What’s one place that most millennials and younger generations dislike frequenting?

The bank.

Although it may be for a good reason, most younger generations dislike going to banks. Most of us can agree that brick-and-mortar banks are frustrating and inconvenient. A survey conducted by MX covered in the Financial Brand found:

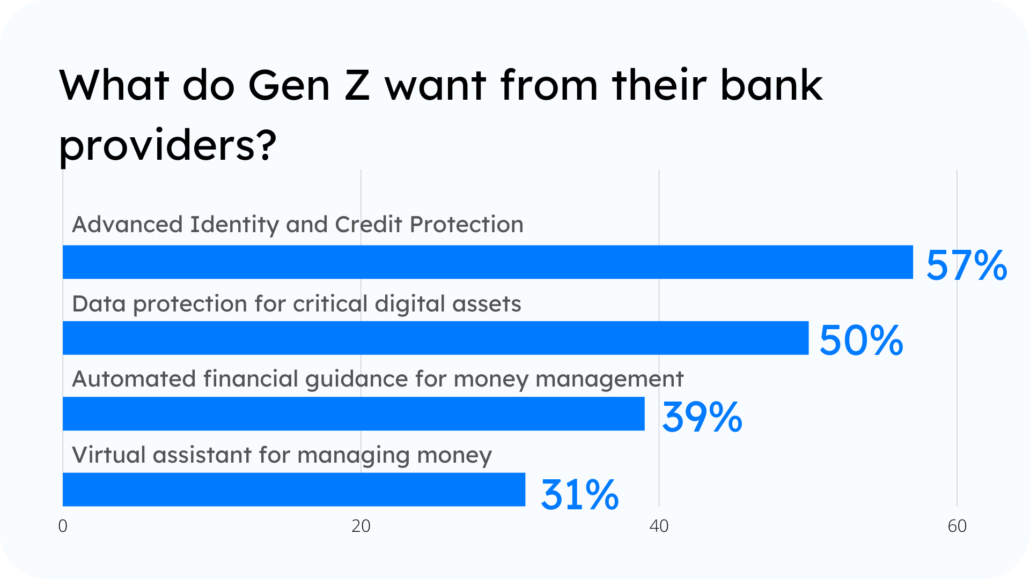

Gen Z is primarily looking for these four things from their bank providers:

- Advanced Identity and Credit Protection

- Data protection for critical digital assets

- Automated financial guidance for money management

- Virtual assistant for managing money

Most banks fail to offer sufficient resources for the second, third, and fourth points. Beyond this, 80% of Gen Z and Millennials use a money transfer tool.

Some fintechs have even redirected their attention to Generation Z.

For instance, SoFi offers both career coaching and attractive interest rates on refinanced student loans. This is a great move to cement their place as a helpful financial provider.

So, how can banks catch up to all the digital options popping up daily? The answer lies in adapting and understanding Banking as a Service. Let’s get right into what Banking as a Service entails and its examples.

What is Banking as a Service?

In simple words:

“Banking as a Service or BaaS refers to an end-to-end financial model that enables digital banks to connect to traditional banks with the help of APIs.”

Banking as a Service is a traditional bank bet response to the upcoming fintechs and digital banking systems. It allows a conventional bank to reach out to users on digital platforms. Digital natives like Generation Z and Generation Alpha make online banking essential. As a foundation on top of the current financial services, they can add their features. In other terms:

- Banks will offer fintechs access to their resources through APIs.

- Fintechs offer banks with their digital capabilities to reach more customers.

- Banks can use a fintech’s digital platform to sell more products effectively.

Financial entities can utilize the BaaS platform’s services without building it themselves. In recent years the Banking as a Service sector has experienced a massive boom. Research shows that:

- In 2020, the Banking-as-a-Service (BaaS) market was worth USD 356.26 billion.

- By 2028, it is likely to reach USD 2,299.26 billion. From 2021 to 2028, it is set to increase at a CAGR of 26.33%.

- In 2022, 85% of top executives are using or planning to use BaaS solutions within the next 12-18 months.

