Customer service isn’t a luxury. It’s the cornerstone of building trust and loyalty, especially in the banking sector.

Whether you need help navigating a new mobile app, resolving a fraudulent transaction, or require personalized financial advice, the quality of that interaction shapes your entire banking experience.

Here are 10 examples of customer service in banking.

1. A customer experiencing an identity theft attempt on their account

Situation:

A customer currently overseas experiences an identity theft attempt on their account.

Customer service solution:

The bank’s fraud department proactively detects the suspicious activity and immediately freezes the customer’s account. They then contact the customer (via secure channels) to confirm their identity and explain the situation. They reissue a new debit card with expedited shipping and ensure the customer has full access to their funds.

Impact:

The customer’s financial security is protected, and they have minimal disruption to their finances. This highlights the bank’s commitment to safeguarding their customer’s money and providing exceptional service even in challenging circumstances.

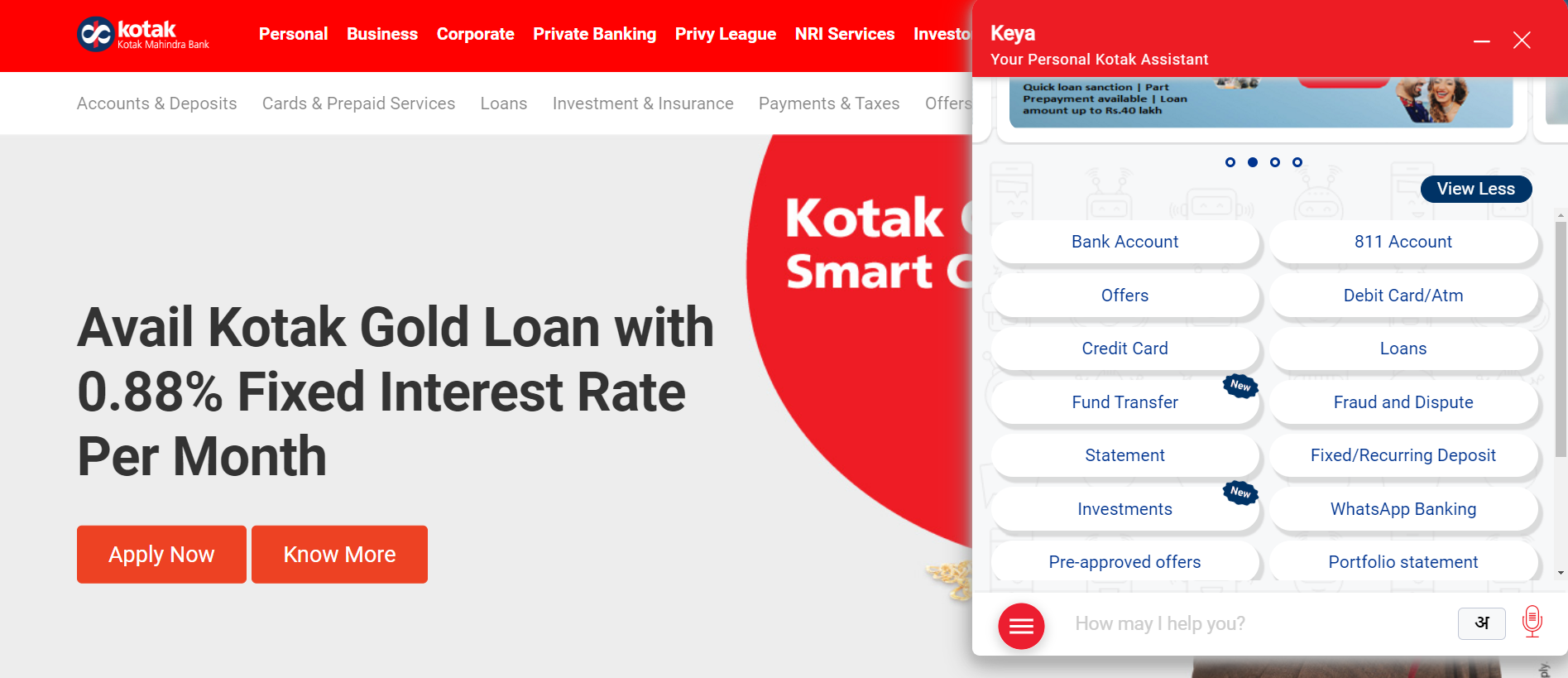

Here’s an example of how Kotak Bank is tackling it through its chatbot Keya.

2. A customer needs help scheduling a large, one-time payment

Situation:

A customer encounters difficulty navigating the online bill payment system and needs help scheduling a large, one-time payment.

Customer service solution:

The bank offers multiple channels for assistance. The customer can choose between live chat with a service representative, a phone call, or scheduling an in-person appointment at a local branch.

The representative patiently walks the customer through the online bill pay process and ensures the one-time payment is scheduled correctly.

