- 1. What is a Loan Management System?

- 2. Common Loan Types Managed by a Loan Management System

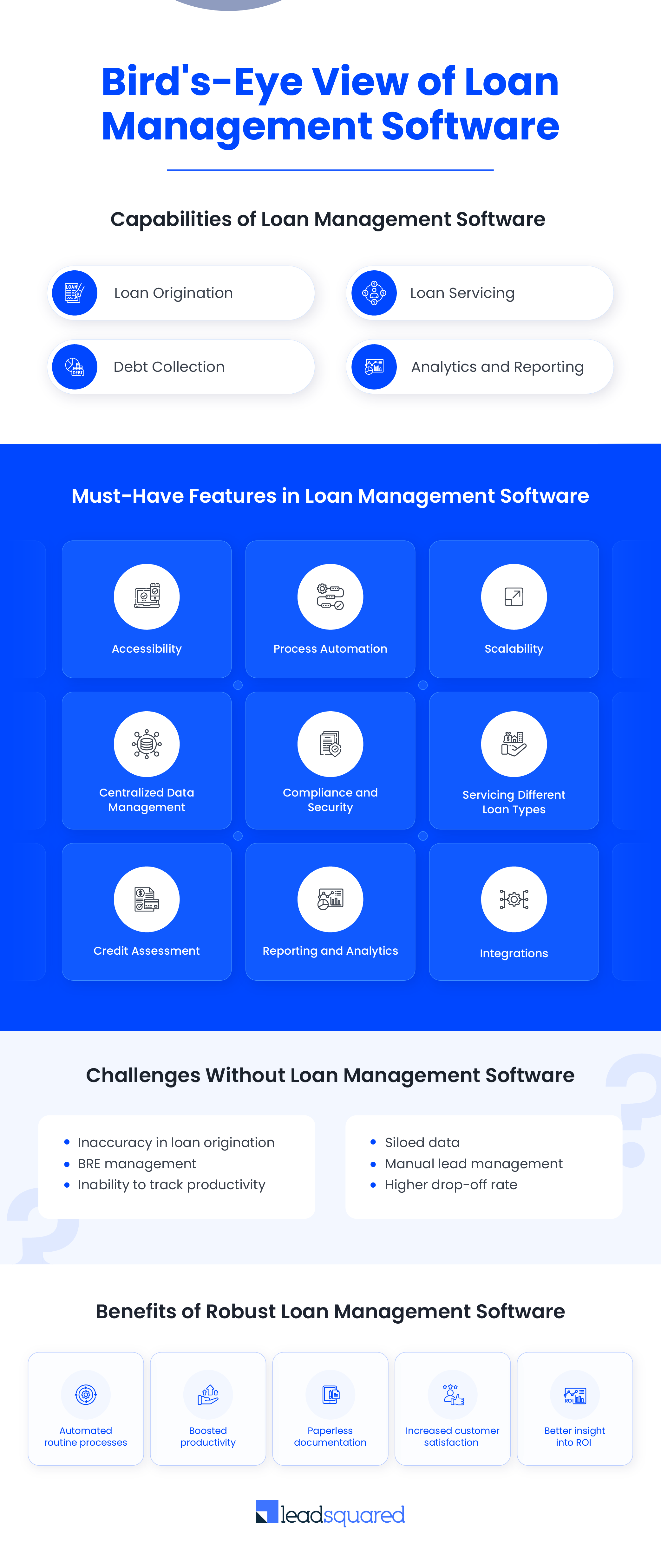

- 3. Essential Features of Loan Management System

- 4. Capabilities of a Loan Management System

- 5. Benefits of a Robust Loan Management System

- 6. How to Choose the Right Loan Management System for Your Business

- 7. 5 Best Loan Management Software Tools

- 8. Poonawalla Fincorp Sees 50% Growth in Loan Sales Using LeadSquared

- 9. Why Modern Loan Management Systems Are Easier to Set Up

- 10. In Conclusion

- 11. FAQs

The Reserve Bank of India (RBI) implemented several monetary easing policies in 2025, with the goal of increasing credit flow across key sectors. Notably, the cash reserve ratio was lowered by 100 basis points, and the repo rate was lowered by 50 basis points. These steps are especially beneficial for retail borrowers and micro, small, and medium-sized businesses (MSMEs). The RBI has also made it easier for underprivileged groups to obtain credit by lowering the income verification requirements for microcredit loans under ₹50,000. Credit disbursement volumes have increased dramatically as a result of these measures, particularly in micro and small credit categories.

