The financial shocks from Covid-19 are still rippling through the global economy and causing stress on the re-payment capabilities of borrowers. In FY21, the microfinance loan portfolio grew by 17%. However, the increasing count of re-payment delinquencies has severely affected the collection efficiency of microfinance businesses.

Today, the micro-credit industry needs a reliable, agile, and digital lending and collections framework. In this Episode of the lending roundtable series, LeadSquared brings you a discussion with senior leaders on digital transformation in the MFI segment and solutions to microfinance challenges.

Panel:

- Purvi Bhavsar, MD and Co-Founder, Pahal Financial Services

- Vivek Tiwari, MD, CIO and CEO, Satya MicroCapital Limited

- Kalpana Sankar, Managing Director, Belstar Microfinance Limited

- (Host) Nilesh Patel, Co-Founder and CEO, LeadSquared

Key Discussion Points:

- What are the emerging challenges and trends for MFIs?

- How do new tech models potentially minimize credit and operational risks?

- How to create an agile operational credit framework

- How can new-age collection systems improve the health of your loan book?

Watch the webinar or read the takeaways below to know how you can create an effective lending process for a healthy loan book.

What were the challenges MFIs faced 10 years ago? Has GST and the Covid-19 pandemic affected the MFI sector? What are the new challenges you foresee?

Vivek: When I go back 10 years from today, almost at a similar time, we faced the AP crisis in Andhra Pradesh in 2011. Then we were an unorganized, less recognized, and less government-controlled sector at that time.

Today, we have the small finance bank and universal bank licenses. We have grown to almost three lakh crore portfolio that includes Banks and SMEs, who have also grown with us.

Sure, there were (and are) challenges. But this industry has bounced back in a different way. Our recognition and strength were realized by almost all the stakeholders within the country and abroad. The best innovation of the decade, especially during the peak of the demonetization crisis, was digitization.

Demonetization made us digitize our models. We’re more like a micro-fintech company now. Most of our processes have become digital with real-time data analysis and decision-making.

