In this article, we bring to you the digital marketing techniques that generate sales-ready leads and yield maximum ROI on your investments. Based on our experience with leading Insurers in the United States and across the globe, we have compiled a list of actionable ideas for high-quality insurance lead generation. After applying these techniques, every penny you spend on a lead will return a dollar.

But before, let us quickly look at the digital marketing lead generation data from the insurance standpoint in the United States.

The US insurance digital marketing lead generation statistics

- The insurance industry is the largest spender on digital advertising spending $11.7 billion in 2021 and on track to spend $12.51 billion in 2022.

- The top 10 insurers cover about 82% of the total insurance digital marketing spend.

- GEICO spends about $4 for every $100 in premium revenue earned.

- Progressive spends $2 for every $100 in premiums.

- Allstate and State Farm spend approximately $1 per every $100 in premiums.

- Companies that spend more than 15% of their revenues on insurance lead generation are more likely to experience significant growth.

- Insurance companies that spend less than 5% of their revenues are almost three times more likely to experience flat revenues.

The role of digital marketing in insurance lead generation

A study by a market intelligence company reveals that the marketing expenditure of the insurance industry surpasses every other U.S. industry by nearly 8%.

However, the strategic dynamics of effective insurance lead generation and ROI entirely depend on the channels of marketing the companies utilize.

Therefore, you need to be strategic while using digital marketing to achieve optimum results. These include:

- Omnichannel marketing

- Email campaigns

- Website chats

- Landing pages

- Mobile apps

- content marketing

- PPC ads

Syncing these marketing strategies provide a unique and balanced experience for your customers. Also, you need to streamline your marketing and sales teams to drive better productivity.