Hence, to effectively manage the spike in transactions, expedite loan servicing, and preserve compliance; financial institutions are now using sophisticated, scalable Loan Management Systems (LMS). The increasing implementation of loan management software in India is directly attributable to such policies.

The projected rise is driven by growth across multiple fronts – rising demand for automated loan origination and processing, increased adoption of loan management systems, RBI relaxing gold loan norms, a growing mobile user base, heightened expectations around customer experience, and a stronger focus on risk management.

A loan management system helps lenders efficiently manage the entire loan lifecycle. It centralizes data, improves communication, and accelerates decision-making. This results in reduced manual tasks, reduced errors, and faster turnaround times. Ultimately, it streamlines operations and enables a seamless digital lending experience.

In this article, we’ll explore the key features to look for in a loan management system, and the benefits of implementing one!

What is a Loan Management System?

A loan management system is a digital platform that helps lenders simplify and automate their loan processes – from application to repayment. It manages customer information, proposals, and collections, while offering features like customer verification, credit analysis, interest rate calculations, loan disbursement, and collection tracking.

Common Loan Types Managed by a Loan Management System

Automated lending solutions can manage a variety of loans, ranging from simple unsecured loans to business funding. Here are the different types of loans that you can streamline with loan management systems.

1. Home loans

Home loans are available to anyone who want to buy, build, or remodel residential property. These are long-term loans with payback terms of up to 30 years that are offered by banks or housing finance companies.

Home loans are a secure type of financing since the property being bought usually serves as security. Before granting the loan, lenders review the applicant’s income, credit history, and property documents.

By automating eligibility checks, document verification, loan disbursal, and EMI tracking, loan management systems improve efficiency and lower manual error rates in the home loan process.

2. Personal loans

These are loans for personal or non-commercial use. Organizations look up the individual’s credit history before giving out a loan, which can be secured or unsecured.

For instance, a car loan is a secure loan, where the borrower will have to offer something as collateral, whereas a student loan is an unsecured loan where money can be borrowed outright.

Also, it is possible to co-sign such loans. In these cases, the borrower has another individual to sign the loan, who will pay the loan in case the borrower fails.

2. Commercial loans

Commercial loans are intended for business purposes only and are offered by financial organizations to startups and established businesses.

These loans are designed to cover expenses that an organization cannot afford on its own. Typically, companies and startups utilize this funding to support their growth or expansion endeavors.

In order to qualify for a commercial loan, borrowers are required to submit certain documents that demonstrate their ability to repay the loan. To streamline this process, lending CRM solutions can automate the processing and storage of these documents.

3. Student loans

Student loans are funds provided for educational expenses, such as tuition and accommodation, by government and private lending organizations.

4. Syndicated loans

A syndicated loan is a loan where multiple lenders provide a loan to several borrowers under the same terms. A group of lenders gives out this type of loan when the credit amount is too large for one lender to manage. Usually, larger organizations and banks give out such loans. This process is usually facilitated by a middleman who coordinates the entire transaction.

5. Mortgage loans

Both individuals and businesses can obtain this type of loan from lenders to finance the purchase of real estate. These loans are secured by the property being purchased and generally have longer repayment periods. In the event of non-payment, the lender has the right to take ownership of the property.

Also read – What is mortgage software?

6. Payday loans

These are short-term personal loans are also marketed as instant loans, salary advances, quick cash loans with high interest rates. Individuals often avail themselves of payday loans to cover for certain until the upcoming payday.

Essential Features of Loan Management System

1. Cloud accessibility

An organization planning to develop a loan management systems in-house may lack sufficient on-premises infrastructure for seamless operation, updates, and support. Scaling during peak workloads and accommodating more users and subscriptions can be difficult.

A cloud-based loan management system solves these issues by helping employees, partners, and customers to access and update information in real time – from anywhere in the world.