In the coming years, BaaS is set to evolve and grow according to consumer needs. But the definition gives us little idea about the real-life examples of banking as a service. Let’s explore how BaaS institutions operate based on some real-life examples.

Examples of Banking as a Service

Before we get into the examples of BaaS providers, let’s distinguish between three major types. Banks have the necessary licenses to provide core financial services. They allow BaaS suppliers access to their main banking system.

After launching an app, for example, you can rent servers via Amazon Web Services (AWS). You can also generally rent IaaS on-demand from traditional banks. Goldman Sachs and ICICI Bank are examples of traditional banks. Solaris Bank is an example of a modern financial institution.

These two entities don’t cover the institutions that need embedded financial solutions. Ecommerce websites and stores that offer in-app purchase features require BaaS solutions. In short, these are the three main users and providers of BaaS solutions:

- Fintech-based BaaS, such as Solaris Bank, specializes in offering BaaS platforms.

- Traditional banks, like JP Morgan, offer their infrastructure to fintechs. (IaaS)

- Non-financial institutions like Shopify who need embedded finance solutions.

Now that we’ve understood the different kinds of BaaS that exists, let’s get into its examples.

1) Credit or Debit Cards

Non-banks can give credit and debit cards to their users with the Banking as a Service (BaaS) model. A recent example of this is the Apple Credit Card. In a 2021 Forbes article, we found that Apple cardholders have grown up to 6.1 million. Not to mention, seventy percent of Apple Card users are in their twenties and thirties.

With this card, customers can obtain real-time updates on all of their transactions. They present the customer’s account information and payments intuitively. Additionally, firms might entice clients by providing reduced interest rates.

Surprisingly, many businesses provide rewards on their credit and debit cards. This cashback can be assets with no expiration date. You can use it to buy any goods or services in stores, online, or apps for client convenience.

2) BNPL

We move on to the Buy Now Pay Later (BNPL) model. It’s a customer-friendly message that’s shaking up the credit sector. Fintechs have been actively pursuing BNPL for different areas. Most commonly it is for point-of-sale (POS) alternatives, e-commerce, and soon, in-store sales. Customers’ needs are at the forefront with BNPL, which delivers ease and personalization.

Banks that opt to overlook BNPL risk missing out on a huge opportunity. Research shows the BNPL IPO will generate $680 billion in transaction volume by 2025. Customers will have direct access to borrow money from businesses using BaaS.

For example, an airline might provide consumers with one-click loans. They can offer this solution to guarantee that their travel plans are not disrupted. This also ensures that they have more options when paying.

“Some stockbrokers, including us, have already launched BNPL. It is another way of looking at the margin trading product, where a customer only pays part of the amount and the rest of it is financed.”

Ashley Almeida, EVP – Digital, Product, and Marketing, Religare Broking Ltd (via LeadSquared)

Customers can also choose to buy now and pay later for small-scale products. For instance, in India, we can link our Simpl account to different delivery apps and pay for groceries using the BNPL model. Other well-known examples of fintechs offering this payment model are:

- Affirm

- Afterpay

- Klarna

BNPL models use the BaaS platforms to carry out business and offer frictionless loans.

3) Internet Banking

As of 2020, 1.9 billion people around the world used online banking services. That number is set to rise to 2.5 billion by 2024. Additionally, only 20% of US consumers want to visit a bank, according to reports from 2019. Most people now prefer using their smartphone or computer than go in person.

BaaS can assist fintech and non-fintech businesses in providing internet banking services. They can concentrate on refining their services and forgo bank licenses and integrations. These user-friendly and highly advanced solutions may be a better option than traditional banking. They can also design apps for their consumers to:

- Keep track of their transaction records, account balances, and funds.

- Provide superior client service and faster access to funds and no extra costs.

Cashfree Payments, for example, provides account creation solutions to neobanks and NBFCs. Their end customers can now build and link accounts. They can also use it to check their balance, accept, and make payments. The best part? All of this is now feasible using simple APIs from a BaaS platform.

