Taking out a loan invites a lot of documentation, verification, credit risk assessment, eligibility checks, and other such processes. Within lending, mortgages alone have always had a reputation of entailing paperwork regarding the collateral that is pledged, proof of ownership, property value, account statements, and so on.

According to a study, out of 48,000 loans, 60% of them closed later than the actual target closing date!

This shows that lenders need to rethink their tech-stack and phase out legacy systems to establish relevance in a new-age market. Workflow automation is one of the solutions to streamline mortgage operations.

In this article, we will look at the benefits of mortgage workflow automation, tools you can use, and examples of lending workflows you can easily automate.

What Is Mortgage Workflow Automation?

Mortgage workflow automation is a way to automate routine tasks to enable error-free business processes, and a consistent borrower experience in every case.

The key point here is to rethink how current processes can be replaced with streamlined automated workflows for better transparency, team efficiency, and leverage lesser resources for the same task that was much more tedious to do before.

What are the Benefits of Mortgage Workflow Automation?

Many lenders struggle with the inefficiencies of legacy systems that lack automation capabilities.

Not determining the credit risk of an applicant or having loopholes in verifying their financial data can cost mortgage lending firms high bad debts. According to a study, about 85% of risk managers point out that legacy infrastructure is the biggest block to digitization.

These inefficiencies have direct implications on customer experience as close to 1 in 4 home buyers face a delay in availing their loan due to delays caused from a process point of view. Moreover, if a lender takes more than 10 days to decide on a loan application, customer satisfaction can drop by 15%.

Thankfully, these challenges can be mitigated with a mortgage workflow automation solution. Here are the benefits you can unlock with it:

1. Increased Productivity

When there are technology solutions that help automate loan origination and disbursal, it allows employees to monitor these automated processes and focus on key tasks at hand.

2. Fraud Detection

With robotic process automation and predictive analysis, firms can leverage data to forecast potential risk margins for various loan types. The lender also has the liberty to estimate which types of loans call for a fraud analysis, considering these workflows are automated.

3. Enhanced Customer Experience

Goes without saying, a frictionless customer experience across a borrower’s journey will result in greater customer satisfaction. The same processes when done manually can lead to higher TAT and wait time for the borrower.

With automation, applications can be processed easily to disburse loans at a quicker rate, customers have access to on-demand services, and having these capabilities can also be a key competitive differentiator.

4. Reduced Processing Costs

Without having to hire additional manpower, lenders can cut off a big chunk of operating expenses.

Contrastingly, the same process from start to finish would require more set of hands to be involved, further increasing the potential chances of errors with lack of transparency.

By automating process workflows, lenders can achieve the same (or even higher) level of efficiency without having to employ additional resources.

5. Adherence to Regulations

The lending sector is a highly regulated one similar to other financial services sectors. With changing regulatory demands, robotic process automation can enable lenders to ensure compliance. Whether it’s checking the authenticity of submitted documents, or overall hygiene of processes.

6. Defined Workflows

Process automation helps remove redundant steps and streamline the lending experience. This could be capturing queries across channels, processing applications, distributing cases to loan agents, or sending them automated notifications.

7. Improved Collaboration Between Teams

From the loan application stage to loan disbursal and closing, there are multiple teams involved in overseeing processes. With a unifying solution layer, teams can work better with process transparency and clarity about upcoming items they need to take action on.

Examples of Mortgage Workflow Automation

Every lending institution may have varied processes depending on the organization’s size, number of employees, their tech stack, etc.

