handle the additional work without additional resources. The insurance industry is heavily dependent on manual labor and requires a lot of resources to handle different tasks such as sales, marketing, legal, underwriting, and claims.

Whenever there is an increase in customer acquisition or a claim, the workload drastically intensifies, and there is an imperative need to scale on demand.

Intelligent Process Automation increases the organization’s work capacity without additional costs or workforce. It reallocates the resources so that employees can focus on nurturing customer relationships, strategizing, driving change, managing exceptions, and implementing continuous improvement – giving the insurance company a strategic edge over its competitors.

5. New insurance product development

The insurance industry frequently adds new features or churns out entirely new products depending on Consumers buying trends, demands, requirements, and other factors such as regulatory laws, etc.

Intelligent process automation is capable of mining through vast data and helps in predicting the next product or service innovation. By facilitating a sandbox approach, Insurers can test new products under a regulator’s oversight in real-time.

It reduces the risks of spending large amounts of capital and resources on products that have lesser chances of success.

In short, IPA in insurance can streamline the following activities:

- Automated document processing

- Perform agent setup

- Calculate and present Insurance quote

- Assign claims to relevant stakeholder

- Manage products and services pricing

- Manage and support distribution channels

- Deliver policies

- Evaluate fraud

- Launch new and enhanced products and services

- Optimize processes by reallocating workforce to core value-added tasks

- Advertise and promote products and services

- Produce bill and quote statement

- Issue payment

- Analyze the market and determine customer needs

- Manage the selling process

- Perform accounting

- Perform reporting

Intelligent process automation in insurance use cases

- Utilize online information to identify claim fraud patterns.

- Identify up-sell and cross-sell opportunities based on customer interaction patterns.

- Improve customer experience through AI bots with natural language processing capabilities to manage customer service interactions

- Analyze sentiments, intent, and behavior to design customized insurance products

- Speech analytics to understand customer perception for the brand

- Improve efficiency by using machine learning methodologies to identify and repair process blockages

- Use machine vision to assess the severity of damage to car/properties etc., using real-time video footage.

- Identify risk attributes associated with customers for accurate underwriting.

Market disruptions by intelligent process automation in the insurance industry

We have looked at all the positive outcomes of implementing intelligent process automation for insurance companies. Let us also look at some market disruptions that IPA may cause in the insurance sector.

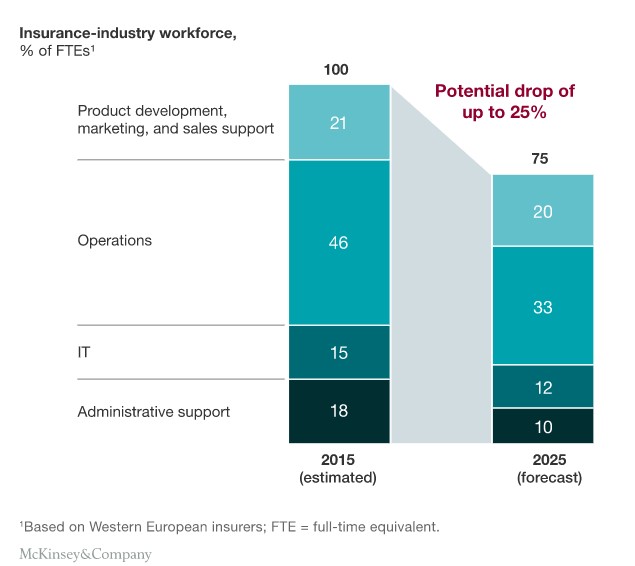

- 51% of financial jobs are prone to be transformed by automation.

- Demand for skills in areas such as data analytics, machine learning, and the development of algorithms will increase. At the same time, business development, product, and marketing roles will also see its fair share of growth.

- These skills will better enable insurance companies to build new insurance products and services using dynamic pricing strategies based on social profiling and lifestyle pattern intelligence and recognition.

- Automation in digital marketing campaigns will also see a rise. The system will automatically profile customers and identify their needs.

- Operations such as policy servicing and reporting will be affected by automation with highly streamlined digital processes.

- Back-office services will drop significantly with the sharpest FTE (Full-time Equivalent) shift and migration.

- Roles will be created by the intelligent process automation in claims by leveraging technologies such as machine vision and optical character recognition to assist employees in resolving complex claim cases.

- Employee-count in the IT and other support functions departments would decrease because of a standardized and automated process and the potential migration to automated cloud platforms and analytical tools. These drastic shifts will also lead to the creation of more fulfilling jobs in the transformed insurance landscape.

- Underwriters and insurance agents of the future will use the tools that work with inputs provided by the cognitive system created by the intelligent process automation.

- Insurance companies will need to upskill the different layers of the employee pyramid to re-deploy human resources into more complex, quality-controlled, judgment-intensive roles.

The bottom line

During this time of enhanced digitization, insurance companies need to react faster to the changes in the market and customer behavior. It will help them reap the benefits that far surpass their competitors, who still utilize legacy systems.

In simplest terms, to leverage IPA:

Check for automation opportunities in your existing system.

The best solution to automate operational processes is to use an intelligent Insurance CRM software. It will help you manage all your products, intermediaries, teams, and distribution channels. When you use a unified platform across teams, productivity and operational efficiency will automatically increase.

Ask yourself why you would need to implement IPA?

We have seen the benefits, cost-savings, and operational efficiencies that intelligent process automation brings to your organization. Now, it is time to think about the business opportunities that you might be losing by not implementing IPA.

- The impact on business after relieving human resources of repetitive tasks

- Business gains due to improved quality and accuracy

- The impact on revenues by improving speed-to-lead and customer acquisition

It is best to automate a few pilot processes to measure the practical benefits based on a live test scenario. Pilot projects can also improve your understanding of the bottlenecks in your business processes and identify the success factors in your organizational ecosystem.

Select a reliable automation partner

You may already have worked with a partner to automate a few software or processes, but will they be able to handle a large-scale overhaul?

Select your automation partner that can match both your current and future needs.

Leadsquared has helped many Insurers succeed and experience measurable business impact by offering business-critical solutions such as automation for sales, marketing, underwriting, to name some.