Insurance is a product that no one actively searches for unless forced to. To convince people to buy insurance, you need to educate them on the importance of the product. But, to do that you need a list of leads that you can target. Selling insurance is hard enough, but how do you crack insurance lead generation?

In this post, we will go through several cutting-edge tactics that will help you generate more leads for your insurance business.

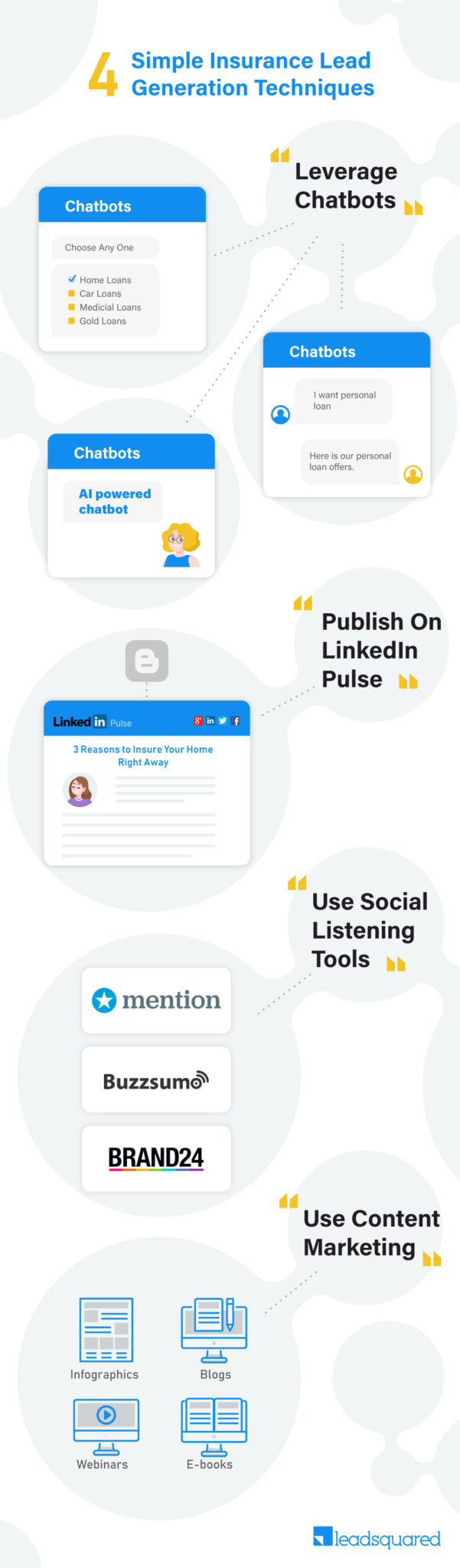

Simple Techniques to Generate Insurance Leads

Technology has improved so much that many businesses have turned to it to help them solve their daily sales and marketing troubles. Insurance is not far behind. Agents used to knock on every door trying to get people to insure their lives and belongings. However, everything is online now.

Let’s see how you can take the help of technology to generate quality leads.

1. Leverage Chatbots

According to a Gartner report, chatbots will drive 85% of customer service interactions. What’s more interesting is that the study says you’re more likely to have an interaction with a chatbot than with your spouse.

Chatbots offer a wealth of functions ranging from customer support, improving engagement, and improving the number of leads you generate. If you combine all of this, you can get yourself a mean lead generation machine :)

Now, let’s take a look at the kind of chatbots you can leverage. One of the simplest chatbots is menu-based chatbots.

Menu-based chatbots

Menu-based chatbots give users multiple choices to pick from. And depending on what he chooses, the bot lists out additional options. This simply forms a multilevel hierarchical set of responses.

Owing to its simplicity that follows an “if this then that” logic, such bots have captured popular sentiment.

These bots allow answering simple questions around products and get prospects immediate information pertaining to purchase.

The versatility ends there. The bots aren’t equipped to handle complex queries. Of the different menu options you list, you can have an option that allows people to sign up for your list. This way you generate quality leads.

Keyword-Based Chatbots

Keyword-based bots rely on some natural language processing to pick relevant keywords from the query and fashion replies based on those keywords.