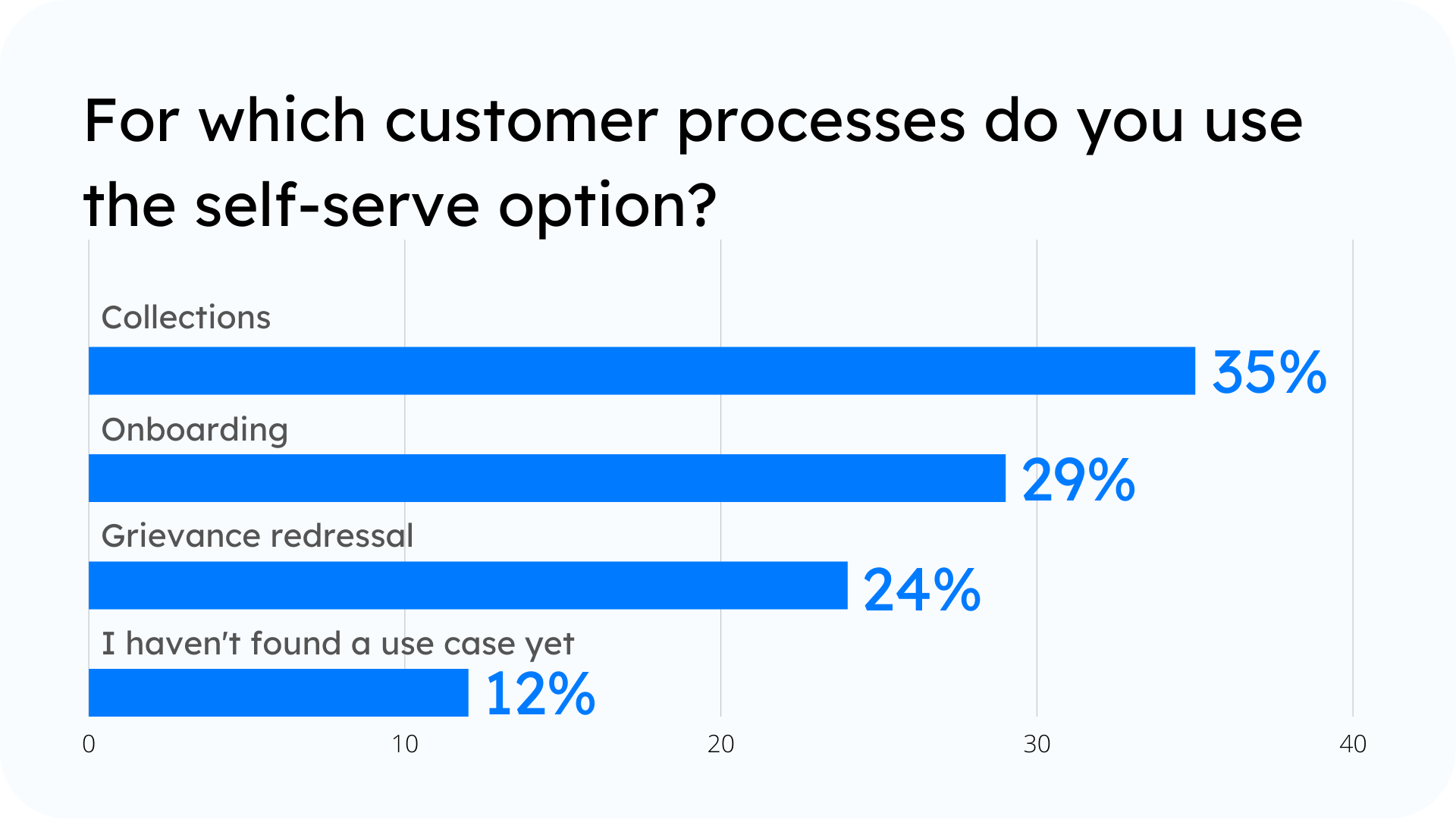

Audience poll: For which customer processes do you use the self-serve option?

Kalpana: From 2002 to 2016, average income has gone up only by 5%. But the borrowing has increased by 25%. We should worry about it in the long term because a lot of debt is going towards consumption.

Purvi: Every crisis in the microfinance industry brings a little more speed to the change. For example, during demonetization, our entire cash disbursement was removed, and we started disbursing loans into the bank accounts. And this time, I think the focus is more on digitizing collections.

At the industry level, the Government of India’s initiative of JAM Trinity—Jan Dhan Yojana, Aadhaar, and the Mobile number have been very helpful. Because of this, we can disburse in the customers’ accounts. We can also pull out the Credit Bureau reports very efficiently. And mobile is obviously helping with all these digital initiatives.

Now, coming to the digitization and the challenge that the microfinance industry goes through at the time of every crisis.

As soon as a crisis occurs, the impact can be seen on the productivity of people.

Let’s consider field operations.

Suddenly, the same number of people are required to make multiple attempts for collections. A lot of it becomes easier when we digitize collections. It also helps us standardize processes.

Microfinance is a very manpower-intensive business. But, through digitization, if you’ve made your processes right—like customer onboarding, customer geotagging, and digital payments—you’re less likely to get impacted by political and environmental disruptions.

How do you see the quality of processes and the level of digitization in India and abroad?

Purvi: M-PESA, Africa’s most successful mobile money service, is an excellent initiative. They moved a lot of transactions to digital including microfinance transactions.

However, when M-PESA was launched in India, it didn’t take off really well. Maybe it was a little ahead of time. But now we see an increase in the UPI transaction here as well.

Vivek: My observation is that Indian microfinance companies have the lowest lending rate worldwide. Also, our operating costs are the lowest. We are operating in the range of 6-7%, whereas, globally, operating cost is in the range of 10-15%. Even though our loan products are restricted by the central bank, we’re able to survive and bring efficiency throughout.

