Insurance CRM. Increase new policy sales & renewals

Sell more policies from all your distribution channels – STP (digital sales), call center, bancassurance, agencies, brokers and field sales

Sell more policies from all your distribution channels – STP (digital sales), call center, bancassurance, agencies, brokers and field sales

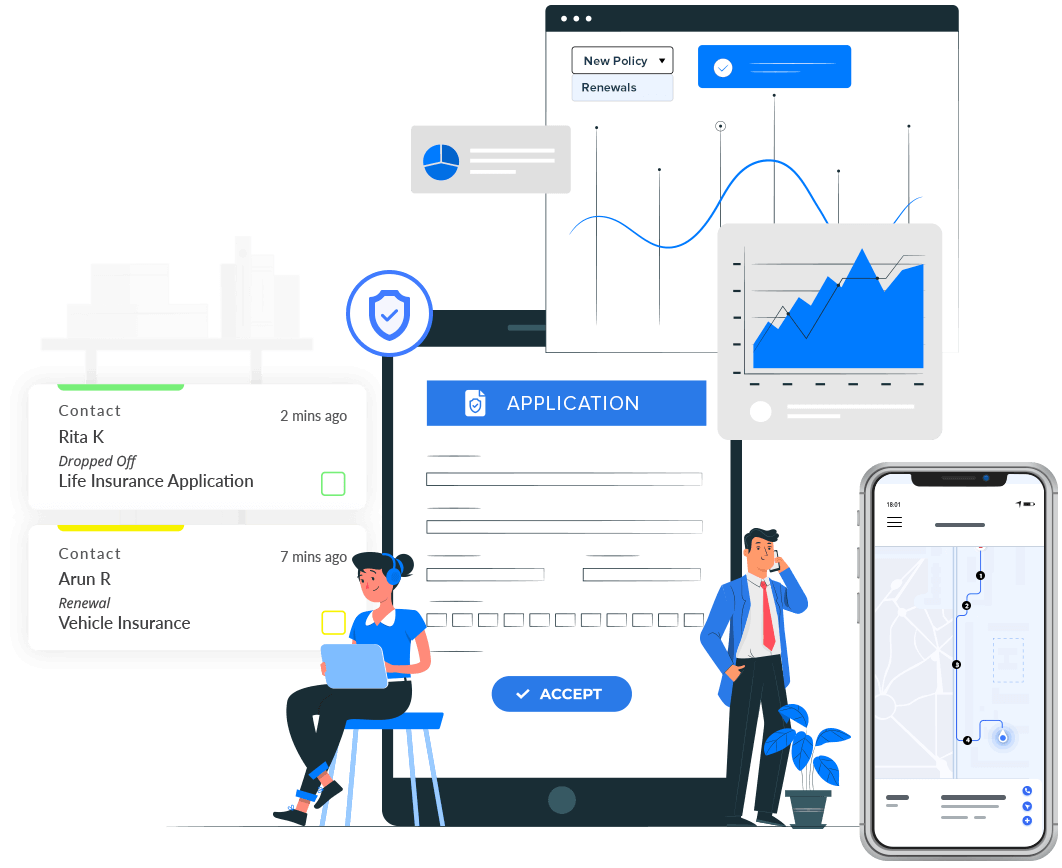

Multiple processes, products and teams – one platform to increase their operational efficiency

Maximize policy sales & renewals digitally and from bancassurance, agencies and other channels