2. Process automation

Configuring processes with automation helps streamline routine tasks, eliminate the possibilities of manual error, and increase productivity. For example, automated communication can be sent out to a customer about the receipt of his loan application during the loan origination process.

3. Scalability

Loan management systems should be evaluated based on two key factors: ease of integration and scalability.

While growing businesses need software that integrates easily, they don’t always require an end-to-end solution from day one.

Instead, they should prioritize scalable systems that can adapt as their needs evolve.

A scalable loan management system—especially one based in the cloud—enables lenders to quickly adjust their operations in response to changing business needs or market conditions. Whether expanding to serve more customers, entering new markets, or responding to economic shifts, scalability ensures your platform can handle increased workloads without disruption. This flexibility helps organizations deliver consistent service quality and react swiftly to new opportunities or challenges, all without the need for massive infrastructure overhauls.

4. Centralized data management

Loan origination, servicing, collections, etc., represent different stages of the loan lifecycle. When these processes are conducted independently, they lack integration. However, data centralization occurs by employing a unified platform, providing employees with a comprehensive overview of past actions and current tasks.

5. Compliance and Security

The banking and financial sector is heavily regulated due to the sensitive nature of customer data. To ensure compliance and safeguard data, lending institutions can rely on loan management systems that help prevent data breaches and avoid regulatory penalties.

Modern loan management platforms, like LeadSquared Lending CRM, use cloud-based servers, which provide enhanced security, flexibility, and scalability compared to traditional on-premises setups. With automated updates, regular maintenance, and the latest security patches handled by third-party providers, lenders benefit from a secure environment without the burden of manual upgrades or unexpected expenses.

6. Servicing different loan types

Every loan type has its own application process and eligibility criteria. If you offer a variety of loan, choose software that can support multiple loan types to ensure flexibility and efficiency in disbursal.

7. Credit assessment

This feature is essential for setting payment terms, determining interest rates, and minimizing the risk of bad debt while maximizing revenue. For applicants without a prior credit history, software that analyzes bank statements, EMIs, tax records, and other transactions helps lenders assess creditworthiness more accurately – enabling smarter, lower-risk lending decisions.

A robust loan management system, like LeadSquared, empowers lenders—including banks, co-operative credit societies/banks, and smaller consumer lenders—to optimize their entire lending operations at lower costs. These modern platforms also open up access to underserved segments, such as individuals without traditional credit histories. By leveraging alternative data sources—like utility bill payments, rental records, or digital transactions —lenders can gain a fuller picture of an applicant’s financial behavior. This approach promotes more inclusive and fair lending practices, without compromising on risk control.