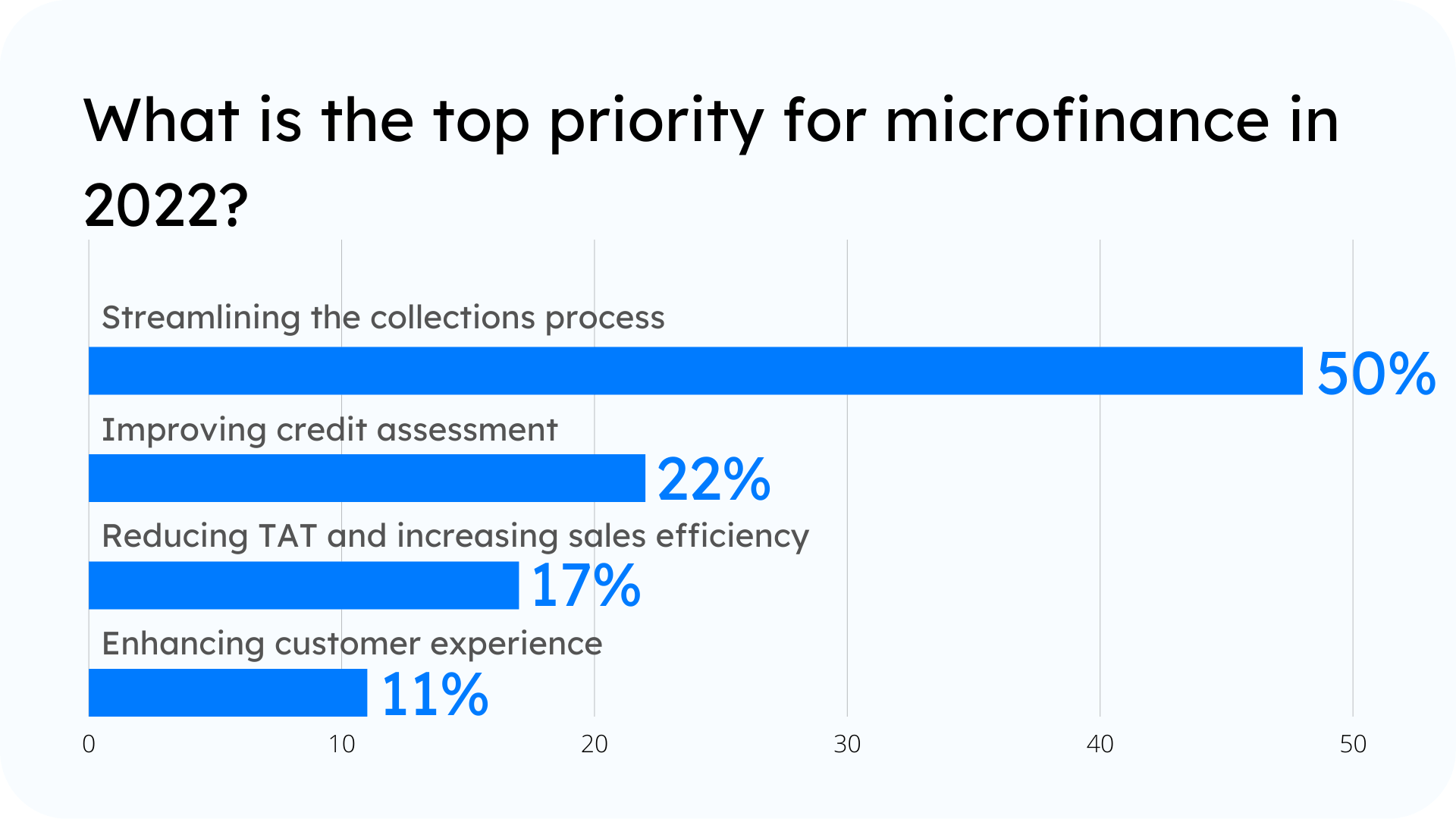

Audience poll: What is the top priority for microfinance in 2022?

Different MFIs are at different stages of digital evolution. Do you rate MFIs in these terms?

Purvi: So far, there is no metric to measure the level of digitization. However, almost all MFIs have switched from cash to bank account (digital) disbursement.

Most established companies have moved their loan origination processes to a digital platform. But smaller companies would find it difficult. It is mainly because the portfolio is so small that the investment in technology may not justify until they reach a certain level.

In terms of collections, the two major processes are collection and disbursements. The collection is now the next big milestone that most enterprises are now aiming at. People are looking at digitizing the collection processes over the next 18 to 24 months.

Internet penetration is increasing, and companies are reading some user data. The same is the case in rural areas. By 2025, we will have more rural internet users than urban ones. These are very enabling factors for MFIs.

How do you see the MFI sector shaping up? Will there be a consolidation where only a certain number of players would survive? Or the market is large enough for more and more players to come in?

Vivek: India is a big country. We need more microfinance institutions on the ground. As of now, we have 53 institutions. 70% of microfinance is controlled by small finance and universal banks in India.