Insurance lead generation in 2024: techniques that will bring results

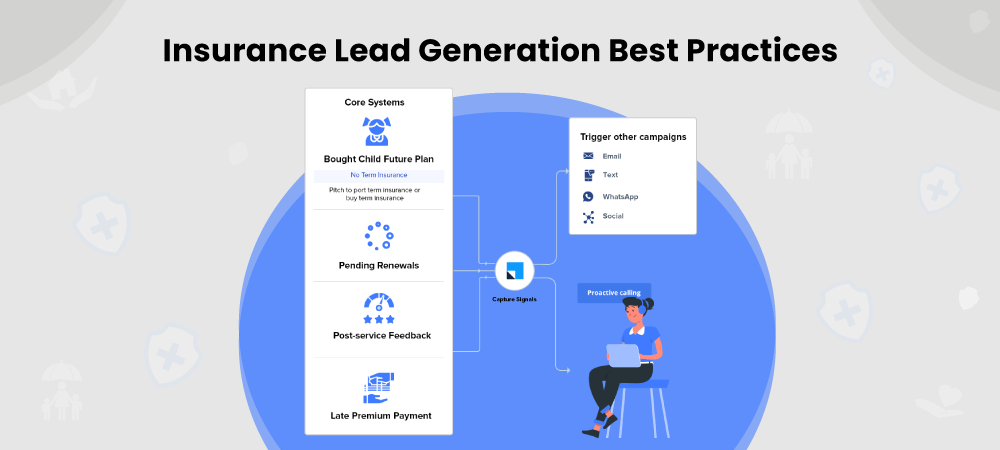

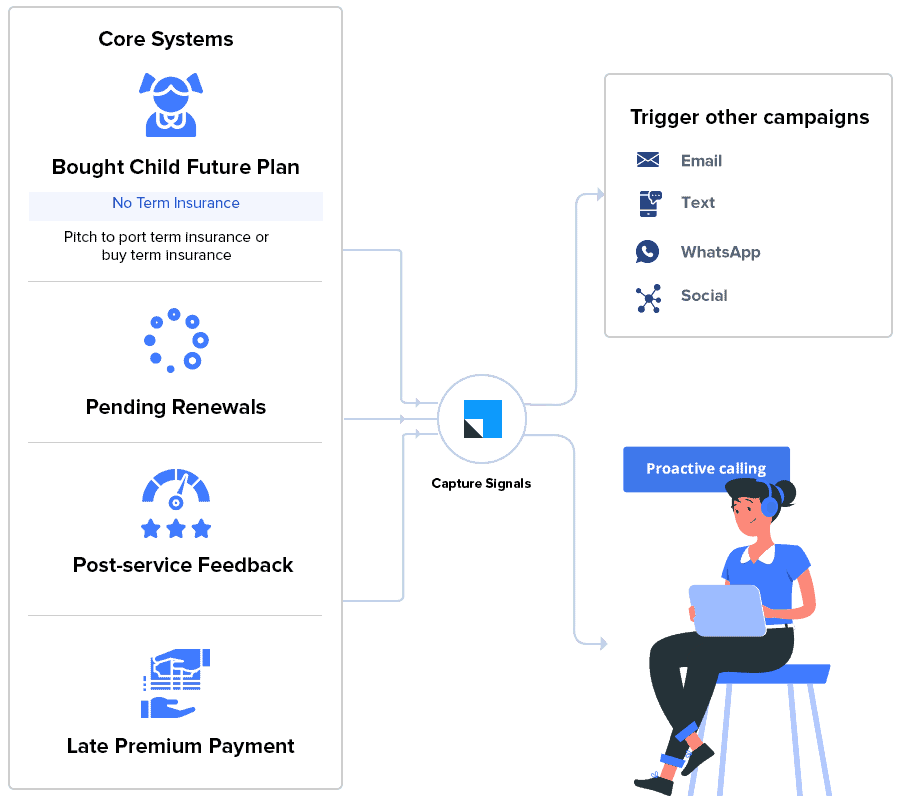

Omnichannel marketing

Insurers throughout the world are inclining towards personalized and consistent user experiences. Omnichannel marketing is a fruitful way to do that. It helps organizations seamlessly communicate with customers via the channels of their choice – from on-site visits, phone calls, emails to website chat, mobile apps, live chats, text messages, Social media, and much more.

Today’s digital savvy customers seek personalized services from Insurers. It also means that the customer will explore other options, for competitive pricing and packages. However, this is also an opportunity to stand out from competitors through your digital marketing efforts and niche services.

Traditional marketing also makes campaigns ineffective because of the following reasons.

- Automation is impossible due to privacy, compatibility, and complaint issues between multiple agencies for insurance lead generation.

- Manpower and other resources spent to manage your digital campaigns could easily double, triple, or more.

- Does not integrate with other apps and software. It also presents numerous challenges in creating future strategies based on analysis.

The time is now to leverage omnichannel for insurance lead generation

With the help of omnichannel marketing CRM, you can automate your operations to overcome all the above issues. You can also provide a comfortable experience for your consumers and the company.

All it takes is a customer-first approach.

The digital customers of today use multiple channels and touchpoints to interact with a business or make a purchase. Forcing a customer to buy from a single point of sale creates fiction and a negative impression of your brand.

- More than 30% of purchases span multiple platforms and devices. Customers could either walk-in a brick and motor store or choose to but their policies online.

- 74% of customers research insurance policies online, but due to the complexity of the purchase, only 25% end up buying them online. And the rest prefer to speak to a live agent or walk into the insurance offices.

- 88% of the insurance customers demand a personalized experience from Insurance providers. Customer expectations have gone higher, especially in this digitized world. Seamless and consistent connectivity is the need of the hour, and omnichannel marketing helps you achieve that.

An omnichannel marketing system will integrate all your platforms to simplify the buyer journey.

[Also read: 25 best ways to generate auto insurance leads]