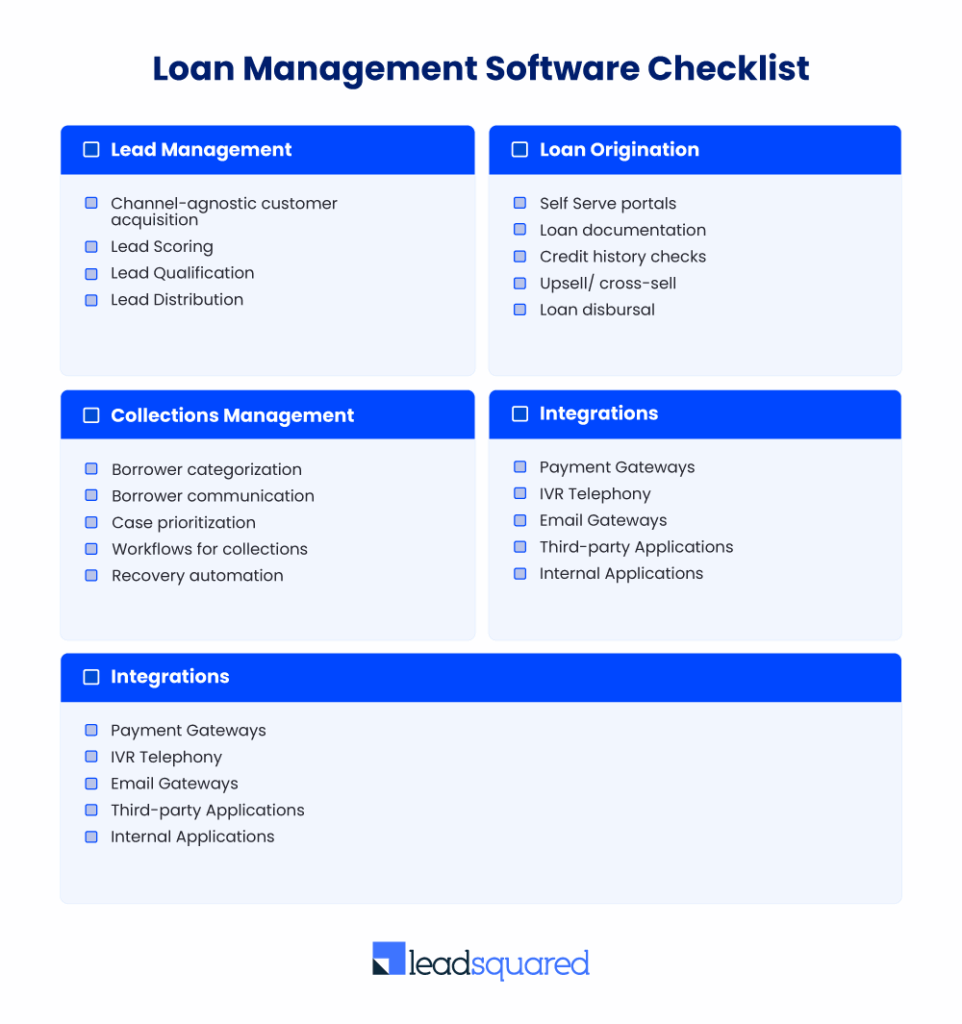

8. Integrations

Intergrations enhance a loan management software’s functionality by allowing it to connect with new tools or extension that improve efficiency As the lending process evolves, having software with strong integration capabilities becomes essential. LeadSquared’s marketplace offers a wide range of industry standard connectors to support seamless workflows.

Capabilities of a Loan Management System

A modern loan management system enhances the borrower experience while streamlining operations for the lender. With a digitized lending solution, borrowers can access loans conveniently through a seamless user-friendly journey. From the lender’s perspective, digital and cloud-based lending systems can automatea segment – or the entirety – of the loan lifecycle, depending on specific needs.

In contrast, relying on legacy loan management systems, often results in manual errors and a sub-par customer experience. Keeping this in mind, we’ve outlined key capabilities you should look for in a modern loan management system/software. This includes:

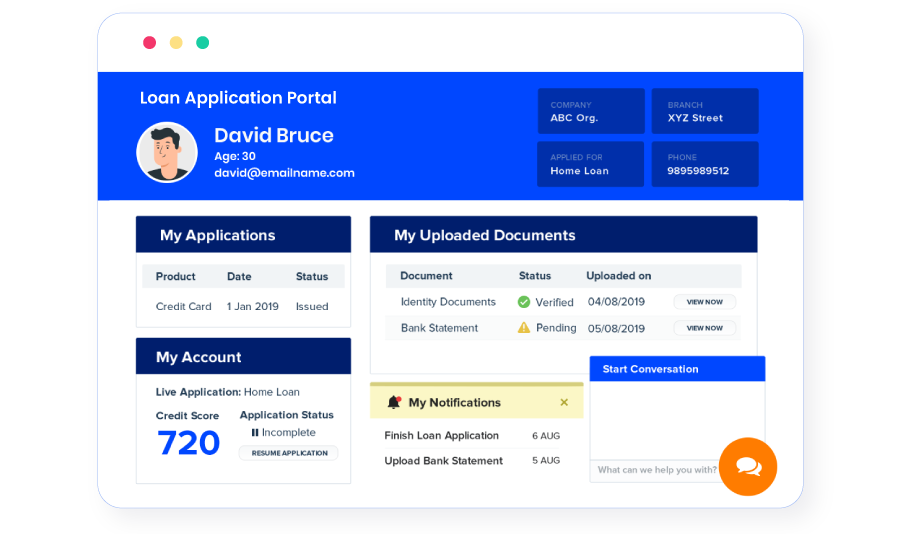

1. Loan origination

When a customer applies for a loan, the lender processes the application through different steps. A lending CRM streamlines loan origination by enabling digital KYC, managing loan documentation, checking credit history, recommending suitable loan options, and facilitating disbursal.