Impact:

The bank demonstrates flexibility in catering to their customers’ preferred communication methods. The personalized guidance empowers the customer to confidently manage their finances online.

3. An investor is unsure about making a complex investment decision

Situation:

An investor is unsure about making a complex investment decision and needs guidance.

Customer service solution:

The banking institution offers a dedicated team of financial consultants who provide personalized investment advice. The consultant takes the time to understand the investor’s risk tolerance and financial goals before recommending suitable investment options. Educational resources are also provided to empower the investor to make informed decisions.

Impact:

The bank goes beyond basic transactions and offers a holistic approach to financial well-being. Customers feel confident and supported by having access to expert guidance.

4. User lost their debit card

Situation:

A mobile banking user experiences a lost or stolen debit card and needs a quick replacement.

Customer service solution:

This banking app allows users to easily freeze their lost/stolen debit card and order a replacement instantly. The app also provides real-time transaction monitoring and fraud alerts.

Impact:

By prioritizing convenience and empowering customers to manage their finances directly through their mobile devices, users can regain control of their account and receive a replacement card efficiently, minimizing disruption.

5. A customer sees unexpected fees and needs clarification

Situation:

A customer encounters unexpected fees and needs clarification.

Customer service solution:

By offering transparent fee structures and readily available customer support, banks can easily handle such grievances. The representatives equipped to explain any charges and explore potential solutions, such as waiving fees or suggesting alternative banking options is the way through.

Impact:

By prioritizing customer understanding and providing clear explanations, banks can build customer loyalty and satisfaction.

6. A customer, unfamiliar with online banking, needs urgent money transfer

Situation:

A customer needs urgent money transfer but is unfamiliar with the online banking platform.

Customer service solution:

This bank offers a multi-channel approach to customer support. The customer can choose between using the interactive voice response (IVR) system for basic transactions, a live chat with a customer service representative for personalized guidance, or video banking for a more face-to-face experience.

In this scenario, the customer could utilize the live chat option. The representative would patiently guide them through the online money transfer process, ensuring a smooth and secure transaction.

Impact:

This demonstrates flexibility by catering to various customer preferences. The personalized guidance empowers individuals who are less familiar with online banking, promoting financial inclusion.

7. A customer faces a fraudulent transaction on their card

Situation:

A credit card holder faces a fraudulent transaction on their card.

Customer service solution:

The bank’s 24/7 customer care service allows the cardholder to report the suspicious activity immediately. A representative will promptly block the card, investigate the fraudulent transaction, and work towards recovering any stolen funds. The bank might also offer an expedited replacement card to minimize disruption.

Impact:

A prompt action safeguards the customer’s financial security and minimizes potential losses. The customer can regain peace of mind knowing their situation is being addressed effectively.

8. A customer needs assistance managing their investment portfolio

Situation:

A customer requires assistance managing their investment portfolio and wants to explore new options.

Customer service solution:

This bank offers dedicated relationship managers who provide personalized investment advice. The relationship manager would meet with the customer to understand their financial goals and risk tolerance.

Based on this information, they can recommend suitable investment options, including mutual funds, stocks, or bonds. Educational resources and investment tools might also be provided to empower the customer to make informed decisions.

Impact:

By going beyond basic banking services and providing a holistic approach to wealth management, customers feel supported by having access to expert guidance tailored to their specific needs.