Here are a few examples of workflows in lending institutions that you can automate if you haven’t already:

1. Customer Onboarding Workflow

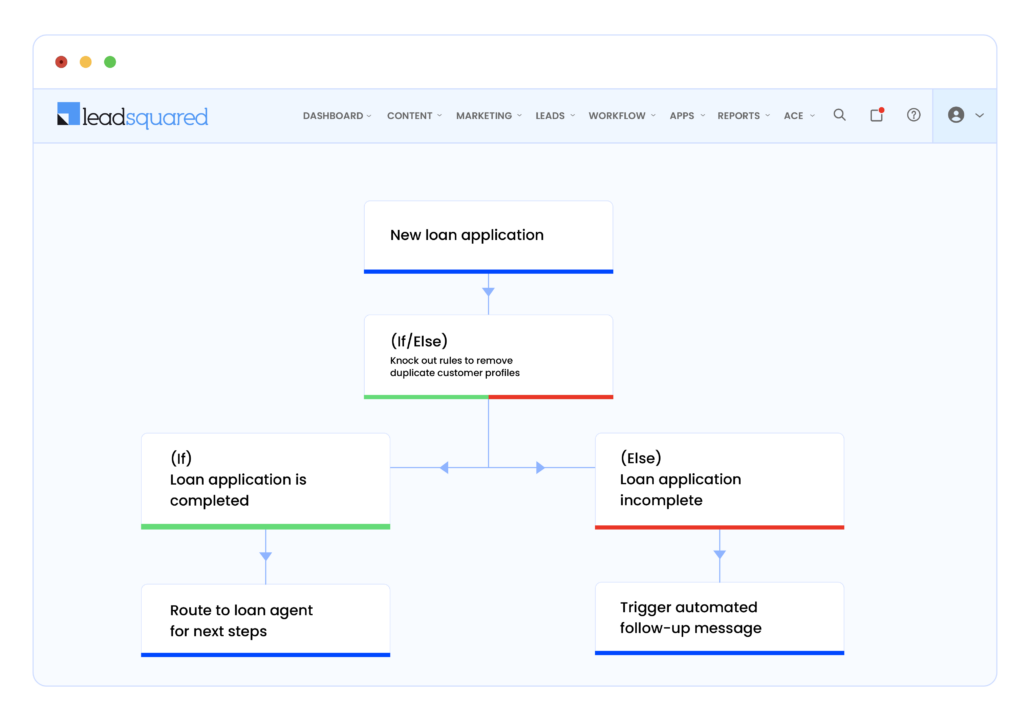

There may be multiple customer acquisition channels such as websites, ads, etc. However, most of the time, customers may drop off with incomplete application forms. An automated workflow like the example shown below will help in ensuring completes application forms.

Benefits: With this workflow, lenders can ensure that there’s a basic hygiene check done on applicants with duplicate profiles removed and completed applications routed to the next step.