Modern loan management systems have moved beyond traditional, on-premise solutions and paper-heavy processes. Today’s platforms are typically cloud-based, eliminating massive upfront investments and replacing them with scalable, flexible, and secure infrastructure. This shift not only speeds up loan origination but also enables features like smart automation, digital application handling, and seamless document storage.

2. Loan servicing

Whether it’s car loans, home loans, or gold loans, they all come with different loan management processes in terms of due diligence, interest payments, and estimating loan repayment periods. Working with a loan management system that can help service loans of different nature makes for a better choice.

Loan servicing helps lenders perform complex computations on taxations, interest rates, track monthly repayments, generate monthly statements, and more.

From a borrower’s perspective, this can help them understand how far off they are in paying off their loans through accurate statements.

Cloud-based platforms also allow lenders to scale operations up or down, catering to business growth or shifts in economic climate, and to seamlessly enter new or emerging markets.

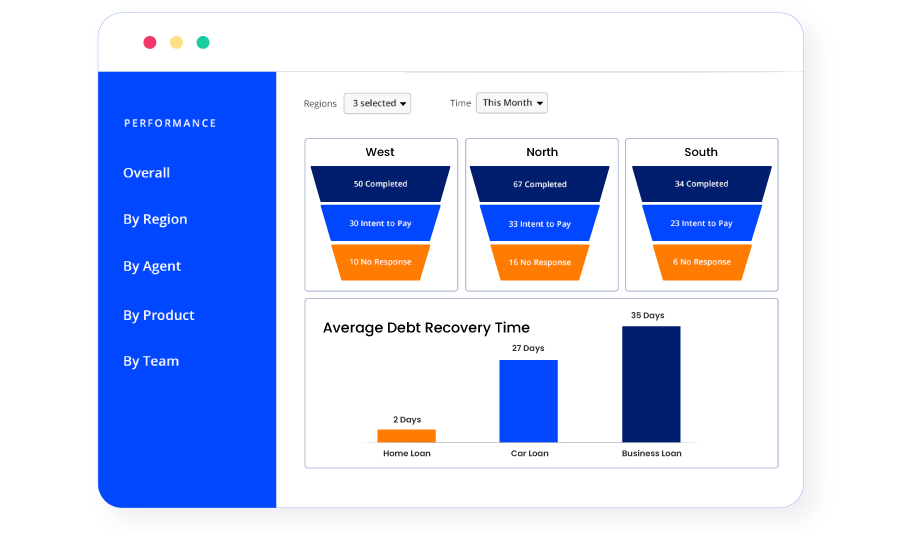

3. Debt collection

The stronger the debt collection process, the lower the risk of bad debt. Lenders manage a wide range of customers, borrower profiles, interest rates, and principal amounts daily.

In this context, systems that support debt collection are essential. They helps track repayments, overdue amounts, and late fees, while also reviewing borrower history and offering options for revised payment terms.

Additionally, loan management systems often support third-party integrations to enhance functionality. They also assist relationship managers and staff in monitoring borrower communication across the entire customer journey.

Unlike legacy systems with siloed data and costly, manual upgrades, modern cloud-based platforms offer automated maintenance, regular security patches, and ongoing updates—usually for a predictable monthly fee. This ensures lenders not only stay secure and compliant but also benefit from the latest features without additional expenses or operational disruption.

By adopting advanced, digital loan management solutions, lenders can minimize manual errors, streamline workflows, and deliver a far better customer experience, all while maintaining the flexibility and security needed in today’s dynamic financial landscape.

4. Analytical insights and reporting

Analyzing insights and reporting are pivotal in understanding profitability and performance of products. Most systems offer dynamic data dashboards to help operate with a better sense of clarity. Clearly, a non-negotiable capability!

Note: Often, the terms LOS (Loan Origination System) and LMS (Loan Management System) are used interchangeably, but they serve different functions. An LOS focuses on the early stages of lending—managing the loan application, verification, approval, and disbursal process. In contrast, an LMS oversees the entire loan lifecycle, from disbursal through repayment, monitoring, collections, and closure. Simply put, LOS handles getting the loan approved and funded, while LMS manages the loan’s ongoing administration after funding.