Email Campaigns

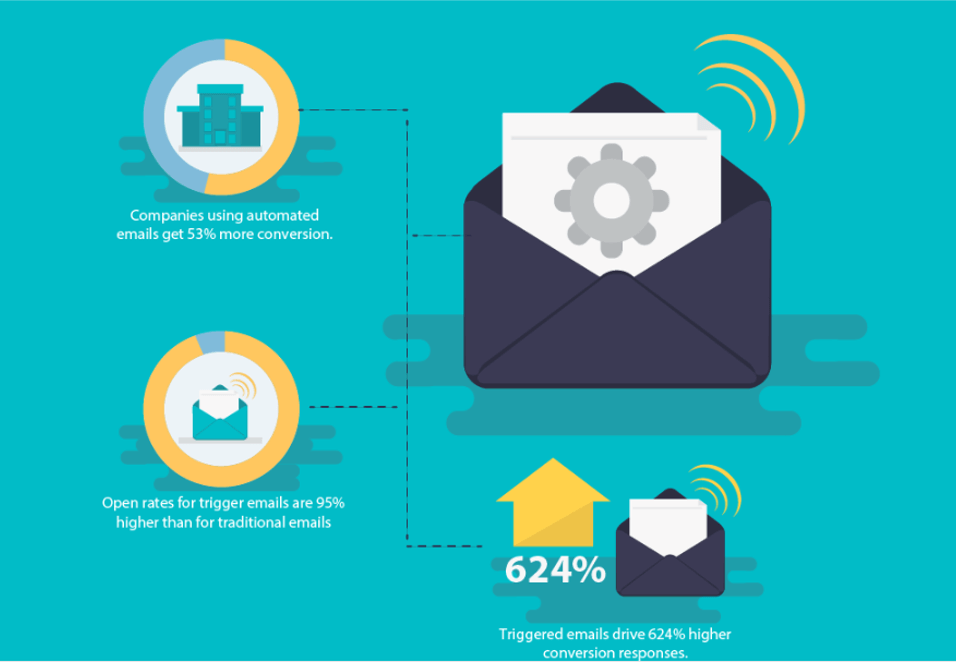

When used strategically, email marketing can be a powerful tool to increase your Insurance lead generation and customer retention.

It also allows the insurance company to reach out to the customer and provide crucial information that they need.

The communication is direct, personalized, and informative. It will not only convert the recipients to leads but also build your brand value.

Insurance lead generation through email marketing and ROI

Email marketing is still one of the best ways to win customers.

- 74% of professional and successful digital marketing companies believe in the power of personalized emails.

- Tailor-made email campaigns improve conversions by 10%.

- Personalized emails increase click-through rates (CTR) by 14% compared to general emails.

- Due to its high ROI (almost 4208%), email marketing is the most preferred mode of digital marketing.

- An average professional in America spends 2.6 hours to 5.52 hours reading and answering emails.

The challenges, however, lay in integrating the email marketing data with other marketing channels. For example, when a potential customer reads your email, there is a 75% chance that they will speak to a live agent.

If there is a mismatch between the details in their personalized insurance email and what your live agent is proposing, it will impart a negative impression and not close the sale.

Insurance CRM can mitigate this risk.

When the customer calls the insurance support center, your agent will immediately get all the details of the previous interactions with the customer across all platforms – social media, SMS, email, website, etc.

Additional resources:

- Email marketing best practices I learned after sending 2,049,567 emails

- What is drip marketing?

- What is email marketing and why use it?

- How to run high-performing email marketing campaigns

- What should be in your email marketing funnel?

Webchats and chatbots

Live agents cannot always be on calls. The case stands for both smaller companies that lack resources and large enterprises that handle millions of inquiries every day.

Web chats and chatbots are an excellent way to engage with your customers and improve lead generation.

Watch the webinar: Decoding the customer journey to convert leads into prospects.

For instance, after introducing chatbot into its omnichannel marketing channel, insurance giant AA Ireland could cut down missed webchats by 81%, reduce live-call agent handling time by 40%, and increase conversion rates by 11%.

Insurance CRM can effectively manage webchats and chatbots and yield better lead conversion rates and ROI. You can also utilize the CRM for specific tasks such as application automation, renewal reminders, claims, collections, or just for getting a complete view of customer information.

Landing pages

Insurance websites tend to be very confusing for visitors because of the number of insurances they offer. Expecting people to explore the website themselves and leave inquiries is unreasonable. It will only lead to drop-offs after some time.

To avoid this situation, you must use landing pages for specific products and campaigns with a clear CTA (call-to-action).

The main difference between a landing page and a home page, which most businesses fail to understand, is that -a homepage is an overview of your business. It holds multiple sections and offerings. On the other hand, the purpose of the landing page is to generate leads who are on the edge of converting into a potential sale and need a slight nudge for a call to action.

Learn the secret to creating high converting landing pages (free ebook).

Further reading:

- What is a landing page and why use it?

- Landing page optimization techniques

- Creating a lead capture page that generates more leads

- Examples of high converting landing pages

Insurance lead generation through PPC ads

Insurance PPC ad campaigns are a costly endeavor. With so much competition in the segment, selling insurance is no small feat. It is a daunting task, and U.S. Insurance laws do not compromise.