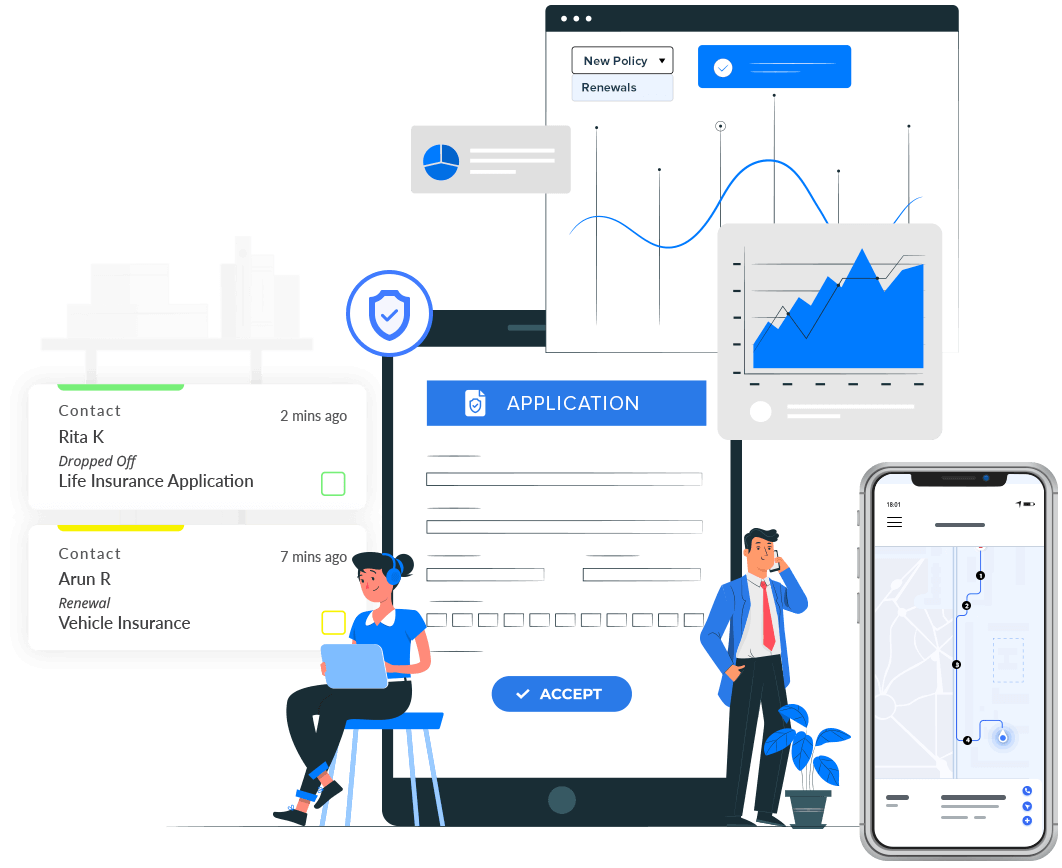

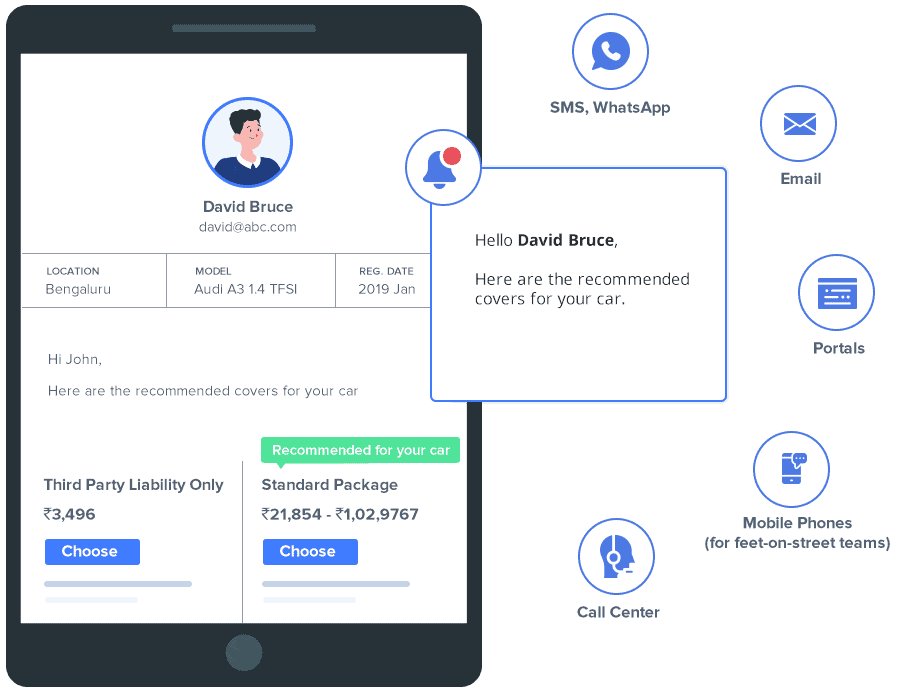

Capture all your policy inquiries and applications from online & offline channels, including insurance aggregator websites (like PolicyBazaar, MyInsuranceClub), social, phone calls, and other online and offline channels. Distribute them to the right call center or field agents based on different agent and applicant attributes.