Benefits of a Robust Loan Management System

Here’s a low-down on the benefits of working with a robust loan management system.

1. Routine task automation

Automation helps eliminate manual errors in background verification, loan processing, interest calculations, etc.

2. Higher team productivity

A digital loan management system can help reduce turnaround times drastically. With reduced TAT, sales executives can achieve higher productivity and efficiency.

3. Paperless documentation

Digital lending processes help reduce paperwork – whether it’s KYC, document uploads, edits, or digital application processing. Lenders no longer have to maintain complicated filing systems, with files being accessible just a click away.

4. Increased customer satisfaction

Customer experience is everything. Customers today want to be understood as a ‘segment of one’. Lenders who understand customer aspirations through data can offer loan propositions aligned to their profile. A loan management system in this case will be a keystone.

5. Better insight into ROI

While analytical reports are easily accessible to monitor productivity, they can also help senior management get better clarity about their revenue streams and performance. With some systems also having prediction capabilities, they can highlight issues that need intervention.

How to Choose the Right Loan Management System for Your Business

When choosing a loan management system for your business, it’s important to consider your specific needs and the size of your business.

1. Small businesses and startups

A lending CRM software can be beneficial for businesses that have just started giving out a small number of loans.

The system/software will have basic loan management functionality along with features for borrower management, interaction history, team management, and analytics.

It can also manage customer information, track payments, and more – similar to most accounting systems. As a cost-effective solution, it helps organizations establish a solid foundation to get operations up and running efficiently.

2. Mid-sized companies

Medium and large-scale lending companies typically offer more complex loan products and a wider range of services, requiring more sophisticated software solutions.

In addition, organizations should consider platforms that enhance customer experience. Some loan management platforms come with customer portals, allowing borrowers to log in, make repayments, update personal details, request support, and engage with the lender directly.

These platforms also enable companies to create payment schedules, helping customers stay on track and encourage timely repayments.

3. Large enterprises

Large lending institutions such as banks cater to millions of customers. The primary need for such organizations is security.

Banks and other major financial institutions seek to minimize credit risk for their clients. They also want to deliver loans more efficiently.

Another requirement is a streamlined workflow. Larger financial institutions also desire better reporting to track the profitability of their operations.

CRM integration with LOS (Loan Origination System), CIBIL, Experian Hunter, Perfios, NetBanking Connect, PDF Statement Analyzer, and others can provide a complete end-to-end loan management solution.

If you’re looking for loan management software solutions, here’s a handy checklist to guide you through the features and capabilities you should look for.

5 Best Loan Management Software Tools

Now that you have an idea of the challenges and benefits of loan management software, here’s a brief about the list of tools that you can evaluate:

- LeadSquared

Popular among lending firms, especially in India and Southeast Asia, for loan origination and customer acquisition

Offers built-in loan workflow automation, lead capture, and integration with multiple financial tools

Designed to streamline sales pipelines and improve borrower engagement through multi-channel communication - Microsoft Dynamics 365

Highly customizable and widely used across industries

Strong integration with Microsoft tools (Office, Teams, Power BI)

Can be tailored for loan origination and management workflows - Zoho

Affordable and flexible CRM with a large app ecosystem

Used by small to mid-sized lending firms for customer and pipeline management

Supports workflow automation and document management - HubSpot

Free tier available, easy to use and popular for marketing and sales

Lenders can adapt it to track borrower interactions and loan pipeline

Less specialized for lending but good for relationship management - SugarCRM

Offers more customization than many CRMs

Can integrate lending-specific modules or third-party loan tools

Focuses on customer journey and lifecycle management

Why LeadSquared is different:

- Purpose-built: LeadSquared is a purpose-built lending-specific sales automation platform, often including loan origination features. The CRMs above are broader platforms that need customization or integration with loan management tools to fully support lending workflows.