4) Customer Identification and Investments

Several organizations can use BaaS platforms to verify their beneficiaries’ bank accounts. This is possible in the case of mass payment transfers across payment modes, such as net banking and UPI.

Payment transfer issues might put an organization’s credibility at harm. It can lead to a business’s merchant account getting labeled as “high-risk.” Payment transfer failures can easily reduce with bank account verification. This makes BaaS platforms all the more necessary in today’s times.

Non-bank and fintech businesses can also leverage the BaaS concept. Using BaaS, you can assist customers to automate their finances and investments. Additionally, they can help create a customized investment plan using low-cost index funds.

They can also periodically rebalance the portfolio to match the customer’s investing strategy. Investing can seem daunting without any tools to help new users. BaaS solutions offer investment management services that make investing far more accessible.

These are the significant examples of Banking as a Service across different sectors.

In the next sections, we’ll get into some of the biggest brands offering BaaS solutions. But first, let’s delve into the major benefits of BaaS.

Benefits of Banking as a Service

BaaS is a $7 trillion business opportunity. Distributors, such as grocers, e-commerce companies, and other retail companies embrace BaaS solutions. Within the next three years, they estimate overall growth to surpass 70% per year. 60-70 percent of distributors want to expand their financial partnership investments. With BaaS, financial firms can reach out to a larger number of clients for less money. Meanwhile, distributor branding can generate new revenue streams and strengthen client connections.

Innovation:

BaaS promotes financial services innovation by allowing non-banks to provide fundamental banking services. They promote continuous improvement and customers have access to more user-friendly products. Furthermore, it leads to increased financial transparency. Third-party BaaS providers also concentrate on unique client issues.

For example, a fintech firm may solely specialize in business payouts. Whereas a neobank might capitalize on making the process of lending to customers as simple as possible. This helps them to concentrate on the task at hand. Rather than fretting about getting a bank license and everything that entails. As a result, we have access to a frictionless and personalized financial solution. This solution is simple to use, appealing, and necessary to meet customer expectations.

Collaboration:

Collaborating with a third-party player allows a bank to obtain new consumers. They also acquire insight into customer preferences as a result of this. For example, their purchasing habits and financial needs. Banks can now use this information to generate tailored offers for their consumers.

Personalization:

Personalization appeals to 90% of buyers in the United States. Despite privacy concerns, the vast majority of Americans support the concept of personalization. Banks can now use BaaS platforms to take a more focused approach to multi-channel marketing. It can assist companies in meeting and exceeding client expectations. Without requiring them to develop their digital channels. In this way, BaaS solutions help banks save money while reaching more customers.

These were some of the significant advantages we can gain by adopting the BaaS model. Which brings us to the next question, who are the front-runners in the BaaS industry? What are the most popular BaaS solutions available right now?

The Top Trending Banking as a Service Companies in 2023

These are firms that offer BaaS platforms for users worldwide. They either fall under the fintech or retail BaaS companies.

Cambr

Cambr is a BaaS firm founded in 2018 as a result of a collaboration between Q2 and StoneCastle. It currently offers a full range of banking services. Unlike some of its competitors, it does not currently provide fully turnkey BaaS solutions. Cambr, on the other hand, provides the required underlying infrastructure. They do this by leveraging the strengths of their founding partners. They offer substantial industry knowledge, cutting-edge technology, and strategic banking ties.

Solaris Bank

Solaris Bank‘s business strategy, founded in 2016, enables users to easily blend financial services. They accomplish this by utilizing current RESTful APIs with the help of their solutions. The team is currently working to create automated procedures. They wish to offer infrastructure that is essentially transparent to end-users. Their main aim is to construct a digital environment where clients can design scalable banking solutions.

Bankable

Bankable is a London-based firm that enables incumbent financial institutions, Fintechs, and other businesses to launch new payment solutions. A digital ledger manager, card payment programs, and e-wallets are among its BaaS offerings. Bankable assists its partners meet technological challenges and overcoming them seamlessly.

