The mortgage lending landscape is witnessing a rapid change in the United States. Banks are looking for a technologically superior and modern loan management system. Solutions like mortgage banking accounting software top the list as they can automate their key processes. Of course, financial institutions seek a fast, flexible, and scalable option, but they also need an agile and cost-effective solution.

According to Brian Lynch, founder & president of Advantage Systems, the initial business accounting systems were not operating at the loan level, and they could not integrate with other systems.

The modern-day mortgage banking accounting software have evolved and support various facets of loan management. It facilitates banks in automating their procedures, thus allowing them to offer a better customer experience and achieve cost savings. Moreover, tech-enabled lending processing also improves productivity throughout the loan lifecycle. In this article, we will discuss how to use the software for end-to-end loan management.

The problems that mortgage accounting software solves

Lenders have had a tough time dealing with redundant spreadsheets. Especially when the scale of the business or the loan volume grows, spreadsheets just cannot cut it. Apart from eliminating manual processes, mortgage software helps in the following ways.

- It provides loan-level details to the lenders, such as credit lines, non-performing loans, participation loans, and more.

- Detailed account details: it records the interaction history at the account (customer) level along with the outstanding loan amount, repayment date, and credit history with other lenders.

- Mortgage software integrates with other services and tools like ElliMae, Calyx, Experian, BlackKnight, Equifax, and more for automating the loan lifecycle management.

- Reduces operational costs by eliminating manual record-keeping, document management and more. With improved team collaboration, lenders can significantly improve operations and reduce costs.

- Mortgage lenders must remain compliant with lending regulations and GAAP (Generally Accepted Accounting Principles). Software solutions help lenders ensure that workflows are as per the guidelines and teams follow the procedures diligently.

How to Use Mortgage Banking Accounting Software for End-to-End Loan Management?

Leadsquared mortgage CRM is the perfect solution for mortgage banking requirements. It is highly customizable and can integrate with several systems. Moreover, it also offers a superior credit rating process. Starting from prospecting to closure, it is the best system for end-to-end loan management. The following are the details.

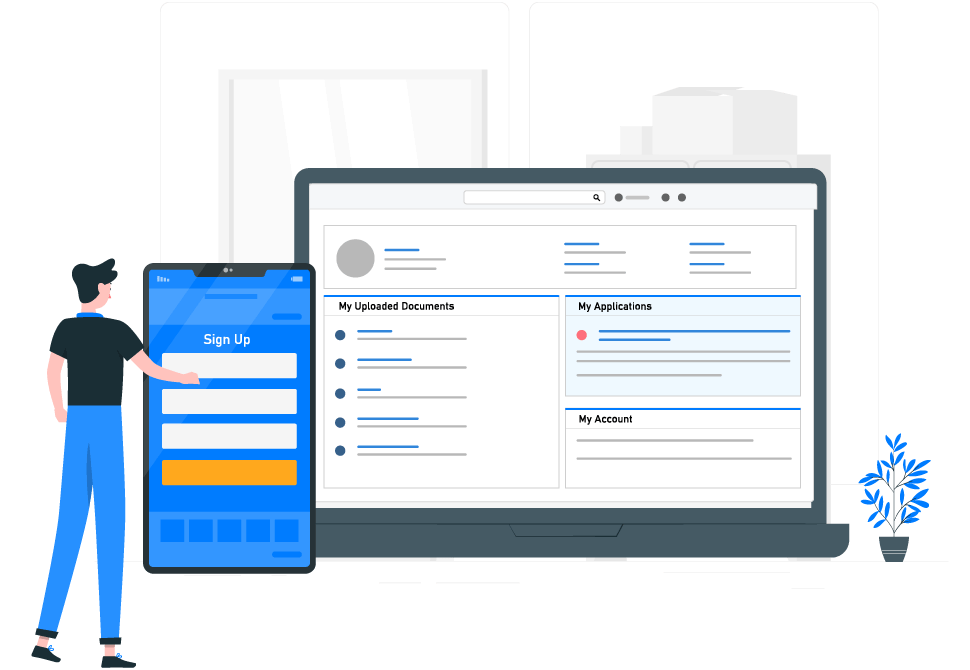

1. Manage Loan Application with a Digital Portal

A manual loan application can slow down the process. Moreover, it also increases the risk of errors and missing data. Thus, leading to future problems between the credit department and the customers.

In this digital era, banks must manage the loan application through a digital portal. Of course, it will reduce manual errors and missing data problems, but it will also improve the overall customer experience. Using the online portal, borrowers can fill out the application forms from their homes. They can also upload the supporting documents and e-sign disclosures.

Offering such convenience to customers also increases the number of qualified leads for banks. Thus, resulting in a win-win situation for both parties.