The demand is huge. But we’re not able to meet those demands. If you look at the microfinance map of India, almost 80-85% of loan customers are microfinance customers. And this is excluding the rural customers, who are underserved.

I see that at least 200-250 MFIs are required to serve the entire country. India is a big country with almost 700 districts. To meet the demands, we need at least one microfinance institution per two to three districts.

Purvi: The household debt compared to the GDP in India is about 11%. While in the mature markets, like the US and China, it is close to about 50%. So, there’s a huge gap. At least, in the next 5-10 years, I don’t see growth as an issue. We have enough opportunities, and we have enough to do.

What changes do you foresee on the product side? How do you see the group loan concept shaping up?

Vivek: In place of joint liabilities, i.e., groups, you’ll find common collection points. Especially in rural areas, people come to a common place for awareness, education, and likewise for collections. It reduces the cost of collection and information sharing.

But if we expect to be paid by one group member from the other members, there may be some limitations. As a theory, using our limited liability groups, where the liability of a group member is limited to up to just 10% of tenure of 3 or 4 only. We don’t want to pass the responsibility of bad customers on to good customers. At the same time, we don’t want to lose our good customers because of the bad ones.

We’ve started improving the group lending model. In some way or other, the group will be there for the next 5-10 years because it reduces the cost of operations and brings transparency to the system.

