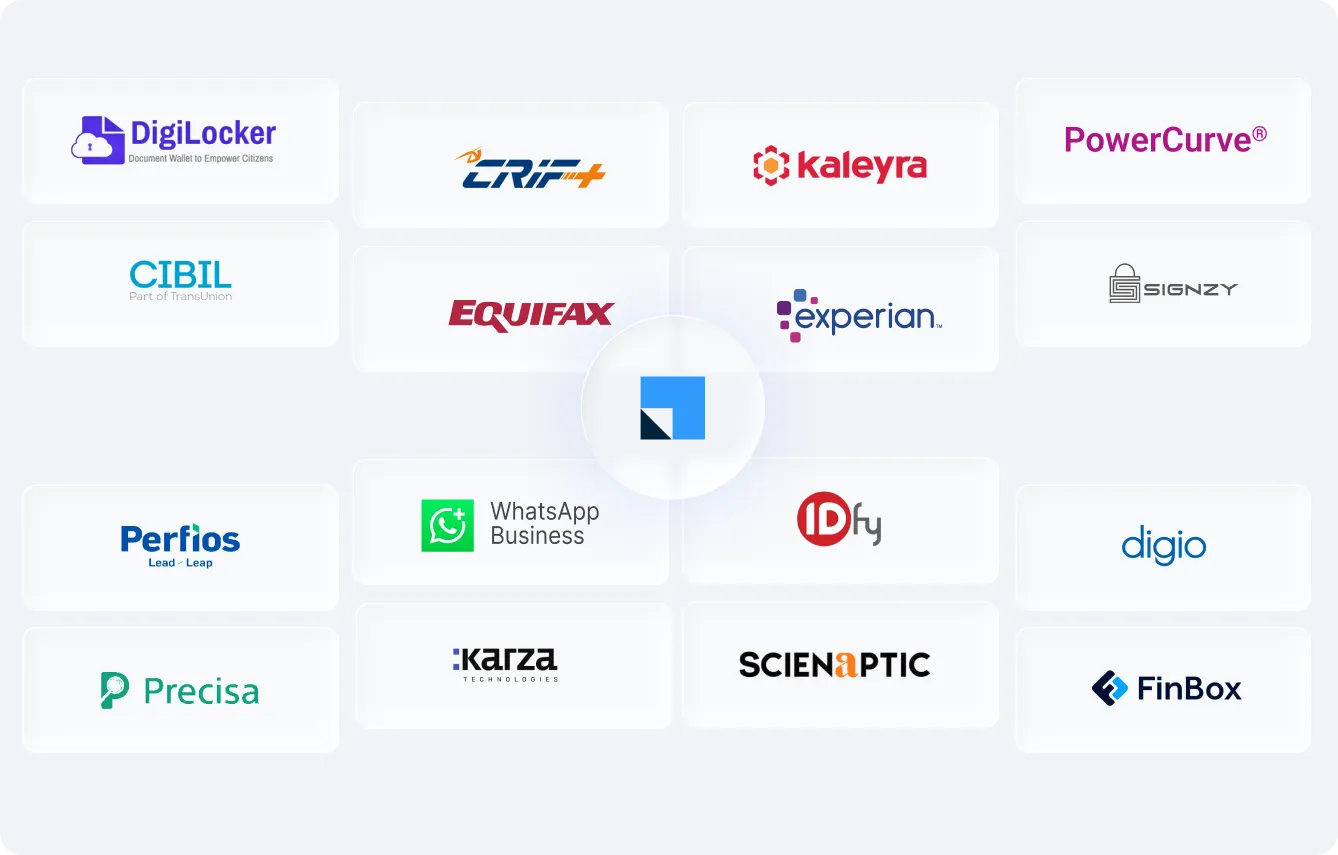

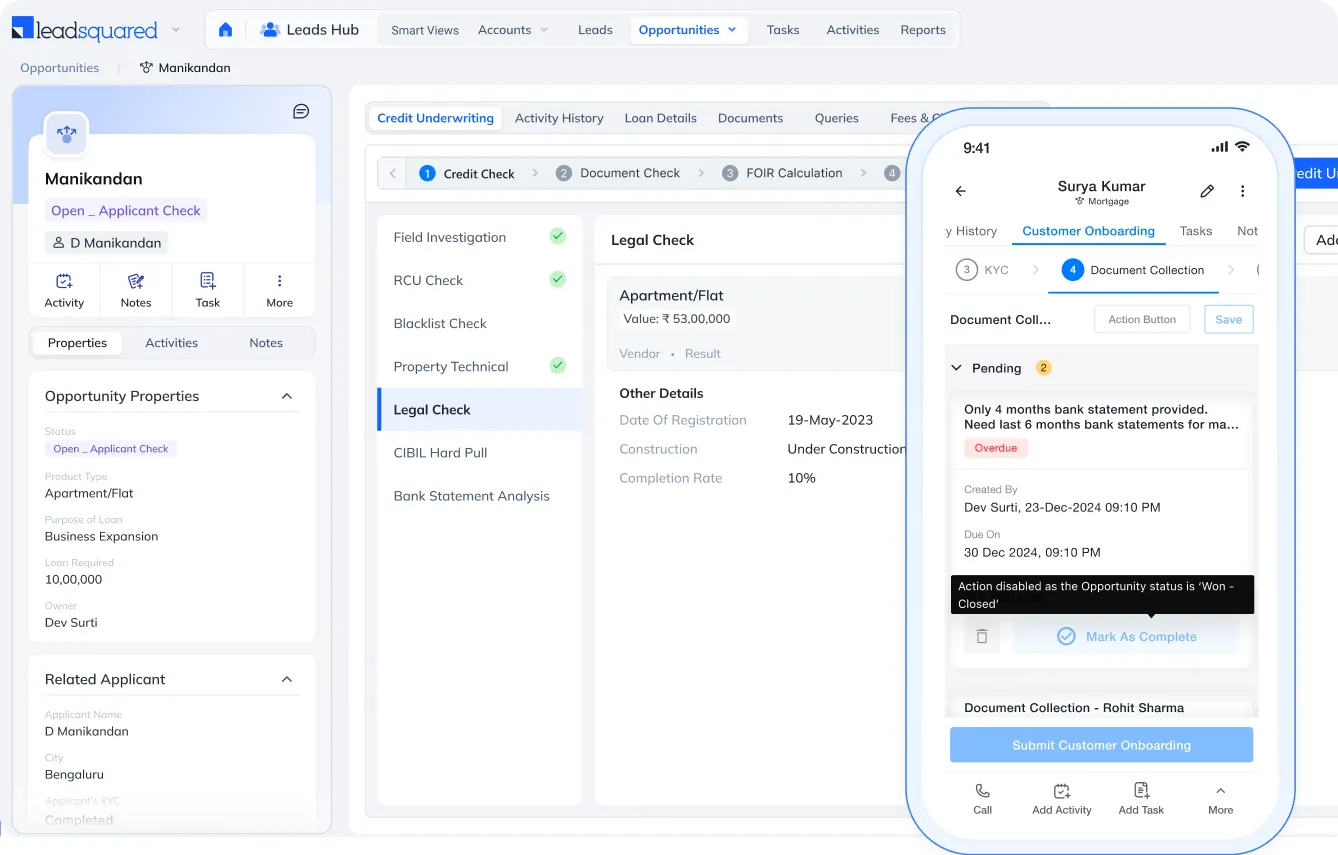

For C&I lending, LeadSquared’s LOS is designed to simplify even the most complex loan journeys. Built for flexibility, the system allows lenders to configure C&I-specific credit policies, BREs (Business Rules Engines), and multi-level approval workflows—completely code-free. Data from sources like Experian, CIBIL, and CRIF can be auto-fetched and embedded into the decisioning process, delivering real-time eligibility assessments and accelerating underwriting.