2. Borrower Engagement Workflow

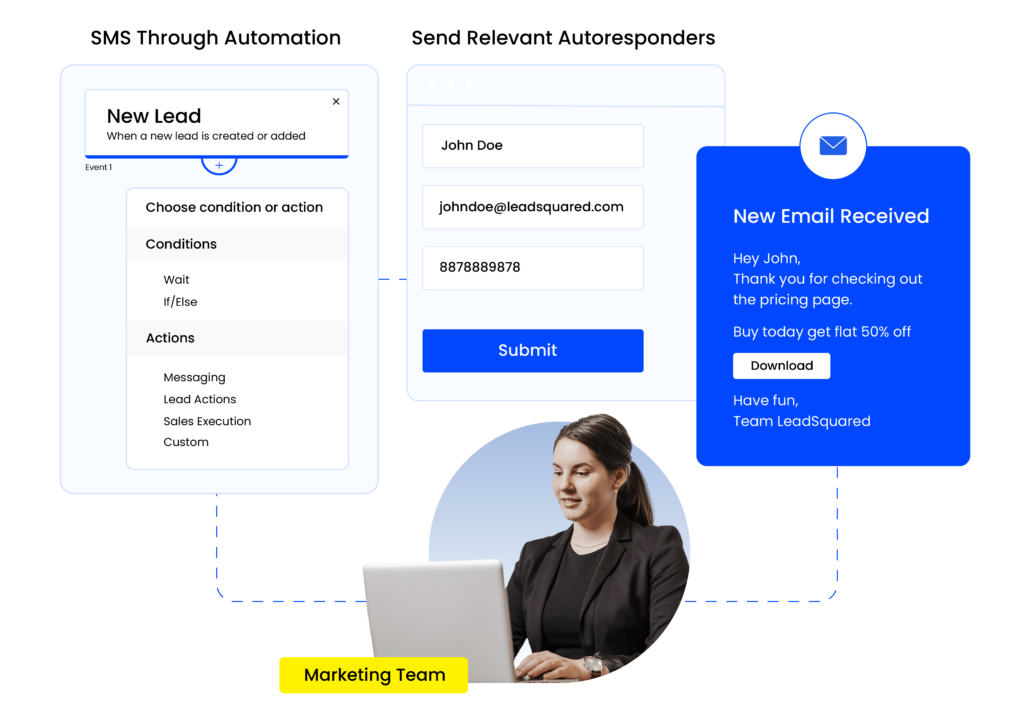

Often, most sales and marketing teams are in situations where the spending to engage with more customers is high, but the conversions are low. To tackle this, Mortgage CRMs or lead management systems can help automatically trigger personalized messages to customers and encourage them to take action based on their activity.

Benefits: Automated personalized messages can have a greater impact on a customer as opposed to generic automated messages that generalize every customer.

3. Loan Offer Generation

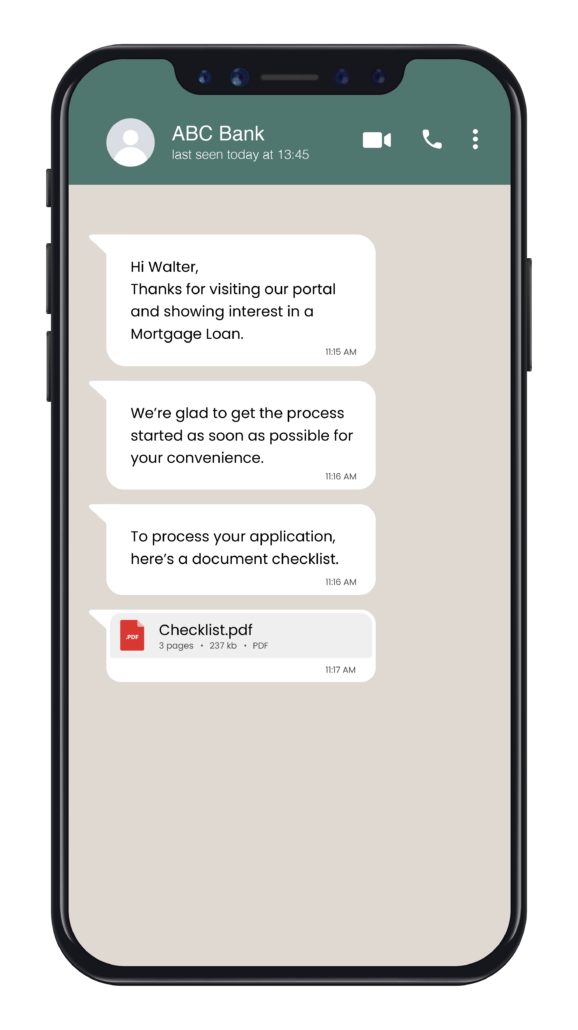

Once loan underwriting is completed, the borrower is presented with a loan offer with terms and conditions aligned to the credit risk involved. The offer may be presented on the website portal and the customer may not have accepted it. This is where a Mortgage CRM can be crucial to enable omnichannel customer engagement. With a CRM, lenders can re-initiate loan offers on channels such as WhatsApp to help customers accept offers.

Benefits: This helps tackle customer drop-offs. Moreover, lending institutions start earning interest only once offers are accepted and the loans are disbursed.

4. Workflow for Loan Document Collection

Document collection and processing can be one of the longest processes in a loan’s lifecycle. Leveraging a Mortgage CRM to automate workflows such as document collection can save a ton of time for the teams involved.

Automated messages can be sent to customers to prompt them to upload documents in a hassle-free manner through a chatbot on a portal or on a platform like WhatsApp.

How to Choose a Mortgage Workflow Automation Tool

Thankfully, there’s an array of software tools for lenders to pick from. These solutions are often packaged as little to no code, integration-friendly, backed with automation capabilities, and have a range of modules that meet the current requirements of lending institutions.