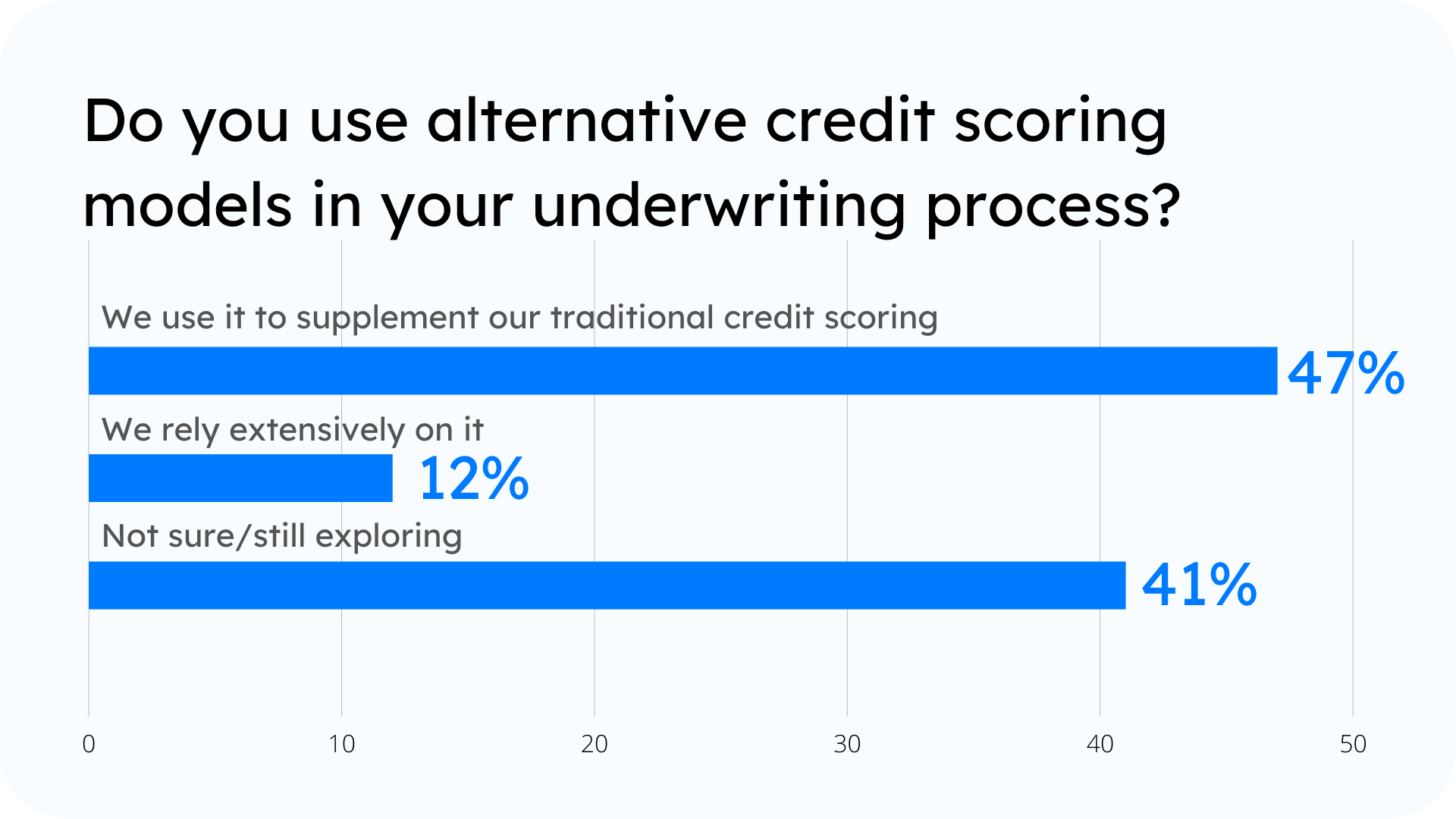

It also brings us to the actual underwriting process. We underwrite by just using the group guarantees. Because we know how much they trust each other. However, enforcing the joint liability of the collections will be a challenge. And to which extent we’ll be able to do so—we, as an industry, will have to find out.