Additionally, insurance-related keywords have ridiculously high CPC rates, averaging close to $54 per bid.

Integrating your PPC campaigns with Insurance CRM can measure the effectiveness of your PPC campaigns as compared to other concurrent campaigns. With this, you will never miss a lead on which you have already spent a large acquisition amount.

Insurance CRM helps you in deploying your resources strategically. These include customers you want to target, regional focus, precise segment, etc. You can achieve even higher conversion rates by using landing pages, launching retargeting campaigns to target prospects who did not convert in the first place.

Also read the following articles for a deeper insights into PPC marketing.

- PPC marketing hacks: we made mistakes, so you won’t have to!

- Google Ads tutorial: improve ROI from PPC campaigns

- 7 benefits of Google Ads to grow your business online

- 10 PPC metrics you should monitor in Google Ads

Insurance Lead Generation: Common Mistakes

Now that you know the effective lead generation techniques in insurance, it is time to look at the practices that may negatively impact your marketing strategies.

1. Targeting your campaigns to everyone and on all channels

Identifying your target demography is crucial. Money spent on the wrong targets is equal to the revenue lost. For instance, a family insurance plan will make no sense for a young, unmarried prospect.

Focus your campaign and funnel it to precisely match your company and the customers you are targeting.

2. Incomplete tracking

However, it requires human intervention to maximize the impact of insurance lead generation campaigns. The additional metrics you must track are:

- Most profitable sources/campaigns

- Improving insurance lead generation response rate

- CPC and sales generated

- Profile of inquiring customers, etc.

3. Not mapping the buyer journey

Digital marketing and buyer journey mapping complement each other. You can’t run a good campaign without knowing the prospect’s motivations, intention, and their position in the buying cycle. Understanding the buyer’s journey gives you actionable insights into customer preferences.

You must understand where the prospect is in his buyer journey and address his concerns accordingly. For instance, if a lead has filled in your form the first time, chances are he might have inquired with your competitors as well. Here, instant and automated responses with policy details would make a lot of difference.

In another scenario, if prospects are filling the application form and drop off after lingering on a field for a long time, then it means that they possibly had difficulty filling that page. In this case, the call center can call and help them out.

How to sync marketing and sales in insurance?

Today, the digitization of customer journey, increasing marketing spent by competitors, advanced tools to track, target, and automate communication campaigns, etc. are making it difficult for new players to survive in the market. Even established Insurers are facing tough competition, and their ROI from lead generation techniques is going down the graph.

Targeting the right customer segments, regions, and various other components ethically are the key to elevate your ROI and lead conversion graph.

Insurance CRM is a perfect solution to interconnect all your marketing and sales platforms. It is also a one-stop-shop to get hold of all your marketing data and assign resources to different platforms depending on various factors. Some of them are:

- Platform performance: webpage, apps, social media, third-party sites/apps, etc.

- Seasonal promotions

- Targeting the right set of audience

How can CRM software help?

Deploying your insurance lead generation marketing campaigns on a single CRM rather than on multiple platforms has several advantages.

- Your data is in one place: Analyzing and correlating become effortless when you have all your data in one CRM platform. You do not need to request data from marketing agencies, nor do you have to pull it through various sources.

- More economical: Paying enormous amounts for different marketing channels and platforms does not sound right in any way when you can get all the services for a more economical CRM package.

- Assign all your resources from one place: Different factors such as target audience, seasonal promotions, regional focus, etc. come into play while you allot funds for leads in your digital marketing campaign. You can switch your marketing efforts and funds allocation without a glitch.

- Automate digital marketing operations: The concept of automation has been in the insurance industry for decades but harnessing its capabilities is a novel concept in insurance digital marketing.

The first step of automation is gathering all your digital marketing channels into one portal – the Insurance CRM.

It is never too late to transform your digital marketing strategies for insurance lead generation.

LeadSquared Insurance CRM is the perfect solution to seamlessly integrate all marketing channels and measure the effectiveness of your campaigns. From allocating resources, managing campaigns to targeting demographics that have the potential for the best ROI, LeadSquared CRM provides you full control over your decisions. Give it a try now.