The bot will reply back with content that strictly revolves around those keywords. The content of the answers is usually niche and topical. It can be seen as both a benefit and a disadvantage. It could be right on point with regard to what the user wants. And in some cases stray far away from the intent with cookie-cutter responses.

The lead may be looking for more information quickly. With these chatbots, you can kill the gap in time it takes for a human agent to pick up the slack.

Natural Language Processing Chatbots

Natural Language processing bots are the most advanced type of bots. They employ AI to deliver the best experience.

These bots improvise based on user input and user preferences. They also deliver better user experiences by auto-correcting typos, delivering the right results for a search.

Finally, one of the best things you can do is a program such a chatbot with responses that cater to people at different stages of the buyer’s journey. With this, you can provide them with information or lead magnets to help them transition from one stage to the next.

For example, here’s an example from Lego that offers product suggestions to me based on my input. It asks questions and understands what I like most.

2. Publish On LinkedIn Pulse

To boost awareness and get as many leads as possible be active on multiple channels.

LinkedIn pulse is one such opportunity because it allows you to post full-length articles on the LinkedIn Pulse platform.

But, what is LinkedIn Pulse?

LinkedIn Pulse is the content arm of LinkedIn. Unlike other social media platforms, organic reach is alive and kicking here.

Pulse is huge. Over 130,000 articles get published every single week on the platform.

As a member, you can self publish content ranging from blog posts, insights, news and other articles.

Businesses who share content have a wonderful opportunity of extending their reach. With LinkedIn, each individual gets content based on their interests. The content they see is highly targeted and most likely something they want to read. This improves the odds of engagement.

On LinkedIn, this is a big way to be seen as an influencer. It helps you build rapport and attract relevant influencers. Publishing content on LinkedIn turns you into a brand authority who people trust and like.

What used to be an avenue for influencers alone in the past, is now something open to everyone. Anyone can use LinkedIn pulse to put out great content, attract followers and build traffic back to their business.

The only caveat? The content should be high-quality.

LinkedIn’s own research on the subject says that 62% of LinkedIn members say they engage with content because its informative and it’s also educational. They engage with content that’s relevant to them according to 61% of members.

As an insurance provider, try writing articles that talk about the benefits of buying insurance. Cite examples, tell them the benefits, let your customers speak for you. The more authentic you seem, the more likely they are to buy from you.

3. Use Social Listening Tools

You can’t forget social media as a part of your marketing. As an insurance business, you can share your best articles, informational videos, or even run paid promotions on social media channels.

Besides, a lot of consumers have taken to social media to air their grievances. Someone needs to be there to address them. But, with a growing organization and customer base, it can get difficult to understand where all the noise is coming from.

Social media listening tools are a boon for us. In this time and age, we are actually able to listen to what our customers are saying about us. So we can enter the conversation, understand their needs accurately and help them. By getting in touch with people based on what they’re saying at the right time you boost customer experience.

Here are some tools and resources you can use for your business:

- Mention The tool tracks brand mentions across the web

- Brand24 This too tracks brand mentions across the web

- BuzzSumo helps figure out the most popular content on a topic

4. Use Content Marketing

While LinkedIn pulse is a great platform for publishing articles, it gives little scope beyond articles.

To drive leads you need other forms of content assets like lead magnets, downloadable graphics, videos, webinars, and more.

To do that you need to offer people a preview of this content. That’s possible with a blog you own.

For example, Clay Collins of Leadpages offered several downloadable lead magnets that allowed him to grow his business to millions in revenue. Most of the growth came on the back of the leads he got courtesy of lead magnets and downloadable assets that he shared on his blog. These assets fuelled his lead-generation campaign, enabling him to find his target audience.

To do the same for your insurance business, find out hot-button topics with keyword research. Next, create lead magnets and other assets revolving around these topics. Give them away for free and get leads in return.

Concluding thoughts

To sum up, here’s what you can do to get relevant insurance leads.

Publish high-quality content.

On your website offer a live chat service 24 hours a day and all 7 days a week. Capture names, emails, and/or phone numbers so an agent can follow-up. And then hook those leads with a human touch. Run email marketing campaigns to get the highest possible ROI.

Research tools and software that match your needs. Configure them to engage first-time visitors. Like LeadSquared for example. Use this tool to qualify, nurture, engage your leads till they close.

About the author:

George is a writer and marketer who shares his journey on his blog Kamayo.