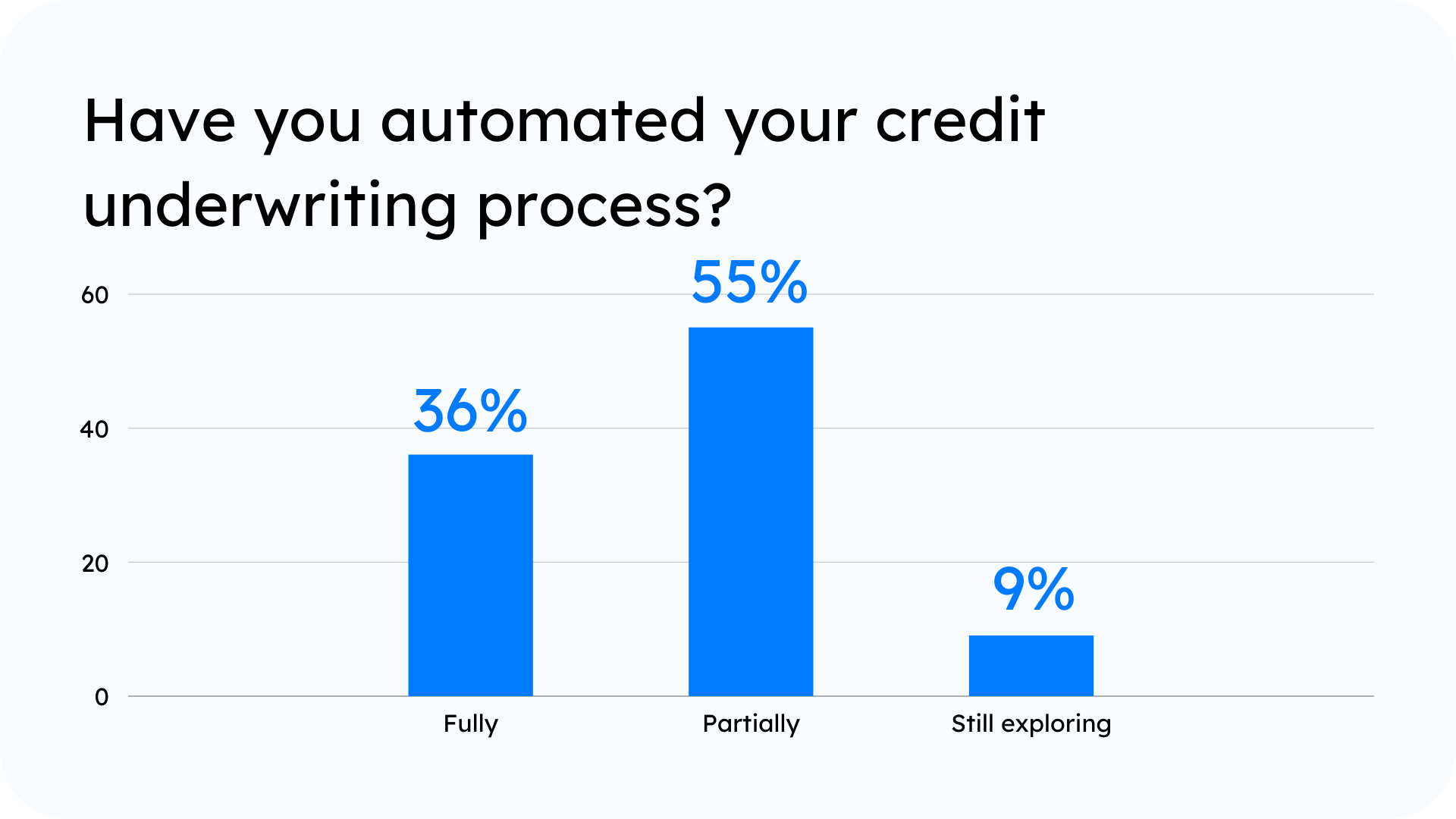

Audience poll: Have you automated your credit underwriting process?

Purvi: The aspiration of the middle class of the 90s is now the aspiration of the customers we are servicing today. As microfinance institutions, we prefer to be available to them at every stage of their lifecycle requirements.

It may be starting from a small group-based loan where they borrow 20-30,000 rupees because they are not capable enough or do not have the credibility. Then they can move to very focused loan products. For example, buying a mobile, television, two-wheeler or education loan, or affordable housing loan.

So, the loan product is going to evolve. And hopefully by then, in 10 years, we would have created enough credit records for them to move to the next level.

What are the digital interventions to reduce fraud?

Purvi: With customer apps, customers or family members can easily check the latest balance, the number of paid MLs, or the last EML credited to their account. It may not completely eliminate the fraud but can reduce it to a great extent. Because the staff is well aware that a customer can view the statements like money is not credited. You also have an option to directly connect with the customer in case of any query.

Vivek: There have been ghost loan frauds in the past, where companies would create false loan agreements and collect cash disbursements from banks. Today, such frauds are not possible.

At our institution, we send SMS to borrowers immediately after the collection meetings (if they’re not paying us today). At the end of the day, we remind them that today was your due date, and you have not paid your installment. In case they’ve paid the installment, they would call the loan officer at grievance numbers, and we track them immediately.

Whether they’re paying or not paying is one thing. What really helps is—the smooth flow of data from the branch office to the head office. We can track every account in just a fraction of a second. So, when the data is there, tracking becomes very easy.

During the pandemic, many of our field officers left us. One original business died in summer in Rajasthan, and almost the entire branch had left for 15 days. However, replacing the entire branch and tracking every borrower was not challenging for us. With the help of geotagging, we were able to reach out to customers from the next day onward. From 100% meetings, our collections were almost on track.

The pandemic also tested our digital capabilities. We are almost paperless and cashless in our operations. Our 95% of collections are digitized as of now. Almost 30% of customers paid directly from their account to our account, either through biometric readers, which are being carried by our loan officers, or through apps like Paytm, MobiKwik, etc.

The chances of fraud have been reduced significantly on the ground. And even the monitoring has become easier. By using the word search, we can monitor our branches. If I want to track a supervisor, I need not travel at all. We can connect remotely, comfortably.

The technology has reduced operating costs and brought more transparency on the ground. The issues that were there with microfinance before are not there today.

Audience poll: Do you use alternative credit scoring models in your underwriting process?

Has your % spending on tech increased over the last five years? Do you see it going up as a % of loan book or profit/revenue metric?

Vivek: In our case, 1% is the cost of the digitization at Satya. And out of my 10% limit, almost 10% is the digitization cost as of now. If I’m able to bring it from 1% to 0.5%, I think my operating costs will reduce by 1 or 1.5%, and the net gain will be around 2%.

Purvi: The percentage of your loan book is a good way to look at it. For a very short time, the cost is likely to go up. But you can also pick up sales and “pay for what you use” kind of models. So, you may not need to put a lot of money into capital investment. By paying on a usage basis you may not strain your expenses or balance sheet. Once you have your processes in place, productivity is bound to increase.

Is the microfinance industry comfortable with cloud technology cloud systems?

Vivek: Without a doubt, the cloud is the only option. Having our own server and keeping it on our own premises increases the risk and cost. The only thing is the regulators are asking for more information: how you are using it and what security measures you have taken.

Audience questions

What are the successful loan amount ranges for LMI segments?

Vivek: EMIs up to 100 rupees per day is comfortable and manageable. When it goes beyond 100 rupees a day, it means they are moving through difficulties.