- Sophisticated Loan Lifecycle Management: LeadSquared’s lending CRM delivers comprehensive loan application processing from origination through disbursal, powered by intelligent workflow automation and configurable business rules engines. The platform features advanced analytics and business intelligence capabilities, providing granular reporting at product, team, and agent levels, along with real-time performance dashboards and predictive analytics for loan approval optimization and risk assessment.

- Mobile-first Operations & Enterprise Integration: Built on a cloud-native, API-first architecture, the system enables seamless integrations with existing banking systems while supporting high-volume lending operations. The dedicated mobile application empowers Field Officer Support (FOS) teams with offline capabilities and real-time data synchronization, ensuring operational continuity across all touchpoints. Combined with built-in compliance frameworks, automated risk scoring, and comprehensive audit trails, LeadSquared provides the sophisticated technology infrastructure that modern lenders need to scale efficiently while maintaining regulatory compliance.

- Enhanced Customer Experience & Operational Excellence: The platform optimizes the entire lending journey through omnichannel communication, automated decision-making for standard criteria, and self-service portals that keep applicants informed throughout the process. With integrated document management, verification systems, and performance tracking capabilities, LeadSquared transforms lending operations into a streamlined, data-driven process that delivers both operational efficiency and superior customer experiences.industries, lending being just one.

Poonawalla Fincorp Sees 50% Growth in Loan Sales Using LeadSquared

Headquartered in Pune, Poonawalla Fincorp (previously Magma Fincorp) is the financial arm of the industry giant, Cyrus Poonawalla Group. As one of the fastest-growing businesses in the Indian financial space, Poonawalla Fincorp is empowering individuals and businesses through their five major lines of business – Personal loans, Home loans, Loan Against Property, Professional loans, and Business loans.

They wanted to onboard a cloud-based solution to provide a seamless borrower experience while also optimizing internal processes for their 7000+ employees, including feet-on-street agents, campaign managers, sales managers, underwriters, and call center agents.

To break it down:

Challenges the faced | LeadSquared Solution | Quantifiable Results |

To create new self-serve journey for website inquiries | Completely paperless self-serve journeys were enabled via LeadSquared Portal builder, empowering 1,10,000 applicants in just three months | 50% increase in loan sales |

A one-stop solution to cater to their loan sales and servicing needs for all their lines of business | As an enterprise-wide digital platform, LeadSquared enables, origination, application, customer service (raising service requests via call centre), and cross/up-sell operations | |

Data from multiple teams/processes collated and segmented, presented seamlessly to senior management | LeadSquared Reports and Analytics gave Poonawalla Fincorp the capability to automatically derive key data points for top management, bringing 100% transparency into the overall pipeline | 100% Drop-Off Elimination |

Seamless distribution of thousands of loan applications received per day | Robust and timely distribution of applications based on criteria such as product, vintage, region, ticket size, and more | 75% reduction in TAT |

Read more here.

Why Modern Loan Management Systems Are Easier to Set Up

Today, the loan management technology has moved away from the days of bulky on-premises servers and manual installations. Modern platforms are cloud-based, which means you won’t face massive upfront investments or complicated hardware setups. Instead, all you need is an internet connection, and your vendor will handle everything from onboarding to data migration.

Cloud-based systems bring several advantages:

- Flexibility and Scalability: Easily scale your operations up or down based on business needs—no hardware upgrades or extra IT resources required.

- Enhanced Security and Compliance: Regular automatic updates and security patches from your provider help keep sensitive customer data safe and your system compliant with regulations.

- Continuous Improvements: You benefit from ongoing software enhancements, bug fixes, and new features without having to manage upgrades yourself.

This shift to the cloud allows you to react quickly to changing market conditions, expand into new markets, and consistently deliver a better experience for your customers—all with minimal setup time required.

Customization and Adaptability

No two lending institutions operate exactly alike, and business requirements can shift quickly in a dynamic market. That’s why it’s essential for loan management systems to offer robust customization options and the flexibility to adapt as conditions evolve.

Customizable systems allow organizations to:

- Tailor workflows to match unique processes, rather than forcing teams to work around rigid software structures.

- Adjust decision-making rules to accommodate changing regulations or risk appetites.

- Refine automation settings, ensuring the right tasks are being streamlined as the business grows or priorities shift.