2. Integrate Leading Software and Services

Having a standalone mortgage banking accounting software is not efficient. Integration with other software and services is essential. Otherwise, it will create several bottlenecks in your loan management experience.

Banks must choose a product that can integrate with other leading services. For instance, integration with a loan origination or productivity tool. This integration functionality will reduce the number of bottlenecks and process inefficiencies. It also offers a seamless experience to your customers. Moreover, the software must also integrate with leading credit scoring services. With this, banks can review and monitor the credit ratings of the borrowers. Thus, reducing the risk of bad debt.

3. Multi-Loan Category Creation

Banks need to create loan accounts across their entire portfolio. These include both EMI-based and non-EMI based loans. The software must allow both banking and non-banking institutions to create multi-loan categories.

The EMI-based product consists of credit cards, loans against property, and personal loans. On the other hand, non-EMI-based products consist of advances or overdraft loans. Thus, allowing the banks to have greater visibility. Moreover, creating a multi-loan category will also improve efficiency across the loan lifecycle.

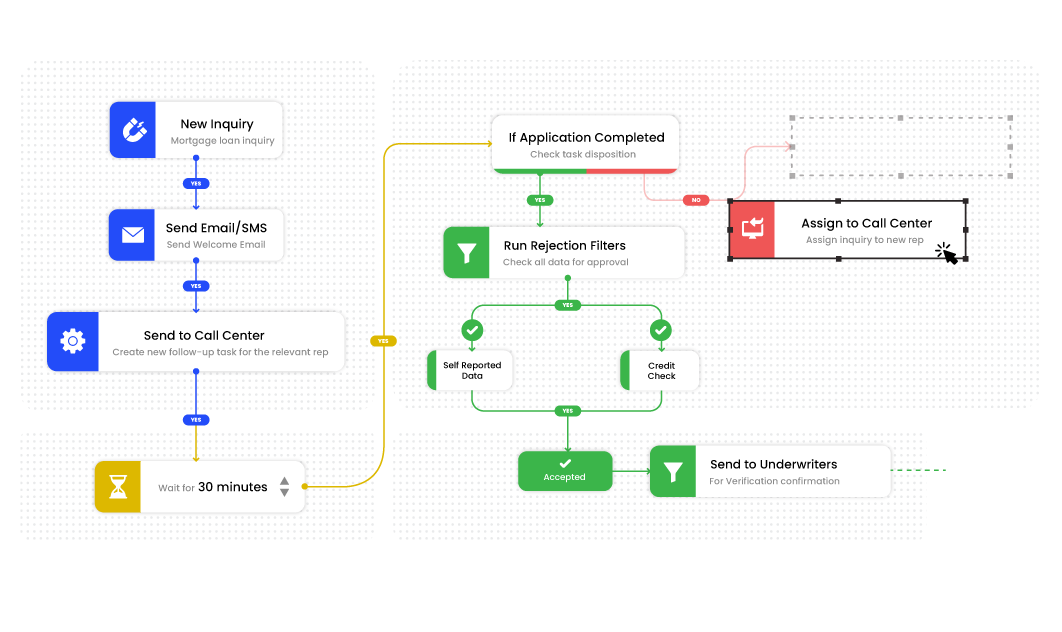

4. Workflow Automation

You can use the mortgage banking accounting software to automate the workflow. Leadsquared CRM has a drag-n-drop editor to create automated workflows in a go. The software provides you with an easy to use and intuitive interface to create a workflow.

The proprietary workflow designer lets you create engaging automation. For instance, you can automate the entire loan application process. This automation will help in minimizing data entry errors during the application process. Of course, it will reduce back-office processing. But it will also improve your turnaround times. Thus, allowing banking institutions to regain their competitive edge.

5. Payment Reconciliation

Manual reconciliation processes need several amounts of working hours at banks. It often reduces the productivity of the banking system. Moreover, manual processes are more prone to verification errors.

Therefore, it is crucial to choose software that allows for efficient payment reconciliation. Using an end-to-end loan management system can automate your reconciliation processes, thus increasing efficiency and productivity. Besides, banks can also deploy their staff time where it matters the most.

6. NPA Management

Non-performing Assets (NPA) are a pressing concern for Financial Service organizations. Bad debts and long-outstanding loans challenge organizations to remain operationally afloat. Mortgage software comes with built-in analytics to help banks predict and manage risks. Banking institutions can adopt a proactive approach to managing credit risks. Using the software, banks can analyze and report early warning signals.

The in-built analytics helps the banking institutions to reduce the possibilities of defaults. Thus, ensuring they can achieve a better return on investment for their institution.

7. Monitoring Loans

Banking institutions are widely adopting alternative credit scoring models. It is because continuous loan monitoring has become essential for banks.