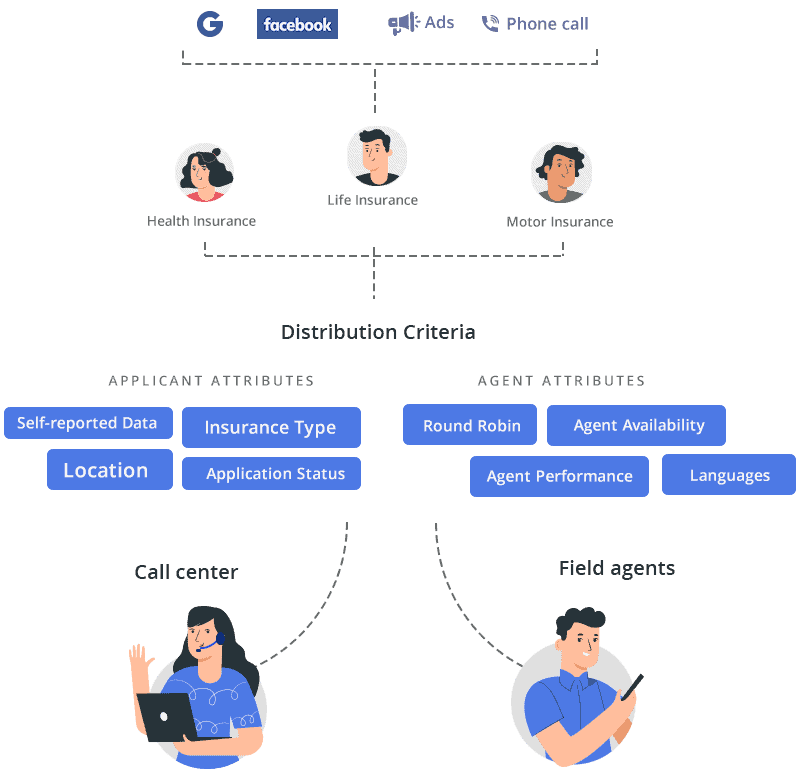

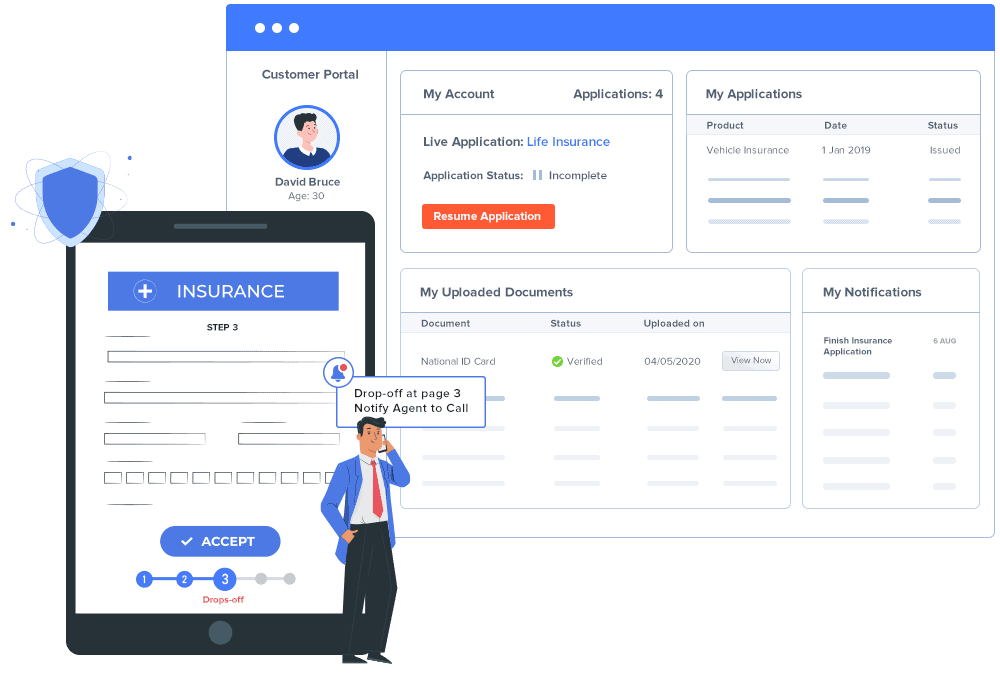

Ensure a smooth application experience for your insurance applicants. Self-serve, mobile-friendly application interface (forms and portals) for paperless and fast application processing. Customer portals ensure that applications can be resumed anytime, thereby enhancing prospect experience, and saving your agents’ time.