- Integrate seamlessly with new tools or platforms—such as third-party identity verification services or evolving compliance monitoring solutions—without disrupting day-to-day operations.

Adaptable loan management platforms help teams respond quickly to new market demands and regulatory changes, minimizing downtime and manual workarounds. For instance, a lender might want to introduce a new loan product, update scoring criteria, or automate an additional compliance check. With a system designed for customization, these adjustments can be made smoothly, keeping the organization agile and competitive.

This level of flexibility not only enhances operational efficiency but also supports a culture of continuous improvement as business needs progress.

In Conclusion

The lending industry is evolving faster than ever, driven by rapidly changing customer expectations. To stay ahead, lenders must treat technology not just as a tool but as a true differentiator and core competency.

With AI, automation and blockchain integration already underway, the loan management landscape is shifting towards greater efficiency. Features such as real-time reporting and analytics give lenders deeper insights, helping them make smarter, ROI-driven investment decisions.

The future of the lending sector is set to become increasingly customer-centric, personalized, data-driven, and technologically advanced.

In addition to smarter decision-making, modern loan management systems can automate a variety of accounting tasks, such as invoicing and the identification of accounts that are overdue or at risk of default. This level of automation not only streamlines daily operations, but also helps lenders maintain accurate financial documents for compliance and tax purposes—ensuring everything is in order when it matters most.

No longer limited to just automating loan origination, today’s loan management software empowers lenders to handle every aspect of the loan lifecycle—from pre-application to final repayment—more smoothly and securely than ever before.

Want to know more about LeadSquared’s robust digital lending solution and how it can help you?

Frequently Asked Questions On Loan Management System

Which is the best loan management system?

The best loan management system for you would be one that serves your business needs and blends well with your existing processes. One of the best solutions is LeadSquared Lending CRM.

It helps disburse loans faster, track recovery, and more. With this, you can also manage all your processes and teams – Sales, Call Center, Field Sales, Collections, and more.

How do I set up a loan management system?

If you’re using a cloud-based or SaaS system for loan management, your vendor will guide you through the setup and integration processes.

Unless you’re using an on-premises loan management system, you need not worry about installation or setting it up.

SaaS Lending solutions are ready-to-use, and you can start using them within 2-3 days of buying a subscription.

How long does it take to implement a loan management system?

The development duration of a loan management system can differ based on several factors, including the system’s size and complexity, the desired features and functionality, and the expertise and experience of the development team. Also, whether you’re building from scratch or customizing a commercial off-the-shelf (COTS) product. It could range from a few weeks for an Off-the-shelf Solution, 1-6 months to customize an Open-Source LMS or Framework, to 3- 12+ months for Custom Development (from Scratch).

What are the functions of loan management system?

A loan management system supports customers from the capacity of loan origination, disbursal, collections, customer service, analytics, etc.

What is the difference between LOS and LMS?

Often, the terms LOS (Loan Origination System) and LMS (Loan Management System) are used interchangeably, but they serve different functions. An LOS focuses on the early stages of lending—managing the loan application, verification, approval, and disbursal process. In contrast, an LMS oversees the entire loan lifecycle, from disbursal through repayment, monitoring, collections, and closure. Simply put, LOS handles getting the loan approved and funded, while LMS manages the loan’s ongoing administration after funding.

How does financial technology (fintech) influence the accessibility of lending products?

Fintech is transforming the lending landscape by making financial products and services more accessible to customers. Through modern digital platforms and mobile-first applications, borrowers can now engage with lenders from virtually anywhere, using smartphones or tablets. This flexibility is particularly valuable for today’s customer-centric market, where convenience and speed are top priorities.

Modern lending solutions leverage cloud-based infrastructure, ensuring compatibility across operating systems and devices—whether Android, iOS, or web browsers. By breaking down the silos of legacy systems, fintech allows lenders to centralize and process data efficiently. The result? Loan applicants benefit from a seamless experience, with faster application reviews, real-time status updates, and streamlined communication—all of which reduce the manual workload for lenders.

Ultimately, fintech enables lending organizations to respond rapidly to evolving customer needs, improving both satisfaction and retention. This increased accessibility also encourages word-of-mouth referrals, as borrowers share their positive experiences with friends and family.