Green Dot

Green Dot is a Pasadena-based “branchless” bank. They specialize in mobile payments and tax refund disbursement processes. Green Dot recently entered the ranks of BaaS providers in Q1 2019. The fintech’s platform offers end-to-end infrastructure for running large-scale banking or payments businesses. Green Dot had rapid results after the original BaaS launch. Their overall operational revenue shot up by 6% year over year in Q1 2018.

These are some among several upcoming BaaS companies available for users globally. Now that we know a bit about the BaaS world, let’s explore its trends in the next section.

Upcoming Trends in the Banking as a Service Sector

1) Embedded finance

Embedded finance is the integration of a financial service within a non-financial app, site, or store. By 2025, embedded finance will bring approximately $230 billion in revenue. From $22.5 billion in 2020, this is a tenfold increase.

Financial tools are available wherever you need them, even non-financial apps. Using the Uber app to pay for your ride-sharing is a simple example of integrated finance in action.

The app connects a financial institution with a non-financial service provider making it unnecessary for you to conduct business with cash or a credit card. Another classic example is purchasing your morning coffee through the Starbucks app.

In current times, embedded finance is essential across different consumer bases.

BaaS makes embedded finance possible with the help of its end-to-end model. Generally, the BaaS solution is an integrated finance option for users. Most embedded finance companies need BaaS platform features to function daily.

2) Growth opportunities

In the banking sector, prospects devoted to BaaS are increasing. They also present that BaaS adoption of several banking products to increase over the next 3 years. According to the financial brand, BaaS growth point toward the following areas:

- POS financing, which includes both BNPL and non-BNPL alternatives

- SME loans will grow at a faster rate than corporate loans in terms of revenue.

- Over the next few years, technology companies and fintech firms will generate the most commercial loan growth.

- Access to traditional deposit accounts and payment options, such as credit cards.

Most of this growth pertains to digital forms of banking. Which in turn puts traditional forms of banking at risk. Although FinTechs are in charge, they lack the knowledge and capital to conduct large-scale operations.

Traditional banking has the necessary capabilities, but FinTech has what the market requires. Traditional banks will need to adapt and implement fintech solutions. In comparison, fintechs cannot function without the help of banks.

3) Industry-specific applications

Industry-specific financial applications will continue to benefit from BaaS. They will alter how individuals and businesses think about making financial transactions. Ride-sharing and gaming are only two examples of BaaS-powered applications. It’ll only be a matter of time until BaaS gains major momentum among US fintechs. BaaS will continue to evolve in the long run to create apps that are increasingly versatile and robust.

Moreover, Artificial intelligence (AI) and other cognitive technologies will raise the bar for operational efficiency and effectiveness. Automating essential banking processes that used to require human judgment is part of this process. Incorporating AI into a BaaS platform automates:

- data collection and processing,

- information preparation and display,

- trend and anomaly detection,

- and the presentation of a recommended course of action.

AI incorporation and industry-specific app creation are trends that will evolve with time. BaaS platforms are already integrating smarter AI-powered capabilities. It’s a matter of time before it is easily available across BaaS solutions.

These trends will push forward a new era in the financial sector worldwide. One trend I’ve not mentioned is the increase in bank and BaaS collaborations. The reason for this is that this isn’t a future trend, it is a current scenario.

Banks will continue to partner with fintech players for more advanced solutions. Fintech players, in turn, will rely on banks for their resources and infrastructure.

Conclusion

Banking as a Service is facilitating new breakthroughs in the financial sector. The key points to note are:

- The increasing interdependence of financial and non-financial companies.

- Consumer needs for digital and frictionless solutions in traditional banks.

- The use of financial apps within retail, e-commerce, and other non-financial companies.

Financial institutions have a clear opportunity to seize revenue growth at a reasonable cost with BaaS. A BaaS company is also scalable and adaptable.

This makes it ideal for breaking into new markets and subsequently expanding. It also provides distributors with numerous chances to generate additional revenue streams. Financial institutions who refuse to opt-in for a BaaS solution may end up missing out on the opportunity of a lifetime.