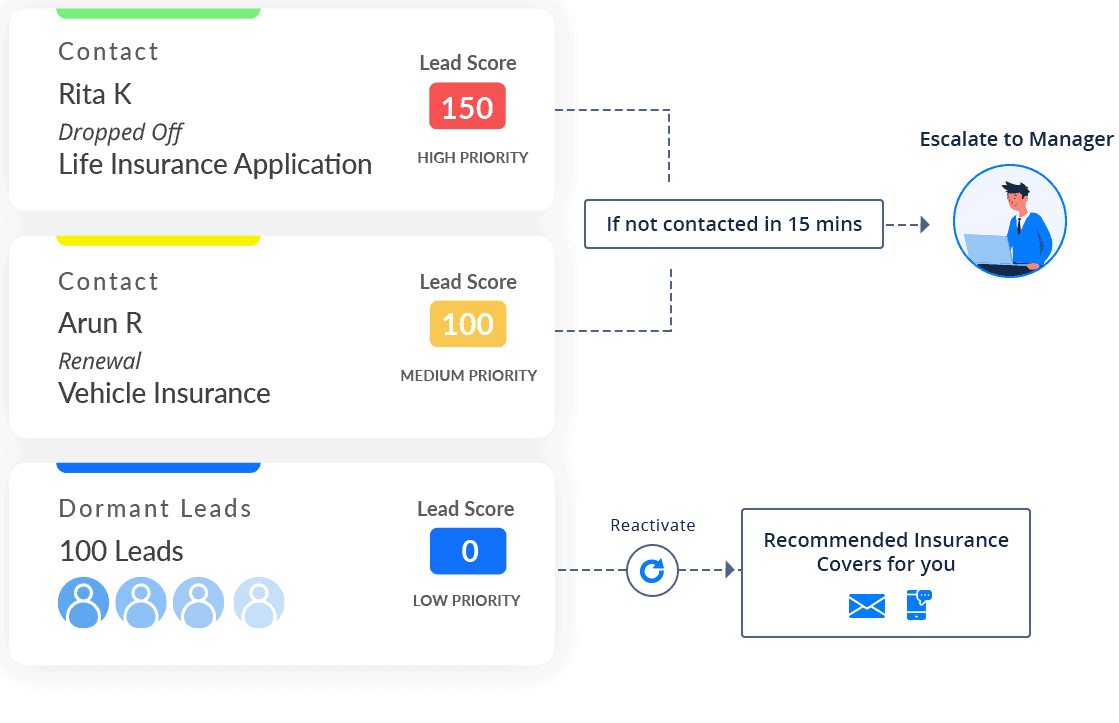

Score all your leads with 360-degree lead profiles and activity tracking, prioritize your agent’s tasks accordingly, and reduce response time. Initiate follow-up actions as well – for instance, if leads are not contacted within 15 minutes, you can initiate escalations to managers. You can even automatically reactivate dormant leads by initiating relevant communication.

Ensure faster and efficient customer onboarding. LeadSquared add-ons like eKYC verification solution and Video KYC helps insurance providers eliminate lengthy verification processes, reduce costs & fight fraud. Help your onboarding agents (both on and off the field), KYC reviewers, and verification teams stay on the same page.

