As discussed in my previous article, (and as you probably already know), the bancassurance model of insurance distribution has found success in many markets. In fact, the growth rate for Banca is four times the growth of life insurance in certain geographies. (Source: Marketwatch, 2018).

As the channel continues to grow, it would help to understand the different advantages of bancassurance for all the parties involved. This means the customers, the banks and the insurance carriers. This would help banks and insurance carriers help grow the channel in new markets, as well as in existing ones.

Let’s start with the stakeholders who drive the growth of any marketing or sales channel anywhere – the customers. In any market, where the regulations allow for the bancassurance to grow, the acceptance of the customers is the foremost success factor.

I) Advantages of Bancassurance for Customers

Let’s look at the major advantages of bancassurance for customers in the infographic below. This would help the bancassurance alliances make the offering more appealing to the end users:

Following are the above-listed advantages of bancassurance for customers, explained:

1. A Complete Solution, Not Just a One-off Policy

The most important thing in B2C buying is customer experience. Financial products are not an exception. Customers want a solution and not just a product.

For instance, when customers buy something off Amazon, they don’t buy just the product. They buy the assurance that comes with it.

The assurance that they’ll be able to return or replace the product if it doesn’t fit their needs. The assurance that it’ll be delivered to their doorstep. And, the assurance of the best value for money.

And, Amazon provides this solution and takes it one step further to ensure cross-sell. Check this email from Amazon post-purchase. I am also recommended products based on my buying pattern, thus keeping me on the site, ensuring that I spend more.

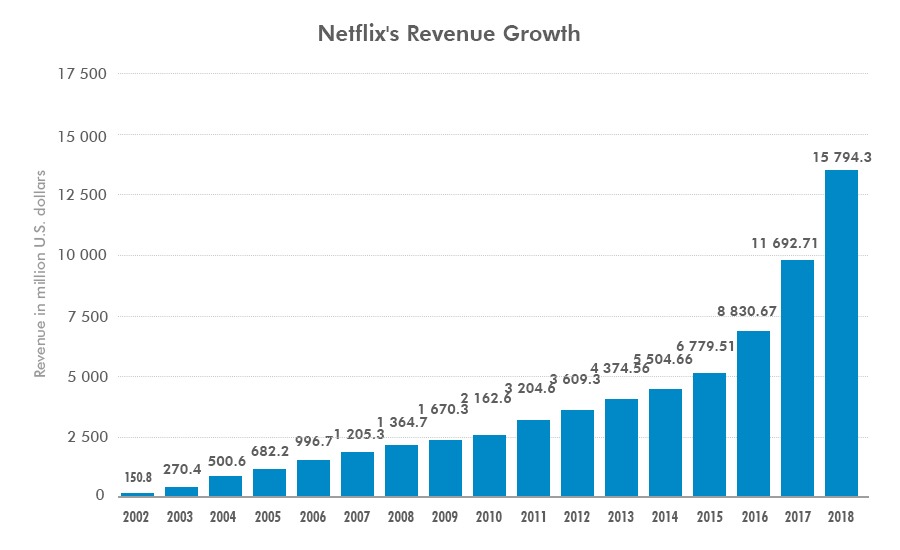

Netflix became a global success not solely based on its content. Not initially, at least. It became a success because it addressed a customer problem – the high late fees of Blockbuster + easier access to entertainment.

Consequently, Netflix’s user base and revenue grew, while Blockbuster’s popularity declined until it finally faded away.

Source: Statista

Customers expect the same kind of responsiveness from their banks and financial service providers as well. The advantage of bancassurance is just that:

a) Right Product: It provides the end users a customized insurance solution.

b) Right Time: At a location, they already are for their financial needs – their banks.

This improves the overall experience of the customers. They are more likely to opt for a complete financial solution from their banks, thus making bancassurance a success.

2. Convenience

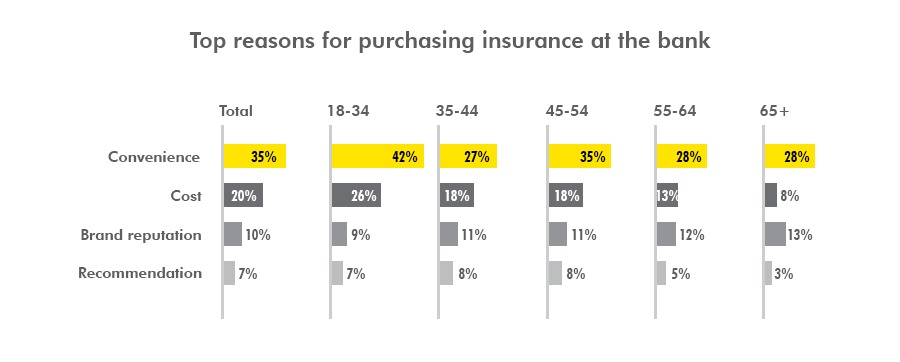

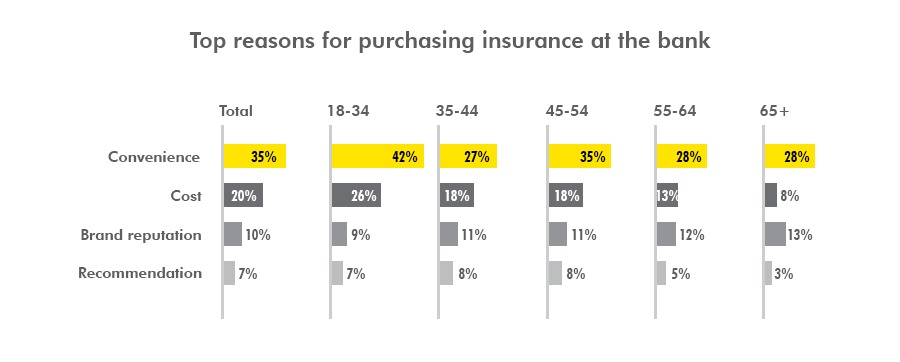

EY conducted a survey in 2017, surveying 1400 retail bank customers in 7 Brazilian cities. Convenience topped the list of reasons the customers chose to purchase insurance at their banks.

Source: https://www.ey.com/Publication/vwLUAssets/ey-rethinking-bancassurance-brazil/$File/ey-rethinking-bancassurance-brazil.pdf

One of the main advantages of bancassurance is this. A customized insurance product at a reduced price (because of the operational cost cutting) along with expert guidance.

3. Trust

Customers trust their banks to sell them the right product. The trust they would place on insurance carriers and independent agents is comparatively lesser. Therefore, the propensity to buy insurance products from their banks is higher.

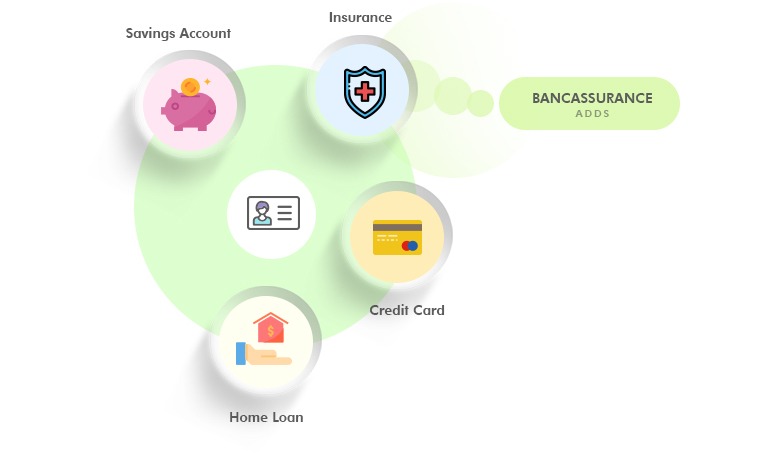

4. One-stop-shop for All Financial Needs

Bancassurance distribution model allows the customers to get an amalgamation of other financial services under one roof. Insurance used to be the missing piece of the puzzle which Bancassurance now completes.

5. Expert Advise

Banks sit on mounds of customer data. This, along with insurance carriers’ expertise in packaging insurance products helps the alliance suggest the right products. Customers also recognize this expertise, majorly because of their trust in their banks.

6. Ease of Renewals

Bank being the front dealing with customers, handle renewals as well, making the transaction even more hassle-free.

In the EY survey quoted above, 52% of insurance customers from banks stated their willingness to renew their policies. This was against a dismal 19% of insurance customers from non-bank channels, willing to renew.

Also with new tech and data access for the bancassurance channel, tracking the renewals is very easy.

7. Easy Access to Claims

Again, taking its root in trust is the belief of an easy claims process. This makes insurance through Banca channel a big draw for the customers.

8. Improved Application and Policy Processing Time

Bank already has the data and documentation of customers. This real-time information accessibility makes sure that the turnaround time is reduced – in application processing and claims management. This is one of the major advantages of bancassurance for customers.

Hopefully, now these advantages of bancassurance for customers are clear to you. Let’s discuss the reasons why banks are entering bancassurance partnerships, and if they aren’t, why they should be.

II) Advantages of Bancassurance for Banks

Banks enter the bancassurance alliances because in most cases, that’s the only way they’ll be allowed to sell insurance. This is attractive for the banks because there is a tremendous untapped opportunity for growth globally in insurance. Let’s discuss the other advantages that they gain by entering these partnerships with insurance carriers.

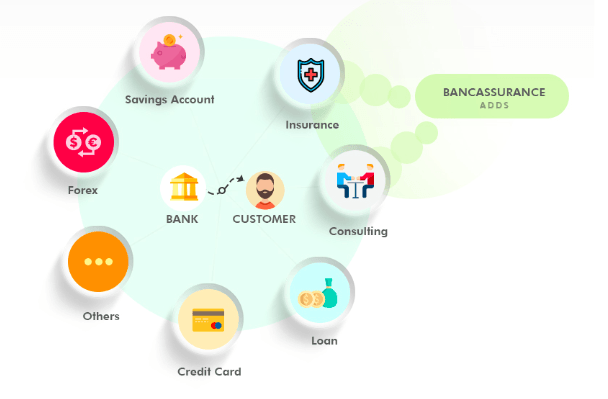

1. Diversification of Customer Portfolio

Banks already have a relationship with their customers selling them an amalgamation of financial products. With Bancassurance, insurance is added to the mix, diversifying the customer portfolio.

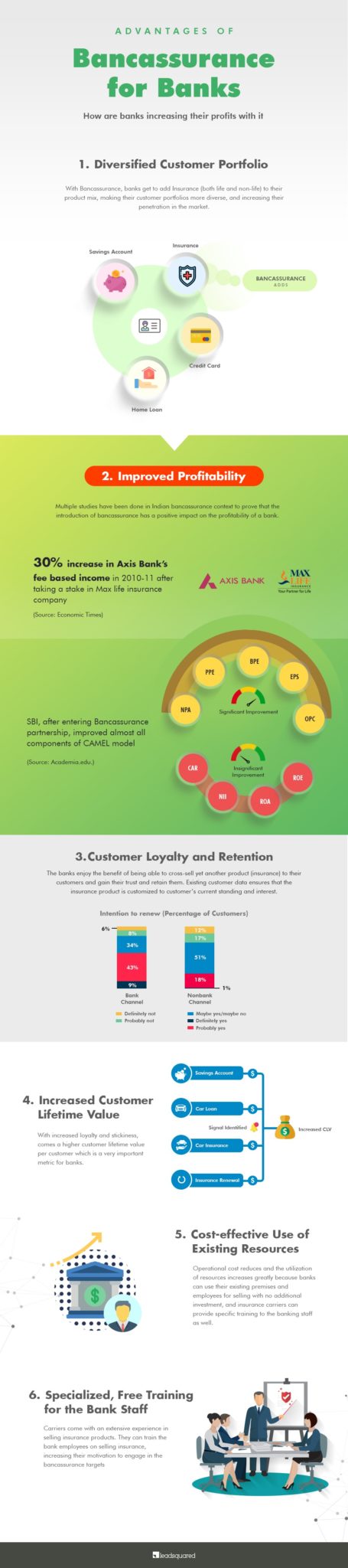

2. Improved Profitability & Non-interest Fee Income

In Bancassurance models, banks can easily generate risk-free income in the form of the commissions from insurance carriers. Multiple studies have been done in Indian bancassurance context to prove its positive impact on the bank’s profitability. Following are a few specific stats from different bancassurance case studies:

- Axis Bank’s fee-based income increased by 30% in 2010-11 after taking a stake in Max Life Insurance Company. Source: Economic Times)

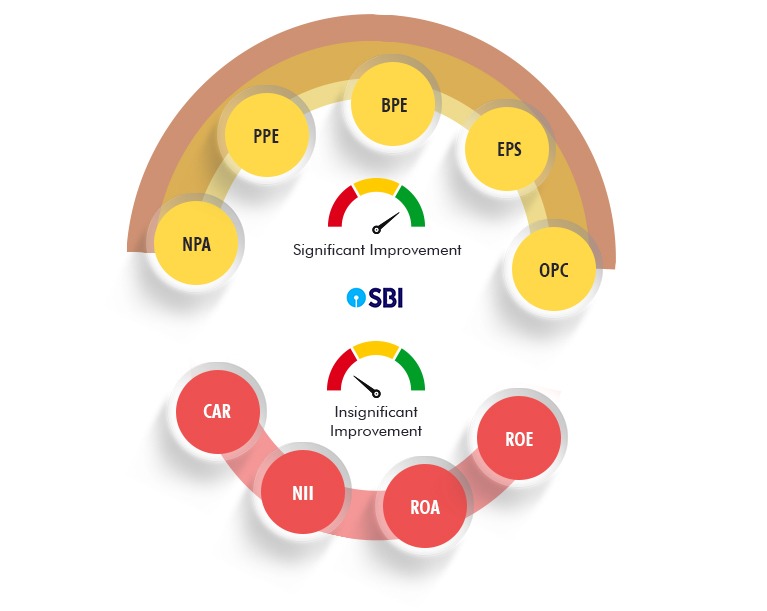

- SBI, after entering Bancassurance, improved almost all components of CAMEL model (except four indicators). The 4 metrics also improved, but the improvement wasn’t significant. Capital Adequacy Ratio (CRAR), Non-interest income (NII), Return-on-Assets (ROA) and Return-on-Equity (ROE) were the 4. (Source: Academia.edu)

With bancassurance, banks can cross-sell insurance, with no increase in their operational expenses. Banks can leverage their distribution and processing capabilities to achieve profitable operating expense ratio.

3. Customer Loyalty and Retention

Banks enjoy the benefit of being able to provide yet another product to their customers. Providing integrated financial services strengthens customer relationships and builds better customer loyalty and retention levels.

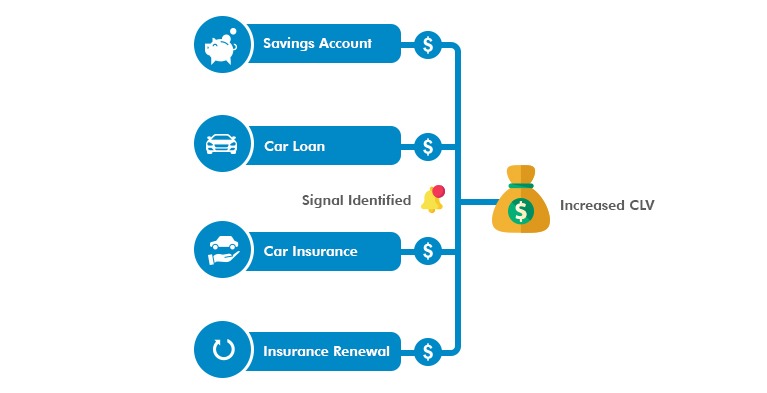

4. Increased Customer Lifetime Value

With increased loyalty and stickiness, comes higher CLV per customer which is a very important metric for banks.

5. Cost-effective Use of Existing Resources

Banks use their existing premises and employees (tellers and branch staff) for the sale of the new insurance products. This means that there’s no additional cost of operation in selling insurance. They also utilize the insurance company’s expertise in training bank employees and packaging insurance products. This reduces the cost of distribution for both insurers and the banks, increasing the channel’s profitability. Banks also get an increased Return on their Assets though this (ROA).

6. Specialized Training for Tellers and Branch Staff

Bank staff is often reluctant to take on the responsibility of selling insurance, in addition to their regular tasks. This is a major challenge in bancassurance implementation. Banks address this by taking the insurance carrier’s help to devise attractive incentive plans & providing them specialized training. So, banks would be able to keep their employees motivated, while helping them build on their skills.

III) Advantages of Bancassurance for Carriers:

Bancassurance forms a very important distribution channel for insurance carriers, with sometimes even 70% of their premiums originating from it. Clearly the advantages of bancassurance for the insurance carriers are huge. Let’s look at them one by one:

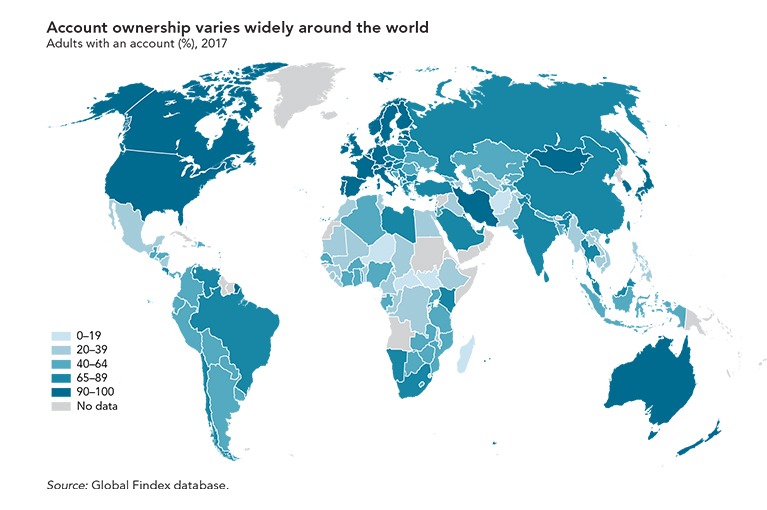

1. Piggybacking on Banks’ High Market Penetration Rate

On its own, it would be impossible for insurance companies to reach the market coverage comparable to that of banks. Banks have a magnanimous distribution network, especially in India, with lakhs of commercial bank branches. There are 150,947 branches spread across urban and rural regions of India (according to RBI’s September 2018 data). So, penetration is the foremost benefit that the insurance carriers gain out of a bancassurance alliance.

2. Increased Premium Turnover

With increased market penetration, insurers’ motive of increasing premium turnover is also achieved using Banca as the driving force.

For instance, Max Life’s partnership with Axis Bank accounted for 55% of its revenue after Axis bank acquired its shares.

3. Customer Trust from Existing Banking Relationships

Banks have already gained trust among their customers. Using Bancassurance as the driver, insurance companies use this confidence to increase their range, penetration, and premiums.

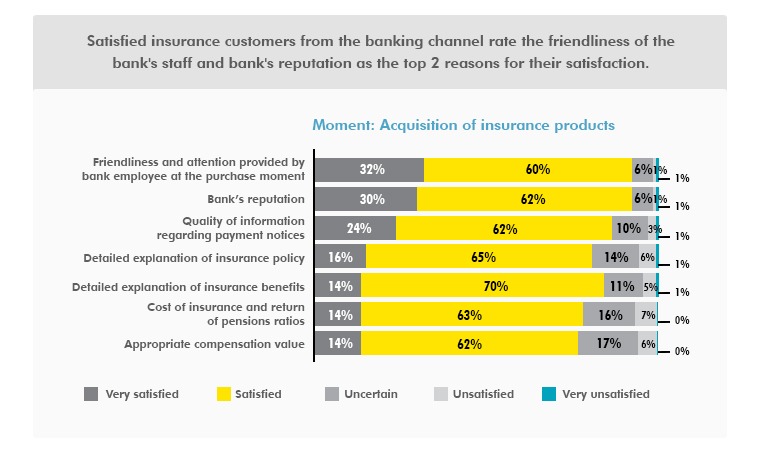

Look at the graph below from EY’s survey of bancassurance customers in Brazil. Bank reputation is one of the top reasons listed by the surveyed customers for buying insurance at the bank.

The same study suggests that satisfied bancassurance customers rate the bank’s reputation highly for their satisfaction. This further highlights the influence of the bank and the customer’s existing relationship.

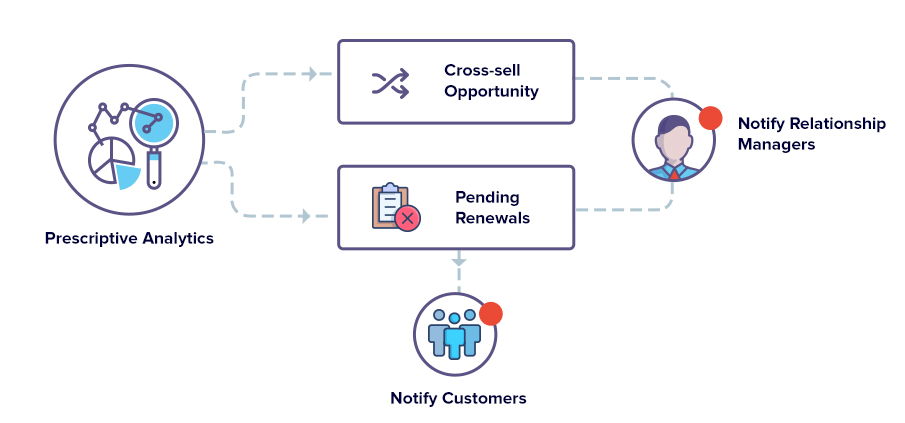

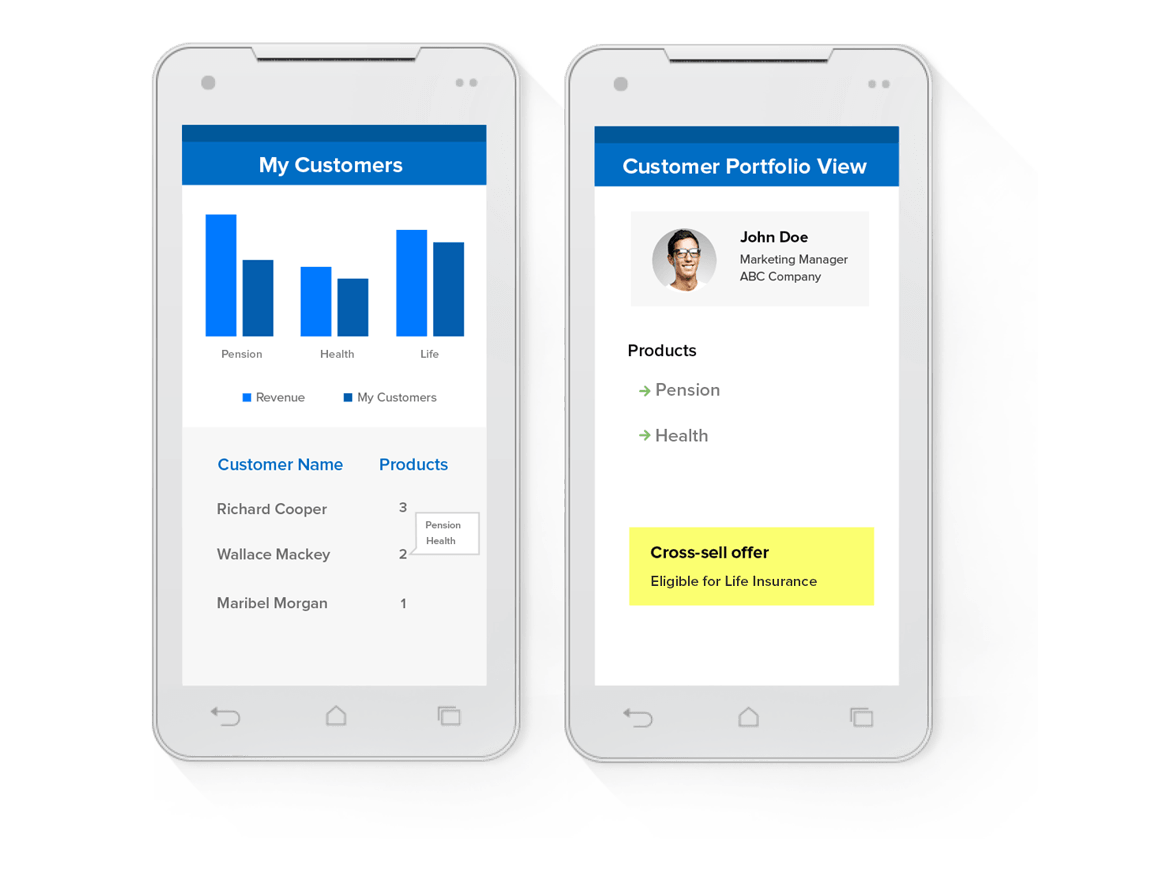

4. Relevant Offer Generation and Customer Engagement

Banks have a huge amount of data on their customers. This includes their demographic and financial info, transactional information, spending patterns, credit repayment history (investment and purchase capability) and more. The carriers and banks can use this information to forge intelligent engagement workflows and to customize relevant insurance covers.

4. Information on New Insurance Products to Launch

Learning from the success/failures of their existing covers, insurance carriers can launch new products more likely to succeed. This is possible because of the bank’s access to data on the covers garnering most interest in specific customer segments.

5. Increased Operational Efficiency and Reduced Costs

In several of the Bancassurance distribution models, bank employees are on the forefront, closing the deals and taking responsibility. Therefore the channel proves to have a much wider reach with much less investment. A similar reach through traditional channels would need them to hire several hundred agents in different parts of the country. Through bancassurance, their market penetration goals can thus be met in a much shorter timeframe than through an agency channel.

For instance: Max Life consolidated 60 branches and closed down 140 to increase efficiency and bring down costs in 2010-11. This was after it entered a Bancassurance agreement with Axis Bank.

6. Better Customer Experience Throughout the Lifecycle

The entire process of origination, application processing, underwriting, risk assessment, fund management, delivery, and claims is managed by the bank. This makes customer experience seamless and hassle-free because there’s just one point-of-contact for them.

7. Improved Turn Around Times (TATs)

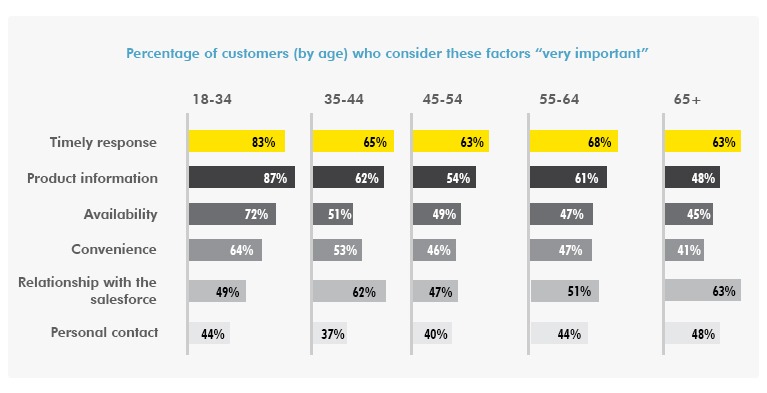

Bank employees are on the forefront, data access ensures that the turn-around-time is low (responsiveness is high). This is important because responsiveness is rated by most customers as a very important factor in insurance buying. In the EY bancassurance study conducted in Brazil, a timely response was rated highly in the decision to buy insurance.

So, these were the advantages of bancassurance for all the involved stakeholders – customers, banks and insurance. This encompasses the reasons why bancassurance is finding success in so many parts of the world. With these advantages leveraged well, the operational efficiencies and the profitability of the bancassurance sales channel can be increased manifold.

Resources used:

- https://www.marketwatch.com/press-release/bancassurance-global-industry-analysis-and-opportunities-challenges-and-forecast-to-2018-2023-2018-11-16

- https://www.ey.com/Publication/vwLUAssets/ey-rethinking-bancassurance-brazil/$File/ey-rethinking-bancassurance-brazil.pdf

![[Roundtable] From Traditional to Digital: Building a Customer-Centric Insurance Strategy](https://www.leadsquared.com/wp-content/uploads/2024/07/insurance-RT-popup-1.gif)