To make your search easier, here are a few essential capabilities that an automation tool must possess:

1. Code-Free Workflow Designer

A mortgage workflow automation system must allow you to configure all your requirements and take the burden of finetuning all the complexities of a process into a much more streamlined one.

For instance, with LeadSquared’s process designer, automate workflows for KYC verification, loan applications, and much more in a few simple clicks.

2. Seamless integration

It’s key to choose software solutions that can integrate with other existing or new tools and partners.

Over 80% of banks around the world work with fintechs and other solution providers. The workflows that you create cannot independently operate, they will be dependent on other components such as a loan origination system, business rules engines, etc.

3. Simple and Intuitive UI/UX

Ultimately, while workflows help enhance customer experience, it also equally helps make day-to-day tasks simpler for software users themselves. Having an easy-to-use user interface will make it easier for teams to adapt to the software quickly.

4. Access Control

Pick software that allows you to gate access to data and processes depending on their role.

For example, financial data is sensitive and it’s crucial for lenders to ensure data confidentiality. Which is why, not everyone should have access to such information. LeadSquared’s Mortgage CRM allows users to customize what each user can or cannot access.

5. Reports and Analytics

Workflow automation tools are meant to make everything simpler for you. They should give you access to data that outlines how well these automated processes are working with you, or which department is taking higher turnaround time, or if there’s any other problem that needs to be fixed.

6. Notifications and Reminders

When tasks are assigned to individuals, they must be made aware of upcoming and overdue tasks. These notifications could be sent through emails or on the phone. Mortgage workflow automation tools must also allow these notifications to be customized based on the nature of the task and role.

How Mortgage Workflow Automations Help These Teams

Implementing process automation can help departments across the organization.

Here’s a look into the key takeaways for the below teams:

- Management and Leadership

Workflow automation ensures that the set process is followed by all stakeholders. The data that’s made accessible with such technology will help decision makers have better insight into current challenges and areas of improvement.

- Customer Success Executives

With data and processes being made centralized and transparent, customer facing teams can be more solution driven. This can be in terms of understanding where they stand in their borrower journey, never missing follow up, having better visibility into query resolution, or helping customers reach the right point of contact along their journey.

- Sales and Marketing

Solutions that are backed by automation such as LeadSquared’s Mortgage CRM, allow sales and marketing teams to have a comprehensive view of customer profiles. This helps teams plan marketing strategies, identify potential opportunities to upsell/cross-sell offerings, etc.

Did you know that 79% of borrowers prefer bundled services for a seamless borrower journey.

- Finance Teams

Mortgage process automation ensures faster invoice processing and helps finance teams look into information trails to understand why charges are computed a certain way, etc.

Conclusion

There’s no way around automation today.

In a time of on-demand services, convenience, emerging tech, and scalability, it’s critical for lending institutions to keep an eye out for technology solutions that give them a competitive advantage. This could be in terms of having the latest tech stack, ensuring seamless customer journeys, or even empowering teams with the best of tools.

We hope you had a great read about mortgage workflow automation and why it’s important in today’s world.

To know more about how LeadSquared’s Mortgage CRM can help your business, click below!

FAQs

Tools that enable workflow automation can help automate mortgage lending processes be streamlined, and error free.

Robotic Process Automation (RPA) is a way to leverage automation technologies to mirror back-end processes that are generally carried out by employees. This could be tasks such as extracting data of loan applicants, auto-filling forms, to name a few.

A workflow designer is a way for lending institutions to augment and automate processes partially or entirely, plan resource allocation, and define responsibilities for different teams involved. For instance, through process designer on LeadSquared’s Mortgage CRM, you can easily design workflows for different processes such as digital onboarding, borrower KYC, document collection, etc.

To implement mortgage workflow automation, identify the challenges in current business processes and processes that have scope to be automated. Post this, here’s how you can go about it:

1. Create a process map

2. Define team tasks

3. Map the desired results

4. Evaluate automation tools that best match your business requirements