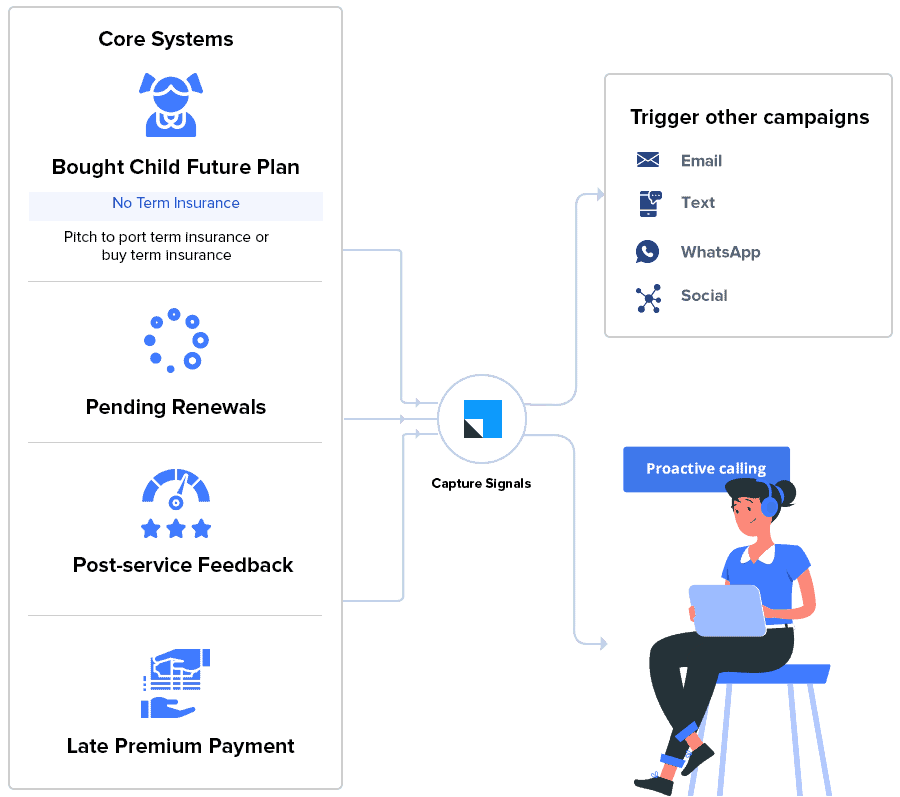

Capture live signals via prospect tracking on your website, and your other core systems (via APIs, LAPPS, or direct integrations), to automate intervention via the right channel – text or email messages, or manual intervention by call center and field agents.

