Marketing trends around the world have expanded into the digital realm. The pandemic has changed marketing in ways unseen, with social media and video content taking center stage. Content marketing is expected to exceed $300 billion, and 70% of consumers want to learn about products through content instead of traditional advertising methods. Digital marketing grew by leaps and bounds in 2020 due to the rapid digitization during the pandemic. In 2021, nearly 88% of all US digital display ad dollars, or $81.00 billion, will flow via automation, according to EMarketer. These numbers are a direct sign to revamp your credit union digital marketing strategy and delve deeper into growing online.

The first step is to understand what your members want and tune your marketing message accordingly.

The most noticeable shift in American digital device use is for mobile phones. Over 81% of the American population own smartphones and 96% of millennials own only smartphones and do not use feature phones (Source). Financial institutions that fail to account for this will lose out on one of the most quickly growing digital marketing strategies – mobile marketing.

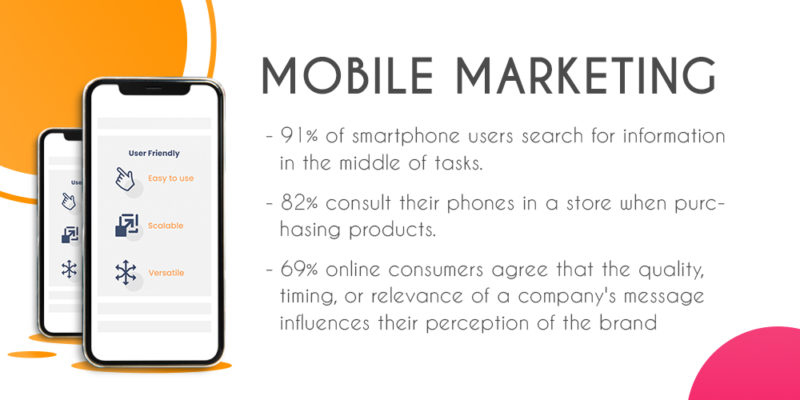

1. Mobile Marketing

Mobile marketing is a multi-channel digital marketing strategy that focuses on capturing leads through smartphones. As the above statistics show that 81% of Americans own smartphones, which means that they often consult the internet for their buying choices. This is seen in what Google has termed “micro-moments.”

Micro-moments, or what is better known as mapping customer micro-moments, is a largely untapped area within credit union digital marketing. These micro-moments are when customers look for information relating to knowing, going, doing, and buying (Source).

- Knowing may relate to searches such as “The best Credit Unions for students”

- Going will be a search along the lines of – “Credit Unions near me”

- Doing will be searches such as “How to invest in Credit Unions?”

- Finally, buying will be – “How to buy Credit Union loans?”

These micro-moments largely revolve around the use of a smartphone, according to Google:

- 91% of smartphone users search for information in the middle of tasks.

- 82% consult their phones when they are standing in a store deciding to make purchases.

- Of online consumers, 69% agree that the quality, timing, or relevance of a company’s message influences their perception of a brand.

As time goes by, consumers will increasingly take to the internet for their purchases. Optimizing your content using local SEO to appear when such searches take place is essential to compete. The content created by your credit union digital marketing team will have to be mobile-friendly and easily accessible. Websites, apps, and advertising need to align within the borders of your smartphone. Mobile marketing through omnichannel communication can greatly boost digital marketing sales in the Credit Union space.

2. Content Marketing

Content marketing is one of the best digital marketing strategies in 2021. In a SEMrush marketing survey, 84% of marketers had content marketing strategies in place in 2020. Over 70% of them also stated that their content marketing efforts were more successful in 2020 than in 2019. Thus, we can say, content marketing will help members become more aware of products and services offered by your Credit Union.

According to the Financial brand, content created with a strategy focused on reaching members can increase financial stability, trust, and loyalty. You can do this by creating informative content in a blog or video format that explains the benefits of credit union membership. In a SEMrush survey, 72% of marketers stated that How-to guides were the best traffic drivers. Also, 44% of the marketers claim that how-to guides have increased lead-generation.

Content that delves deep into your Credit Union services has a high chance of increasing membership. Another area of importance in marketing is the landing page. 35% of respondents stated that they benefit significantly from product descriptions on their landing pages. Therefore, Credit Unions need to build responsive landing pages to increase user engagement.