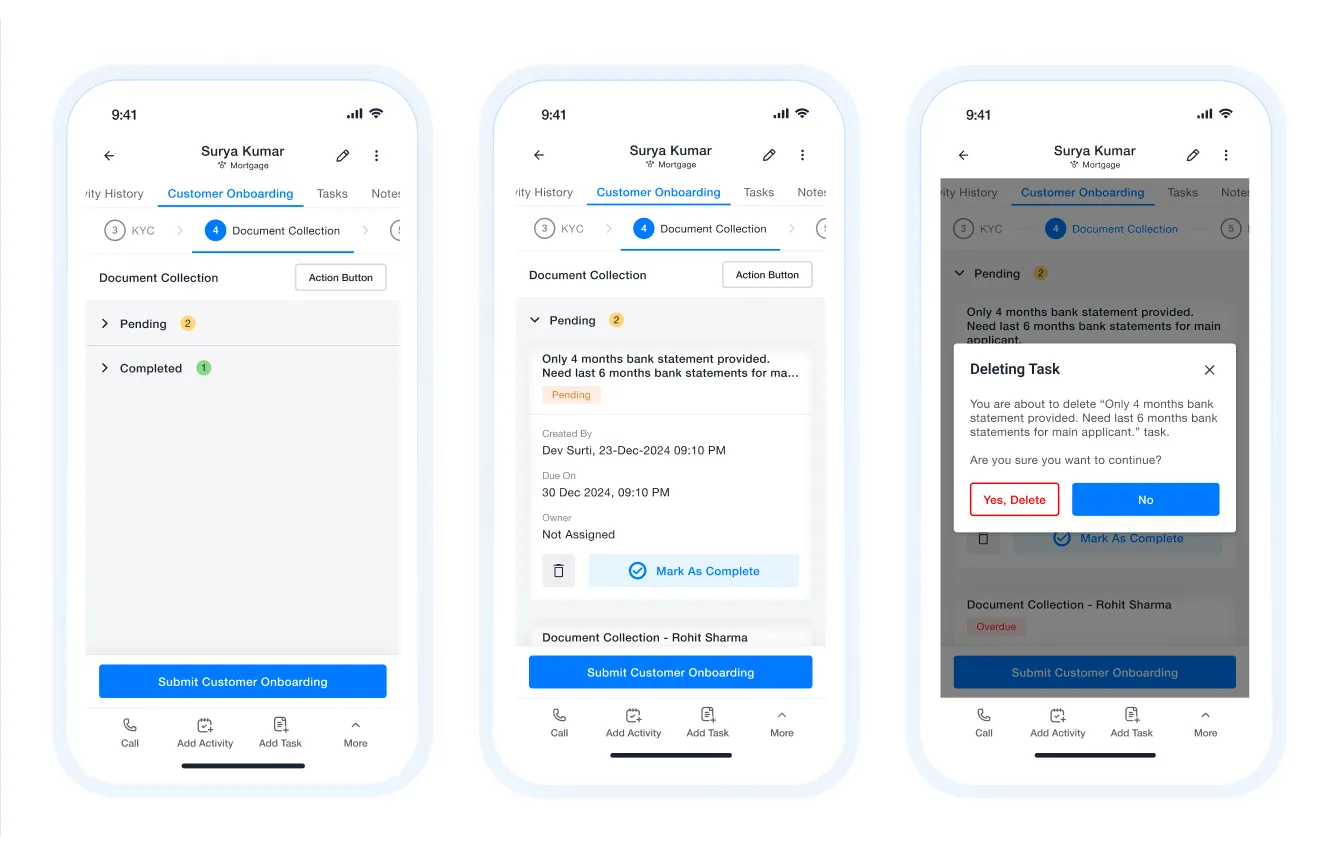

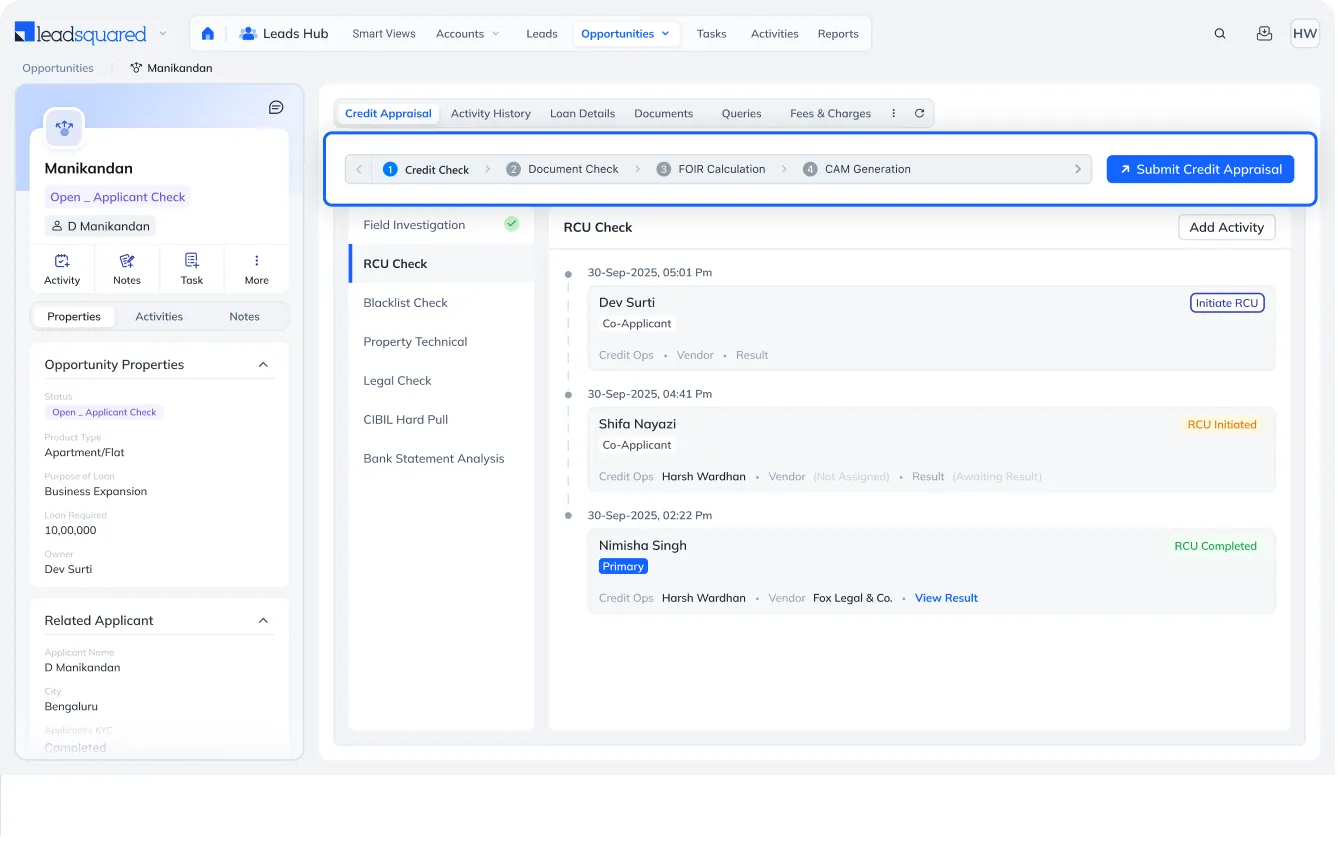

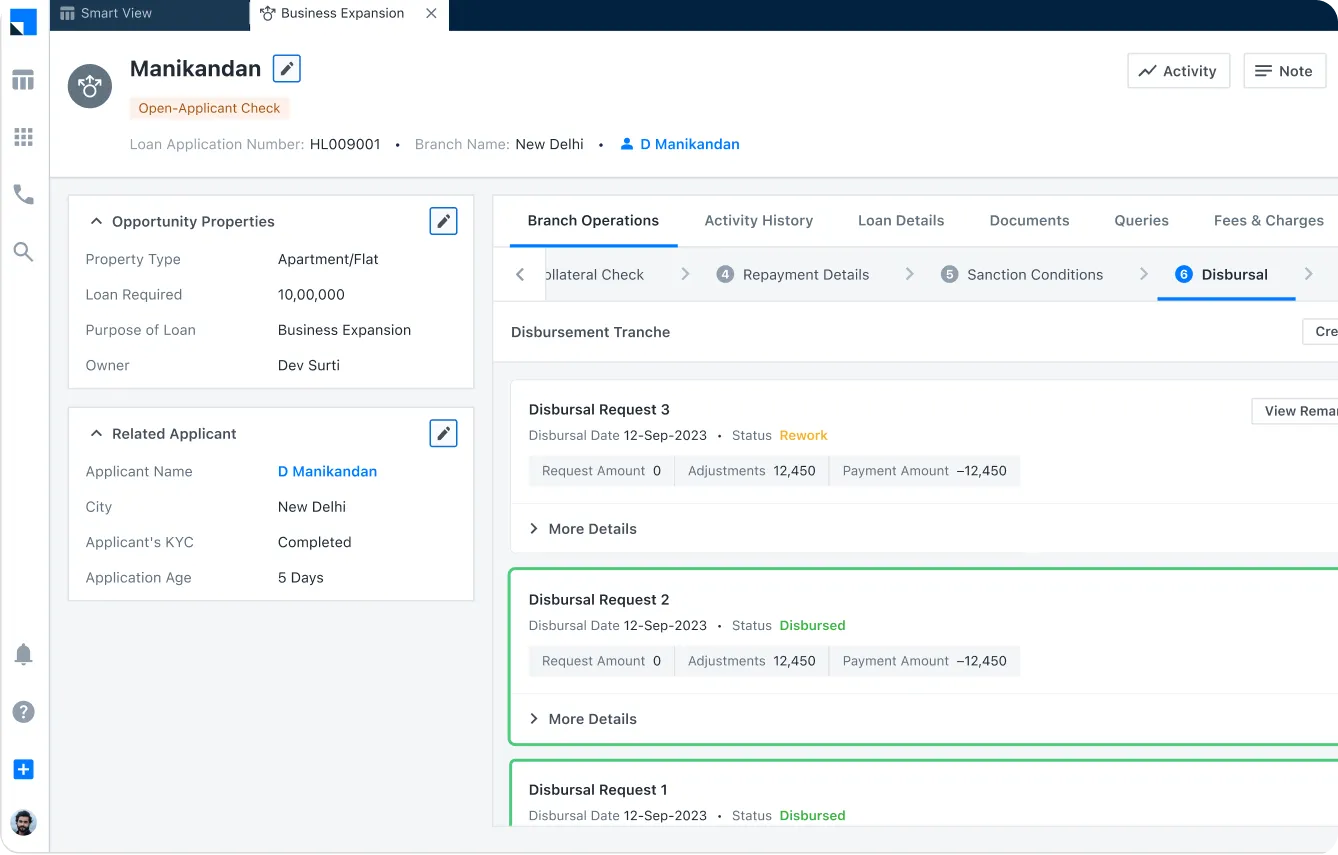

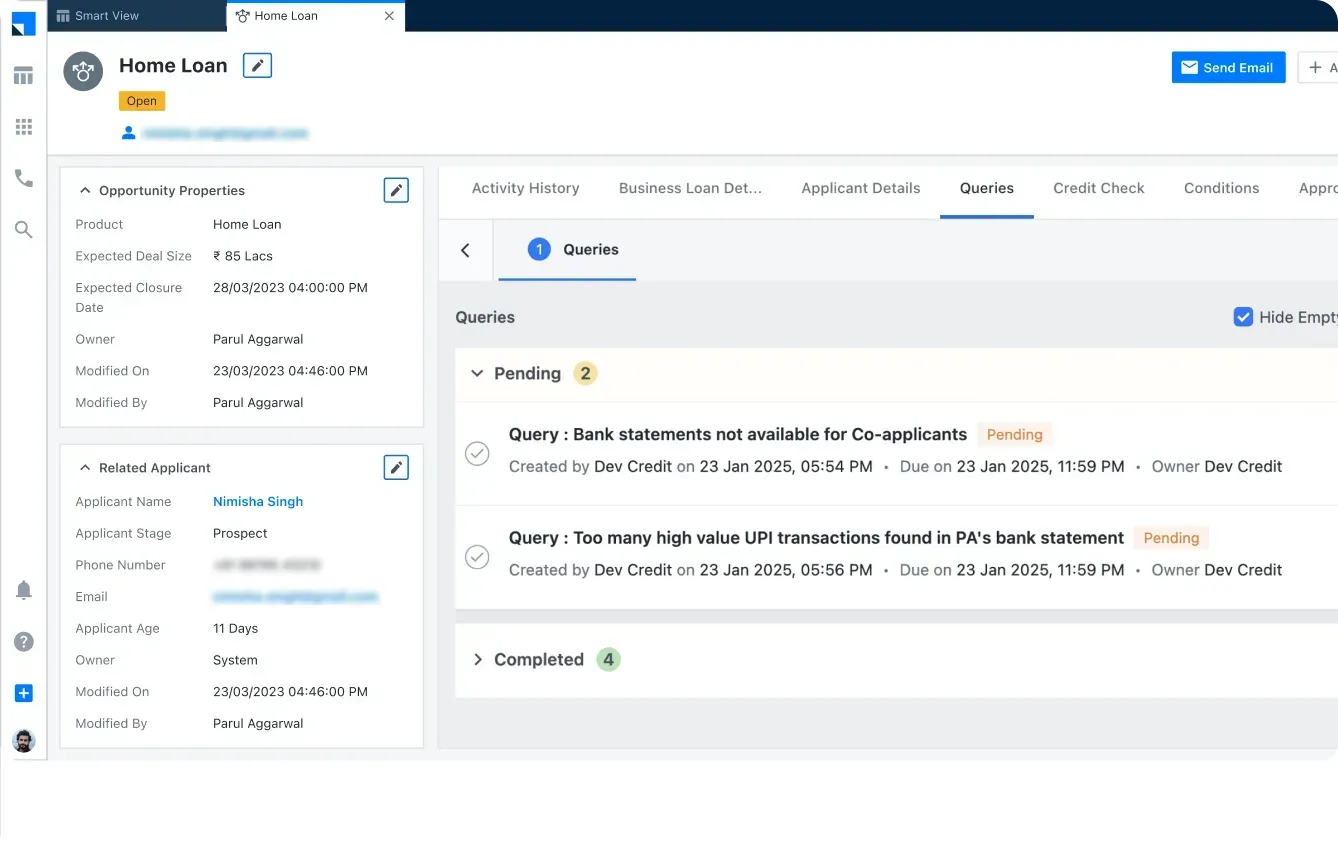

Clear, auditable workflows and real-time collaboration tools help operations, credit, and field teams stay in sync—from document collection (with support for multi-format uploads) through complex legal, technical, and financial verifications. Whether handling working capital loans, equipment finance, or term loans, every stage is digitally tracked and governed, supporting strong compliance and faster turnarounds.

Read the full story

Read the full story