Purvi: So that’s about 40,000 to 50,000 kind of a loan for 24 months.

Can we see an asset-like model with branches of micro banking like Zomato and Swiggy in the microfinance sector?

Vivek: For me, maybe after 10 years from today. For the next five or seven years, that is not the reality. But definitely, the potential is there.

Purvi: Currently, microfinance thrives on relationships, the comfort of the person visiting their houses and collecting the money, and conducting the meetings, which is not going to go away very soon. I agree that it will take some time to reach that level of operations.

Microfinance or any financial services is not a game of distribution. It doesn’t matter how efficiently and how quickly you can distribute money. The success lies in how efficiently you can bring the collections. How much can you collect on the due date? And how efficiently you can bring that money back into the system is the test of success for any financial service.

Kalpana: Partnership with fintech companies can bring a lot of value. FinTech companies are promising loans within five hours. I think partnerships between 5 and 6 companies can begin new products, and we can service customers at a faster pace.

Are tech enhancements of support functions such as audit risk important in the growth of an MFI?

Purvi: Just a small example, we have about 200 branches. Now, tallying the cash every day is a manual activity. It takes up a lot of time, and we run in shifts. We are right now contemplating the idea of putting bots instead of manual intervention. With this, we would be able to tally cash well within the turnaround time, and we will not be required to work a shift. Since it will be digital, we can pull reports on time.

Also, for support functions like audits, you need not go to the field for checking every small little thing. You can geotag your branch the same way you geotag your customers. So, before you disburse loans, you can see how far the center is from the branch, which was earlier done manually by the auditors. Digitization is critical for both—disbursement and collections.

Vivek: Remote audit is the best innovation so far. As an MD, I can sleep properly because the process governance and controls in the branches were properly taken care of by auditing. We have digitized cost movements. This is documented in our minutes. We don’t have any pain in closing the casebook at the end of the day.

Do the MFI work on partnerships like the DSA model?

Vivek: As an industry, we don’t have a DSA model, we have employees, branches, and trained employees on the ground. With their help, we run our business. But on the other side, we work as banking correspondents for banks when the final approval of the loans is in the bank.

Speakers

Purvi Bhavsar

MD and Co-Founder, Pahal Financial Services

Purvi Bhavsar is a first-generation entrepreneur from Ahmedabad and Co-founder of Pahal Financial Services Private Limited. She has a prolific experience of over 27 years in the areas of BFSI and Telecom industry, having worked in many reputed organizations like Kotak Mahindra, HDFC Bank, ICICI Bank, and Vodafone India. She was recognized as one of the Top 10 women in Finance – 2020 and also is currently serving on the board of an affordable housing finance company.

Vivek Tiwari

MD, CIO and CEO, Satya MicroCapital Limited

Acquiring prolific experience of nearly two decades in the microfinance sector to promote financial inclusion, social entrepreneurship, and impact investing, Mr. Vivek Tiwari is the MD, CIO & CEO of SATYA MicroCapital Ltd – one of the leading NBFC-MFIs across the nation. He is also a member of Governing Board of MFIN (Microfinance Institutions Network) – an association for the microfinance sector in India. He is recently recognized as Promising Entrepreneurs of India 2021 on 28th September 2021 by The Economic Times.

Kalpana Sankar

Managing Director, Belstar Microfinance Limited

Dr. Kalpana Sankar is the Managing Director of Belstar Microfinance Limited, a leading microfinance institution, and also the Managing Trustee of Hand in Hand India since 2004. She was the first recipient of a scholarship to pursue an Executive MBA from TRIUM. She is the recipient of the “Princess Sabeeka Bint Ibrahim AI- Khalifa Global Award for Women Empowerment. She has also received the “Nari Shakti Puraskar-2016″ for the contribution to the empowerment of vulnerable and marginalized women.

Nilesh Patel

Co-Founder and CEO, LeadSquared

Nilesh is the CEO of LeadSquared, a sales execution platform. He is focused on helping businesses in high velocity, high volume sales to improve their sales execution and increase sales efficiencies. He is on a mission to build LeadSquared as the software partner of choice for sales execution for businesses. Previously, Nilesh was the founder of Proteans, a recognized leader in the software product development services space. Nilesh has a degree in engineering from Delhi University, and before founding Proteans spent four years in IBM with their microprocessor test tools division.