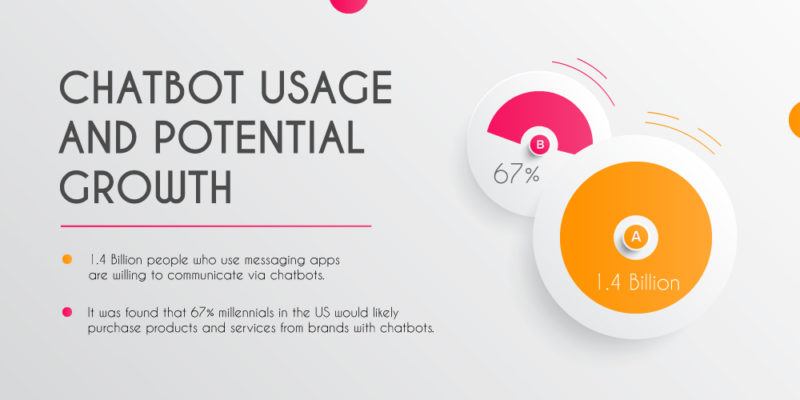

3. Chatbots

Chatbots are one of the most important credit union digital marketing tools. Chatbot marketing is estimated to have a market size of 1.3 billion dollars in 2024, with several organizations increasing investments in chatbots for customer-facing operations. 1.4 Billion people who use messaging apps are willing to communicate via chatbots. Also, 67% of millennials in the US would likely purchase products and services from brands with chatbots. Chatbots created using artificial intelligence and data analytics are highly efficient communicators.

The importance of chatbots in marketing:

IBM explains the importance of chatbots in reducing customer service costs. They have found that businesses spend $1.3 trillion on 265 billion customer service calls each year. They state that chatbots can help businesses save on customer service costs by-

- speeding up response times

- freeing up agents for more challenging work, and

- answering up to 80% of routine questions

A critical aspect of digital marketing is keeping your members engaged and responding in a timely manner. Without chatbots that offer automated responses for initial conversations, you may miss out on some important leads. Chatbots gather member information that you can use while implementing financial marketing strategies in the future. According to the Financial Brand, as banks and credit unions have become more comfortable using chatbots, more have used chatbots for personalizing advisory messages.

4. Micro-Influencers for Major Marketing

Social media is an incredibly effective digital marketing tool in 2021. From $1.7 billion in 2016, influencer marketing is estimated to have grown to a market size of $9.7 billion in 2020 and is expected to reach $13.8 billion in 2021. Social media is quickly becoming the best place to engage your community members as it allows organizations to work around ad blockers. Influencers, as the term signifies, have great potential in influencing member choices. Collaborations between influencers and major financial institutions have increasing levels of success. 89% of marketers stated that ROI from influencer marketing is comparable to or better than other marketing channels.

To achieve this, you need not invest heaps of money to sponsor influencers with a massive following. Instead, the smarter choice would be to invest in micro or nano-influencers. Micro-influencers have the highest engagement rates (averaging at 7%) on their feed posts. As engagement rates on Instagram continue to decline, more and more businesses are seeing the value in partnering with Instagram influencers who have a small (or “micro”) but highly engaged following. By reaching out to influencers who are part of your credit union and are the right fit for your organization’s image, you can connect with your members via social media.

Another important influencer marketing channel is YouTube. YouTube has an immense reach among U.S. Gen Z and Millennial internet users regardless of gender. In a September 2019 internet users survey, 95 percent of male and 92 percent of female respondents stated that they used the online video platform (Source). In contrast, Facebook had a 70 and 78 percent reach, respectively. Investing or sponsoring influencers has a great chance of generating leads, building trust, and creating a favorable impression on your potential members. Credit union digital marketing strategies need to evolve to meet changing member needs across different platforms.

5. Automated Marketing

According to The Financial Brand, personalization in marketing is no longer optional. It has become a driving force that ensures your organization’s growth — a key to managing relationships and an essential tool that improves retention. According to research, organizations that use marketing automation software have a 77% increase in conversion rates. They also saw an 80% increase in leads. There is also a 451% increase in qualified leads in companies that use marketing automation software.

Marketing automation typically possess tools that improve accessibility to data and consumer information.

The first tool is reports and data analytics; this ensures that your message reaches the right member at the right time, requiring a mix of segmentation and reporting. Reports and data analytics can give you information about members looking for several products and services, which increases cross-selling opportunities and member engagement while building a community based on marketing campaigns. The right marketing automation paired with a smart sales automation tool can assign leads, qualify them, and make the lives of your sales executives much easier. Once the software has accumulated data to analyze qualified leads, these leads will be automatically assigned to the right agent.

The agent can trigger omni-channel communication and send messages, emails, and notifications. Automated marketing is particularly helpful when sending emails. According to Statista, in 2019, the number of global e-mail users amounted to 3.9 billion and is set to grow to 4.48 billion users in 2024. Email marketing strategies allow credit unions to directly communicate with their members. Personalized automated emails sent in a systematic manner can generate leads and strengthen engagement among credit unions. Investing in digital marketing tools such as chatbots, content, automation, and more can significantly boost credit union growth.

The pandemic has accelerated digitization without which it becomes much harder to communicate. Automated channels of communication that offer personalized member journeys are vital for success in 2021.

Related articles: