Selling life insurance policies requires a high level of customer relationships. The more you inform your prospects about your policy, the more are your chances of gaining a customer. Life Insurance CRM software enables you to cultivate this relationship and allows you to pitch your policy at every opportunity you get.

Not only that, it helps you to take your customers through a streamlined sales process and nurture them at every step. Clearly, when the engagement level is at its peak, your prospects are more inclined to purchase their policy from you.

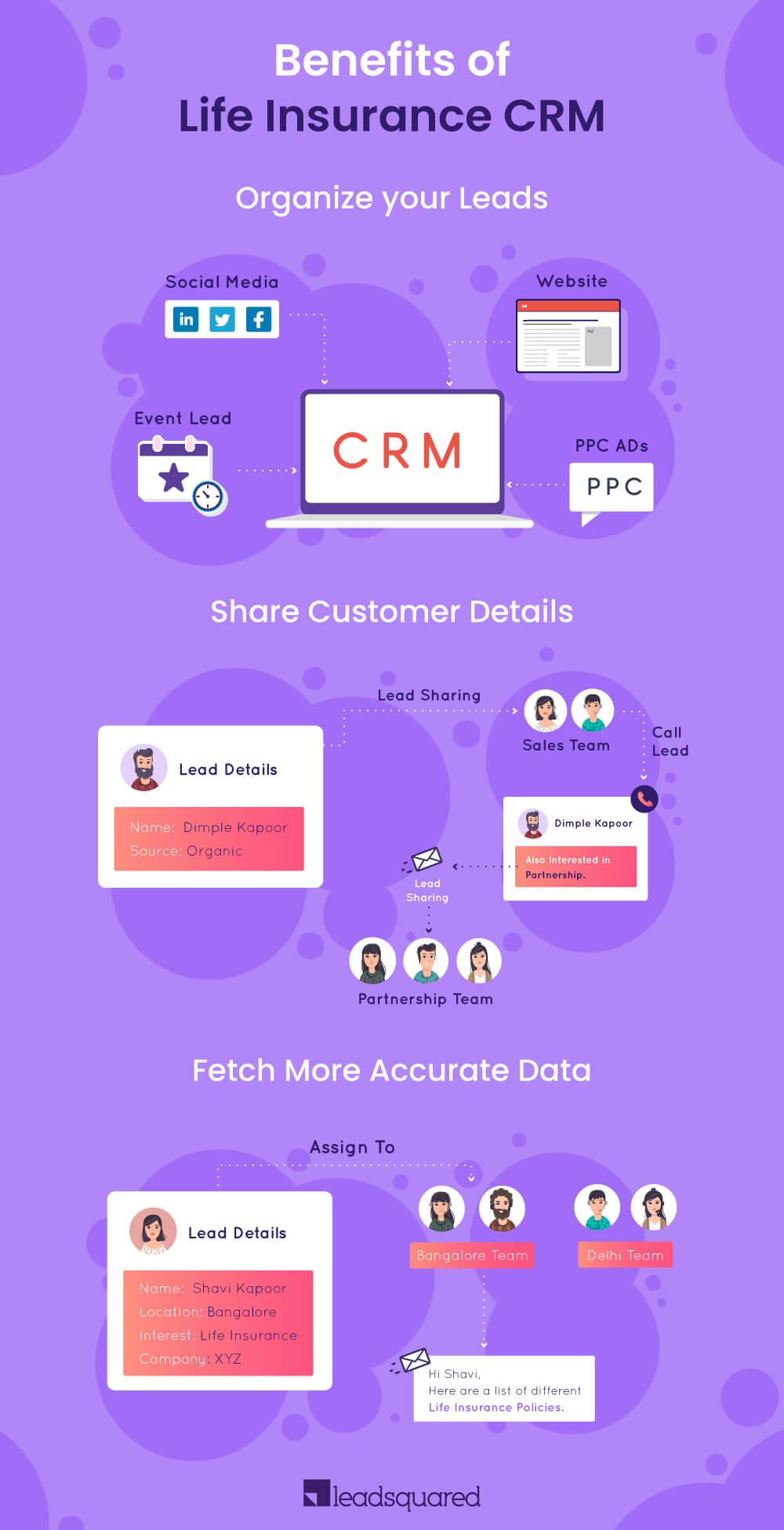

Benefits of Life Insurance CRM

Your customers and prospects have different pain points; adopting a manual process only makes it more challenging to address. You need a system that helps you get the best out of all those leads sitting in your sales pipeline.

Here are some of the benefits of choosing a dedicated life insurance CRM.

Organize your leads better than before

The last thing you want as a life insurer is having your leads sitting in different siloes and miss out on important prospects. A life insurance CRM allows you to automatically import leads, contacts, and customers into a single platform, thereby enabling you to monitor sales and engagement easily.

Share customer details among your team and other departments

You can share data by providing team members access to the same sources of information. Since data sharing makes processing less strenuous and allows for timely utilization of data, you and your sales management team would be able to do more within little time.

Fetch more accurate data

Providing sales manager(s) with goal-achieving integers for your company is more comfortable with the reporting. If your sales team focuses solely on selling life insurance policies, a life insurance CRM ensures that you don’t spend time pursuing leads that are probably interested in health insurance or vehicle insurance, for instance.

The ideal platform will help you to not only store all customer details, but help you determine if they are ripe and right for your company’s offering (life insurance policies) based on certain criteria like age, marital status, number of children, etc. This way, your sales team doesn’t spend time working the wrong leads.

Top Features of A Life Insurance CRM

There are a lot of life insurance CRMs out there, some of which adopt a one size fits all approach. However, you want a system that understands the unique needs of the insurance sector. So, here are some common and important features to look out for when choosing the ideal life insurance CRM.

Centralized Lead Database

As mentioned earlier, a life insurance CRM, like any functional CRM, allows you to view all your leads and customers in one single platform. This way, you can tell the status of each lead at any point in time. It also enables you to minimize data redundancy and enjoy better security.

Lead segmentation

This allows you to categorize prospects through electronic scoring. Based on specific criteria, the life insurance CRM assigns scores to your leads and rank them based on who is more likely to purchase a life insurance policy in the nearest future.

Automated communication

Using automatic messages can help improve customer relations. It saves time and keeps the customer interested in your products and services. Here, you are provided with the option of a chatbot that allows interactions between you and your customers to be faster and more effective.

Notifications and reminders

Notifications and reminders allow you to stay up to date on important tasks, keep in touch with information, which is very important to you as insurance agents. For instance, when a new lead enters the system, your agents get automated alerts. Beyond that, it notifies them if they’ve scheduled meetings or calls with a prospect. Nothing is lost in transition.

Advanced search

Some life insurance CRMs have a customized search engine that makes it easier for agents to find all necessary information like claims, assets, contacts, customer data, etc. There is also the option of advanced filtering that allows you to get the most accurate search results.

This is especially important when you want to quickly find a customer’s information while you’re on a call with them. Being informed shows the prospect that you take them seriously. It also sends the message that you’re organized, which most customers really like.

Mobile CRM

An essential feature of any life insurance CRM for agents is its mobility. You want your sales agent to be able to work on the go. They can respond to inquiries or schedule meetings without having to be at the office. A traditional CRM doesn’t afford you this functionality, hence the need for modern systems with great flexibility.

Reports

Look out for a life insurance CRM with a reporting tool that enables the organization and presentation of valuable data in the most efficient way. It also helps to provide business data views, management reports, trends analysis, an indicator of performance, financial analysis, and much more.

Policy management

With this feature, insurance companies can now develop their own customer acquisition campaigns, create quotes, ensure management of renewals, check policies, resolve issues quicker, prepare reports, and so on.

LeadSquared’s Insurance CRM

A life insurance CRM gives you perfect control over your leads, potentially helping you to sell more life insurance policies. LeadSquared’s insurance CRM software carefully addresses the most important issues that life insurers face in the field. The platform allows you to get more out of your leads, increase conversions, and gain even more premiums like never before.