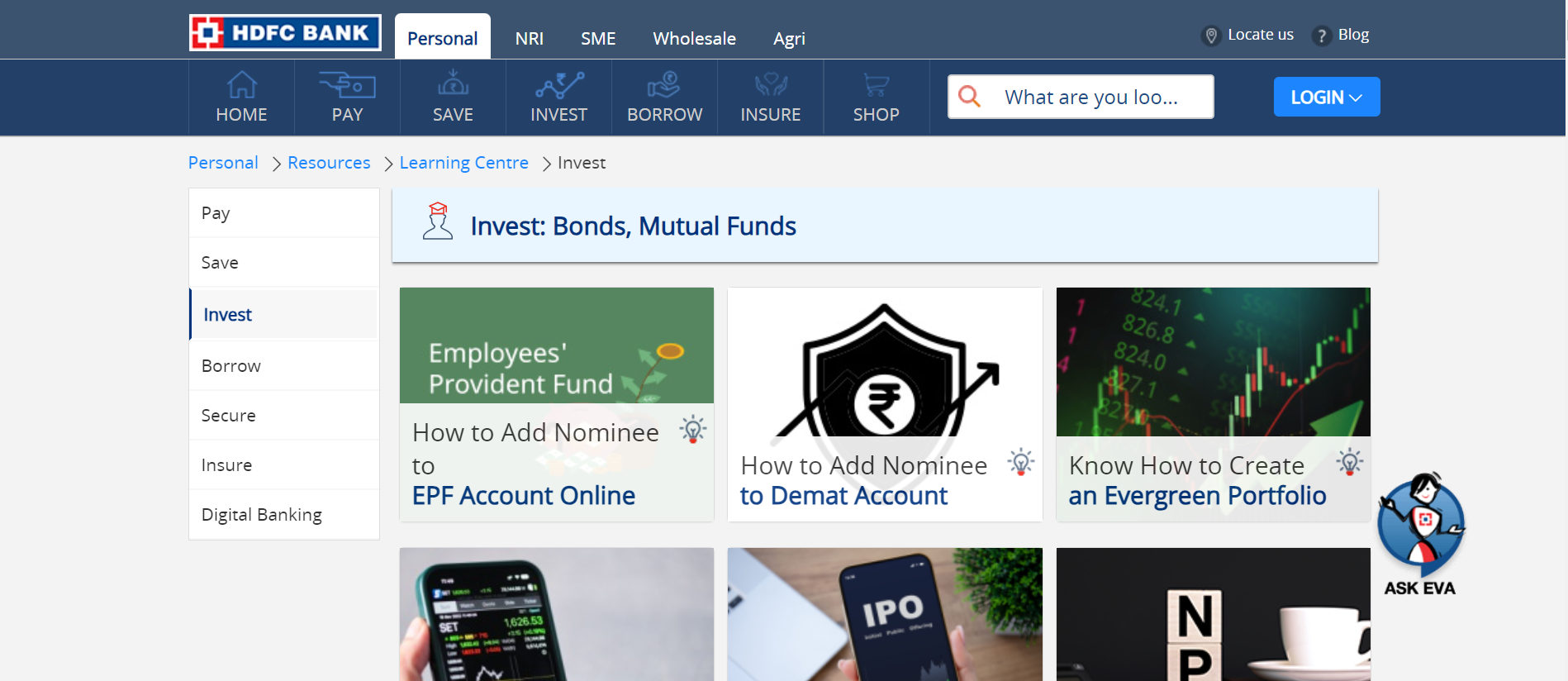

Here’s an example of how HDFC Bank is educating customers through online resources.

9. A senior citizen struggles to navigate mobile banking app

Situation:

A senior citizen struggles to navigate their new mobile banking app and feels overwhelmed by the technology.

Customer service solution:

This bank offers a tiered approach to support digital banking adoption. They provide in-branch training sessions specifically designed for seniors. These sessions walk them through the app’s functionalities in a step-by-step manner at a comfortable pace. Additionally, personalized support might be offered over the phone or through video chat for those unable to visit a branch.

Impact:

By bridging the digital divide through training and personalized support, a bank can empower seniors to confidently manage their finances independently, fostering financial inclusion and peace of mind.

For example, Bendigo Bank has created a How-to videos playlist for common customer queries.

10. Unexpected decline in debit card transaction

Situation:

A customer experiences an unexpected decline in their debit card transaction while travelling overseas.

Customer service solution:

The bank’s 24/7 international customer care hotline allows the customer to reach a representative immediately. The representative will verify the customer’s identity and work to understand the situation. They might take steps to unblock the card if it was a security measure or expedite a temporary replacement card to a designated location.

Impact:

The bank’s prompt response ensures the customer has access to their funds while abroad, minimizing inconvenience and stress during their travels. This highlights their commitment to customer well-being in unexpected situations.

Streamlining Service Experiences for Banking Customers

Streamlining service creates a win-win for banks and customers, driving loyalty and satisfaction.

Banks can do this through customer service software systems, intuitive apps, and efficient support channels. It will help them reduce wait times, foster financial independence, and build trust.

If you’re looking for a solution to manage support tickets, check out LeadSquared’s Service CRM.

It can help you with:

- Omnichannel customer support

- Ticket enrichment and customer interaction history

- Improved team collaboration

- Workflow automation

As Mohammed Lakdawala, Manager—Customer service, Sriram Finance, puts it:

“After evaluating several vendors, we found LeadSquared’s Service CRM to be the best fit because it offers both service and sales solutions on one comprehensive system. The reporting capabilities have reduced the turnaround time and their prompt issue resolution has ensured our business operations remain unaffected.”

Contact us to know more about the platform.

More in this series:

- What is Customer Service? A Complete Guide with Examples

- Understanding the Difference between Customer Service and Customer Support

- The Power of Customer Service Automation: Benefits and Examples

- 10 Crucial Customer Service Metrics for Success

- Omnichannel Customer Service: Why Is It the Need of The Hour

- Omnichannel Support: Definition, Popular Channels, and Best Practices

- Empathy in Customer Service: How to Build Genuine Connections

- 15 Empathy-driven Customer Service Email Templates

- 10 Best Customer Service Software in India for Great Support

- How to Write Effective Customer Service Emails

- 15 Customer Service Email Templates

- 15 Highly Effective Customer Service Scripts to Practice