Therefore, use a software solution that can integrate credit inputs from various sources. It will allow you to have a detailed understanding of the loan creditworthiness of the borrower. Moreover, through continuous monitoring of loan activities, you can recover your debt faster.

8. Credit Bureau Reporting and Analysis

It is crucial to integrate data from multiple credit rating agencies. It helps bankers to understand their customers and their financial behavior. Thus, improving the quality of their decisions, resulting in better credit management.

The software can help bankers overcome the problem of incomplete credit bureau data. The integration with several reporting agencies will also improve the loan approval rates.

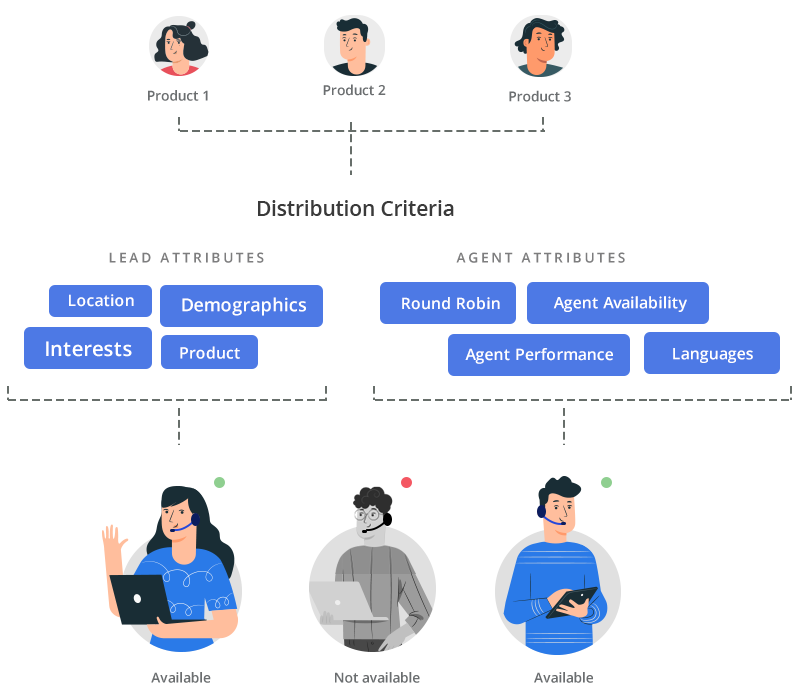

9. End-To-End Call Center Automation

For efficient banking operations, it is crucial to have a well-connected system. More precisely, lenders need a system that can manage end-to-end call center operations. The lending software allows you to route the leads to the call center efficiently. Whether you are capturing them online or offline, the call centers must know the lead details immediately.

Leadsquared mortgage CRM allows you to distribute the leads effectively. Banks can distribute loan-leads among call center executives or in-house sales teams based on several factors. These factors include the interest in a product, the language they speak, and much more. Moreover, the lead distribution can also take place in a round-robin manner.

The automated lead distribution strategy increases the efficiency of the call centers. Thus, helping the banking institutions in expanding their loan books.

Final Thoughts

Mortgages are at an all-time high. The rising urbanization and improving lifestyles mean that these numbers are only going to increase in the future. In 2019, the United States accounted for $16.1 trillion in outstanding mortgage debt. And the amount of outstanding mortgage debt is steadily increasing since 2012. Thus, representing the rising demand for efficient loan management and accounting software.

Having an end-to-end loan management software is beneficial for both the bankers and the customers. For banking institutions, it simplifies the complete lending process. It helps them in identifying market gaps. Moreover, it allows banking and lending institutions to disburse loans with precision. Thus, allowing them to create more value for their customers.

From the customer’s perspective, a digital application portal simplifies checking eligibility and applying for loans. Thus, customers can also enjoy a seamless application process. Moreover, if they qualify for loans, then they can also get simple and faster access to their mortgages.

If you are looking for a software solution to streamline your lending processes, you must try LeadSquared mortgage CRM!

Mortgage Accounting Software FAQs

Mortgage brokers generally use LOS (Loan Origination Software) or mortgage CRM for loan origination, servicing, and recovery automation.

LeadSquared mortgage CRM software is best for loan origination and end-to-end loan lifecycle management.

Lenders account for loan receivables by recording the amounts paid out and owed to them in the asset and debit accounts of their general ledger. A loan accounting system is a software solution for managing loan receivables. It is a double-entry system of accounting that makes a creditor’s financial statements more accurate.

A mortgage loan origination software (LOS) is a digital tool that allows lenders to manage different stages of their loan servicing cycle – right from application to disbursal. The primary purpose of mortgage LOS software is to help lenders process loans faster. Details.