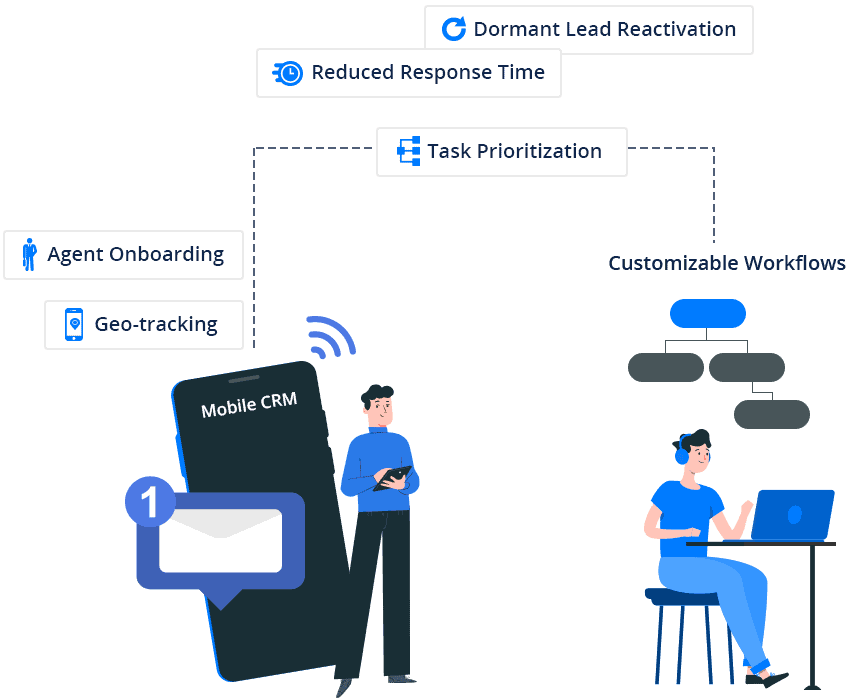

Initiate timely actions based on lead priority to reduce response time

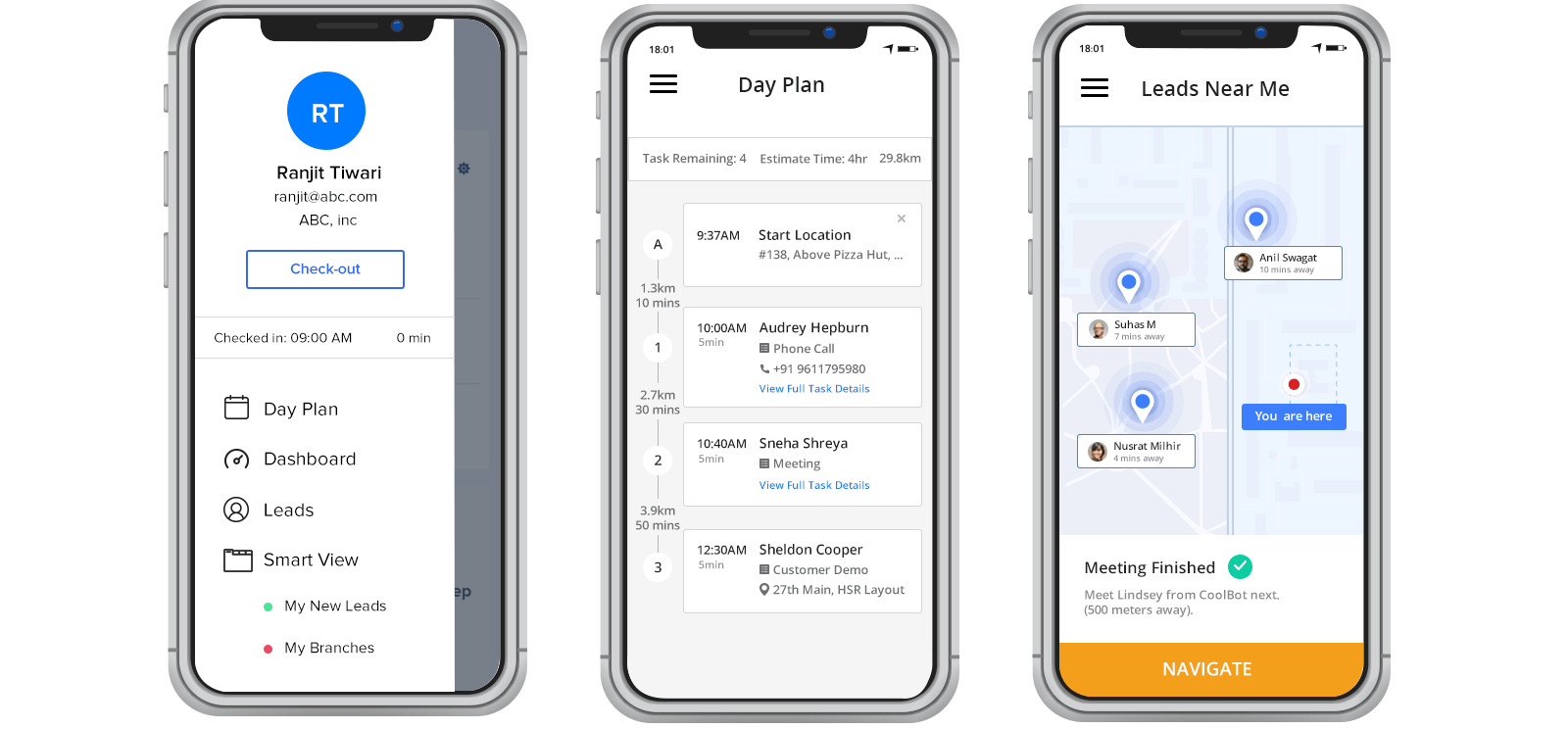

Prioritize the meetings and calls for your call center and field agents including route planning.

Recommend the next lead to call or customer to meet for all your teams

Track every move of your field agents to ensure no misrepresentations

Ensure easy and fast agent onboarding – easy to set-up, easy to use. Built for scale

Get real-time reports both for your call center and field agents to ensure productivity

Customizable for your teams – captive + independent sales agents, bancassurance and service teams

Know the complete customer details – including the policies the customers have purchased and complete details about them. Automate prospect and customer communication armed with these insights – for renewal reminders, offer communication, or for retention.

Across teams, products, regions, relationship managers, channels and more

With LeadSquared, we could bring together all our processes and teams into a single enterprise-wide solution. Our agents are more efficient, and the journeys are more seamless, helping us deliver a premium experience to every borrower. Overall, our loan sales have taken a quantum leap with a significant reduction in our turn-around times.

Book a custom demo now

(+1) 732-385-3546 (US)

080-46971075 (India Sales)

080-46801265 (India Support)

62-87750-350-446 (ID)